Company Overview

Cleveland BioLabs, Inc. (NASDAQ: CBLI) is a biopharmaceutical company engaged in the development of techniques to activate the immune system to address medical needs. The company’s proprietary platform of toll-like immune receptor activators has applications in radiation mitigation, oncology immunotherapy, and vaccines.

CBLI conducts business in the United States and Russia. The company’s Russian operations include a wholly-owned subsidiary, BioLab 612, LLC, and Panacela Labs, Inc., a joint venture company founded in 2011 by CBLI and Rusnano.

CBLI was formed in 2003 as a spin-off from The Cleveland Clinic, and is headquartered in Buffalo, New York.

Products

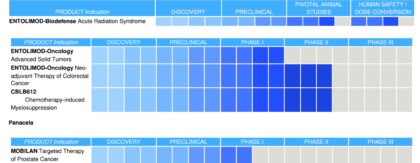

CBLI’s most advanced product candidate is entolimod, which is being developed as a radiation countermeasure and an immunotherapy for oncology. The company’s remaining pipeline products are detailed below:

Source: Company Reports

Generally speaking, CBLI’s development efforts are related to apoptosis, a regulated form of cell death that can occur in response to internal stresses or external events such as exposure to radiation or toxic chemicals. Among other things, apoptosis is largely responsible for the lethality of high-dose radiation exposure. However, it also serves as a defense mechanism which allows the body to eliminate defective cells such as those with cancer-forming potential. The company has developed strategies to target the molecular mechanisms controlling apoptotic cell death for therapeutic benefit. These consist of:

- Temporary and reversible suppression of apoptosis in normal cells to protect healthy tissues using compounds called Protectans. All the pipeline products listed above are classified in this category.

- Reactivation of apoptosis in tumor cells to eliminate cancer using compounds called Curaxins. The primary compound under consideration is known as CBL0137, which is being developed a former subsidiary of CBLI, Incuron, LLC.

Entolimod Biodefense is the company’s most advanced Protectan product candidate. It is being developed as a radiation countermeasure to prevent death from Acute Radiation Syndrome (ARS). The company’s pivotal study demonstrated that non-human primates given a single dose of entolimod were three times more likely to survive after being given a 70 percent lethal dose of total body irradiation.

Entolimod Oncology consists of the company’s efforts to develop entolimod to treat cancer by activating the innate adaptive immune response in patients. CBLI has exclusive worldwide development and commercialization rights for entolimod.

CBLB612 is a proprietary compound based on a natural activator of another tissue-specific component of the innate immune system. Preclinical studies have shown that CBLB612 stimulates white blood cell regeneration. The company has licensed CBLB612 to Zhejiang Hisun Pharmaceutical Co., Ltd. for the territories of China, Taiwan, Hong Kong, and Macau, but holds rest-of-world development and commercialization rights.

Mobilan is the lead product candidate of the company’s joint venture, Panacela. It is being developed for the treatment of prostate cancer. Panacela holds exclusive worldwide development rights for Mobilan. As of December 31, 2016, CBLI owned 67.57 percent of Panacela.

CBL0137 is a small molecule with a multi-targeted mechanism of action that is being developed by Incuron. This product may be broadly useful for the treatment of many different types of cancer. As noted above it is categorized as a Curaxin. The company sold its equity interest in Incuron in 2015, but retained certain royalty interests relating to future sales.

Market Overview

The market for radiation countermeasures has grown substantially, primarily due to the perceived threat of chemical, biological, radiation, and nuclear attacks. In addition to the U.S. government, which maintains a national stockpile of emergency products, potential customers include state and local governments, foreign governments, NGOs, multinational corporations, security companies, healthcare providers, and nuclear power facilities.

Due to the limitations of the two currently approved treatments to deal with a large-scale radiation event, CBLI believes that entolimod is a compelling product candidate.

Recent Developments

On April 17, 2017, CBLI announced that the U.S Food and Drug Administration (FDA) had completed its review of two formulations of entolimod. The FDA has subsequently authorized the company to initiate an in vivo biocomparability study of these formulations in non-human primates. The objective of this study is to compare the historical drug formulation used in prior studies to the to-be-marketed drug formulation of entolimod submitted for pre-Emergency Use Authorization (pre-EUA).

If the FDA approves the pre-EUA application, federal government agencies may procure entolimod for stockpiling so that the drug is available to distribute in the event of an emergency, prior to the drug being formally approved under a Biologics License Application. While pre-EUA approval does not constitute full licensure, it would allow the company to generate revenue from the sale of entolimod. Furthermore, CBLI believes that pre-EUA status could generate sales to foreign governments.

CBLI also announced that the European Medicines Agency (EMA) has accepted the company’s pediatric investigation plan, which would allow the company to apply for marketing authorization for entolimod as a radiation countermeasure in the EU.

First Quarter Earnings Review

Revenue for the quarter ended March 31, 2017, decreased slightly to $0.8 million. The reduction in revenue was attributable to the completion of contracts with the Russian Federation Ministry of Industry and Trade (MPT). However, this decline was partially offset by increased revenue from the Joint Warfighter Medical Research Program (JWMRP).

Research and development costs decreased 26 percent year-over-year to $1.4 million, driven by the reduction in expenses associated with the MPT contract. As above, this was partially offset by ongoing expenses from the JWMRP. General and administrative expenses fell by one-third primarily due to reductions in personnel costs and other cost-saving initiatives.

Cash used in operating activities was roughly flat from the same period one year ago. As of March 31, 2017, the company listed cash and short-term investments of $13.1 million, which the company believes is sufficient to fund operations through the first quarter of 2018.

Stock Influences

- Agreements and approvals to expand sales domestically and internationally;

- Threats to global security including the possibility of a radiological attack;

- Exercise of warrants and further equity offerings to raise cash; and

- Significant advances in the company’s technology.

Risk Factors

- The company will require significant additional financing to achieve its stated objectives. Debt financing may restrict the company’s operations and require equity financing;

- There is no guarantee that the company will be able to develop and commercialize its current pipeline of product candidates. Further, the company may not be able to secure the necessary regulatory approvals in a timely manner;

- The company is dependent on government funding, which carries additional risks not present in the commercial marketplace;

- The company has material operations in Russia that are subject to a variety of political risks; and

- The company’s stock price remains volatile and subject to speculation.

Stock Performance

As of August 9, 2017, shares of CBLI closed at $2.99 after gaining 15 percent on the day, yielding a market capitalization of approximately $30 million. The recent spike is likely due to recent tensions with North Korea, but there have also been rumors of a new research contract with the Department of Defense.

Following Traders News source initial coverage back in April, CBLI hit a 12-month high of $5.55. However, the stock has given back much of those gains, and has recently settled between $2.50 and $2.80. Despite recent losses, the shares are up more than 100 percent year-to-date.

Summary

The announcements relating to CBLI’s FDA and EMA applications are positive developments for the company’s primary product candidate, entolimod. As noted above, if the company receives approval for its pre-EUA application, CBLI may begin marketing to federal government agencies. In the wake of recent threats from North Korea, government agencies (both foreign and domestic) may be more inclined to start building reserves.

However, there is no guarantee that the company’s application will proceed as planned. Other material uncertainties include the company’s future sources of financing and political risks related to its Russian operations, which could be impacted by economic sanctions.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Ivan Neilson, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ about forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.

[1] Rusnano is a private equity and venture capital vehicle created by the Russian government to commercialize developments in nanotechnology.

[2] CBLI divested its interest in Incuron, LLC, which was formed in 2010 to develop CBL0137 and its predecessor. CBLI retains a royalty on the future commercialization, licensing, or sale of the CBL0137 technology and future change of control transaction of Incuron.

[3] It is not feasible or ethical to test entolimod as a radiation countermeasure in humans. It is being developed under the FDA’s Animal Rule.