- Trillion Energy (TCF) has shared its third-party December 31, 2022 year-end reserves report

- Net present value of proved and probable (P2) natural gas reserves (NPV10%) increased to US$432 million net to Trillion, up from US$82 million (2021), a 426-per-cent YoY increase

- Proved and probable conventional natural gas reserves (P2) increased to 48.6 BCF, up from 20.1 BCF (2021), an increase of 141 per cent YoY

- The company intends to unlock the value of its reserves through a development program this year

- Colin Robson, VP Corporate Development, spoke with Brieanna McCutcheon about the news

- Trillion Energy International is focused on natural gas production with assets in Turkey and Bulgaria

- Trillion Energy International (TCF) last traded at $0.405 per share

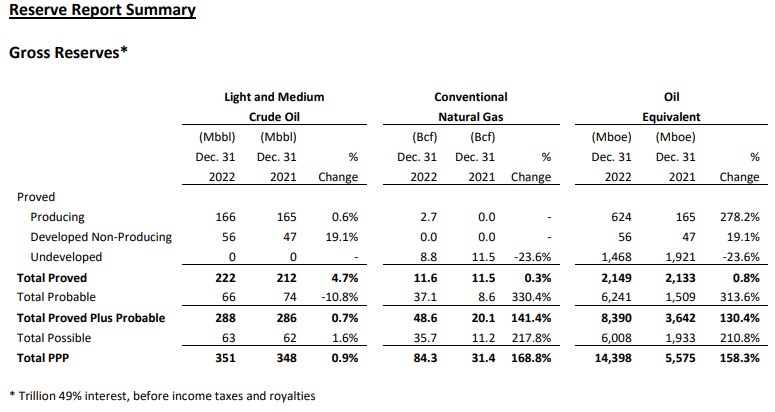

Trillion Energy (TCF) has shared its third-party December 31, 2022 year-end reserves report.

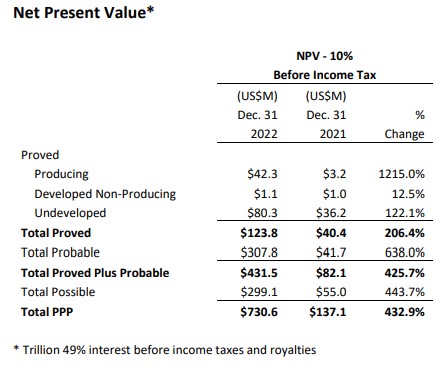

Net present value of proved and probable (P2) natural gas reserves (NPV10%) increased to US$432 million net to Trillion, up from US$82 million (2021), a 426-per-cent YoY increase. The US$432 million NPV10 value represents US$1.12 per common share.

Proved and probable conventional natural gas reserves (P2) increased to 48.6 BCF, up from 20.1 BCF (2021), an increase of 141 per cent YoY.

Net present value of proved reserves (P1 – NPV10) increased to US$123.8 million from US$40.4 million (2021), a 206-per-cent YoY increase.

Net present value of proved, probable and possible reserves (P3) NPV10 increased to US$731 million net to Trillion, up from US$137 million (2021), an increase of 433 per cent and US$1.8990 per common share net present value.

Proved and probable oil reserves (2P) of 288,000 barrels of oil (boe) having an NPV10% of US$5.2 million relating to the Cendere oil field.

Net present value of P1 oil reserves NPV10 increased to US$4.3 million compared to prior year of US$4.2 million (2021).

The evaluation was undertaken by GLJ, Ltd.

“We are very pleased that our 2022 exploration and development efforts have paid off, resulting in very substantial increases in reserves and values during the year. It is our plan to realize the reserves value through a development program extending throughout 2023 and beyond,” stated Arthur Halleran, Trillion’s CEO. “We expect that our 2023 drilling program will further increase our reserves and cash flows. Our reserves values represent a substantial intrinsic value to shareholders.”

Colin Robson, VP Corporate Development, spoke with Brieanna McCutcheon about the news.

Trillion Energy International is focused on natural gas production with assets in Turkey and Bulgaria.

Trillion Energy International (TCF) last traded at $0.405 per share.