MariMed Inc. (OTCQB: MRMD) provides consulting services for the design, development, operation, funding, and optimization of medical cannabis cultivation, production, and dispensary facilities.

The company also develops and manages facilities for the cultivation, production, and dispensing of legal cannabis and cannabis-infused products under the Kalm Fusion brand name. In addition, it offers legal, accounting, human resources, and other corporate and administrative services. As of December 31, 2017, it developed and managed six operating cannabis facilities for clients in Delaware, Illinois, Nevada, and Maryland.

Canada is set to implement their legalization of recreational cannabis use on October 17th. In the U.S., 30 states have some form of legal medical cannabis use and 9 states have approved recreational cannabis use along with many municipalities. In November voters will decide on ballot proposals for recreational cannabis use in Michigan and N. Dakota. Utah and Missouri voters will be deciding if they want a medical marijuana law on their books.

______________________________________________________________________

Our members have booked up to 800% on our recent NASDAQ and NYSE small cap alerts. We will be initiating coverage on another exciting small cap security on 10/11/18 just after market open. View our recent picks, track record and sign up for our mobile/text alerts in real time here- https://tradersnewssource.com/traders-news-source-new-members/

______________________________________________________________________

Recent Events

September 27, 2018. MariMed announced it had consummated its strategic investment in Sprout, an all-in-one CRM and marketing software company for marijuana dispensaries and cannabis brands. This completes the previously announced MariMed LOI for investment in Cannabis Venture Partners, parent company of Sprout. Sprout’s CRM and marketing automation software combines technology, data and content to help dispensaries and cannabis brands increase sales, improve customer loyalty and reach more customers. https://finance.yahoo.com/news/marimed-completes-strategic-investment-sprout-130107001.html

Services

Design & Development

If providing safe and secure access for medical cannabis patients is a priority for your organization let MariMed Advisors provide real estate selection consultation and professional build-out planning for your facility.

Operation & Funding

MariMed offers a full complement of business planning services, including detailed financial models, business and operational plans.

Optimization

MariMed has a strong team of experts from multiple cannabis consulting disciplines to assist you in accelerating the growth of your business.

About

MariMed Inc. provides consulting services for the design, development, operation, funding, and optimization of medical cannabis cultivation, production, and dispensary facilities. The company also develops and manages facilities for the cultivation, production, and dispensing of legal cannabis and cannabis-infused products under the Kalm Fusion brand name. In addition, it offers legal, accounting, human resources, and other corporate and administrative services. As of December 31, 2017, it developed and managed six operating cannabis facilities for clients in Delaware, Illinois, Nevada, and Maryland. MariMed Inc. was incorporated in 2011 and is based in Newton, Massachusetts.

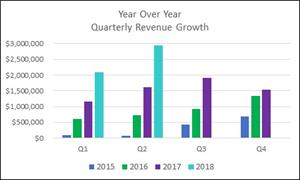

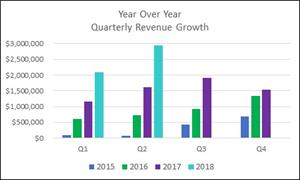

Financial review

Q2 Results

Revenue: Increased 81.2% to $2.9 million in Q2 2018, compared to $1.6 million in Q2 2017.

Assets: Tripled in size to $45.4 million at June 30, 2018 from $15.4 million at June 30, 2017.

EBITDA: Increased 50% to $1.02 million for three months ended June 30, 2018 from $682,000 for the comparable period ended 2017.

Debt Reduction: Reduced promissory note balances by $1.98 million for the six month period ended June 30, 2018 through the conversion of $1.28 million into common stock and the retiring of $700,000.

Cash on Hand: Increased to $5.1 million at June 30, 2018 from $1.3 million on December 31, 2017.

For the three and six months ended June 30, 2018, the Company realized a net loss of approximately $6.3 million and $8.1 million, respectively. This compares to net income of approximately $505,000 and $614,000 for the comparable periods in 2017. The is due to two non-cash items—issuance of stock options and warrants, and the settlements of debt via the issuance of common stock. These non-cash items had no effect on the operating earnings or liquidity of the Company. Excluding these non-cash items, net income for the three and six months ended June 30, 2018 was approximately $575,000 and $530,000, respectively.

Corporate highlights

Raised $10.4 million during the six months ended June 30, 2018 to fund operations, facility development and expansion of branded licensing.

Acquired iRollie LLC, a manufacturer of branded cannabis products and accessories for consumers, and custom product and packaging for companies in the cannabis industry.

Expanded distribution of MariMed’s new Nature’s Heritage Cannabis™ branded strains and products to 45 dispensaries via MariMed licensed client Kind Therapeutics USA.

Began distribution from first harvests of Tikun Olam™ branded cannabis strains that have been proven effective in clinical research trials.

Stock influences and risk factors

Continuing efforts to legalize cannabis across North America could be a catalyst for the company shares.

Marijuana remains illegal under federal law. It is a Schedule I controlled substance. Even in those jurisdictions in which the use of medical marijuana has been legalized at the state level, its prescription is a violation of federal law.

Their clients may have difficulty accessing the service of banks, which may make it difficult for them to purchase our products and services.

Demand and market acceptance for their licensed branded new cannabis infused products are subject to a high level of uncertainty.

Stock chart

On Wednesday, October 10, 2018, MRMD shares were at $4.18 on traded volume of 801K shares. The current RSI (14) is 56.83

At $4.18, MRMD shares are trading above their 50 DMA and 200 DMA of $3.08 and $1.96 respectively.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.