Immune Pharmaceuticals, Inc. (NASDAQ: IMNP) is a biopharmaceutical company developing novel therapeutic agents for the treatment of immunologic and inflammatory diseases. Currently, the company is conducting two Phase II clinical trials to test bertilimumab in patients suffering from bullous pemphigoid and ulcerative colitis, respectively.

On September 27th, IMNP announced Positive Results from Ongoing Phase 2 Trial of Bertilimumab in Bullous Pemphigoid. The six subjects in the study experienced a decline in the Bullous Pemphigoid Disease Area Index (BPDAI) Total Activity Score of 85% (p=0.0096). All six subjects in the study achieved a greater than 50% reduction in their BPDAI Total Activity Score by the final assessment, and four of the six patients had a greater than 90% reduction. Bertilimumab was well tolerated in all six subjects, and no serious adverse events were reported.

As per management, these results are quite impressive. Moderate-to-severe bullous pemphigoid is typically managed with 60 mg of prednisone. The improvement seen in these subjects despite such a low prednisone dose and a rapid taper, strongly suggests bertilimumab may provide a clinically meaningful benefit.

Bullous pemphigoid, is an autoimmune condition that is imbibed in the immune system creating and adversely affecting the antibodies that break down the bonds between skin cells in humans. This breaking down of the bonds translates to open sores and severe blisters.

Immune is working towards changing this with bertilimumab, which is a monoclonal antibody that stops the bonds being broken. If bertilimumab could significantly reduce or maybe even eliminate the need for systemic corticosteroids in the treatment of bullous pemphigoid and their significant toxicity, it will be a major step forward in the rapid improvement of what is the most common blistering disease.

The company would continue to enroll subjects into this phase 2 open-label BP trial, which has a target enrollment of around 15 patients, as it initiates plans for a larger clinical trial designed to prove that bertilimumab provides a significant benefit to patients suffering from this severe inflammatory disease.

In fact, these promising preliminary results support the company’s strategy of focusing its human capital and financial resources on bertilimumab and NanoCyclo product candidates while streamlining operations by divesting unrelated oncology business.

Therefore, the company is an interesting biotech play and has various catalysts (in addition to bertilimumab), which the markets are going to be watching very closely as indicative of the future success of the company.

- The company has an orphan drug designation filing with the FDA, which it should have an update before the end of 2017.

- There’s a phase 2 study of the same drug in ulcerative colitis indication, which should announce results during the second quarter of next year.

- There’s also a pivotal initiation for Ceplene, which should be under the sole management of the company’s spinoff Cytovia, in the US.

These are few significant catalysts over the near to medium term and if they come out as “positive,” it could place the stock on a rapid growth trajectory. Immune’s share price is low right now and therefore is a value stock at current prices.

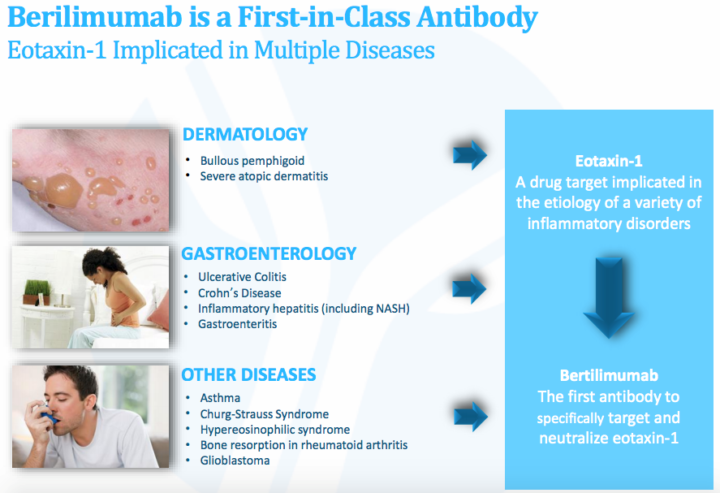

About the Company: Immune Pharmaceuticals is a biopharmaceutical company developing novel therapeutic agents for the treatment of immunologic and inflammatory diseases. Its lead program, bertilimumab, is a first-in-class, humanized monoclonal antibody that targets and lowers levels of eotaxin-1, a chemokine that plays a role in immune responses and attracts eosinophils to the site of inflammation.

About Bertilimumab: Bertilimumab is a first-in-class human monoclonal antibody designed to block the protein eotaxin-1, which is responsible for causing inflammation in a significant number of diseases.

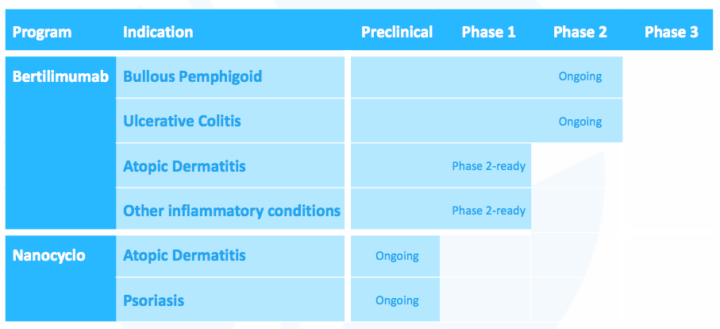

- Currently running phase 2 trials in bullous pemphigoid (open-label single arm) and ulcerative colitis (randomized, double-blind, placebo-controlled)

- Strong efficacy signal from BP trial – first six subjects had a significant reduction in disease activity despite an aggressive prednisone taper

- Well-established safety profile – substantial human exposure (n>100 total; >60 IV); no drug associated SAE

- Multiple additional clinical applications including atopic dermatitis, asthma, other eosinophil-driven diseases, glioblastoma, and others

Nanocyclo: Nanoformulation of cyclosporine enables the molecule to better penetrate the skin layers and provide a local anti-inflammatory effect. Cyclosporin is widely used as a systemic agent to prevent organ transplant rejection and has also been approved to treat autoimmune diseases such as rheumatoid arthritis and psoriasis, and for local use in the treatment of dry eye and some forms of keratitis.

Product/pipeline with multiple indications:

Cytovia Spin-off Update: Progress continues on segregating the IMNP oncology assets into Cytovia, Inc., and recruitment of a Cytovia management team in preparation of a spin-off and a distribution of Cytovia’s shares to Immune’s shareholders.

2017 Second quarter financial results:

- The Company recorded no revenue for the six months ended June 30, 2017, and 2016.

- At June 30, 2017, the Company had a working capital deficit of approximately $14.2 million. Accumulated deficit amounted to $104.3 million and $95.6 million at June 30, 2017, and December 31, 2016, respectively. Net loss for the three and six months ended June 30, 2017, was $4.9 million and $8.7 million, respectively.

- Operations since inception have been funded primarily with the proceeds from equity and debt offerings. As of June 30, 2017, the Company had approximately $22,000 in cash.

- The following table summarizes select balance sheet and working capital amounts as at June 30, 2017, and December 31, 2016 ($ in thousands):

Key risk factors and potential stock drivers:

The upcoming updates on the clinical trial targeted enrolment, would drive the future direction of the stock. If these updates support the recent data, stock prices could surge.

IMNP presently has net level losses. Therefore, any crunch in its liquidity and financial flexibility will further impact its business & financial profile.

NASDAQ Letter: on August 23, 2017, the Company received written notice from the Listing Qualifications Department that the Company no longer complies with the minimum stockholders’ equity requirement under the NASDAQ Listing Rule. The Company also does not meet the alternative compliance standards relating to the market value of listed securities of $35 million or net income from continuing operations of $500,000 in the most recently completed fiscal year or in two of the last three most recently completed fiscal years.

By NASDAQ Listing Rules, the Company has 45 calendar days, or until about October 6, 2017, to submit a plan to regain compliance. If accepted, NASDAQ may grant the Company an extension of up to 180 days. An unfavorable outcome of this matter could impinge to stock performance over the near term.

Stock Chart:

On Wednesday, October 4th, 2017, IMNP closed at $1.52 on an average volume of 1.69 million shares exchanging hands. Market capitalization is $16.07 million. The current RSI is 60.62

In the past 52 weeks, shares of IMNP have traded as low as $1.01 and as high as 7.15

At $1.52, shares of IMNP are trading above its 50-day moving average (MA) at $1.42 and below its 200-day MA at $2.70

The present support and resistance levels for the stock are at $1.49 & $1.60 respectively.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.