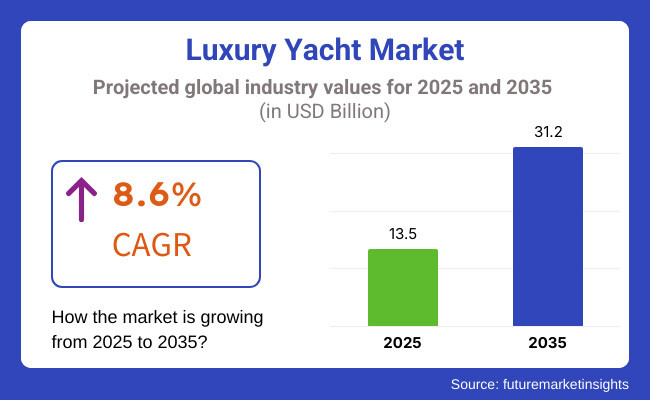

The global luxury yacht market is on track to reach USD 13.5 billion by 2025 and expand further to USD 31.2 billion by 2035, growing at a CAGR of 8.6% over the decade. This growth is fueled by increasing demand for personalized, high-end marine experiences, the rise of ultra-high-net-worth individuals (UHNWIs), and advancements in sustainable yachting technologies.

Leading yacht manufacturers such as Feadship, Lürssen, and Sunseeker are pushing boundaries with hybrid propulsion systems, AI-powered automation, and ultra-luxurious custom interiors. Meanwhile, yacht charter platforms like Fraser Yachts and Northrop & Johnson are revolutionizing yacht rentals with digital booking solutions and NFT-backed fractional ownership programs.

Luxury yacht owners and charterers increasingly prioritize sustainability, with brands like Oceanco and Azimut-Benetti integrating hydrogen fuel cells and recycled materials into their yacht designs. The market also benefits from the emergence of yachting destinations in the Mediterranean, Caribbean, and Southeast Asia, where marinas are evolving to accommodate next-generation superyachts.

Explore FMI!

Book a free demo

Between 2020 and 2024, the luxury yacht industry rebounded from pandemic-related disruptions, recording a CAGR of 5.9% as UHNWIs increased their investment in private travel solutions. The period saw a surge in yacht refitting projects, an expansion of charter services, and the integration of AI-powered navigation and automation systems.

Manufacturers such as Sanlorenzo and Heesen Yachts pioneered hybrid propulsion, while shipyards in the Netherlands and Italy saw record-breaking demand for superyacht orders. Charter operators introduced dynamic pricing and blockchain-secured contracts, ensuring seamless transactions for high-net-worth clients.

Looking ahead, the market will embrace AI-assisted design for ultra-personalized yachts, sustainable propulsion technologies, and digital concierge services offering 24/7 remote yacht management. New marina developments in Dubai, Miami, and the French Riviera will enhance accessibility for the growing superyacht segment.

| Country | Number of Yachts Deployed (2024) |

|---|---|

| United States | 5,200 |

| Italy | 4,500 |

| United Kingdom | 2,800 |

| France | 3,600 |

| Spain | 2,900 |

| United Arab Emirates | 1,750 |

| Australia | 1,500 |

| China | 2,200 |

| Greece | 3,100 |

| Monaco | 1,900 |

The United States remains the largest yacht market, with Florida and California serving as prime luxury yacht hubs. Private ownership dominates, with charter companies thriving in the Caribbean. Italy, home to industry leaders like Azimut-Benetti and Ferretti Group, focuses on yacht manufacturing, while the French Riviera and Spain’s Balearic Islands host thriving charter industries. The United Arab Emirates is rapidly expanding its high-end yacht marina infrastructure, with Dubai leading in ultra-luxury yacht developments. Meanwhile, Australia sees growing demand for long-range expedition yachts, and China is investing in marina expansion to cater to its rising class of yacht owners. Monaco continues to be a global superyacht epicenter, attracting elite clientele who dock their vessels at Port Hercule during the Monaco Yacht Show.

| Factor | Impact on the Luxury Yacht Industry |

|---|---|

| AI-Powered Smart Yachts | Automated yacht operations with real-time route optimization and energy efficiency management. |

| Hydrogen & Electric Propulsion | Zero-emission yachts gaining traction as sustainability regulations tighten. |

| NFT & Blockchain-Based Ownership | Increased transparency and security for yacht transactions and fractional ownership models. |

| Personalized Concierge Services | AI-driven crewless yachts offering on-demand luxury experiences and custom itineraries. |

| Remote Work & "Liveaboard" Trend | More UHNWIs adopting yachts as mobile offices, fueling demand for long-term, tech-enabled vessels. |

Motor yachts dominate the luxury yacht market, accounting for over 70% of total sales. Buyers favor these vessels for their high speed, advanced automation, and custom-built luxury features. Leading manufacturers like Princess Yachts and Pershing push the boundaries with AI-assisted autopilot systems, hybrid propulsion, and intuitive smart controls.

Princess Yachts has pioneered energy-efficient V-class motor yachts that balance high performance with reduced emissions. Meanwhile, Pershing Yachts is redefining the segment with its 140-foot flagship, featuring a lightweight aluminum hull that enhances speed while optimizing fuel efficiency.

Motor yachts also cater to adventure-driven UHNWIs who demand high-speed travel and long-range cruising capabilities. Ferretti’s Navetta series offers hybrid propulsion and extended-range fuel efficiency, enabling seamless transatlantic crossings. On the ultra-luxury end, Sunseeker’s 100 Yacht integrates panoramic sky lounges, infinity jacuzzis, and AI-managed crew operations for a bespoke yachting experience.

Technological innovations continue to shape this segment. AI-powered predictive maintenance, integrated smart yacht management, and voice-activated control systems redefine convenience. As buyers seek sustainability, hybrid-electric motor yachts from brands like Silent Yachts and Arc Marine gain traction, proving that high performance and eco-conscious design can coexist in luxury yachting.

Superyachts are revolutionizing luxury, with billionaires and corporate leaders clamoring for them. Feadship, Lürssen, and Benetti are amongst the top builders, designing yachts that are over 100 feet long with bespoke customization and innovation. Feadship's Project 821, which measures 333 feet, features a hybrid propulsion system, underwater observatory lounge, and retractable helicopter hangar, raising the bar in the industry.

Superyacht buyers prioritize privacy, exclusivity, and cutting-edge amenities. Lürssen’s 400-foot mega-yacht M/Y Blue integrates AI-powered energy management, ensuring maximum efficiency during transoceanic voyages. Similarly, Benetti’s B.Now 50M features an open beach club design with seamless indoor-outdoor living, attracting owners who seek a blend of relaxation and entertainment.

Sustainability is a major trend, with Oceanco introducing the world's first hydrogen fuel cell-powered superyacht. Silent-Yachts' solar-powered superyachts also become popular, cutting down on fossil fuels without sacrificing luxury. As marinas around the globe increase in size to accommodate larger yachts, the superyacht market continues to be the industry's most profitable and fastest-growing sector.

Private ownership dominates the luxury yacht industry, accounting for nearly 65% of the market. UHNWIs acquire private yachts to enhance exclusivity, privacy, and long-term investment value. Companies like Feadship and Sanlorenzo specialize in fully customized yachts, allowing buyers to design everything from helipads to underwater lounges. Jeff Bezos’s Flying Fox and Larry Ellison’s Musashi exemplify the trend of ultra-personalized superyachts.

| Ownership Type | Market Share (%) |

|---|---|

| Private Ownership | 65% |

| Charter & Fleet Ownership | 35% |

Market Share (%) Private Ownership 65% Charter & Fleet Ownership 35%harter ownership, accounting for around 35% of the market, is growing at a pace as more high-net-worth clients choose easy, hassle-free yachting experience. Charter firms such as Burgess and Camper & Nicholsons own some of the world's most opulent superyachts, with bespoke itineraries available in the Mediterranean and Caribbean. The growth of fractional ownership structures, spearheaded by companies like YachtLife, is targeting young millionaires who prefer to share luxury over owning it. Online booking platforms now facilitate yacht rentals, and chartering is an accessible and scalable niche in the luxury yacht industry.

The United States dominates the international luxury yacht market, which is fueled by its high density of UHNWIs, global-standard marinas, and robust domestic yacht-manufacturing sector. Florida is the hub of luxury yachting, with Miami, Fort Lauderdale, and Palm Beach featuring high-end yacht shows like the Fort Lauderdale International Boat Show (FLIBS). They act as principal sales platforms for brands including Westport, Trinity Yachts, and Viking Yachts.

Westport Yachts, a leading USA -based superyacht builder, is known for its semi-custom 112- to 172-foot superyachts. American billionaires prefer the company's Westport 164 model, which incorporates state-of-the-art stabilization systems and large sundecks, providing both performance and luxury. Trinity Yachts, on the other hand, is known to build fully customized aluminum superyachts for clients who want one-of-a-kind, high-performance superyachts.

The USA is also at the forefront of yacht chartering. Burgess and Denison Yachting, for instance, provide customized itineraries in the Bahamas, Caribbean, and the Pacific Northwest, catering to high-net-worth individuals looking for seasonal getaways. Tech billionaires and finance barons increasingly use luxury charters, employing yachts as personal retreats and networking venues.

Meanwhile, innovation in superyacht ownership models is catching on. Fractional ownership companies like SeaNet and YachtLife enable owners to share the ownership of superyachts at a lower maintenance cost but high access. USA-based fintech companies are also leveraging blockchain in yacht transactions, facilitating sales and bolstering security.

As luxury yacht demand increases, USA shipyards keep on growing. With more and more investment being made in AI-based yacht management systems and green propulsion technologies, the nation establishes itself as a world yachting leader, creating trends that define the future of the industry.

Italy is the powerhouse of the luxury yacht production market, home to some of the globe's most desirable superyachts. High-profile shipyards like Ferretti Group, Azimut-Benetti, and Sanlorenzo dominate the market, producing boats that balance masterful craftsmanship with innovative technology. Azimut-Benetti, the largest yacht producer in the world, continues to raise the bar with its Grande and Oasis ranges, incorporating hybrid propulsion systems and smart yacht management systems.

Sanlorenzo's SP110 is notable for its sophisticated fuel-saving water jet propulsion, capable of higher speeds with lower emissions. Meanwhile, Ferretti Yachts is leading the way with fully customizable interiors, allowing owners to personalize everything from cabin arrangement to entertainment areas so that every yacht is a one-of-a-kind masterpiece.

Going beyond aesthetics, Italy's dominance covers its strong supply chain, wherein a web of expert artisans and marine technology companies complement yacht interior, propulsion, and safety solutions. Italian boat manufacturers are incorporating eco-friendly products, including recovered teak flooring and power-conscious lithium battery units, appealing to the green awareness ultra-high-net-worth end-users.

Italy's successful yacht culture is seen in its annual yacht shows, like the Genoa International Boat Show and the Venice Boat Show, where shipyards launch their new models. Italy's marinas, like Porto Cervo and Marina di Portofino, continue to be top spots for yacht owners, reinforcing Italy's position as both a manufacturer and a trendsetter in luxury yachting. As demand for bespoke, high-performance yachts continues to rise, Italy's yacht industry remains ahead of the game, merging heritage with innovation to reimagine modern luxury yachting.

The international luxury yacht market shows a moderately high concentration, dominated by a small number of giant players with substantial market share. Italian shipbuilders like Azimut-Benetti, Ferretti Group, and Sanlorenzo dominate the industry, together boasting more than 40% new yacht deliveries. Northern European brand names like Feadship and Lürssen hold ground in the ultra-luxury and bespoke-made superyacht market. Whereas major conglomerates power production efficiency and innovation, luxury builders such as Heesen and Perini Navi establish niche markets with deeply personalized designs. The growing involvement of digital platforms and fractional models is also altering market concentration patterns.

Recent Developments in the Global Luxury Yacht Industry

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, MEA |

| Key Companies Profiled | Feadship, Lürssen, Sunseeker, Azimut-Benetti, Sanlorenzo, Pershing, Princess Yachts, Fraser Yachts |

The global luxury yacht market is valued at approximately USD 12.9 billion in 2024. It is expected to reach USD 13.5 billion by 2025 and grow to USD 31.2 billion by 2035, with an estimated CAGR of 8.6%.

The rising number of ultra-high-net-worth individuals, increasing demand for personalized marine experiences, sustainability-driven yacht designs, and advancements in AI-powered automation are fueling market expansion.

Leading companies include Feadship, Lürssen, Azimut-Benetti, Sanlorenzo, Sunseeker, Ferretti Group, Heesen Yachts, and Oceanco.

AI-powered navigation, hybrid and hydrogen propulsion systems, blockchain-backed fractional ownership, and digital yacht concierge services are revolutionizing luxury yacht manufacturing and ownership models.

Yacht builders are integrating sustainable propulsion solutions, such as hybrid-electric and hydrogen-powered systems, while using eco-friendly materials like recycled teak and energy-efficient battery storage.

Fractional ownership models allow multiple individuals to co-own a yacht, reducing operational costs and increasing accessibility.

Hyper-personalized yacht experiences, AI-driven yacht management, and frictionless digital booking solutions are defining the luxury yachting future, which is becoming easier and more convenient to own or charter.

Cultural Tourism Market Analysis by Tourism Type, By Traveler Category, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

USA Staycation Industry Analysis from 2025 to 2035

Germany Staycation Market Analysis – Size, Share & Forecast 2025-2035

GCC Countries Staycation Market Trends – Growth, Demand & Forecast 2025-2035

UK Staycation Market Outlook – Share, Growth & Forecast 2025-2035

USA Boutique Hotel Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.