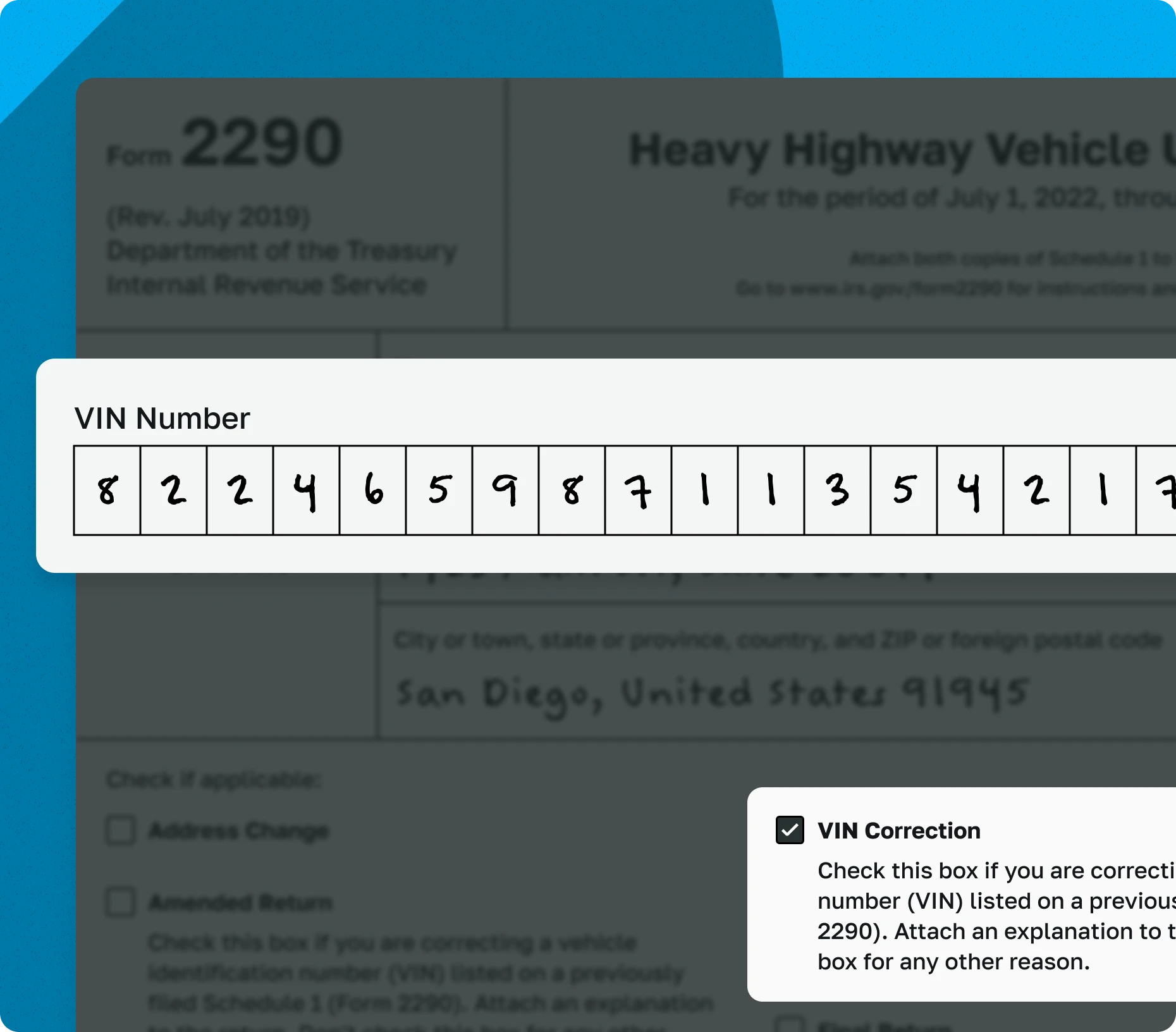

How do I file a VIN Correction with ExpressTruckTax?

Filing your VIN Correction has been made very easy and simple with ExpressTruckTax. Here are the steps to file a VIN correction with ExpressTruckTax:

If you accidentally entered the wrong VIN on your return, don’t worry! With ExpressTruckTax, you can make a VIN correction for free.

Guaranteed Schedule 1 or Your Money Back

Free VIN Checker & VIN Corrections

Copy Details From Your Last Return

US-Based Customer Support in Both English & Spanish

File Your 2024-25 Form 2290 Now with ExpressTruckTax!

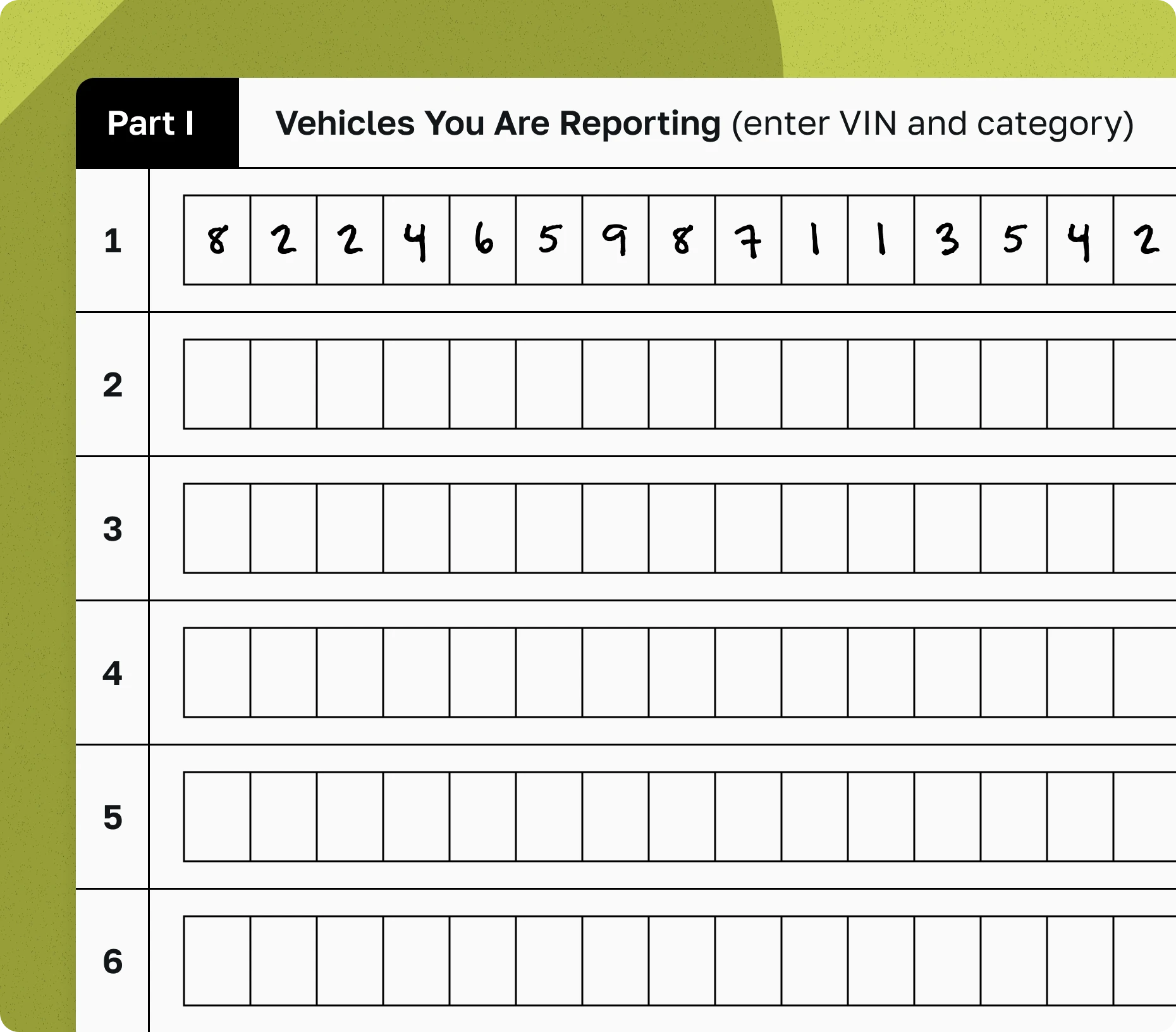

Vehicle Identification Number (VIN) is a 17 character unique identification sequence that is a combination of both numbers and letters. The IRS uses the VIN for identification purposes. The VIN is a distinct code offered to every vehicle, so two vehicles cannot have the same VIN.

If you have already filed your Form 2290 return with the wrong VIN and the IRS has accepted it, you have to file a Form 2290 VIN correction to make changes to the incorrect VIN on your Schedule 1.

You must file a VIN Correction if you made a mistake on the Form 2290 you previously filed. There is no deadline to file a VIN Correction. You can file a VIN correction amendment when you realize that you have made an error in the VIN of any vehicle in your Form 2290.

Filing your VIN Correction has been made very easy and simple with ExpressTruckTax. Here are the steps to file a VIN correction with ExpressTruckTax:

If you had filed your original return with us, the data from the original return would be auto-updated in the VIN Correction Form and you do not have to pay for the return.

We understand that it is human to make errors. VIN is a 17 digit sequence, and the chances of making a mistake while typing your VIN are high. We do not want the users to pay multiple times just because they missed a character while filing their return. If you filed your original Form 2290 return with ExpressTruckTax, you could file your VIN Correction for free.

Online IRS-Authorized HVUT E-Filing Software You Can Trust