Company Overview

The Meet Group, Inc. (NASDAQ: MEET) operates a portfolio of location-based social networking applications. The applications can be accessed on a variety of mobile platforms including iOS, Android, and the web. In order to appeal to a wide selection of consumers, Meet offers its social networks through different branded applications.

Meet monetizes its platforms through advertising, in-app purchases, and paid subscriptions. The company’s online marketing capabilities allow customers to display advertisements in multiple formats across different locations. Meet is headquartered in New Hope, Pennsylvania.

Products and Services

As noted above, Meet has a portfolio of four applications allow users to meet and interact with one another:

MeetMe is an application that allows users to discover and meet new people. MeetMe includes features such as Chat, Meet, Discuss, and Live Video.

Skout, like MeetMe, allows users to connect with one another based on their location. Features include Chat, Meet, Interested, and Buzz. Skout was founded in 2007 and acquired by Meet in 2016.

Tagged / hi5 are sister brands originally created by social networking start-up if(we) that were acquired by Meet in April 2017. Both applications have overlapping user bases and offerings.

Ninety percent of Meet’s mobile revenue comes from advertising, and the remaining 10 percent is generated by in-app purchases and subscriptions:

In-App Purchases – Users may purchase credits (or earn them by completing third-party offers) which can be used to boost the visibility of their profile or meet people in other cities.

Subscriptions – Users may purchase a subscription to MeetMe+ or Skout Premium to receive extra features and the ability to suppress mobile advertisements.

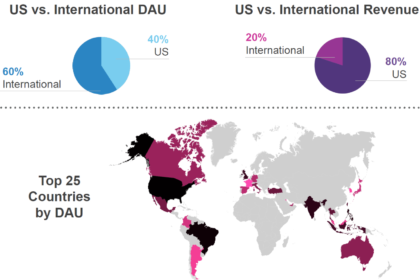

Including Tagged and hi5, Meet has a total of 2.8 million daily active users and 130,000 new user registrations per day. While more than half of company’s daily active users are international, the United States generates 80 percent of the company’s revenue:

Source: Company Presentation

Across its user base, Meet generates more than 10 billion mobile ad impressions per month. The company has more than 100,000 monthly advertisers, and the top marketing categories are retail, mobile applications, auto, and restaurants. Meet has robust advertising operations to support monetization efforts including partnerships with 2,000 ad networks, 50 direct integrated exchanges / demand-side providers, and two direct header bidding partners.

Market Overview

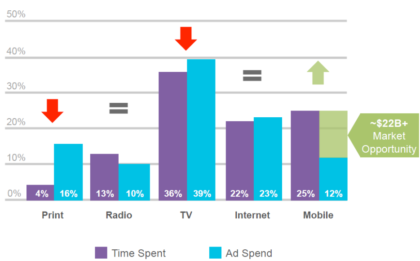

In 2016, there were more than 2.1 billion smartphone users globally. As consumers spend more time on smartphones, marketers are devoting more resources to mobile advertising. As shown below, print and television advertising budgets could shift to mobile:

Source: Company Presentation

In 2016, the U.S. spent $46.7 billion on mobile advertising. Going forward, the company projects a 17 percent compound annual growth rate, with total spending reaching more than $100 billion by 2021.

Recent Developments

- On April 3, 2017, Meet closed its acquisition of if(we), creator of the Tagged and hi5 mobile applications. Concurrently, the company rebranded from MeetMe, Inc. to The Meet Group, Inc. to better reflect its diverse portfolio of assets.

- On March 15, 2017, the company closed a public offering of 9,200,000 shares of common stock at an offering price of $5.00 per share. The company plans to use the net proceeds for general corporate purposes, funding a portion of the if(we) acquisition, and potential future acquisitions.

First Quarter Earnings Review

Total revenue for the quarter ended March 31, 2017, increased 51 percent year-over-year to $20.1 million. This growth was supported by a 61 percent year-over-year increase in mobile revenue due to increased mobile impressions from the Skout acquisition. Operating expenses increased to $19.6 million, a 76 percent increase from the first quarter of 2016.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) was $4.8 million, a 30 percent increase from the same period one year ago, yielding an adjusted EBITDA margin of 24 percent. Adjusted EBITDA primarily removes the impact of stock-based compensation and acquisition and restructuring charges. It is also a primary operating metric for the company.

Cash flow from operations increased from $6.8 million in the first quarter of 2016 to $8.7 million. At March 31, 2017, the company listed a cash balance of $74.5 million, including $43 million generated by the aforementioned public equity offering. The company noted that $60 million was used in April 2017 to acquire if(we).

Outlook

By rebranding itself as The Meet Group, it appears that the company is poised to continue making acquisitions. Meet does not have any long-term debt, and it recently raised $43 million of equity to help fund the if(we) deal.

Organic user growth has been relatively weak – average daily users for MeetMe and Skout declined slightly in the fist quarter. However, Meet intends to boost its marketing budget to increase users internationally and in the U.S. New video features have also shown promising returns for user engagement.

The company has strong advertising operations and a demonstrated ability to monetize its applications. Meet also has experience integrating acquisitions into its existing ecosystem. Therefore, it is likely that Meet will pursue other deals to expand its existing portfolio.

Analysts expect 2017 full-year revenue to be between $125 million and $130 million.

Stock Influences

- Changes in subscriber and active-user metrics;

- Changes in revenue and profitability; and

- M&A activity.

Risk Factors

- The company may not be able to successfully integrate the assets of if(we). Further, the company may incur unexpected expenses and liabilities as a result of the if(we) merger;

- The company faces substantial competition from other social networks and companies with significantly more resources;

- The company is heavily reliant on advertising revenue and a negative public relations incident could impact the company’s ability to generate advertising revenue in the future; and

- The company relies on several third-parties to distribute and promote its platform including Apple, Google, and Facebook. Any changes to these business relationships could adversely affect the company.

Stock Performance

As of May 16, 2017, shares of Meet closed at $4.95. Investors were generally disappointed by the company’s decrease in net income (as measured by generally accepted accounting principles).

Shares hit a high of $8.11 in August 2016 following the Skout acquisition announced in June, but have mostly traded between $5.00 and $6.00 since then. Still, the stock is up more than 40 percent from one year ago.

Following are selected analyst ratings and price targets:

| Analyst | Firm | Rating | Price Target | Date |

| Darren Aftahi | Roth Capital Partners | Buy | $9.25 | 5/2/2017 |

| Michael Latimore | Northland CM | Outperform | $9.00 | 4/6/2017 |

Summary

Meet has made multiple acquisitions in the past year, and has shown no signs of slowing down. Furthermore, the company is generating positive cash flow, and has a relatively strong balance sheet. Organic user growth has dropped off somewhat recently, but the company has announced several initiatives to improve in this area. If Meet can successfully apply its monetization model to future acquisitions, there is plenty of room for growth. Accordingly, a price target of $9.00, comparable to the analysts cited above, appears justified.

Welcome to Traders News Source Small Cap and Mid Cap Research for the Independent Trader

(see an example our recent track record below)

Expect 3-4 small cap profiles per month consisting of two emails per week. We do not spam or send emails daily, we understand that is annoying! Our reports are only sent when we see an actionable situation and potential for near term gains.

Traders News Source recent profiles and track record, 534% in verifiable potential gains for our members on three of our well-timed reports alone!

January 31st, 2017 (NASDAQ: HIMX) opened at $5.10/share and hit a high of $9.68/share March 24th, 2017 for gains of 89% within 60 days- http://finance.yahoo.com/news/himax-technologies-review-4q-2016-130000319.html

February 6th, 2017- (NASDAQ: SCON) opened at $1.12/share hit a high of $1.80/share within 10 days our member potential gains- 60% – http://finance.yahoo.com/news/superconductor-technologies-potential-revolutionize-smart-130000844.html

March 6th, 2017 (OTC: USRM) opened at .035/share and hit over .17/share within 25 days for gains of 385% for our members- http://finance.yahoo.com/news/traders-news-issues-comprehensive-report-130000743.html

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

Limited Time Offer VIP Mobile Alerts

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Traders News Source Mission Statement

We strive to highlight the future potential as well as the inherent risk in each small cap company we cover while remaining neutral as a leading third-party equity research firm.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Ivan Neilson, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure