Hong Kong regains global IPO crown from New York in 2018 thanks to its listing reforms

- The city saw 125 companies raise US$36.5 billion, the highest since 2010, according to Refinitiv data

- TMT sector accounted for 39 per cent of all funds raised on the back of listing reforms

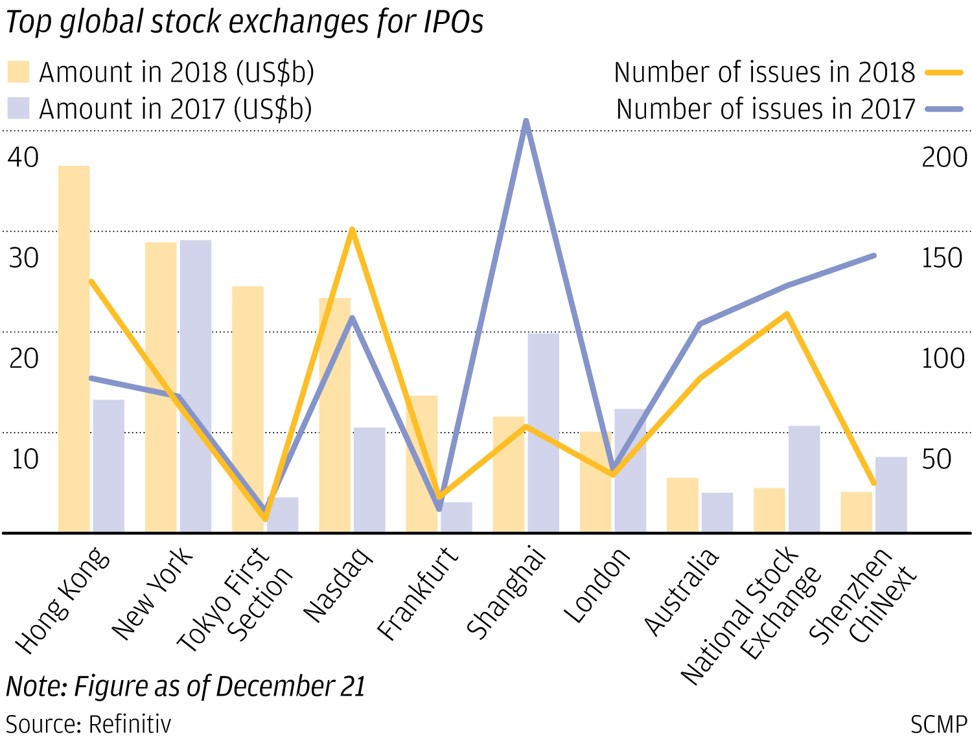

The Hong Kong stock exchange reclaimed its crown as the No 1 IPO market in the world in 2018, beating last year’s winner New York, as listing reforms led to the highest fundraising in eight years, according to Refinitiv data.

Hong Kong’s main board had a 17.6 per cent share of the global IPO market this year as of December 21, with 125 companies raising US$36.5 billion. This was the highest since 2010 and up 175.5 per cent from last year, according to the data provider formerly known as Thomson Reuters.

The New York Stock Exchange on the other hand saw 64 IPOs raising US$28.9 billion, accounting for 13.9 per cent of the global IPO market.

While Hong Kong was the No 1 IPO market in 2015 and 2016, the city mainly attracted traditional manufacturing firms and financial companies, with few tech companies listing here as they preferred New York and the Nasdaq.

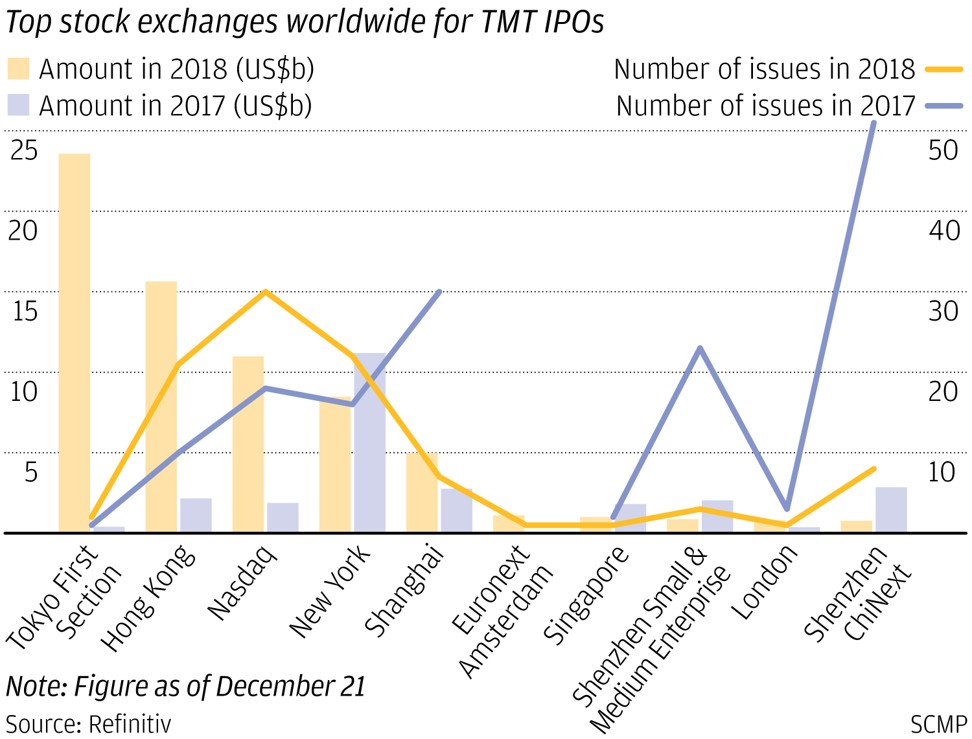

In terms of TMT (telecommunications, media and technology) listings, Hong Kong came second after Tokyo in its highest ranking ever in this category.

The largest reforms in 25 years allowing dual-class shareholding companies and pre-revenue biotech firms to list proved to be a major driving force in boosting tech IPOs this year.

Dual-class or weighted voting rights shareholding companies allow founders and key management greater say than other shareholders. These are favoured by many technology companies such as Facebook, Google, JD.com and others.

The reforms launched by the bourse operator Hong Kong Exchanges and Clearing in April attracted two dual-class shareholding companies: the world’s fourth largest smartphone maker Xiaomi, which raised US$5.4 billion in its July listing, and food delivery firm Meituan Dianping with its US$4.9 billion IPO in September.

Mobile tower operator China Tower’s US$7.5 billion IPO – the largest IPO in Hong Kong this year – was also tech related.

Overall TMT IPOs raised US$15.7 billion, up 605.5 per cent from 2017 while the number grew 94.4 per cent year on year.

Tokyo’s rise to third place in the IPO league table this year was also due to its ability to draw tech plays with US$24.5 billion in proceeds. This was mainly due to Softbank mobile unit’s US$23.3 billion jumbo IPO this month – Japan’s largest ever IPO and the world’s second largest after Alibaba Group Holding’s US$25 billion fundraising in New York in 2014.

The Japanese conglomerate owns stakes in e-commerce giant Alibaba and ride-sharing companies Uber and Didi Chuxing, among others.

Alibaba is the parent company of the South China Morning Post.

China tech IPO boom to carry on into 2019: China Renaissance CEO

Telecommunications and hi-tech were the two biggest fundraising sectors in Hong Kong this year, representing 39 per cent of funds raised, compared to 10 per cent in 2017. The financial sector, traditionally the largest sector in Hong Kong, this year represented just 9.5 per cent of all fundraising, compared to 32 per cent last year.

The total funds raised from Hong Kong’s equity capital markets – share placements, rights issues and IPOs – stood at US$64.2 billion in 2018, up 80 per cent year on year. It was also the highest after US$91.7 billion raised in 2015.

“The listing reform has attracted many big players to list in Hong Kong but it was at the expense of lowering our corporate governance standards,” said Jeffrey Chan Lap-tak, founding partner of Oriental Patron Financial Group. “The HKEX will need to introduce more measures to enhance investor protection.”

Is the IPO wave of 2018 the last hurrah before the party ends?

Francis Leung Pak-to, chairman of the Chamber of Hong Kong Listed Companies, said Hong Kong’s IPO market will face pressure from Shanghai when it launches its new tech board in 2019, as China’s financial capital will be competing for the same group of unicorns as Hong Kong and the US.

The accounting and consulting firm KPMG said that it expects IPOs to decline by HK$100 billion (US$12.7 billion) next year amid market uncertainties.

Stephen Chan Yiu-kwong, a partner at global law firm Dechert, said that unless issues surrounding the global markets – the US-China trade war, Brexit and political unrest in certain parts of Europe – are resolved, Hong Kong will see a noticeable slowdown in IPO activity next year.