Aptevo Therapeutics Inc. (NASDAQ: APVO) is a clinical-stage biotechnology company focused on novel oncology and hematology therapeutics to improve patients’ lives.

In the recent past, APVO’s stock gained enormous strength & popularity, just after it sold three of its products for a much higher than expected value. On August 31st, Aptevo announced that it has agreed to sell its three marketed hyperimmune products to Saol Therapeutics.

The overall transaction is valued at up to $74.5 million, including an upfront payment of $65 million, and an additional potential milestone payment of up to $7.5 million related to the achievement of gross profit milestones. Additionally, Aptevo may receive up to $2 million related to the collection of certain accounts receivable after the closing. With this, the financing overhang on the company has been eliminated at least for the medium term.

The three products that Saol will get are all coming from Aptevo’s hyperimmune portfolio and are WinRho SDF for autoimmune platelet disorder and hemolytic disease of the newborn; HepaGam B for the prevention of Hepatitis B following liver transplantation and for treatment following hepatitis B exposure; and VARIZIG for treatment following exposure to varicella zoster virus for individuals with compromised immune systems.

The transaction described above brings in significant non-dilutive funding for Aptevo, enabling it to continue investing in its promising pipeline. With a deal value of up to $74.5 million, representing approximately 2.8 times of its market capitalization on August 30, 2017 and its 2016 annual revenue, the management views this as a very attractive opportunity to monetize its non-core assets and at the same time not dilute stockholders as it continues to invest in promising assets like ADAPTIR™ platform.

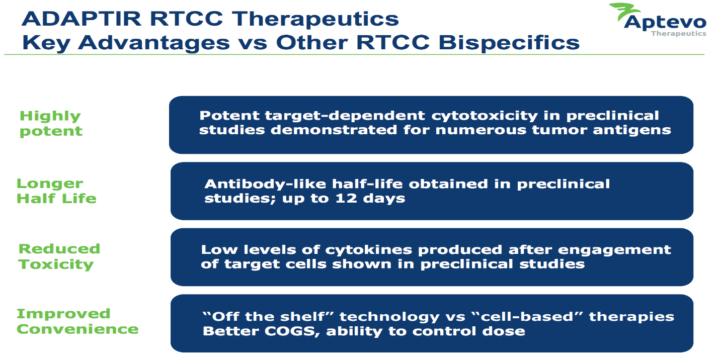

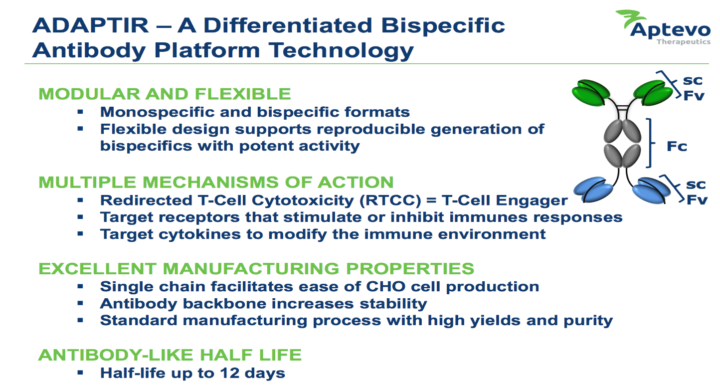

ADAPTIR is a modular protein technology platform that can generate highly-differentiated, bispecific antibodies with unique mechanisms of action to treat cancer or various autoimmune diseases. Furthermore, it can do so relatively quickly and comparatively cheaply when looked at against the cost of developing a unique asset in this type of oncology indication.

Therefore, the recent drug asset sale strengthens Aptevo’s cash position and provides it with all the necessary flexibility to continue to advance its ADAPTIR product candidates through potentially value-adding inflection points, including an ongoing dose-escalation Phase 1 study of APVO414 in metastatic castration resistant prostate cancer; an ongoing Phase 2 clinical program for otlertuzumab, and future Phase 1 clinical studies of its novel bispecifics focused on engaging the immune system, including, APVO436 and ALG.APV-527, a bispecific targeting ROR1, and a bispecific based on targeted cytokine delivery, APVO210 (formerly known as ES210.)

On the flip side, future revenues for the company might temporarily take a hit, but the overall financial flexibility and liquidity of the company has improved significantly. In other words, there’s no dilution risk for next 1-2 years, and by that time a few significant catalysts are likely to be crystallized.

It’s rare to find an exciting biotech play like APVO, who has low market cap, with huge liquidity, efficient/promising product pipeline in a high growth industry. In fact, the company estimates that the global market for patients with metastatic castration-resistant prostate cancer therapies is expected to reach $9.5 billion by 2020.

Driven by above-mentioned factors, traders and investors seem to be pricing APVO positively. The stock currently has an average rating of “BUY” and a consensus price target of $5. Considering present valuation, APVO is at an extremely favorable risk-reward position.

About the Company: Aptevo Therapeutics Inc. is a clinical-stage biotechnology company focused on novel oncology and hematology therapeutics to improve patients’ lives meaningfully.

Aptevo has a commercial product, IXINITY®, approved and marketed in the United States for the treatment of Hemophilia B, and a versatile core technology – the ADAPTIR™ modular protein technology platform capable of generating highly-differentiated bispecific antibodies with unique mechanisms of action to treat cancer or autoimmune diseases. Aptevo has two ADAPTIR antibody candidates currently in clinical development, and a broad pipeline of novel investigational-stage bispecific antibody candidates focused on immuno-oncology and autoimmune infection and inflammation.

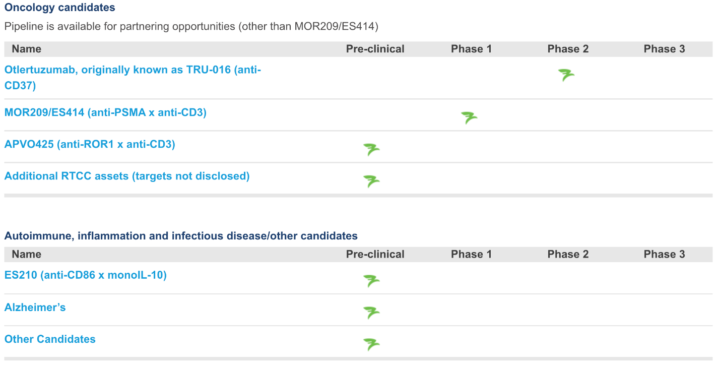

ADAPTIR Clinical and Preclinical Portfolio:

- APVO414 – a bispecific ADAPTIR candidate, currently in Phase 1 development, targeting prostate-specific membrane antigen (PSMA), an enzyme that is expressed on the surface of prostate cancer cells, and, CD3, a component of the T cell receptor complex expressed on all T cells. APVO414 redirects T cells to specifically kill PSMA expressing tumors and is being developed for metastatic castration-resistant prostate cancer, which is advanced prostate cancer that has spread to other organs and no longer responds to hormone-blocking therapies.

- Otlertuzumab – a monospecific ADAPTIR candidate currently in Phase 2 development for the treatment of chronic lymphocytic leukemia (CLL). Data from a Phase 2 clinical trial evaluating otlertuzumab in combination with bendamustine, compared to bendamustine alone, demonstrated a significant increase in median progression-free survival for the combination, from approximately 10 to 16 months.

- APVO436 – a bispecific ADAPTIR candidate currently in preclinical development targeting CD123, a cell surface receptor highly expressed on several hematological malignancies and CD3, a component of the T-cell receptor. APVO436 engages T cells in killing tumor cells.

- APV-527 – a bispecific antibody candidate, partnered with Alligator Bioscience, featuring a novel mechanism of action designed to simultaneously target 4-1BB (CD137) and an undisclosed tumor antigen.

- APVO210 – a bispecific ADAPTIR preclinical candidate with a novel mechanism of action based on targeted cytokine delivery.

- ROR1 Bispecific – a proof-of-concept bispecific candidate targeting ROR1, an antigen found in several solid tumors and hematologic, or blood-related malignancies. Initial preclinical data demonstrate redirected T cell killing of tumors expressing ROR1 in vitro and in vivo in animal models.

Other recent announcements:

On Oct 2nd, the company announced new information on the Company’s proprietary next-generation ADAPTIR™ protein therapeutic platform was presented at the 8th Annual World Bispecific Summit in Boston, MA, September 26-28, 2017.

Aptevo’s next generation ADAPTIR platform, highlights improvements that have led to the development of new ADAPTIR candidates with increased stability, superior manufacturability and antibody expression levels, and an extended half-life of up to 12.5 days in rodents.

As per management, recent data on APVO436 confirm the important advances it made with its next-generation ADAPTIR candidates, specifically improved stability, half-life, activity, and manufacturability – all critical attributes for commercialization.

2017 Second quarter financial results:

Liquidity and Financial Flexibility: Aptevo had cash, cash equivalents, and short-term investments as of June 30, 2017, totaling $48.6 million. With the money coming in and given the current burn rate of about $10M – $15M per quarter, the company is estimated to have at least two years of liquidity.

Moreover, the company recently announced that it had amended the terms of a credit agreement initially executed with MidCap Financial Trust in August 2016. The first tranche of this term loan, for $20 million, was funded in August 2016. The amendment allows Aptevo to retain this $20 million funding tranche, for which repayment was anticipated coincident with the sale transaction of Aptevo’s hyperimmune commercial assets. As part of the amendment, the companies have agreed to eliminate the option for the second tranche of $15 million.

Product Sales Revenue: Total product sales revenue was $10.8 million for the three months ended June 30, 2017, compared to $10.2 million for the same period in 2016. The increase in product sales revenue was primarily due to increased sales of IXINITY as new supply of IXINITY was reintroduced during the current period, offset by reduced sales of WinRho.

Net Loss: Aptevo’s net loss for the three months ended June 30, 2017, was $11.2 million or ($0.53) per share, compared to $12.8 million or ($0.63) per share for the corresponding period in 2016.

Key risk factors and potential stock drivers:

After the recent asset sale, the focus on R&D expenses is likely to increase. Additionally, the revenues are expected to shrink together with a higher than before cash burn, until the existing pipeline starts to contribute meaningfully.

Therefore, Aptevo will need to demonstrate the meaningful value in its R&D activities, and the market will react accordingly. Any non-favorable news regarding the same could be a major constraining factor for the company’s business risk profile.

Given the historical track record of the asset sale, the company might sell other products as well, which could potentially produce another substantial cash inflow within the next 1-2 years.

The biotech space is a high-risk sector due to uncertainties associated with the novel drug development. Therefore, favorable outcome of the upcoming catalyst is necessary for the stock to retain its momentum. Any adversities related with the same could upset the stock performance significantly.

Stock Chart:

On Monday, October 9th, 2017, in intra-day trading, APVO was at $2.57 (-4.81%) on volume of 400 thousand shares exchanging hands. Market capitalization is $57.20 million. The current RSI is 66.38

In the past 52 weeks, shares of APVO have traded as low as $1.15 and as high as 3.85

At $2.57, shares of APVO are trading above its 50-day moving average (MA) at $1.87 and above its 200-day MA at $2.01

The present support and resistance levels for the stock are at $2.53 & $2.88 respectively.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.