Tonix Pharmaceuticals Holding Corp. (NASDAQ: TNXP) is a clinical-stage biopharmaceutical company focused on discovering and developing pharmaceutical products to treat serious neuropsychiatric conditions and biological products to improve biodefense through potential medical counter-measures.

Tonix is developing Tonmya, which has been conditionally accepted by the U.S. Food and Drug Administration (FDA) as the proposed trade name for TNX-102 SL (cyclobenzaprine HCl sublingual tablets) for the treatment of PTSD. TNX-102 SL is an investigational new drug and has not been approved for any indication.

On November 29th, 2018, company announced that it had received the official minutes from the October 29th Breakthrough Therapy Type B Clinical Guidance meeting with the U.S. Food and Drug Administration (FDA). The minutes are consistent with the preliminary guidance the Company received at the meeting and confirm FDA’s acceptance of the new Phase 3 “RECOVERY” study design.

- New Phase 3 RECOVERY Trial to Include Approximately 250 Participants

- Trial to Commence First Quarter 2019 With Topline Data Expected First Half 2020

The Company plans to start the RECOVERY trial for the treatment of posttraumatic stress disorder (PTSD) in the first quarter of 2019. The new trial will incorporate several new design features including restricting enrollment of study participants to individuals with PTSD who experienced an index trauma within nine years of screening, instead of 2001 or later as in the Phase 3 HONOR study.

As per management, Tonix is now in a strong position for value growth with Phase 3 development in a major medical indication, i.e. PTSD including military-related PTSD. Moreover, the minutes from TNXP’ breakthrough Therapy Clinical Guidance meeting with the FDA are consistent with its previous assessment. Tonix is moving forward expeditiously to initiate the RECOVERY study in the first quarter of 2019 and expect to have top-line data in the first half of 2020.” Therefore, it is not too far from commercial operations.

Tonix development highlights and unique differentiating factor:

- Phase 3 development of Breakthrough Therapy treatment for PTSD, including military-related PTSD

- Major unmet need; ~11 million Americans affected

- Benefited from FDA 505(b)(2) NDA approval requirement New indication in development for agitation in Alzheimer’s Disease

- Unmet medical need, no approved drug available

- Fast Track Phase 2/3 ready program Complimentary day-time PTSD treatment in development

- Leverages development expertise in PTSD, i.e., regulatory, trial recruitment and execution Innovative

the vaccine in development to prevent Smallpox

- Opportunity to supply stockpiling requirement; short development path

- Studies in mice suggest improved safety profile

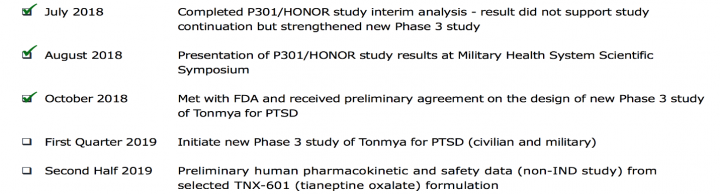

Other recently completed and Upcoming milestones

Tonix’s business risk profile derives substantial strength through the series of positive developments in the recent past, which has been steadily encouraging for the company. Collectively, these developments suggest a reasonably strong outlook for the company over the near to medium term.

However, notwithstanding these positive biases, it should also be noted that Tonix’s historical clinical trials have not been very successful. Additionally, the company has raised significant equity in the past, causing dilution to its shareholders. Therefore, Tonix’ business risk profile is substantially dependent on the success of its present flagship product, i.e. TNX-102 SL, and is exposed to the risk related to proper and timely commercialization of the same.

Per www.marketbeat.com, Their average twelve-month price target is $45.00, suggesting that the stock has a possible upside of 545.62%. The high price target for TNXP is $80.00, and the low-price target for TNXP is $10.00. There are currently three hold ratings, and 2 buy ratings for the stock, resulting in a consensus rating of “Hold.”

______________________________________________________________________

TradersNewsSource – We will be initiating coverage on a small float, potential breakout trade Tuesday (12/04/18) at 9:30 AM Eeastern. Visit this page at 9:30 AM to read this report as soon as it is issued- https://tradersnewssource.com/traders-news-source-new-members/

Alternatively, join our SMS/text alert service by sending the word “Traders” to “25827” from your cell phone. It’s easy and free for most carriers.

______________________________________________________________________

Description & manufacturing set-up:

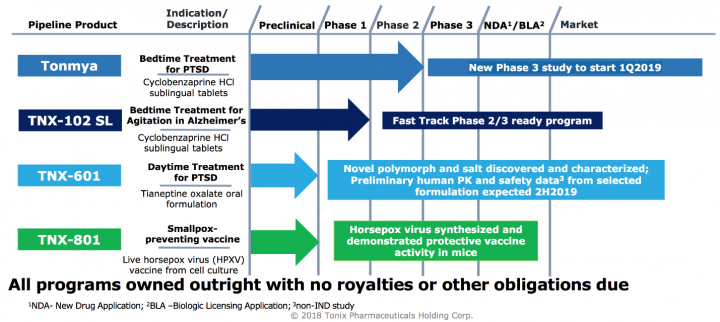

Tonix is a clinical-stage biopharmaceutical company focused on discovering and developing pharmaceutical products to treat serious neuropsychiatric conditions and biological products to improve biodefense through potential medical counter-measures. Tonix is developing Tonmya, which is in Phase 3 development and has been granted Breakthrough Therapy designation, as a bedtime treatment for PTSD. Tonix is also developing TNX-102 SL as a bedtime treatment for agitation in Alzheimer’s disease under a separate IND to support a Phase 2, potential pivotal, efficacy study and has been designated a Fast Track development program by the FDA for this indication. TNX-601 (tianeptine oxalate) is in the pre-IND application stage, also for the treatment of PTSD but by a unique mechanism and designed for daytime dosing. Tonix’s lead biologic candidate, TNX-801, is a potential smallpox-preventing vaccine based on a live synthetic version of horsepox virus, currently in the pre-IND application stage.

Product Pipeline:

Source: Company presentation

Recent Program Highlights:

- Received the U.S. Food and Drug Administration’s (FDA) preliminary agreement on the new PTSD Phase 3 study design in October. The new Phase 3 study of Tonmya will begin in the first quarter of 2019 and will have several innovative design features including restricting enrollment to individuals with PTSD who experienced an index trauma within nine years of screening

- Presented results and retrospective analyses of the Phase 3 HONOR study in a poster presentation at CNS Summit 2018 in November.

- New composition of matter patent was issued in November which expands the Company’s intellectual property protection for Tonmya, or TNX-102 SL, in the U.S. The patent is part of an expanding portfolio of patents and patent applications and other intellectual property addressing the formulation, manufacturing, and uses of Tonmya, or TNX-102 SL, for a variety of indications including posttraumatic stress disorder, agitation in Alzheimer’s disease and fibromyalgia.

- Presented results and retrospective analyses of the Phase 3 HONOR study and Phase 2 AtEase Study at the 2018 Military Health System Research Symposium in August.

- Phase 3 HONOR study stopped early in July based on interim analysis of Week 12 data in 274 PTSD participants.

- Received Fast Track designation for TNX-102 SL for agitation in Alzheimer’s disease, from the FDA in July. The Company received FDA comments on Phase 2 / potential pivotal efficacy study protocol for this indication in October

About PTSD condition: PTSD is a serious condition characterized by chronic disability, inadequate treatment options especially for military-related PTSD, and overall high utilization of healthcare services that contributes to significant economic burdens.

- Breakthrough Therapy (BT) designation from the FDA

- Expedited development and accelerated approval are expected

- One Phase 2 study completed, and one Phase 3 study stopped early due to inadequate separation from placebo (unblinded interim analysis of ~50% participants)

- Both studies were accepted by the FDA as potential pivotal efficacy studies in military-related PTSD if successful

- No safety or tolerability concerns

- Phase 2 study (P201) formed the basis of BT designation

- Phase 3 study (P301) provided evidence of effectiveness as early as four weeks after treatment but diminished over time due to high placebo response

- Retrospective analysis showed Tonmya response in the subgroup with trauma ≤nine years from screening

- Both studies can be used as supportive evidence of efficacy and safety for Tonmya NDA submission

- FDA feedback and guidance on new Phase 3 trial received on October 1

- Patent protection through 2034 in the U.S.

- The composition of matter patent for transmucosal delivery of cyclobenzaprine

- Novel mechanism targets sleep quality

- Memory processing during sleep is important to recovery from PTSD

Potential risk factors & key stock Influences over the near to medium term:

Exposed to project risk along with significant dependence on TNX-102 SL: The Company is still under the pre-commercialization stage and is not likely to generate meaningful revenue until successful commercialization of their products occurs. Therefore, it is exposed to the risk associated with the pre-commercialization process. In fact, in the past, Tonix had to freeze development of its fibromyalgia drug failed in a late-stage trial. After this setback, Tonix shifted its resources towards developing TNX-102 SL.

Negative profitability & subdued liquidity: As with any pre-development stage company, Tonix has experienced net losses, and negative cash flows from operations since inception and expects these conditions to continue for the foreseeable future. Therefore, to fund operations, it needs to raise money through capital markets and/or private financing.

If additional financing is not available in a timely manner, Tonix may be required to delay, reduce the scope of or eliminate its research and development programs, reduce its commercialization efforts or obtain funds through arrangements with collaborative partners or others that may require it to relinquish rights to certain product candidates.

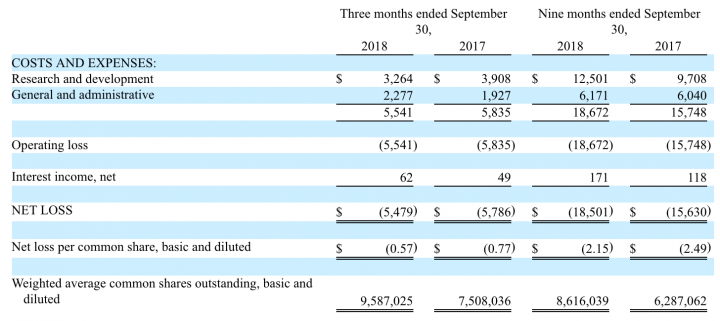

Earnings Review (In, thousands):

Tonix had no revenues or cost of goods sold during the three months ended September 30, 2018, and 2017.

Research and development expenses for the third quarter of 2018 totaled $3.3 million, compared to $3.9 million for the same period in 2017. This decrease is predominately due to the termination of the Phase 3 HONOR study at the end of July 2018.

General and administrative expenses for the third quarter of 2018 were $2.3 million, compared to $1.9 million for the same period in 2017. This increase is primarily due to an increase in legal fees related to patent prosecution, as well as investor and public relations.

Net loss was $5.5 million, or $0.57 per share, for the third quarter of 2018, compared to net loss of $5.8 million, or $0.77 per share, for the third quarter of 2017.

Liquidity and financial flexibility: At September 30, 2018, Tonix had $14.7 million of cash and cash equivalents, compared to $25.5 million as of December 31, 2017. Cash used in operations was $4.9 million for the three months ended September 30, 2018, compared to $5.0 million for the three months ended September 30, 2017.

Stock Performance

Comments:

- On Friday, November 30, 2018, TNXP closed at $5.19, on volume of 1.2 million shares exchanging hands. Market capitalization is $9.91 million. Current RSI is 47.09

- In the past 52 weeks, shares of TNXP have traded as low as $0.36 and as high as $9.60

- At $5.19, shares of TNXP are trading below its 50-day moving average (MA) at $5.99 and below its 200 days moving average at $23.21

- The present support and resistance levels for the stock are at $4.36 & $10.90 respectively.