Immunomedics, Inc. (NASDAQ: IMMU) is a clinical-stage pharmaceutical company. The company’s principal area of investigation is monoclonal antibody-based products capable of treating cancer, autoimmune disorders, and other diseases. Immunomedics’ portfolio of products consists of antibody-drug conjugated (ADCs) that are designed to deliver a specific payload of a chemotherapeutic directly to the tumor while reducing overall toxic effects to the patient. The company’s most advanced product candidate is IMMU-132 (sacituzumab govitecan), an ADC that has received breakthrough therapy designation from the FDA for the treatment of triple-negative breast cancer.

Immunomedics was formed in 1982 and is headquartered in Morris Plains, New Jersey.

Pipeline and Products

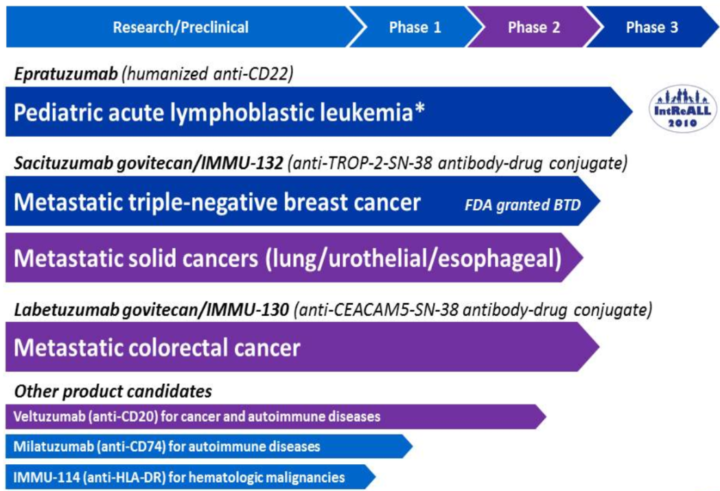

Using its proprietary technologies, the company has developed a pipeline of six clinical-stage product candidates. Immunomedics’ research pipeline is further detailed below:

Source: Company Website

IMMU-132, Immunomedics’ most advanced product candidate, is an ADC which contains the chemotherapeutic SN-38, which due to its toxicity and solubility cannot be given directly to patients. As noted above, possible applications include triple-negative breast cancer and small/non-small-cell lung cancers. The drug is currently being evaluated in a multicenter Phase II study in patients with solid cancers.

IMMU-130 (labetuzumab govitecan) is another investigational solid-tumor ADC conjugated to SN-38. The drug is currently being studied in patients with metastic colorectal cancer who have received at least one prior irinotecan-containing regimen and had an elevated blood titer of carcinoembryonic antigen. The drug is currently being tested in a Phase II study.

Epratuzumab is a humanized antibody that targets CD22, an antigen found on the surface of B-lymphocytes, a type of white blood cell critical to proper immune system function. Elevated expression of CD22 has been associated with blood cancers and autoimmune diseases. Immunomedics is currently studying epratuzumab in collaboration with Bayer. The IntreALL Inter-European study group is conducting a large, randomized, Phase III study.

Early-Stage Pipeline consists of the following:

Veltuzumab is a humanized monoclonal antibody under development for the treatment of immune thrombocytopenia and non-Hodgkin lymphoma (NHL). Phase I/II trials are currently underway.

Milatuzumab is a humanized monoclonal antibody under which has received orphan drug designation for the treatment of chronic lymphocytic leukemia (CLL). The company has completed Phase I clinical trials.

IMMU-114 is a humanized antibody directed against an immune response target, HLA-DR, for the treatment of B-cell cancers. The drug is being investigated in a Phase I dose-escalation treatment study in patients with NHL and CLL.

In the course of its research activities, the company has accumulated a large portfolio of patents related to its product candidates as well as other technologies for which product candidates have not yet been identified. As of August 1, 2016, Immunomedics held nearly 300 patents in the United States, and more than 400 foreign patents. The vast majority of the company’s patents expire between 2023 and 2033.

Market Opportunity

Triple-negative breast cancer represents approximately 15 percent of all breast cancer diagnosed, and there is currently no standard therapy in adjuvant or metastatic settings. The median survival rate is approximately 12 months, and the progression-free survival rate (PFS) is between 1.7 and 3.7 months.

Recent Developments

- On September 21, 2017, Immunomedics exchanged $80 million of 4.75 percent senior convertible notes maturing in 2020 for common stock. This represented 80 percent of the outstanding balance of the company’s senior convertible notes as of June 30, 20117.

- On November 13, 2017, abstracts related to ongoing studies related to ongoing studies of IMMU-132 were posted by the San Antonio Breast Cancer Symposium. In particular, the Phase II study involving 110 patients reported an objective response rate of 34 percent, including three complete responses and 34 partial responses. Results of the independent central blinded review and sensitivity analyses of prior treatment regimens will be presented on December 6, 2017. The final data from this study will likely be submitted to the FDA in the first quarter of 2018 for accelerated approval of IMMU-132 as a third line treatment for triple-negative breast cancer.

Analysis

The shares reacted negatively to the newly-released data due to concerns that the FDA will required Phase III overall survival (OS) study data for approval of IMMU-132 (as opposed to Phase II objective response rate (ORR) and duration of response (DOR) data). However, Jeffries analyst Matthew Andrews notes that the FDA has approved 12 solid tumor drugs under the breakthrough designation with ORR and DOR as the primary endpoints for approval. Of these, only one drug, Lartruvo, required OS data. As such, he believes IMMU’s current profile for ORR/DOR (and tolerability) is robust and approvable.

First Quarter Earnings Review

In the quarter ended September 30, 2017, Immunomedics reported revenue of $0.7 million, equal to that reported in the same period one year ago. Revenue consisted primarily of product sales, along with research and development revenue and license fees.

Total costs and expenses increased 42 percent year-over-year to $22.3 million. General and administrative expenses increased $4.0 million due to greater legal and professional fees (related to a proxy contest), while research and development expenses increased $2.8 million due to the upcoming regulatory submission of IMMU-132. The net loss attributable to shareholders in the first quarter of fiscal 2018 was $118.7 million ($0.97 per share) as compared to a net loss of $16.2 million ($0.17 per share) for the same period one year ago.

Net cash used in operating activities increased 22 percent to $20.6 million. Cash and marketable securities totaled $139.6 million at September 30, 2017, as compared to $154.9 million at June 30, 2016. As of September 30, 2017, the company’s long-term debt obligations consisted of $19.7 million of senior convertible notes. However, the company also listed $165.8 million of warrant liabilities.

Stock Influences

- Positive data readouts from the company’s ongoing studies of IMMU-132;

- Accelerated approval from the FDA for IMMU-132 without additional OS data;

- New partnerships and collaborations for the company’s existing product candidates; and

- M&A Activity.

Risk Factors

- The company has historically been a research and development company, but is moving to commercialize its products as well;

- The FDA could require additional data from the company’s primary product candidate, IMMU-132;

- Due to the high cost, governments and insurance agencies may initially limit the use of the company’s products; and

- The company may fail to successfully develop any other products from its product pipeline.

Stock Performance

As of November 24, 2017, shares of Immunomedics closed at $11.15 after gaining more than one percent on the day, yielding a market capitalization of $1.7 billion. The stock has climbed steadily in the past 12 months due to optimism regarding the accelerated approval of IMMU-132, and hit a high of $14.48 in early October. As discussed above, Immunomedics lost nearly 20 percent and traded as low as $9.96 after the abstracts for the SABCS presentations were posted, but positive analyst opinions regarding the recent study data helped to push the stock higher.

Following are selected analyst ratings and price targets:

| Analyst | Firm | Rating | Price Target | Date |

| Matthew Andrews | Jeffries | Buy | $16.00 | 11/14/2017 |

| Phil Nadeau | Cowen | Outperform | $15.00 | 11/13/2017 |

Summary

The market initially reacted negatively to the SABCS abstract data for IMMU-132, mainly due to decreases in DOR, PFS, and OS. However, analysts believe that the drug remains approvable, and are optimistic that it will be able to navigate the accelerated approval process. The full data set, due out in early December, will give a much clearer picture.

While Immunomedics continues to burn cash, it has sufficient reserves to continue operations for the next 12 months and beyond. The company may need to raise additional cash if additional studies for IMMU-132 are needed.

Welcome to Traders News Source

Our track record speaks for itself…

Traders News Source recent profiles and track record, 487% in verifiable potential gains for our members on 3 small cap alerts alone! These are just three examples from over two dozen winners this year.

January 31st, 2017 (NASDAQ: HIMX) opened at $5.10/share and hit a high of $9.68/share March 24th, 2017 for gains of 89% within 60 days- http://finance.yahoo.com/news/himax-technologies-review-4q-2016-130000319.html

May 23rd, 2016- (NYSE: XXII) opened at $.87/share hit a high of $3.03/share so far our member potential gains- 248% – http://mailchi.mp/tradersnewssource/updates-5-of-our-profiles-for-212-400-and-whats-coming-next?e=[UNIQID]

October 31st, 2017 (NASDAQ: PYDS) Although we have been covering this security for over a year, our recent coverage October 31st, 2017 opened at $1.45/share hit $4.10 within three days for gains of over 150%- http://mailchi.mp/tradersnewssource/update-pyds-back-in-the-value-zone-with-news-out?e=[UNIQID]

So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletter. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

Big Opportunities Trading Small Cap Stocks

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Ivan Nielson, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.