Ensco PLC, (NYSE: ESV) operates through three segments: Floaters, Jackups, and Other. The company owns and operates an offshore drilling rig fleet in the Middle East, Africa, and the Asia Pacific. It also offers management services on rigs owned by third-parties. The company serves government-owned and independent oil and gas companies. Ensco plc was founded in 1975 and is headquartered in London, the United Kingdom.

More recently, UBS has upgraded Ensco to from Neutral to Buy with a price target of $8.00 (from $6.00). The research house foresees a critical inflection in offshore utilization for floaters and jackups with an underlying belief that demand will slowly return in 2018. Oil prices are expected to remain range-bound around $50 and move higher in 2019/2020 and, creates a compelling valuation to enter now ahead of this inflection point.

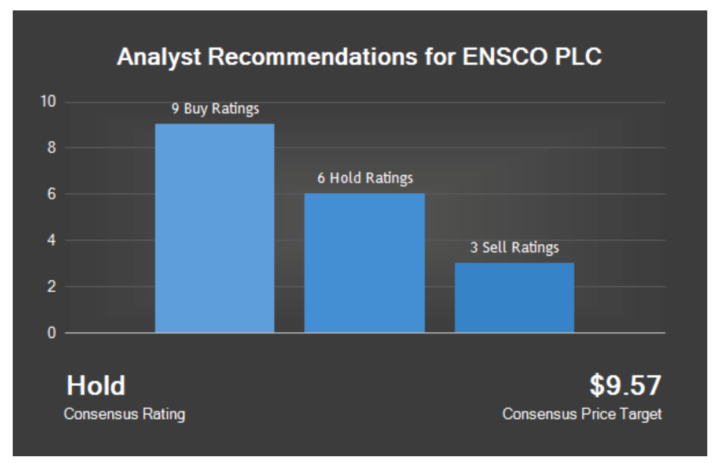

In fact, several other research firms also recently issued favorable reports on ESV. Four analysts have rated the stock with a sell rating, seven have assigned a hold rating, and nine have assigned a buy rating to the company’s stock. The stock currently has an average rating of Hold and a consensus target price of $9.57.

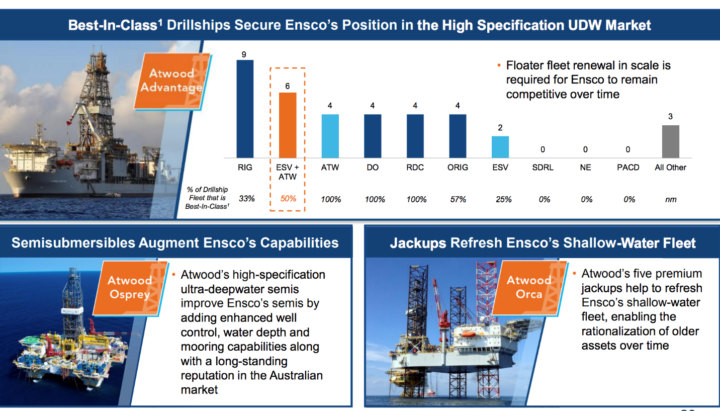

On October 6th, ESV announced the completion of its acquisition of Atwood Oceanics, Inc. Under the terms of the merger agreement, Atwood shareholders are entitled to receive 1.60 Ensco Class A ordinary shares for each share of Atwood common stock they own. Ensco and Atwood shareholders will own approximately 69% and 31%, respectively, of the outstanding shares of the combined company. Regarding the completion of the transaction, Atwood common stock has ceased trading on the New York Stock Exchange.

Ensco has used timely acquisitions to grow into one of the leading offshore drilling companies, and the addition of Atwood is another major milestone in its progression. By acquiring Atwood at a pivotal time in the market cycle, Ensco purchased very high-quality assets at compelling prices as values for the highest-specification assets are at a critical inflection point.

Additionally, these high-specification assets will further ESV’s ability to meet increasing customer demand and strengthen its competitive position, which coupled with significant expected synergies, will generate meaningful, long-term value for shareholders.

Synergies due to acquisition:

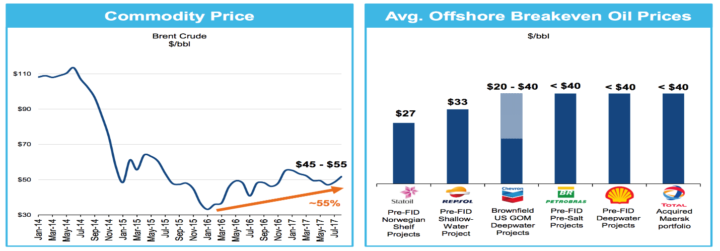

The past few days or so have been quite eventful for Ensco, and stock of the company has gained significant strength. The improving sentiments in the offshore drilling sector are led by the positivity within oil producers to look forward to new opportunities to increase their fast depleting oil & gas reserves, at a relatively compelling cost.

Moreover, Global Utilization has stabilized, as commodity prices and project economics have improved and with the slow recovery in oil prices, Ensco is likely to turn this acquisition as an extremely successful move and value creator for its shareholders. Therefore, Ensco shares have a good opportunity to continue their upside move over the near to medium term.

About the Company: Ensco plc brings energy to the world as a global provider of offshore drilling services to the petroleum industry. For 30 years, the Company has focused on operating safely and going beyond customer expectations. Operating one of the newest ultra-deepwater rig fleets and a leading premium jackup fleet, Ensco has a major presence in the most strategic offshore basins across six continents. Ensco plc is an English limited company (England No. 7023598) with its corporate headquarters located at 6 Chesterfield Gardens, London W1J 5BQ.

2017 Second quarter financial results:

Revenue and net loss: Revenues were $458 million in second quarter 2017 compared to $910 million a year ago. Excluding $205 million of early contract termination settlements received during second quarter 2016, revenues declined 35% compared to the year-ago period. Fewer rig operating days due to a decline in reported utilization to 56% from 61% in second quarter 2016 as well as previously announced sales of rigs that operated a year ago also contributed to lower year-to-year revenues. The average day rate for the fleet declined to $156,000 in second quarter 2017 from $195,000in second quarter 2016. The company reported ($0.10) EPS for the quarter, topping the consensus estimate of ($0.12) by $0.02.

Contract drilling expense declined to $291 million in second quarter 2017 from $350 million a year ago as lower personnel and other activity-based costs due to fewer rig operating days more than offset costs related to the settlement of a previously disclosed legal contingency and contract preparation costs.

Interest expense in second quarter 2017 was $60 million, net of $14 million of interest that was capitalized, compared to interest expense of $54 million in second quarter 2016, net of $13 million of interest that was capitalized. The year-on-year increase in interest expense is primarily due to senior convertible notes issued in fourth quarter 2016, partly offset by debt repurchases. Second quarter 2016 other income included a $261 million gain on the repurchase of $940 million of senior notes at an average discount of 27%.

The firm also recently disclosed a quarterly dividend, paid on, September 22nd. Investors of record on September 11th were issued a $0.01 dividend. The ex-dividend date was September 8th. This represents a $0.04 annualized dividend and a yield of 0.70%. Ensco Plc’s dividend payout ratio is currently 23.53%.

Key risk factors and potential stock drivers:

- The development and exploitation of alternative fuels; Disruption to exploration and development activities due to hurricanes and other severe weather conditions and the risk thereof;

- Improvement or stability in oil prices could improve the company’s performance;

- Natural disasters or incidents resulting from operating hazards inherent in offshore drillings, such as oil spills, and;

- The worldwide military or political environment, including uncertainty or instability resulting from an escalation or additional outbreak of armed hostilities or other crises in oil or natural gas producing areas of the Middle East or geographic areas in which ESV operates, or acts of terrorism.

Stock Chart:

On Monday, October 9th, 2017, in intra-day trading, ESV was at $5.68 on volume of 7.2 million shares exchanging hands. Market capitalization is $1.73 billion. The current RSI is 59.40

In the past 52 weeks, shares of ESV have traded as low as $4.10 and as high as 12.04

At $5.68, shares of ESV are trading above its 50-day moving average (MA) at $4.97 and below its 200-day MA at $7.42

The present support and resistance levels for the stock are at $5.56 & $5.83 respectively.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.