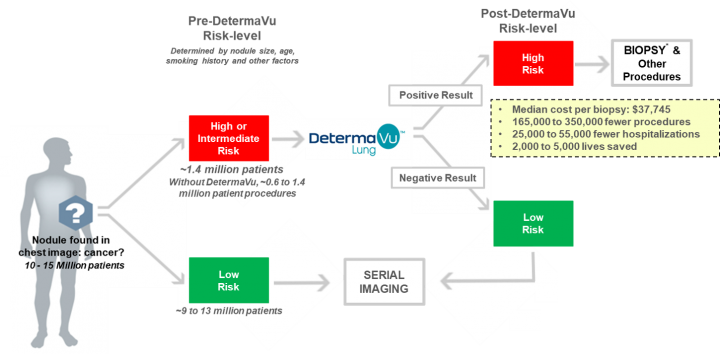

OncoCyte’s is developing a confirmatory, non-invasive liquid biopsy test intended to facilitate clinical decision making in lung cancer diagnosis. The diagnostic is being developed as an intermediate step to confirm the absence of cancer between imaging modalities (LDCTs) detecting suspicious lung nodules and downstream invasive procedures that determine if the nodules are malignant.

As molecular diagnostics evolve from tissue based to liquid biopsy based, fewer downstream procedures will be required resulting in cost savings, earlier diagnosis and decreased risks to the patient.

OncoCyte’s portfolio of pipeline products detect biomarkers that are associated with specific types of cancer (lung, breast and bladder) to help physicians by confirming false positives to improve the standard of care and reduce overall health care spend.

Recently the company conducted a R&D Validation study demonstrating the accuracy of the Company’s DetermaVu™ liquid biopsy test for lung cancer.

On Tuesday, January 29, 2019, the stock ran up over 250% on volume of about 36 million shares, compared with the full-day average volume of about 30,350 shares. The company said the DetermaVu study demonstrated sensitivity of 90%, which is the percentage of malignant nodules that are correctly identified, and specificity of 75%, which is the percentage of benign nodules correctly identified.

OncoCyte said in a statement. “DetermaVu™ has the potential to dramatically reduce U.S. healthcare costs by billions of dollars each year by eliminating unnecessary biopsies, which, according to a recent Medicare study, cost on average $14,634 each.” The company expects DetermaVu to be commercially available in the second half of 2019.

In practice, physicians could use a simple DetermaVu™ blood test to determine whether or not a patient’s lung nodule should be biopsied for cancer. If the DetermaVu™ test indicates a benign result, the patient can be monitored without a biopsy, eliminating the cost and safety risks of an invasive procedure. With 75% specificity, physicians could use DetermaVu™ to eliminate up to three quarters of unnecessary biopsies and their associated complications and deaths. These reduced costs and improved patient outcomes highlight DetermaVu™ ‘s value proposition for payers such as Medicare and health insurance companies.

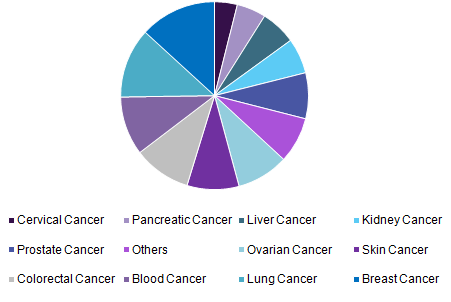

Cancer Diagnostic Market

According to Grandview Research, the global cancer diagnostics market size was valued at USD 124.0 billion in 2016 and is expected to grow at a CAGR of 7.2% over the forecast period. Growing prevalence of oncologic cases, constant technological advancements in diagnostics, and increasing demand for effective screening tests are some of the prime factors spurring the demand for screening tools across the world. In addition, rising awareness and supportive government initiatives are some additional factors that are anticipated to boost the growth of the sector during the forecast period.

Although various screening procedures, such as lab tests, imaging, and endoscopy, enable disease detection at an early stage, there are certain risk factors posed by medical imaging, such as excessive radiation exposure and the administration of fluorescent and barium contrast media in imaging and endoscopic procedures, that cause several adverse effects such as nausea and diarrhea. In addition, the cost entailed in performing diagnosis is relatively high.

Cancer is one of the leading causes of deaths across the world, which is attributed to the escalating prevalence of the disease. Therefore, healthcare professionals are focusing on the development of effective diagnostic and treatment solutions to check the prevalence level. Early detection increases the success rate of treatment regimens. As a result, healthcare agencies and market players through various awareness programs are promoting routine checkups.

About

OncoCyte Corporation focuses on the development and commercialization of novel and non-invasive blood and urine (liquid biopsy) diagnostic tests for the early detection of cancer. The company is developing diagnostic tests using genetic and protein markers expressed in various types of cancer. It develops diagnostic tests based on liquid biopsies using blood or urine samples for detecting lung, bladder, and breast cancer. The company was founded in 2009 and is based in Alameda, California. OncoCyte Corporation is a subsidiary of BioTime, Inc.

Analysts

3 Wall Street analysts have issued ratings and price targets for OncoCyte in the last 12 months. Their average twelve-month price target is $7.00, suggesting that the stock has a possible upside of 17.65%. The high price target for OCX is $7.00 and the low-price target for OCX is $7.00. There are currently 3 buy ratings for the stock, resulting in a consensus rating of “Buy.”

Date Brokerage Action Rating Price Target

1/29/2019 Lake Street Capital Boost Target Buy $4.00 ➝ $7.00

1/29/2019 Janney Montgomery Upgrade Neutral ➝ Buy

7/11/2018 Benchmark Initiated Coverage Buy

Financial review

Q3 2018 (FYE is December 31)

OCX is a development stage company and has not yet generated revenue.

Expenses $3,023,000

Other income $ 52,000

Net loss $2,971,000 ($.07 per share)

The company ended Q3 2018 with $10,821,000 in cash.

Stock influences and risk factors

Continuing progress in product development could be a catalyst for the company shares.

They have incurred operating losses since inception and do not know if they will attain profitability.

They may need to issue additional equity or debt securities in order to raise additional capital needed to pay operating expenses.

The reduction of sales and marketing staff as part of a cost savings plan could delay their ability to commercialize DetermaVu™ and may result in alternative options for commercialization.

Stock chart

On Tuesday, January 29, 2019, OCX shares were at $6.75 (+270%) on traded volume of 36.2 million shares. The current RSI (14) is 93.70

At $6.75, OCX shares are trading above the 50 DMA and 200 DMA od $1.73 and $2.26 respectively.

_____________________________________________________________________

About Traders News Source

Over 75% in realistic bookable gains so far in 2019

Any trader in any market would fall all over themselves to book gains like this. So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in class. We know with a large following comes a large responsibility as we have everyone from the institutional investor to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

View our track record and currently featured reports and updates here- https://tradersnewssource.com/traders-news-source-new-members/

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Traders” to the phone number 25827 from your cell phone.

Pay attention, if you’re just joining us you are about to see why everyone wants to be like us. There are a lot of imitators but only one Traders News Group.

The Traders News Team

______________________________________________________________________

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Mark Roberts. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.