Analysts’ Viewpoint on U.S. Market Scenario

Rise in the number of cardiovascular surgeries has led to an increase in usage of ambulatory cardiac monitoring devices to continuously monitor a patient's heart condition. Ambulatory cardiac monitoring devices are presently required to track and monitor the heart in order to prevent fatal outcomes from cardiovascular diseases.

According to an article titled, "National Variation in Congenital Heart Surgery Outcomes", published in October 2020, around 40,000 children in the U.S. undergo congenital heart surgery each year. Cardiac monitoring is critical for diagnosing and treating heart attacks, calculating cardiac output, and tracking sepsis cases.

Ambulatory heart monitoring devices can be used in research institutions and organizations, as they can detect, eliminate, and control mycoplasma infection in cell culture. Growing concerns among heart patients is expected to drive the ambulatory cardiac monitoring devices market in the U.S. in the next few years.

Ambulatory cardiac monitor is an electrocardiogram that records the rhythm of the heart. The length of recording time and the ability to send recordings over the phone are two features that set it apart. Ambulatory cardiac monitors are used by most professional experts to assess heartbeat over time, correlate signs with the heartbeat, make a diagnosis of abnormal heart rhythms, and evaluate other symptoms related to the heart. These devices help monitor the heart with increased detection time and more precise results as compared to traditional heart monitors.

Ambulatory monitoring devices allow for a new healthcare paradigm by gathering and examining lengthy data for trustable diagnostics. These devices are gaining popularity for continuous cardiac disease monitoring. Recent advancements have enabled solutions that are both affordable and dependable, enabling vulnerable populations to be monitored from the comfort of their own homes. These devices detect important physiological events early, resulting in timely alerts to seek medical attention.

Request a sample to get extensive insights into the Ambulatory Cardiac Monitoring Devices Market

An electrocardiography (ECG) device uses electrical impulses to record heartbeats, which are then amplified and displayed on an ECG display. ECG devices are used to detect various heart diseases and arrhythmias in a person's body and to help choose the best treatment. Electrocardiograms can presently obtained at home using a portable ECG device, thanks to advances in technology. According to the World Health Organization, cardiovascular diseases affect more than 60% of the global population.

Moreover, Mobile Cardiac Telemetry (MCT) is a constant form of ambulatory care ECG monitoring that can last a maximum of 30 days. MCT is a relatively new form of ambulatory cardiac monitoring that has been demonstrated to be a reliable and efficient way to monitor a patient's ECG data while the patient is at work or sleeping.

Various smart portable EKG monitoring devices are available, such as EMAY Portable EKG Monitoring Device (for iPhone & Android, Mac & Windows. This portable ECG monitor is small enough to fit in a person's pocket. It is compatible with majority of smartphones. It also has the ability to save, view, and share reports, and record 30 seconds of a person's heart rate and rhythm. This device is activated by resting one's hands on the sensors on either side of the ECG monitor for 30 seconds. The information can then be transferred to the smartphone. These factors are likely to propel ambulatory cardiac monitoring devices market demand in the U.S.

Cardiac implantable electronic devices (CIEDs) have been linked to increased survival and quality of life when used to treat cardiac arrhythmias. However, CIED-related infection is a significant concern. Infections from CIEDs are most common in patients who have a cardiac resynchronization therapy defibrillator or an implantable cardioverter defibrillator. According to the European Heart Journal (CRTDs), the rate of CIED infections in pacemakers was 1.19% in implantable cardioverter-defibrillators, 2.18% in cardiac resynchronization therapy pacemakers (CRT-Ps), and 3.35% in CRT defibrillators.

Medtronic provides an absorbable, multifilament mesh envelope to improve CIED stabilization in the subcutaneous pocket and to elute the antibiotics minocycline and rifampin (TYRX Absorbable Antibacterial Envelope). These envelopes are designed to be used in conjunction with cardiac implantable electronic devices (CIEDs), such as pacemakers and implantable cardioverter defibrillators (ICDs). In 2019, an international randomized controlled trial discovered that the envelope reduced the incidence of infection by 40% when compared to standard-of-care infection prevention alone. These factors are propelling the ambulatory cardiac monitoring devices market share in the U.S.

Request a custom report on Ambulatory Cardiac Monitoring Devices Market

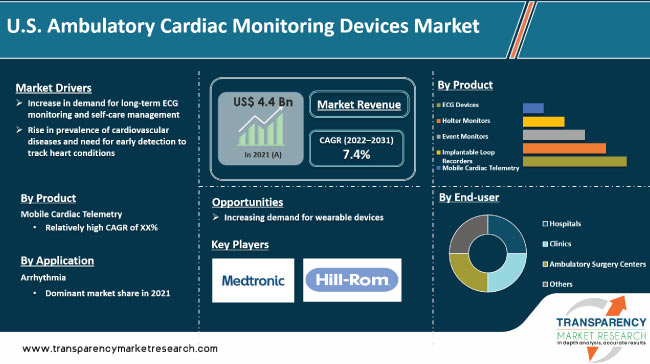

In terms of product, the ambulatory cardiac monitoring devices market has been classified into ECG devices, Holter monitors, event monitors, implantable loop recorders, and mobile cardiac telemetry. Mobile cardiac telemetry is a relatively new technology in the field of ambulatory cardiac monitoring. This technology is significant because it is a real-time ECG monitor, capable of automatically detecting any ECG abnormalities and automatically transmitting this ECG information via cell phone technology to an accredited diagnostic laboratory for professional review.

Mobile cardiac telemetry monitoring is the method of the future because it has several technological advantages over other long-term monitoring options. MCT monitoring technology captures cardiac abnormalities in real-time, making it a superior method for detecting ECG abnormalities. The accelerated nature of MCT could reduce long-term healthcare costs and improve diagnostic care. This in turn is likely to augment the wireless ambulatory telemetry monitors market.

Based on application, the ambulatory cardiac monitoring devices market in the U.S. has been segregated into arrhythmia, coronary artery disease, hypertension, and others. Electrocardiographic monitoring devices can be utilized effectively for management of cardiac arrhythmias and ambulatory diagnosis. Palpitations, hypotension, antiarrhythmic drug monitoring, and arrhythmia surveillance in patients with suspected arrhythmias are all potential indications.

Ambulatory arrhythmia monitoring devices track heartbeats in hospitals, ASCs, homecare, and other settings. The ambulatory cardiac monitoring devices market trends in the U.S. indicate that the demand for these devices is expected to be driven by increase in the geriatric population and rise in the prevalence of cardiovascular disorders. Therefore, the demand for effective monitoring systems is expected to increase in the near future. Furthermore, the development of efficient medical devices is aided by the improvement of healthcare infrastructure, which could promote industry growth in the near future.

In terms of end-user, the ambulatory cardiac monitoring devices market in the U.S. has been divided into hospitals, clinics, ambulatory surgery centers, and others. Some of the ambulatory cardiac monitoring devices used in hospitals are electrocardiograms, blood pressure monitors, electronic fetal monitors, pulse oximeters, wearables, body temperature monitors, and others. Ambulatory cardiac monitoring devices are one of the most important medical devices, saving millions of lives every day. Every hospital requires a monitoring system in order to provide the best possible care to their patients.

The ambulatory cardiac monitoring devices market in the U.S. is consolidated, with the presence of a small number of leading players. Most of the companies are investing significantly in R&D activities, primarily to introduce advanced ambulatory cardiac monitoring devices in the country. Key players are engaging in strategic alliances to increase revenue and market share.

Furthermore, diversification of product portfolios and mergers & acquisitions are prominent strategies adopted by key players. Abbott Laboratories, Biotronik, Boston Scientific Corporation, GE Healthcare, Hill-Rom Holdings, Koninklijke Philips N.V., Medtronic, and Nihon Kohden Corporation are prominent players operating in the U.S. market

Each of these players has been profiled in the U.S. ambulatory cardiac monitoring devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 4.4 Bn |

|

Market Forecast Value in 2031 |

More than US$ 9.0 Bn |

|

Growth Rate (CAGR) |

7.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 4.4 Bn in 2021

It is projected to reach more than US$ 9.0 Bn by 2031

The ambulatory cardiac monitoring devices market in the U.S. is anticipated to grow at a CAGR of 7.4% from 2022 to 2031

Increase in demand for long-term ECG monitoring and self-care management is driving the ambulatory cardiac monitoring devices market in the U.S.

The ECG devices segment held more than 40% share of the ambulatory cardiac monitoring devices market in the U.S. in 2021

Abbott Laboratories, Biotronik, Boston Scientific Corporation, GE Healthcare, Hill-Rom Holdings, Koninklijke Philips N.V., Medtronic, and Nihon Kohden Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

3. Executive Summary: U.S. Ambulatory Cardiac Monitoring Devices Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. U.S. Ambulatory Cardiac Monitoring Devices Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Disease Prevalence & Incidence Rate globally with key countries

5.2. Brand Analysis

5.3. Value Chain Analysis

5.4. Pricing Analysis

5.5. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. U.S. Ambulatory Cardiac Monitoring Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017 - 2031

6.3.1. ECG Devices

6.3.1.1. Resting ECG Devices

6.3.1.2. Stress ECG Devices

6.3.2. Holter Monitors

6.3.2.1. Conventional Holters

6.3.2.2. Extended Holters

6.3.3. Event Monitors

6.3.4. Implantable Loop Recorders

6.3.5. Mobile Cardiac Telemetry

6.4. Market Attractiveness Analysis, by Product

7. U.S. Ambulatory Cardiac Monitoring Devices Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017 - 2031

7.3.1. Arrhythmia

7.3.2. Coronary Artery Disease

7.3.3. Hypertension

7.3.4. Others

7.4. Market Attractiveness Analysis, by Application

8. U.S. Ambulatory Cardiac Monitoring Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017 - 2031

8.3.1. Hospitals

8.3.2. Clinics

8.3.3. Ambulatory Surgery Centers

8.3.4. Others

8.4. Market Attractiveness Analysis, by End-user

9. Competition Landscape

9.1. Market Player – Competition Matrix (by tier and size of companies)

9.2. Market Share Analysis, by Company, 2021

9.3. Company Profiles

9.3.1. Abbott Laboratories

9.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

9.3.1.2. Company Financials

9.3.1.3. Growth Strategies

9.3.1.4. SWOT Analysis

9.3.2. Biotronik

9.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

9.3.2.2. Company Financials

9.3.2.3. Growth Strategies

9.3.2.4. SWOT Analysis

9.3.3. Boston Scientific Corporation

9.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

9.3.3.2. Company Financials

9.3.3.3. Growth Strategies

9.3.3.4. SWOT Analysis

9.3.4. GE Healthcare

9.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

9.3.4.2. Company Financials

9.3.4.3. Growth Strategies

9.3.4.4. SWOT Analysis

9.3.5. Hill-Rom Holdings

9.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

9.3.5.2. Company Financials

9.3.5.3. Growth Strategies

9.3.5.4. SWOT Analysis

9.3.6. Koninklijke Philips N.V.

9.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

9.3.6.2. Company Financials

9.3.6.3. Growth Strategies

9.3.6.4. SWOT Analysis

9.3.7. Medtronic

9.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

9.3.7.2. Company Financials

9.3.7.3. Growth Strategies

9.3.7.4. SWOT Analysis

9.3.8. Nihon Kohden Corporation

9.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

9.3.8.2. Company Financials

9.3.8.3. Growth Strategies

9.3.8.4. SWOT Analysis

List of Tables

Table 01: U.S. Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: U.S. Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017–2031

Table 03: U.S. Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Holter Monitors, 2017–2031

Table 04: U.S. Ambulatory Cardiac Monitoring Devices Market Volume (in Mn Units) Forecast, by Product, 2017–2031

Table 05: U.S. Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 06: U.S. Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: U.S. Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: U.S. Ambulatory Cardiac Monitoring Devices Market, by Product, 2021 and 2031

Figure 03: U.S. Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 04: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by ECG Devices, 2017–2031

Figure 05: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by Holter Monitors, 2017–2031

Figure 06: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by Event Monitors, 2017–2031

Figure 07: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by Implantable Loop Recorders, 2017–2031

Figure 08: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by Mobile Cardiac Telemetry, 2017–2031

Figure 09: U.S. Ambulatory Cardiac Monitoring Devices Market, by Application, 2021 and 2031

Figure 10: U.S. Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 11: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by Arrhythmia, 2017–2031

Figure 12: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by Coronary Artery Disease, 2017–2031

Figure 13: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by Hypertension, 2017–2031

Figure 14: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by Others, 2017–2031

Figure 15: U.S. Ambulatory Cardiac Monitoring Devices Market, by End-user, 2021 and 2031

Figure 16: U.S. Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 17: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by Hospitals, 2017–2031

Figure 18: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by Clinics, 2017–2031

Figure 19: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by Ambulatory Surgery Centers, 2017–2031

Figure 20: U.S. Ambulatory Cardiac Monitoring Devices Market (US$ Mn), by Others, 2017–2031