As the electric vehicle (EV) market continues to heat up, automakers are going all in on electrification. Vehicle manufacturers and battery makers plan to invest $860 billion globally by 2030 in the transition to EVs. Nearly a quarter, $210 billion, is expected to be invested in the United States, more than in any other country. This is based on a recent analysis by Atlas Public Policy that searched through press releases, company earnings reports, and other public resources to tally EV investments from the private sector and track where those investments are expected to be made.

The recent passage by the federal government of the Infrastructure Investments and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) provides unprecedented levels of support for EVs, including at least $83 billion of loans, grants, and tax credits that could support the production of low or zero-emission vehicles, batteries, or chargers. Support like this can help prompt private sector investment by creating confidence in the availability of funding. Clear regulatory signals, for example on tailpipe emissions rules, would create further confidence for the private sector and help ensure companies follow through on their EV investment plans.

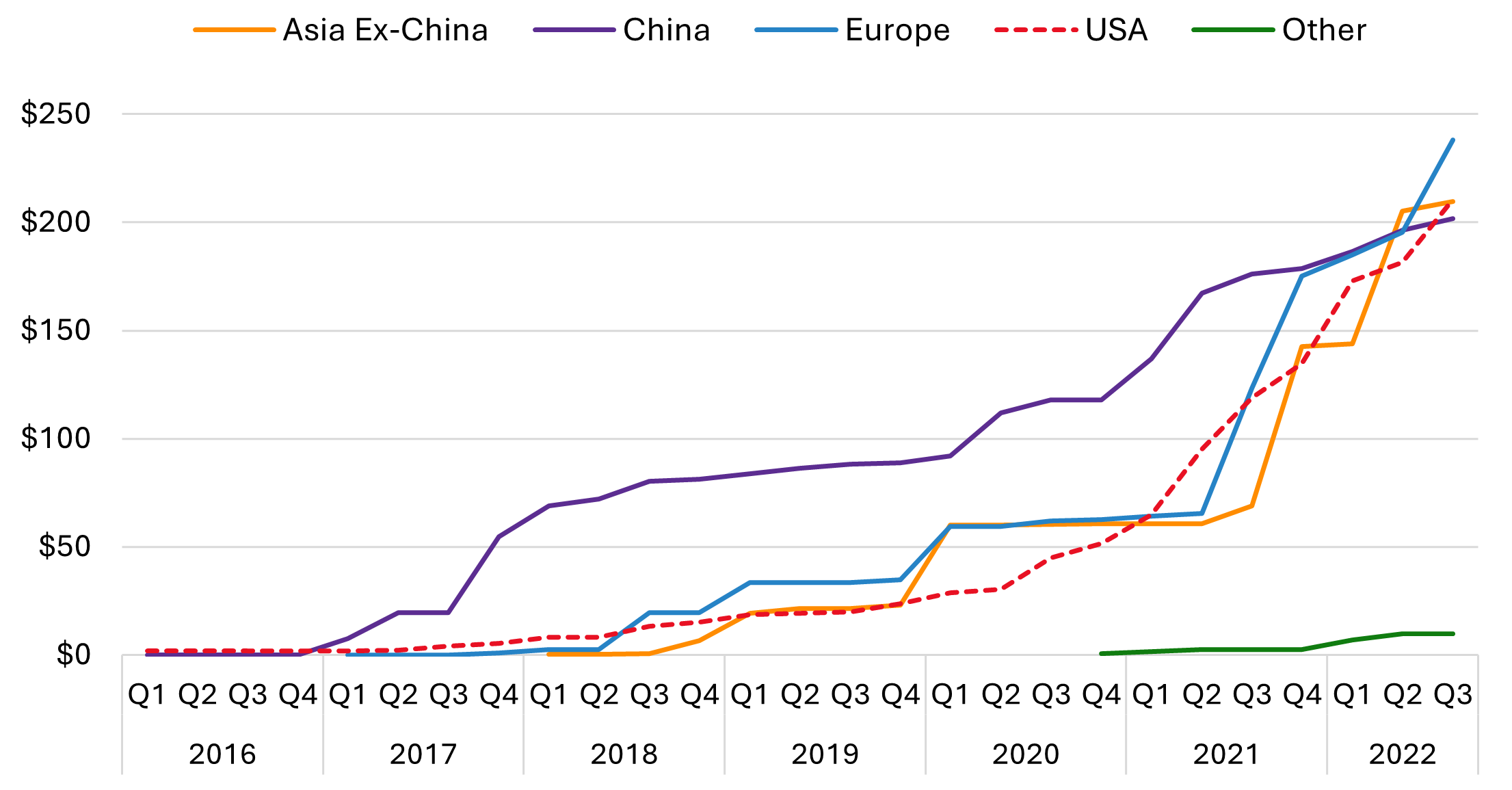

At the end of 2020, U.S. investments were lagging both Asia and Europe as companies had announced just $51 billion in domestic EV and battery manufacturing, less than half of the $115 billion announced for China at that time and behind both Europe and the rest of Asia. Since then, the United States has seen a flurry of investment activity, as domestic manufacturers look to ramp up production and foreign manufacturers position themselves to take advantage of new incentives and growing EV sales in the United States. Since the start of 2021, announced U.S. investments have totaled more than $150 billion. This has corresponded with an increase in U.S. EV sales of 40 percent year to date in 2022 [1].

While China still holds a commanding lead in number of EVs on the road,[2] the U.S., Europe, and the rest of Asia have now all surpassed China in announced investments. As of the end of Q3 2022, Europe leads with $238 billion announced, followed by the United States and Asia Ex-China each with $210 billion, $199 billion in China, and $10 billion outside of these regions (including Mexico, Canada, and Australia). Figure 1 depicts the rapid rise in U.S. EV investment.

Figure 1: Cumulative Announced EV Investment by Region ($Billion)

This figure depicts cumulative announced investment by region where investment is expected to be made. Announced investment includes a) investments dedicated to EV-specific manufacturing facilities, b) capital dedicated towards electrification from automakers, and c) capital raised through venture capital, public offering, bonds, loans, or other financial mechanisms from EV-only manufacturers and EV battery manufacturers or recyclers. Investments that are not specified for a specific country are assumed to occur in the investor’s home country.

In total, companies headquartered in the United States account for 72 percent of the total announced investment expected to be made in the United States, while companies headquartered in Asia Ex-China and Europe account for 15 and 10 percent, respectively. Chinese companies account for less than two percent of announced investment going to the United States.

Globally, U.S.-based companies have so far announced that they will invest more than $173 billion in the transition to EVs, with Ford, General Motors (GM), Tesla, and Stellantis leading the way.

- Ford announced in March 2022 it will increase its global investment in EVs to $50 billion, landing it fourth among all automakers globally and first in the United States. Ford has announced it will manufacture EVs in Kentucky, Michigan, Missouri, Ohio, and Tennessee, as well as Cologne, Germany.

- GM announced in June of 2021 it will invest $35 billion globally by 2030, and has announced EV manufacturing facilities in Indiana, Michigan, Ohio, and Tennessee as well as Canada and Mexico.

- Stellantis, the multinational company formed in 2021 by the merger of Italian-American Fiat Chrysler Automobiles and the French PSA Group, announced in 2021 it will invest 30 billion euros globally (equivalent to $35.5 billion at the time of announcement) towards electrification. So far, Stellantis has announced EV manufacturing facilities in Canada, Italy, and the U.S. state of Indiana.

- Tesla, the current EV market leader, plans to spend from $6 to $8 billion per year in Germany and the United States from 2022 to 2024 according to a filing with the U.S. Securities and Exchange Commission. Combined with previous announcements, Tesla has invested or expects to invest at least $32 billion, including gigafactories in China, Germany, and the U.S. states of California and Texas. If Tesla sustains its current rate of investment through 2030, it could invest a total of $68 to $80 billion. A Reuters analysis [3] estimates that it could in fact cost Tesla as much as $600 billion to reach Elon Musk’s goal of selling 20 million vehicles in 2030. Nonetheless, for this analysis Atlas uses Tesla’s announced and allocated investments through 2024 to avoid speculation.

In addition to announcements from established automakers, the United States has seen an influx of investment in new market entrants. Atlas includes capital raised by EV-only manufacturers in the total investment announced for EVs. Electric truck maker Rivian leads the way, having raised more than $22 billion, followed by Lucid Motors with $12 billion. Rivian currently builds vehicles in Illinois and has announced plans for a second facility in Georgia, while Lucid produces vehicles in Arizona.

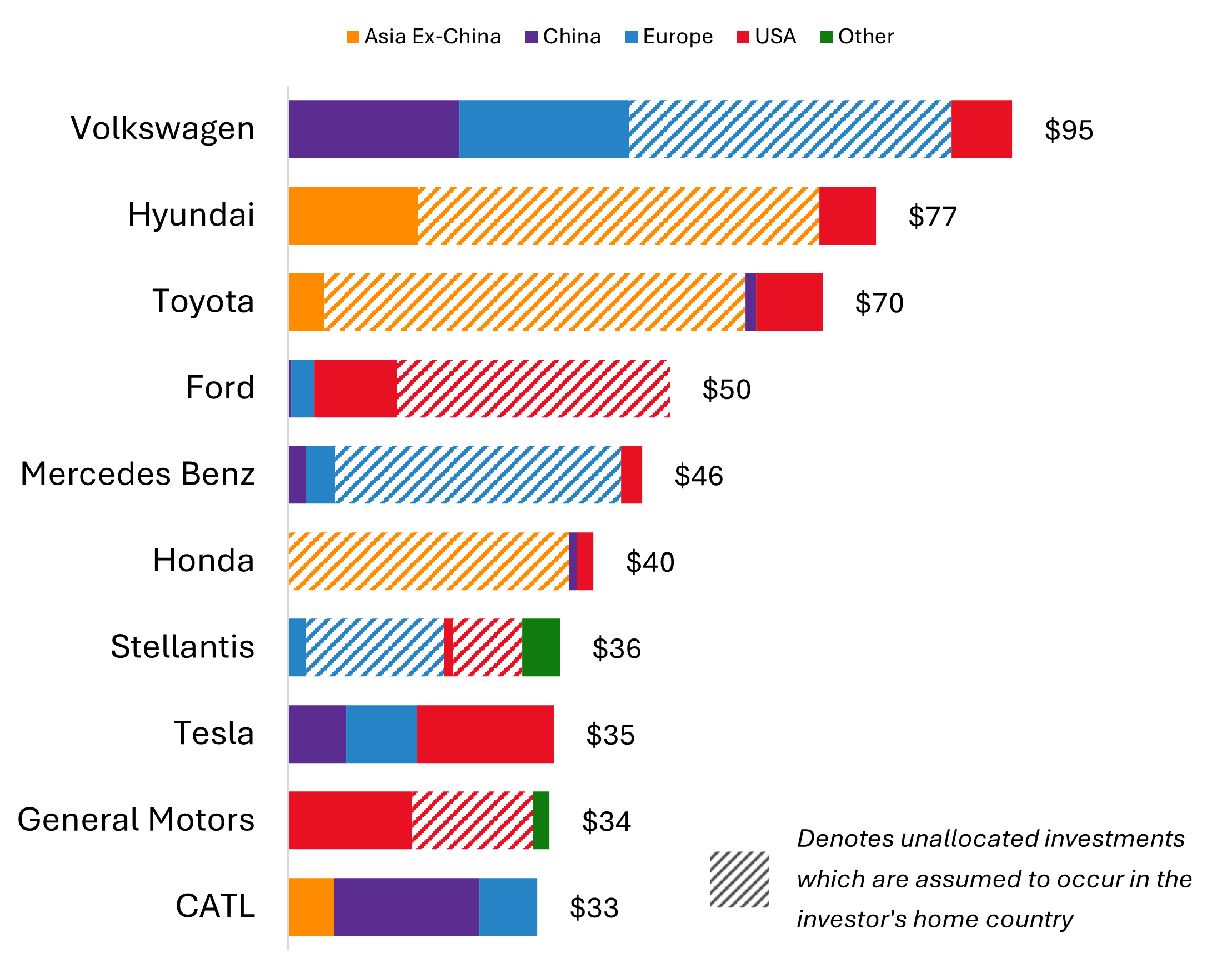

Figure 2 depicts the top ten automakers by announced EV investments and the target regions for their investments. Atlas Public Policy assumes that unspecified announced investment will go to the investor’s home country. For Stellantis, Atlas assumes that unspecified investment will be evenly split between France, Italy, and the United States.

Figure 2: Announced EV and EV Battery Manufacturing Investments by Company and Target Region ($Billion)

This figure depicts the total announced investment in EV and EV battery manufacturing for the top 10 automakers and battery manufacturers. Investments that are not specified for a specific country are assumed to occur in the investor’s home country. For Stellantis, Atlas assumes that unspecified investment will be evenly split between France, Italy, and the United States. Announced investment includes a) investments dedicated to EV-specific manufacturing facilities, b) capital dedicated towards electrification from automakers, and c) capital raised through venture capital, public offering, bonds, loans, or other financial mechanisms from EV-only manufacturers and EV battery manufacturers or recyclers.

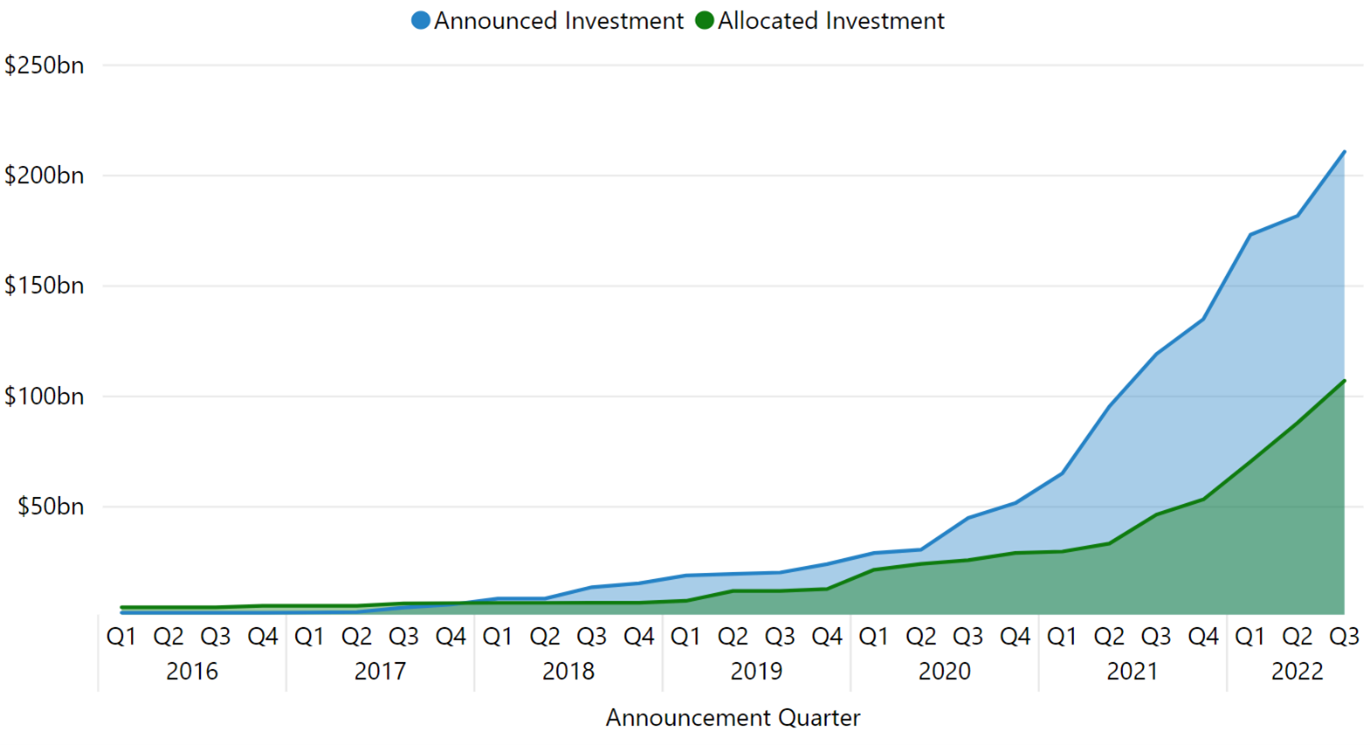

Of the $210 billion in announced investment expected to be made in the United States, over half has already been allocated for specific EV and EV battery manufacturing facilities [4]. Figure 3 splits out these “allocated” investments: domestic investment in specific EV and EV battery production facilities has skyrocketed from just $12 billion at the start of 2020 to more than $100 billion as of Q3 of this year. 2022 has been an especially busy year for allocated investments, with companies slating $61 billion for new or retrofitted factories for EVs and EV batteries.

Figure 3: Announced and Allocated U.S. EV Investment Over Time

This figure displays announced and allocated U.S. EV investment over time and shows that over half of the $210 billion of announced investment expected to be made in the U.S. has been allocated for specific EV-related projects. In this report, Atlas defines “allocated” investments as those for a specific manufacturing facility. “Announced” investments include allocated investments as well as other unspecified investment announcements such as GM’s more general announcement that it will invest $35 billion by 2030.

23 different companies have allocated at least $1 billion of investment for a specific EV or EV battery plant. The two largest investments in individual facilities are both joint ventures between Ford and battery-maker SK Innovation. The companies allocated a combined $5.8 billion and $5.6 billion for factories in Kentucky and Tennessee, respectively. Legacy automakers like Ford are not the only ones pouring billions into state-of-the-art facilities. Among startups, Rivian has the highest investment to a single plant: the manufacturer of the R1T will spend $5 billion on its second EV plant east of Atlanta, Georgia.

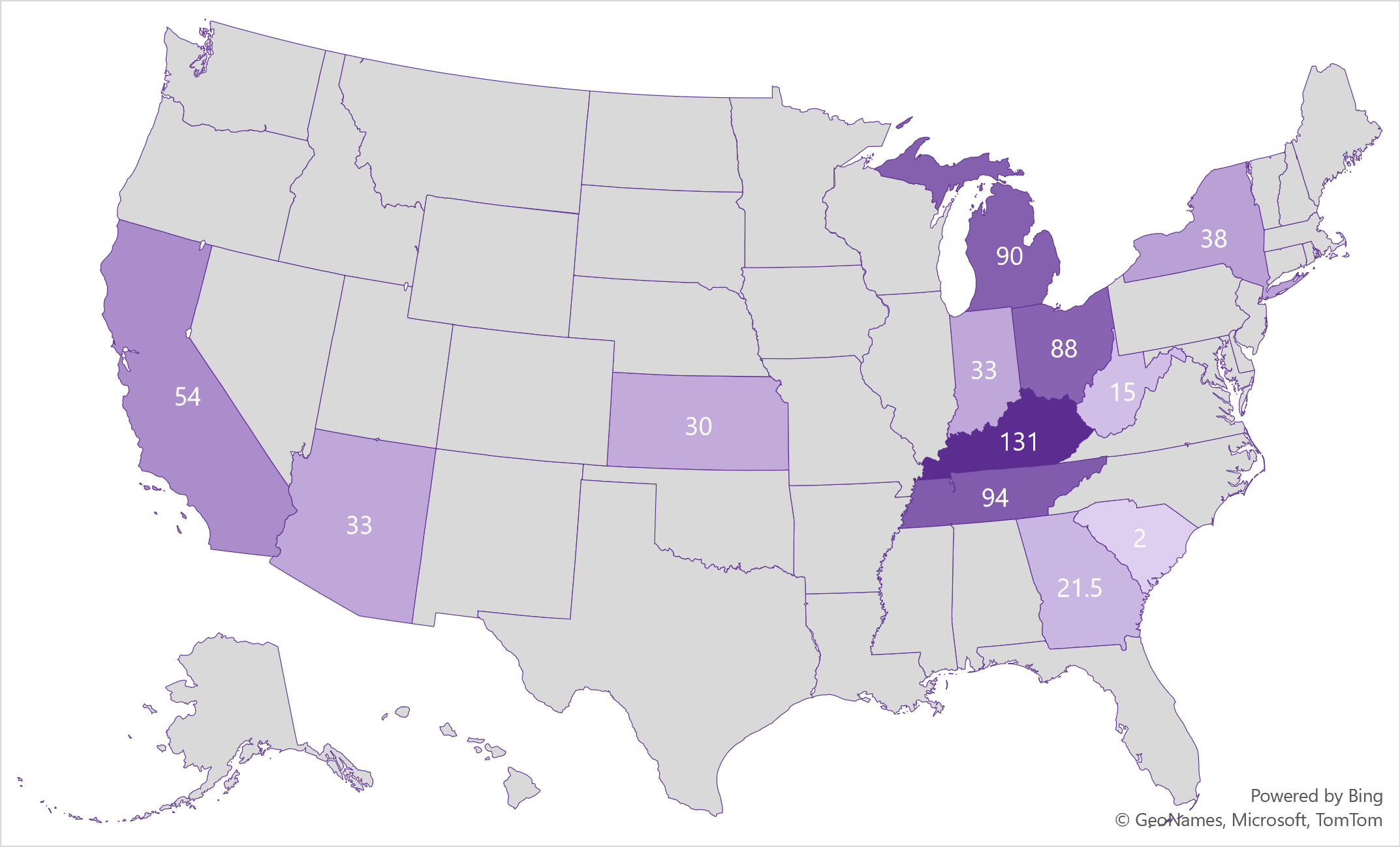

Automakers and battery makers also plan to spend $54 billion across 37 dedicated EV battery manufacturing facilities scattered across the country, from Statevolt’s Imperial Valley Gigafactory in California to Ascend Element’s Apex 1 facility in Georgia and Imperium’s Huron Campus in New York. At full capacity, these factories could produce 654 gigawatt hours (GWh) of EV battery capacity annually – enough for almost 10,000,000 light-duty vehicles annually by 2030 [5]. Figure 4 displays the location of all current and allocated U.S. EV battery factories with at least 1 GWh of annual production capacity.

The recently-passed Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) provide unprecedented levels of funding for transportation electrification programs that help foster private sector confidence and therefore support private sector investment in EVs. Both laws include programs to accelerate the supply and affordability of EVs as well as the availability of charging stations.

IRA and IIJA include at least $83 billion of loans, grants, and tax credits that could support the production of low or zero-emission vehicles or batteries. This includes $8.1 billion of grants and at least $25 billion of loans specifically for the production of low or zero-emission vehicles or batteries [6]. IRA also includes $10 billion in tax credits for a variety of manufacturing facilities, including EV and battery manufacturing facilities, as well as $40 billion in loans to be granted by the Department of Energy for pollution reduction projects [7].

IIJA and IRA also provide significant programs to help consumers purchase new, used, and commercial EVs. Notably, IRA removes the 200,000 vehicle cap per automaker for the Clean Vehicle Credit. While IRA also adds some stricter requirements around domestic mineral extraction and battery component manufacturing, the removal of the vehicle cap provides more certainty for automakers, allowing them to make production and investment decisions based on the tax credit. IRA includes tax credits for light-duty, medium-duty, and heavy-duty EVs.[8] IRA also includes a used vehicle tax credit, an important step toward making EVs an option for all drivers.

Both laws include substantial support for charging infrastructure, including $7.5 billion of grants for EV charging in IIJA as well as tax credits in IRA. There are also many programs in both laws for which EV charging projects would likely qualify. In total, between both laws there is at least $145 billion of funding for which EV charging projects could be eligible.

Table 1 summarizes key programs in IRA and IIJA that will help accelerate investment in EVs in the United States.

Table 1: EV-Eligible Funding in IRA and IIJA

|

|

Program Title |

Law |

Section No. |

Funding ($ billions) |

Funding Type |

|

$9.2 Billion for Alternative Fueling Infrastructure Specifically (EV Charging Eligible) |

Grants for Charging and Fueling Infrastructure |

IIJA |

11401 |

$1.3 |

Competitive Grant |

|

Grants for Charging and Fueling Infrastructure |

IIJA |

11401 |

$1.3 |

Competitive Grant |

|

|

Alternative Fuel Refueling Property Credit (30C) |

IRA |

13404 |

$1.7 |

Tax Credit |

|

|

National Electric Vehicle Formula Program |

IIJA |

Division J – Title VIII – 1 |

$5.0 |

Formula Grant |

|

|

$83.1 billion for EV and Battery Production |

Battery Processing and Manufacturing |

IIJA |

40207 |

$6.1 |

Competitive Grant |

|

Funding for DOE Loan Program Office (LPO) |

IRA |

50141 |

$40.0 [9] |

Loan Program |

|

|

Advanced Technology Vehicle Manufacturing (ATVM) |

IRA |

50142 |

$25.0 |

Loan Program |

|

|

Domestic Manufacturing Conversion Grants |

IRA |

50143 |

$2.0 |

Competitive Grant |

|

|

Extension of the Advanced Energy Project Credit (48C) |

IRA |

13501 |

$10.0 [10] |

Tax Credit |

|

|

$12.5 billion for EV tax credits |

Clean Vehicle Credit (30D) |

IRA |

13401 |

$7.5 [11] |

Tax Credit |

|

Credit for Previously-Owned Clean Vehicles (36E) |

IRA |

13402 |

$1.38 |

Tax Credit |

|

|

Qualified Commercial Clean Vehicles (45W) |

IRA |

13403 |

$3.68 |

Tax Credit |

|

|

$135 billion EV Charging Eligible [12] |

Multiple |

Multiple |

n/a |

$135 |

Multiple |

|

$4.5 billion “other” EV Eligible Funding9 |

Multiple |

Multiple |

n/a |

$4.5 |

Multiple |

|

TOTAL: $245 billion EV Eligible Funding in IRA and IIJA |

|||||

These billions of dollars of EV-eligible support in IRA and IIJA represent more than 30 times more support than had previously been made available for EVs by the federal government.[13] Combined with the billions of dollars of announced private sector investment, these levels of EV support are unprecedented and have the potential to significantly accelerate EV adoption in the United States over the next few years.

This significant policy support and major private sector investments put the United States in an increasingly competitive global position. With more than $245 billion eligible for EVs from IIJA and IRA and $210 billion in private investments already announced for EV and battery manufacturing, the United States is poised to become a global leader in the EV transition. Additional policy support at the state level could provide even greater confidence to the private sector and lock in additional investment in EV and battery manufacturing.

[1] This includes fully electric vehicles and plug-in hybrid vehicles.

[2] IEA, Global EV Outlook 2022

[3] Reuters, Analysis: Musk’s bold goal of selling 20 million EVs could cost Tesla billions

[4] In this report, Atlas defines “allocated” investments as those for a specific manufacturing facility. Atlas defines “announced” investments to include allocated investments as well as unspecified investment announcements such as GM’s announcement that it will invest $35 billion by 2030.

[5] U.S. Energy Information Administration, Annual Energy Outlook 2022, projects 15.2 million light-duty vehicle sales in 2030 under its reference scenario.

[6] Section 40207 of IIJA (Battery Processing and Manufacturing grants), Section 50142 of IRA (the Advanced Technology Vehicle Manufacturing program provides loans for low or zero-emission vehicles and IRA removes a previous $25 billion cap on loan authority), and section 50143 of IRA (Domestic Manufacturing Conversion Grants)

[7] Section 50141 from IRA (DOE Loan Program) and section 13501 of IRA (Extension of the Advanced Energy Project Credit (48C))

[8] Section 13401 of IRA (Clean Vehicle Credit (30D)), section 13402 of IRA (Credit for Previously-Owned Vehicles (36E)), section 13403 of IRA (Qualified Commercial Clean Vehicles (45W))

[9] IRA authorized up to $40 billion of loans for projects eligible under the Energy Policy Act. Note however that IRA appropriates a smaller amount of funding for this program.

[10] IRA states the total amount of credits which may be allocated under the program shall not exceed $10 billion. Note however that IRA appropriates a smaller amount of funding for this program.

[11] Funding based on Estimated Budget Effects of the Revenue Provisions of IRA.

[12] These funding totals are a result of Atlas’s efforts to identify all sections of IRA that could provide funding for climate investments. There may be additional sections of the law that could fund climate investments.

[13] Atlas Public Policy, EV eligible funding in IIJA and IRA represents nearly 30 times the total EV funding awarded by U.S. government to date.

Methodology

A note on methodology: Announced investment includes a) investments dedicated to EV-specific manufacturing facilities, b) capital dedicated towards electrification from automakers, and c) capital raised through venture capital, public offering, bonds, loans, or other financial mechanisms from EV-only manufacturers and EV battery manufacturers or recyclers. Investments that are not specified for a specific country are assumed to occur in the investor’s home country. Atlas defines “allocated” investments as those for a specific manufacturing facility. “Announced” investments include allocated investments as well as other unspecified investment announcements such as GM’s more general announcement that it will invest $35 billion by 2030.

Learn More

/cloudfront-us-east-2.images.arcpublishing.com/reuters/U3WXCWRAHNKBXCGYQBW4FN4MKQ.jpg)