Smarter Sustainable Investing

Climate Positive Investing

Bring an innovative edge to your portfolio

Play Video

Smarter Sustainable Investing

Climate Positive Investing

Bring an innovative edge to your portfolio

Play Video

Climate & ESG Returns

Etho Capital® is a financial technology company on a mission to align investor profits with a better planet. Our research team combines unique data and analysis to create public equity index strategies that deliver financial performance driven by efficiency, innovation, diversification, and superior environmental, social and governance (ESG) sustainability.

We also work directly with asset owners to track portfolio-wide climate and ESG impacts and implement customized strategies to reach decarbonization targets. Our goal is to help investors of all sizes synchronize their values with their portfolios while reducing risks and enhancing financial returns.

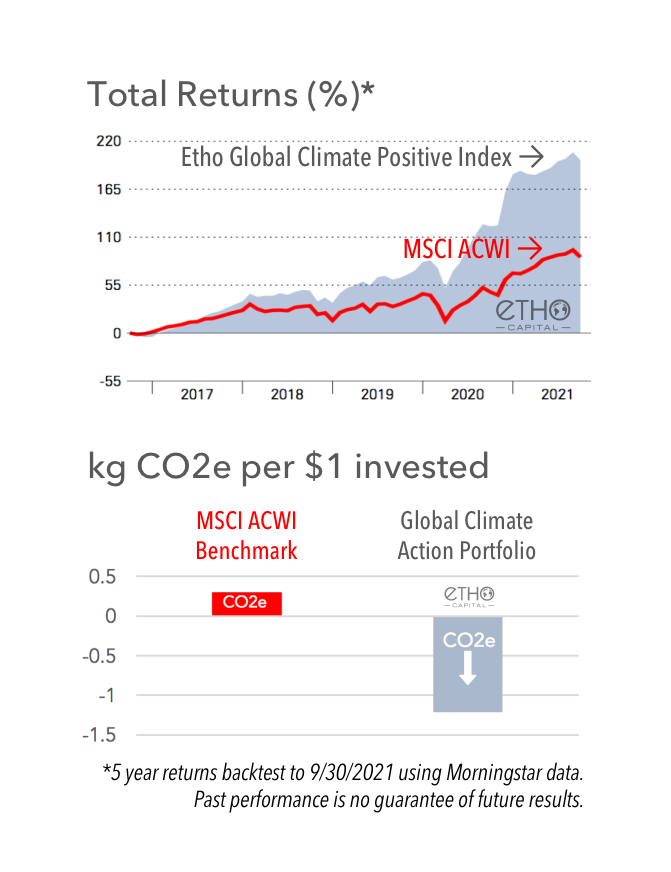

Our flagship US ETF is based on our Etho Climate Leadership Index® and traded on NYSE with the "ETHO" ticker. Our Global Climate Action Portfolio is based on our Etho Global Climate Positive Index™ and run in collaboration with Newday Impact, which integrates our Climate Positive Investing™ process into all portfolio decisions.

Climate Leadership

EFFICIENCY Advantage

TRUE LEADERSHIP FROM SMARTER SUPPLY CHAINS

Climate Leadership

EFFICIENCY Advantage

TRUE LEADERSHIP FROM SMARTER SUPPLY CHAINS

Invested in innovation

Etho Capital believes investment strategies that incorporate ESG data and information will produce better financial returns. This is because ESG data, when accurately and appropriately applied, can help identify the most innovative and well-run companies. For instance, we have found that climate pollution can be a powerful measure for both sustainability and overall operational efficiency, which can signal competitive advantages. Our research has shown that more "climate efficient" companies (Climate Leaders) consistently outperformed their less efficient counterparts (Climate Laggards) over the preceding decade.

Go in-depth to learn more about our investing thesis.

Innovative Investments

Data-Driven Approach

Thoughtful Analysis beyond "Greenwashing"

Innovative Investments

Data-Driven Approach

Thoughtful Analysis beyond "Greenwashing"

DEEPER DATA

Etho Capital’s investing approach screens out bad actors while digging deeper into company supply chains to get beyond CSR "greenwashing" and find true leaders. Our Smart Sustainability Process™ uses quantitative climate metrics and qualitative ESG analysis, along with sound portfolio-construction and risk-management techniques, to generate broadly diversified strategies comprised of only the most sustainable and innovative companies. Can this all yield impressive performance? Compare our ETHO ETF with the S&P 500 or the Russell 3000 to see for yourself.

Learn more about our approach.

Performance

100% ESGIntegration

Meaningful Investments for a better future

Performance

100% ESGIntegration

Meaningful Investments for a better future

OUR COMMITMENT

Etho Capital's investment strategies are all built to produce compelling returns for your portfolio, as well as meaningful and measurable ESG sustainability benefits. We are committed to exceeding the expectations of investors by delivering both leading financial and sustainability performance, redefining how smarter investing can create a better future for everyone.

Click here to view our performance.