Auris Medical Holding AG (NASDAQ: EARS) is a Swiss biopharmaceutical company dedicated to developing therapeutics that address important unmet medical needs in neurotology.

The company is focused on the Phase 3 development of treatments for acute inner ear hearing loss (AM-111) and for acute inner ear tinnitus (Keyzilen®; AM-101) by way of intratympanic administration with biocompatible gel formulations.

EARS recently announced the execution of two share purchase agreements for up to $15.0 million with Lincoln Park Capital Fund, LLC (“LPC”), a Chicago-based institutional investor. The share purchase agreements provide great flexibility and the potential to extend the financial runway for the company.

On the operational front, the company continues to make great progress with its clinical-stage pipeline, including the completed enrollment of AM-111 HEALOS trial in acute inner ear hearing loss and the ramp-up of the AM-125 program with intranasal betahistine for Meniere’s disease and other vestibular disorders.

More recently, EARS also completed the recruitment of patients for TACTT3, its pivotal trial with Keyzilen® in Europe. Keyzilen® has the potential to become the first specific pharmacological treatment for patients with inner ear tinnitus and the management look forward to announcing top-line results from TACTT3 early next year.

TACTT3 is a randomized, double-blind, placebo-controlled Phase 3 trial in inner ear tinnitus following traumatic cochlear injury or otitis media. The primary efficacy endpoints for the trial include either the improvement of tinnitus loudness or improvement in Tinnitus Functional Index score. Also, the amended protocol includes certain patient subgroups in confirmatory statistical testing, and the trial size was increased.

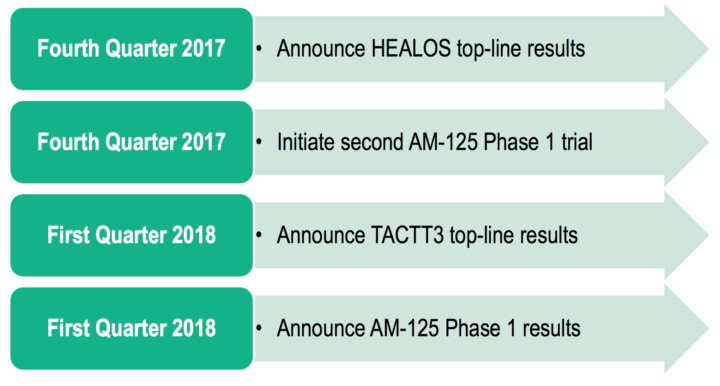

Furthermore, EARS is also moving toward initiating a second Phase 1 trial for AM-125, and announcing top-line Phase 3 results from the HEALOS trial. With positive HEALOS results, AM-111 has the potential to become the first-in-class treatment for acute inner ear hearing loss.

Auris Medical has a few major catalysts lined up including phase 3 data releases expected. We expect that action would continue to drive EARS higher during the upcoming periods as the trial initiates and as markets factors in a successful outcome. Several equities research analysts recently issued favorable reports on EARS shares. On average, the consensus target is $4.25 over the medium term.

About the company: Auris Medical is a Swiss biopharmaceutical company dedicated to developing therapeutics that address important unmet medical needs in neurotology. The Company was founded in 2003 and is headquartered in Zug, Switzerland. The shares of Auris Medical Holding AGtrade on the NASDAQ Global Market under the symbol “EARS.”

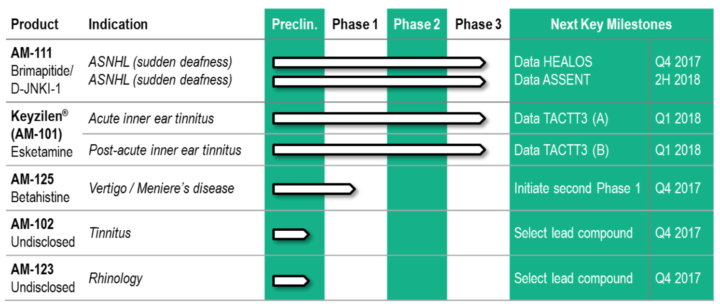

Product Candidates:

EARS currently have two late-stage development programs: Keyzilen® for the treatment of acute inner ear tinnitus and AM-111 for the treatment of acute inner ear hearing loss. Keyzilen®’s therapeutic time window beyond the acute stage is currently being evaluated as part of the TACTT3 clinical trial in Europe.

Early-stage development programs focus on vestibular disorders (AM-125), a second-generation tinnitus treatment (AM-102) and a treatment for a major rhinology indication (AM-123).

Present Trials:

Key Upcoming Milestones:

2nd Quarter 2017 Financial Results:

- Cash and cash equivalents at June 30, 2017, totaled CHF 26.2 million.

- Total operating expenses for the second quarter of 2017 were CHF 6.0 million compared to CHF 9.0 million for the second quarter of 2016.

- Research and development expenses for the second quarter of 2017 were CHF 4.7 million compared to CHF 7.3 million for the second quarter of 2016.

- Net loss for the second quarter of 2017 was CHF 5.4 million, or CHF 0.12 per share, compared to CHF 8.4 million, or CHF 0.25 per share, for the second quarter of 2016.

- The Company continues to expect that its operating expenses in 2017 will be in the range of CHF 28 to 32 million and that existing cash and cash equivalents will enable the funding of operations into the first quarter of 2018.

Upcoming Results: EARS will release their next quarterly earnings announcement on Tuesday, November 28th, 2017.

Key risk factors and potential stock drivers:

- There is the potential upside catalyst for the company and, if news hits press favorably, the stock of the company will be on a growth trajectory. Even if it misses, the subsequent dip in share price will serve as an option to make a position for the eventual upside run.

- Notwithstanding promising data and partnerships, EARS does not have a product yet approved. There is a risk that their potential product candidates might fail during the clinical trials.

- Given the current burn rate, the company might need incremental working capital. Therefore, we might see a near-term raise and subsequent dilution.

- The company may experience financial, regulatory, or operational difficulties, which may impair its ability to commercialize their drug products.

Stock Chart

On Monday, November 6th, 2017, EARS closed at $0.728/share, with an above average volume of 455,130.00 shares exchanging hands. Market capitalization is $32.22 million. The current RSI is 35.39

In the past 52 weeks, shares of EARS have traded as low as $0.60 and as high as $1.50

At $0.728, shares of EARS are trading below its 50-day moving average (MA) at $0.770 and below its 200-day MA at $0.799 as well.

The present support and resistance levels for the stock are at $0.66 & $0.80 respectively.

Welcome to Traders News Source

Our track record speaks for itself…

Traders News Source recent profiles and track record, 487% in verifiable potential gains for our members on 3 small cap alerts alone! These are just three examples from over two dozen winners this year.

January 31st, 2017 (NASDAQ: HIMX) opened at $5.10/share and hit a high of $9.68/share March 24th, 2017 for gains of 89% within 60 days- http://finance.yahoo.com/news/himax-technologies-review-4q-2016-130000319.html

May 23rd, 2016- (NYSE: XXII) opened at $.87/share hit a high of $3.03/share so far our member potential gains- 248% – http://mailchi.mp/tradersnewssource/updates-5-of-our-profiles-for-212-400-and-whats-coming-next?e=[UNIQID]

October 31st, 2017 (NASDAQ: PYDS) Although we have been covering this security for over a year, our recent coverage October 31st, 2017 opened at $1.45/share hit $4.10 within three days for gains of over 150%- http://mailchi.mp/tradersnewssource/update-pyds-back-in-the-value-zone-with-news-out?e=[UNIQID]

So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletter. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

Big Opportunities Trading Small Cap Stocks

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.