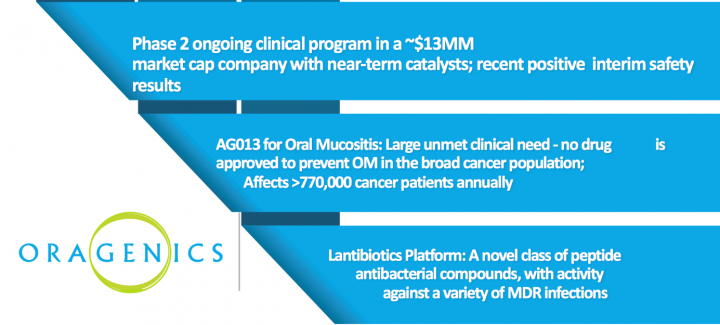

Oragenics, Inc. (NYSE: OGEN) is focused on becoming a leader in novel antibiotics against infectious disease and on developing effective treatments for oral mucositis. Oragenics, Inc. has established two exclusive worldwide channel collaborations with Intrexon Corporation Inc., a synthetic biology company. The collaborations allow Oragenics access to Intrexon’s proprietary technologies toward the goal of accelerating the development of much needed new antibiotics that can work against resistant strains of bacteria and the development of biotherapeutics for oral mucositis and other diseases and conditions of the oral cavity, throat, and esophagus.

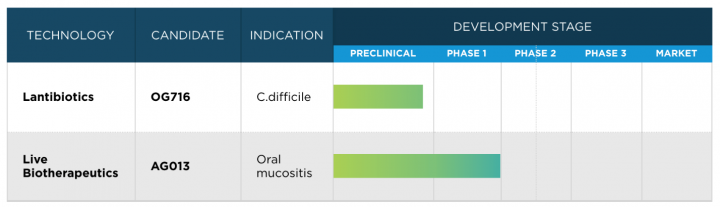

Oragenics’ pipeline:

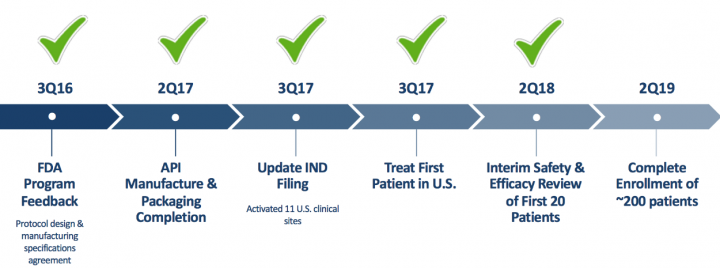

On November 15th, 2018, the Company announced that it has received clearance to enroll patients residing in Germany from the Paul Erlich Institute and patients residing in the United Kingdom from the Medicines and Healthcare Products Regulatory Agency (MHRA), into its Phase 2 clinical trial of AG013, a live biotherapeutic product for the potential prevention and treatment of OM.

AG013, which has been granted Fast Track designation with the U.S. Food and Drug Administration and orphan drug status in Europe, is an Intrexon Actobiotics therapeutic candidate formulated to deliver the therapeutic molecule, human Trefoil Factor 1, to the mucosal tissues in the oral cavity in a convenient oral rinsing solution.

Before this on November 14th, the company announced financial results for the quarter ended September 30, 2018. As of September 30, 2018, the Company reported $13.8 million in cash, compared to $6.2 million as of December 31, 2017. Besides, the company has received an additional $9.5 million in cash proceeds as a result of the exercise of 9.5 million warrants. As of November 13, 2018, the Company had approximately $22.3 million in cash. Total operating expenses, which include research and development and general and administrative expenses were $2.8 million for the third quarter of 2018, compared to $1.9 million for the same period during 2017.

______________________________________________________________________

TradersNewsSource – We will be initiating coverage on a small float, potential breakout trade Tuesday (12/04/18) at 9:30 AM Eeastern. Visit this page at 9:30 AM to read this report as soon as it is issued- https://tradersnewssource.com/traders-news-source-new-members/

Alternatively, join our SMS/text alert service by sending the word “Traders” to “25827” from your cell phone. It’s easy and free for most carriers.

______________________________________________________________________

“We are pleased with the recent exercise of warrants that provided us with an additional $9.5 million of capital. Our cash on hand will be used to continue the clinical site expansion of our ongoing Phase 2 clinical trial of our lead compound, AG013, for the prevention of oral mucositis, as well as the advancement of our novel lantibiotic treatment for Clostridium difficile, OG716,” commented Alan Joslyn, president and CEO of Oragenics, Inc. “We look forward to advancing both compounds’ development and to providing updates to our shareholders on those results.”

Investment highlights:

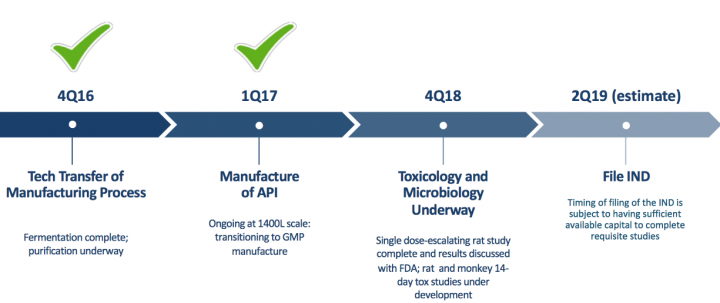

Milestone and Timelines:

- AG013:

- Lantibiotics: OG716 C. difficile Program Milestones

About AG013: AG013, which has been granted Fast Track designation with the U.S. Food and Drug Administration and orphan drug status in Europe, is an ActoBiotics® therapeutic candidate formulated to deliver the therapeutic molecule Trefoil Factor 1 to the mucosal tissues in the oral cavity in a convenient oral rinsing solution. Trefoil Factors are a class of peptides involved in the protection of gastrointestinal tissues against mucosal damage and play an important role in subsequent repair. The compound was designed by the company’s strategic partner, ActoBio Therapeutics, Inc., a wholly-owned subsidiary of Intrexon Corporation (NYSE: XON).

About Lantibiotics: Lantibiotics are a class of antibiotic compounds with a novel mechanism of action, prized for their ability to overcome antibiotic-resistant infections. With resistant strains on the rise, particularly healthcare-acquired infections (HAI), the need for these potent lantibiotic agents is critical. Oragenics is pursuing the commercial-scale production of a lantibiotic for use as an antimicrobial.

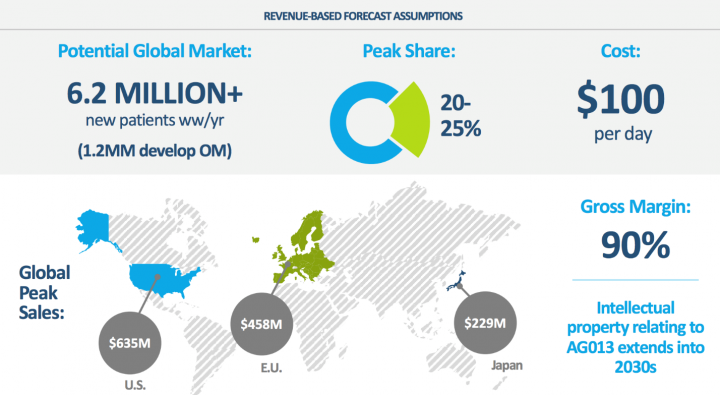

Industry Potential: AG013 Has Large Addressable Market with Potential W.W. Sales >$1.0Bn for Oral Mucositis

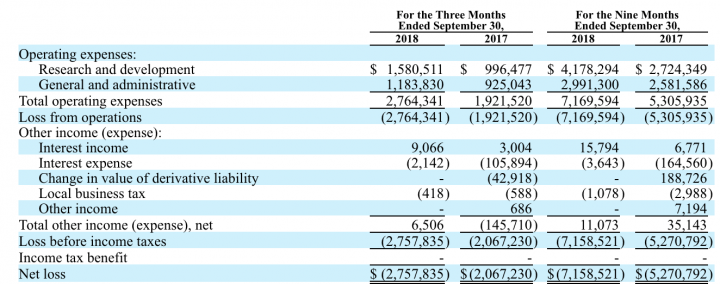

Third Quarter 2018 Financial Highlights:

Research and Development: Research and development expenses were $$1,580,511 for the three months ended September 30, 2018, compared to $$996,477 for the three months ended September 30, 2017, an increase of $584,034 or 58.6%.

Other Income: Other income, net was $6,506 for the three months ended September 30, 2018, compared to $(145,710) for the three months ended September 30, 2017, resulting in an increase of $152,216.

Liquidity: As of September 30, 2018, the Company reported $13.8 million in cash, compared to $6.2 million as of December 31, 2017. In addition, the company has received an additional $9.5 million in cash proceeds as a result of the exercise of 9.5 million warrants. As of November 13, 2018, the Company had approximately $22.3 million in cash.

Key risk factors and potential stock drivers:

Successful completion of the upcoming milestones would lead future direction for the company. Any adversities related to these upcoming milestones might adversely impact the overall investor sentiments.

OGEN is still an early stage entity and has not yet generated meaningful revenue and will likely operate at a loss as it grows its market position and seeks ways to monetize it.

OGEN has a history of operating losses. Therefore, any time or cost overrun in its ongoing R&D activities and its impact on business & financial profile will remain a key business sensitivity factor.

Stock Performance

Comments:

- On Friday, November 30th, 2018, OGEN closed at $1.35, with an average volume of 6.8 million shares exchanging hands. Market capitalization is $39.735 million. The current RSI is 65.25.

- In the past 52 weeks, shares of OGEN have traded as low as $0.38 and as high as $4.70

- At $1.35, shares of OGEN are trading above its 50-day moving average (MA) at $1.10 and above its 200-day moving average (MA) at $1.21

- The present support and resistance levels for the stock are at $0.97 & $1.61 respectively.