Analysts’ Viewpoint

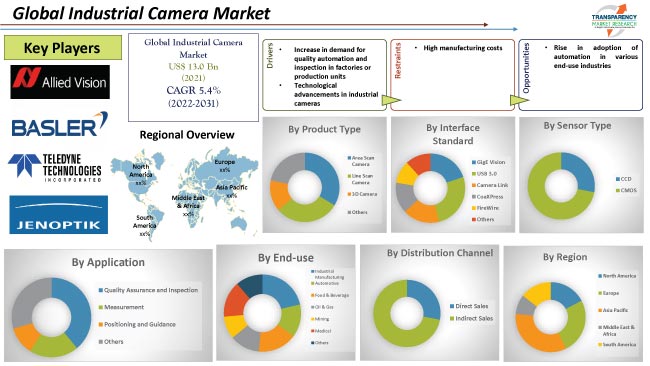

Increase in manufacturing and automation activities in different industry verticals is driving the global industrial camera business. Industrial camera systems are widely adopted for inspection purposes in factory automation. Establishment of smart industry has led to the introduction of highly advanced networking systems. This is creating lucrative industrial camera business opportunities for manufacturers in the global market.

Increase in concern about safety and security of employees working in hazardous environments such as mining and construction is further fueling the demand for industrial cameras. Market players are following the industrial camera industry trends to gain revenue benefits.

Industrial cameras are used in challenging conditions such as high temperature, pressure, and vibration in various end-use industries. These cameras can monitor units on conveyors, analyze extremely small parts, and regulate the production cycle in end-use industries such as industrial manufacturing, automotive, oil & gas, and medical.

Demand for industrial borescopes is rising across the globe. High-tech industrial cameras are gaining traction in the manufacturing industry. Industrial security cameras are also being widely adopted in numerous industries. Thus, rise in demand for industrial cameras is anticipated to positively impact the global industrial camera market development in the near future.

Request a sample to get extensive insights into the Industrial Camera Market

Smart camera technology is an all-in-one solution for industrial quality automation and inspection. This smart camera system is progressively becoming an industry standard for several manufacturers across the world due to its precision and versatile functionality. Furthermore, smart camera offers integrated software packages and a wide range of alternatives for different applications such as measurement, quality, and inspection.

According to the industrial camera industry forecast report, demand for robotic vision camera is gaining traction in the global market. Robotic vision camera features a large, adjustable workspace, a broad field of view, and resistance to ambient light and reflections. It can be constructed using synchronized laser scan technology, which allows it to work with high-speed stability. Thus, technological advancements are anticipated to fuel the industrial camera market progress in the next few years.

Rapid expansion of the industrial manufacturing sector has led to an increase in usage of industrial cameras for quality assurance and inspection; measurement; positioning and guidance; and various other purposes in applications such as production of machinery, food, and electronic products. This is anticipated to contribute to the industrial camera market demand during the forecast period.

Rise in inclination for zero-error tolerance, digital networking, artificial intelligence, and deep learning systems is expected to boost the industrial camera market size in the near future. Various end-use industries are making investing in enhancing their equipment and machineries, which is a key factor significantly contributing to the industrial camera market growth. Rise in inclination toward the possession of various industrial camera types among different industry verticals is anticipated to further drive the market during the forecast period.

Request a custom report on Industrial Camera Market

According to the global industrial camera market research report, in terms of product type, the global market has been segmented into area scan camera, line scan camera, 3D camera, and others. The area scan camera segment is likely to dominate during the forecast period. This can be ascribed to its ability to rapidly capture a defined area, simplicity of installation, and cost-effectiveness in comparison with other types.

On the other hand, demand for line scan cameras and 3D cameras is increasing in several industry verticals across the globe.

According to the global industrial camera market analysis, the USB 3.0 segment is likely to lead the global market in the near future, based on interface standard. This can be ascribed to its simple connectivity and high bandwidth.

GigE Vision, Camera Link, CoaXPress, and FireWire are also gaining traction, owing to their ability to achieve quick data transfer in multiple synchronizations at low cost.

Asia Pacific is anticipated to dominate the global market during the forecast period. Growth in the manufacturing sector in China, India, and Japan is likely to positively impact market statistics in the region in the near future.

Europe and North America held large share of the global market in 2021. This can be ascribed to the rise in investment in advanced manufacturing equipment by companies operating in these regions.

The market is consolidated, with a few large-scale companies controlling substantial share. Market participants are focusing on producing smart cameras that are programmable for AI applications. Demand for smart cameras is expected to rise during the forecast period, as several industries are increasingly adopting AI-based products.

Allied Vision Technologies GmbH, FLIR Machine Vision, IMPERX, Inc., Industrial Video & Control Co., JAI, Jenoptik, Keyence Corporation, PixeLINK, Teledyne DALSA, and The Imaging Source are some of the top key players in industrial camera market.

The industrial camera market report profiles key players based on parameters such as business strategies, business segments, financial overview, product portfolio, company overview, and recent developments.

|

Attribute |

Detail |

|

Market Value of Industrial Camera in 2021 |

US$ 13.0 Bn |

|

Market Forecast Value in 2031 |

US$ 21.7 Bn |

|

Growth Rate (CAGR) |

5.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It is expected to reach US$ 21.7 Bn by 2031

It is estimated to grow at a CAGR of 5.4% during the forecast period

Increase in demand for quality automation and inspection in factories or production units and technological advancements in industrial cameras

Quality assurance and inspection segment accounted for the largest share in 2021

Asia Pacific is likely to be the most attractive for vendors in the near future

Allied Vision Technologies GmbH, FLIR Machine Vision, IMPERX, Inc., Industrial Video & Control Co., JAI, Jenoptik, Keyence Corporation, PixeLINK, Teledyne DALSA, and The Imaging Source

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.6.1. Supply Chain Analysis

5.6.1.1. Top Distributors Players

5.6.1.2. Top Integrators Players

5.6.1.3. Top System Vendors Players

5.7. Regulatory Framework

5.8. Technological Overview

5.9. Industrial Camera Installation Analysis

5.9.1. Wireless Camera Installation

5.9.2. Caballed Camera Installation

5.9.2.1. Cable Length Analysis (between the cameras to the processing)

5.10. COVID-19 Impact Analysis

5.11. Global Industrial Camera Market Analysis and Forecast, 2017- 2031

5.11.1. Market Value Projections (US$ Mn)

5.11.2. Market Volume Projections (Thousand Units)

6. Global Industrial Camera Market Analysis and Forecast, by Product Type

6.1. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

6.1.1. Area Scan Camera

6.1.2. Line Scan Camera

6.1.3. 3D Camera

6.1.4. Others

6.2. Incremental Opportunity, by Product Type

7. Global Industrial Camera Market Analysis and Forecast, by Interface Standard

7.1. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Interface Standard, 2017- 2031

7.1.1. GigE Vision

7.1.2. USB 3.0

7.1.3. Camera Link

7.1.4. CoaXPress

7.1.5. FireWire

7.1.6. Others

7.2. Incremental Opportunity, by Interface Standard

8. Global Industrial Camera Market Analysis and Forecast, by Sensor Type

8.1. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Sensor Type, 2017- 2031

8.1.1. CCD

8.1.2. CMOS

8.2. Incremental Opportunity, by Sensor Type

9. Global Industrial Camera Market Analysis and Forecast, by Application

9.1. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

9.1.1. Quality Assurance and Inspection

9.1.2. Measurement

9.1.3. Positioning and Guidance

9.1.4. Others

9.2. Incremental Opportunity, by Application

10. Global Industrial Camera Market Analysis and Forecast, by Interface Standard, by Application

10.1. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Interface Standard, by Application, 2017- 2031

10.1.1. GigE Vision

10.1.1.1. Quality Assurance and Inspection

10.1.1.2. Measurement

10.1.1.3. Positioning and Guidance

10.1.1.4. Others

10.1.2. USB 3.0

10.1.2.1. Quality Assurance and Inspection

10.1.2.2. Measurement

10.1.2.3. Positioning and Guidance

10.1.2.4. Others

10.1.3. Camera Link

10.1.3.1. Quality Assurance and Inspection

10.1.3.2. Measurement

10.1.3.3. Positioning and Guidance

10.1.3.4. Others

10.1.4. CoaXPress

10.1.4.1. Quality Assurance and Inspection

10.1.4.2. Measurement

10.1.4.3. Positioning and Guidance

10.1.4.4. Others

10.1.5. FireWire

10.1.5.1. Quality Assurance and Inspection

10.1.5.2. Measurement

10.1.5.3. Positioning and Guidance

10.1.5.4. Others

10.1.6. Others

10.1.6.1. Quality Assurance and Inspection

10.1.6.2. Measurement

10.1.6.3. Positioning and Guidance

10.1.6.4. Others

11. Global Industrial Camera Market Analysis and Forecast, by End-use

11.1. Industrial Camera Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

11.1.1. Industrial Manufacturing

11.1.2. Automotive

11.1.3. Food & Beverage

11.1.4. Oil & Gas

11.1.5. Mining

11.1.6. Medical

11.1.7. Others

11.2. Incremental Opportunity, by End-use

12. Global Industrial Camera Market Analysis and Forecast, by Distribution Channel

12.1. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

12.1.1. Direct Sales

12.1.2. Indirect Sales

12.2. Incremental Opportunity, by Distribution Channel

13. Global Industrial Camera Market Analysis and Forecast, by Region

13.1. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Region, 2017- 2031

13.1.1. North America

13.1.2. Europe

13.1.3. Asia Pacific

13.1.4. Middle East & Africa

13.1.5. South America

13.2. Incremental Opportunity, by Region

14. North America Industrial Camera Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

14.5.1. Area Scan Camera

14.5.2. Line Scan Camera

14.5.3. 3D Camera

14.5.4. Others

14.6. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Interface Standard, 2017- 2031

14.6.1. GigE Vision

14.6.2. USB 3.0

14.6.3. Camera Link

14.6.4. CoaXPress

14.6.5. FireWire

14.6.6. Others

14.7. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Sensor Type, 2017- 2031

14.7.1. CCD

14.7.2. CMOS

14.8. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

14.8.1. Quality Assurance and Inspection

14.8.2. Measurement

14.8.3. Positioning and Guidance

14.8.4. Others

14.9. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Interface Standard, by Application, 2017- 2031

14.9.1. GigE Vision

14.9.1.1. Quality Assurance and Inspection

14.9.1.2. Measurement

14.9.1.3. Positioning and Guidance

14.9.1.4. Others

14.9.2. USB 3.0

14.9.2.1. Quality Assurance and Inspection

14.9.2.2. Measurement

14.9.2.3. Positioning and Guidance

14.9.2.4. Others

14.9.3. Camera Link

14.9.3.1. Quality Assurance and Inspection

14.9.3.2. Measurement

14.9.3.3. Positioning and Guidance

14.9.3.4. Others

14.9.4. CoaXPress

14.9.4.1. Quality Assurance and Inspection

14.9.4.2. Measurement

14.9.4.3. Positioning and Guidance

14.9.4.4. Others

14.9.5. FireWire

14.9.5.1. Quality Assurance and Inspection

14.9.5.2. Measurement

14.9.5.3. Positioning and Guidance

14.9.5.4. Others

14.9.6. Others

14.9.6.1. Quality Assurance and Inspection

14.9.6.2. Measurement

14.9.6.3. Positioning and Guidance

14.9.6.4. Others

14.10. Industrial Camera Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

14.10.1. Industrial Manufacturing

14.10.2. Automotive

14.10.3. Food & Beverage

14.10.4. Oil & Gas

14.10.5. Mining

14.10.6. Medical

14.10.7. Others

14.11. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

14.11.1. Direct Sales

14.11.2. Indirect Sales

14.12. Industrial Camera Market Size (US$ Mn) (Thousand Units) Forecast, by Country, 2017- 2031

14.12.1. U.S.

14.12.2. Canada

14.12.3. Rest of North America

14.13. Incremental Opportunity Analysis

15. Europe Industrial Camera Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Supply side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

15.5.1. Area Scan Camera

15.5.2. Line Scan Camera

15.5.3. 3D Camera

15.5.4. Others

15.6. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Interface Standard, 2017- 2031

15.6.1. GigE Vision

15.6.2. USB 3.0

15.6.3. Camera Link

15.6.4. CoaXPress

15.6.5. FireWire

15.6.6. Others

15.7. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Sensor Type, 2017- 2031

15.7.1. CCD

15.7.2. CMOS

15.8. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

15.8.1. Quality Assurance and Inspection

15.8.2. Measurement

15.8.3. Positioning and Guidance

15.8.4. Others

15.9. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Interface Standard, by Application, 2017- 2031

15.9.1. GigE Vision

15.9.1.1. Quality Assurance and Inspection

15.9.1.2. Measurement

15.9.1.3. Positioning and Guidance

15.9.1.4. Others

15.9.2. USB 3.0

15.9.2.1. Quality Assurance and Inspection

15.9.2.2. Measurement

15.9.2.3. Positioning and Guidance

15.9.2.4. Others

15.9.3. Camera Link

15.9.3.1. Quality Assurance and Inspection

15.9.3.2. Measurement

15.9.3.3. Positioning and Guidance

15.9.3.4. Others

15.9.4. CoaXPress

15.9.4.1. Quality Assurance and Inspection

15.9.4.2. Measurement

15.9.4.3. Positioning and Guidance

15.9.4.4. Others

15.9.5. FireWire

15.9.5.1. Quality Assurance and Inspection

15.9.5.2. Measurement

15.9.5.3. Positioning and Guidance

15.9.5.4. Others

15.9.6. Others

15.9.6.1. Quality Assurance and Inspection

15.9.6.2. Measurement

15.9.6.3. Positioning and Guidance

15.9.7. Others

15.10. Industrial Camera Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

15.10.1. Industrial Manufacturing

15.10.2. Automotive

15.10.3. Food & Beverage

15.10.4. Oil & Gas

15.10.5. Mining

15.10.6. Medical

15.10.7. Others

15.11. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

15.11.1. Direct Sales

15.11.2. Indirect Sales

15.12. Industrial Camera Market Size (US$ Mn) (Thousand Units) Forecast, by Country, 2017- 2031

15.12.1. U.K.

15.12.2. Germany

15.12.3. France

15.12.4. Rest of Europe

15.13. Incremental Opportunity Analysis

16. Asia Pacific Industrial Camera Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Key Trends Analysis

16.3.1. Supply side

16.3.2. Demand Side

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

16.5.1. Area Scan Camera

16.5.2. Line Scan Camera

16.5.3. 3D Camera

16.5.4. Others

16.6. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Interface Standard, 2017- 2031

16.6.1. GigE Vision

16.6.2. USB 3.0

16.6.3. Camera Link

16.6.4. CoaXPress

16.6.5. FireWire

16.6.6. Others

16.7. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Sensor Type, 2017- 2031

16.7.1. CCD

16.7.2. CMOS

16.8. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

16.8.1. Quality Assurance and Inspection

16.8.2. Measurement

16.8.3. Positioning and Guidance

16.8.4. Others

16.9. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Interface Standard, by Application, 2017- 2031

16.9.1. GigE Vision

16.9.1.1. Quality Assurance and Inspection

16.9.1.2. Measurement

16.9.1.3. Positioning and Guidance

16.9.1.4. Others

16.9.2. USB 3.0

16.9.2.1. Quality Assurance and Inspection

16.9.2.2. Measurement

16.9.2.3. Positioning and Guidance

16.9.2.4. Others

16.9.3. Camera Link

16.9.3.1. Quality Assurance and Inspection

16.9.3.2. Measurement

16.9.3.3. Positioning and Guidance

16.9.3.4. Others

16.9.4. CoaXPress

16.9.4.1. Quality Assurance and Inspection

16.9.4.2. Measurement

16.9.4.3. Positioning and Guidance

16.9.4.4. Others

16.9.5. FireWire

16.9.5.1. Quality Assurance and Inspection

16.9.5.2. Measurement

16.9.5.3. Positioning and Guidance

16.9.5.4. Others

16.9.6. Others

16.9.6.1. Quality Assurance and Inspection

16.9.6.2. Measurement

16.9.6.3. Positioning and Guidance

16.9.6.4. Others

16.10. Industrial Camera Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

16.10.1. Industrial Manufacturing

16.10.2. Automotive

16.10.3. Food & Beverage

16.10.4. Oil & Gas

16.10.5. Mining

16.10.6. Medical

16.10.7. Others

16.11. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

16.11.1. Direct Sales

16.11.2. Indirect Sales

16.12. Industrial Camera Market Size (US$ Mn) (Thousand Units) Forecast, by Country, 2017- 2031

16.12.1. China

16.12.2. India

16.12.3. Japan

16.12.4. Rest of Asia Pacific

16.13. Incremental Opportunity Analysis

17. Middle East & Africa Industrial Camera Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Key Supplier Analysis

17.3. Key Trends Analysis

17.3.1. Supply side

17.3.2. Demand Side

17.4. Price Trend Analysis

17.4.1. Weighted Average Selling Price (US$)

17.5. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

17.5.1. Area Scan Camera

17.5.2. Line Scan Camera

17.5.3. 3D Camera

17.5.4. Others

17.6. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Interface Standard, 2017- 2031

17.6.1. GigE Vision

17.6.2. USB 3.0

17.6.3. Camera Link

17.6.4. CoaXPress

17.6.5. FireWire

17.6.6. Others

17.7. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Sensor Type, 2017- 2031

17.7.1. CCD

17.7.2. CMOS

17.8. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

17.8.1. Quality Assurance and Inspection

17.8.2. Measurement

17.8.3. Positioning and Guidance

17.8.4. Others

17.9. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Interface Standard, by Application, 2017- 2031

17.9.1. GigE Vision

17.9.1.1. Quality Assurance and Inspection

17.9.1.2. Measurement

17.9.1.3. Positioning and Guidance

17.9.1.4. Others

17.9.2. USB 3.0

17.9.2.1. Quality Assurance and Inspection

17.9.2.2. Measurement

17.9.2.3. Positioning and Guidance

17.9.2.4. Others

17.9.3. Camera Link

17.9.3.1. Quality Assurance and Inspection

17.9.3.2. Measurement

17.9.3.3. Positioning and Guidance

17.9.3.4. Others

17.9.4. CoaXPress

17.9.4.1. Quality Assurance and Inspection

17.9.4.2. Measurement

17.9.4.3. Positioning and Guidance

17.9.4.4. Others

17.9.5. FireWire

17.9.5.1. Quality Assurance and Inspection

17.9.5.2. Measurement

17.9.5.3. Positioning and Guidance

17.9.5.4. Others

17.9.6. Others

17.9.6.1. Quality Assurance and Inspection

17.9.6.2. Measurement

17.9.6.3. Positioning and Guidance

17.9.6.4. Others

17.10. Industrial Camera Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

17.10.1. Industrial Manufacturing

17.10.2. Automotive

17.10.3. Food & Beverage

17.10.4. Oil & Gas

17.10.5. Mining

17.10.6. Medical

17.10.7. Others

17.11. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

17.11.1. Direct Sales

17.11.2. Indirect Sales

17.12. Industrial Camera Market Size (US$ Mn) (Thousand Units) Forecast, by Country, 2017- 2031

17.12.1. GCC

17.12.2. South Africa

17.12.3. Rest of Middle East & Africa

17.13. Incremental Opportunity Analysis

18. South America Industrial Camera Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Key Supplier Analysis

18.3. Key Trends Analysis

18.3.1. Supply side

18.3.2. Demand Side

18.4. Price Trend Analysis

18.4.1. Weighted Average Selling Price (US$)

18.5. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

18.5.1. Area Scan Camera

18.5.2. Line Scan Camera

18.5.3. 3D Camera

18.5.4. Others

18.6. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Interface Standard, 2017- 2031

18.6.1. GigE Vision

18.6.2. USB 3.0

18.6.3. Camera Link

18.6.4. CoaXPress

18.6.5. FireWire

18.6.6. Others

18.7. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Sensor Type, 2017- 2031

18.7.1. CCD

18.7.2. CMOS

18.8. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

18.8.1. Quality Assurance and Inspection

18.8.2. Measurement

18.8.3. Positioning and Guidance

18.8.4. Others

18.9. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Interface Standard, by Application, 2017- 2031

18.9.1. GigE Vision

18.9.1.1. Quality Assurance and Inspection

18.9.1.2. Measurement

18.9.1.3. Positioning and Guidance

18.9.1.4. Others

18.9.2. USB 3.0

18.9.2.1. Quality Assurance and Inspection

18.9.2.2. Measurement

18.9.2.3. Positioning and Guidance

18.9.2.4. Others

18.9.3. Camera Link

18.9.3.1. Quality Assurance and Inspection

18.9.3.2. Measurement

18.9.3.3. Positioning and Guidance

18.9.3.4. Others

18.9.4. CoaXPress

18.9.4.1. Quality Assurance and Inspection

18.9.4.2. Measurement

18.9.4.3. Positioning and Guidance

18.9.4.4. Others

18.9.5. FireWire

18.9.5.1. Quality Assurance and Inspection

18.9.5.2. Measurement

18.9.5.3. Positioning and Guidance

18.9.5.4. Others

18.9.6. Others

18.9.6.1. Quality Assurance and Inspection

18.9.6.2. Measurement

18.9.6.3. Positioning and Guidance

18.9.6.4. Others

18.10. Industrial Camera Market Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

18.10.1. Industrial Manufacturing

18.10.2. Automotive

18.10.3. Food & Beverage

18.10.4. Oil & Gas

18.10.5. Mining

18.10.6. Medical

18.10.7. Others

18.11. Industrial Camera Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

18.11.1. Direct Sales

18.11.2. Indirect Sales

18.12. Industrial Camera Market Size (US$ Mn) (Thousand Units) Forecast, by Country, 2017- 2031

18.12.1. Brazil

18.12.2. Rest of South America

18.13. Incremental Opportunity Analysis

19. Competition Landscape

19.1. Competition Dashboard

19.2. Market Share Analysis % (2021)

19.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

19.3.1. Allied Vision Technologies GmbH

19.3.1.1. Company Overview

19.3.1.2. Product Portfolio

19.3.1.3. Financial Information, (Subject to Data Availability)

19.3.1.4. Business Strategies / Recent Developments

19.3.2. FLIR Machine Vision

19.3.2.1. Company Overview

19.3.2.2. Product Portfolio

19.3.2.3. Financial Information, (Subject to Data Availability)

19.3.2.4. Business Strategies / Recent Developments

19.3.3. IMPERX, Inc.

19.3.3.1. Company Overview

19.3.3.2. Product Portfolio

19.3.3.3. Financial Information, (Subject to Data Availability)

19.3.3.4. Business Strategies / Recent Developments

19.3.4. Industrial Video & Control Co.

19.3.4.1. Company Overview

19.3.4.2. Product Portfolio

19.3.4.3. Financial Information, (Subject to Data Availability)

19.3.4.4. Business Strategies / Recent Developments

19.3.5. JAI

19.3.5.1. Company Overview

19.3.5.2. Product Portfolio

19.3.5.3. Financial Information, (Subject to Data Availability)

19.3.5.4. Business Strategies / Recent Developments

19.3.6. Jenoptik

19.3.6.1. Company Overview

19.3.6.2. Product Portfolio

19.3.6.3. Financial Information, (Subject to Data Availability)

19.3.6.4. Business Strategies / Recent Developments

19.3.7. Keyence Corporation

19.3.7.1. Company Overview

19.3.7.2. Product Portfolio

19.3.7.3. Financial Information, (Subject to Data Availability)

19.3.7.4. Business Strategies / Recent Developments

19.3.8. PixeLINK

19.3.8.1. Company Overview

19.3.8.2. Product Portfolio

19.3.8.3. Financial Information, (Subject to Data Availability)

19.3.8.4. Business Strategies / Recent Developments

19.3.9. Teledyne DALSA

19.3.9.1. Company Overview

19.3.9.2. Product Portfolio

19.3.9.3. Financial Information, (Subject to Data Availability)

19.3.9.4. Business Strategies / Recent Developments

19.3.10. The Imaging Source

19.3.10.1. Company Overview

19.3.10.2. Product Portfolio

19.3.10.3. Financial Information, (Subject to Data Availability)

19.3.10.4. Business Strategies / Recent Developments

20. Key Takeaways

20.1. Identification of Potential Market Spaces

20.1.1. By Product Type

20.1.2. By Interface Standard

20.1.3. By Sensor Type

20.1.4. By Application

20.1.5. By End-use

20.1.6. By Distribution Channel

20.1.7. By Region

20.1.8. By Interface Standard, by Application

20.2. Understanding the Procurement Process of the End-users

20.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Product Type, 2017 - 2031

Table 2: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Product Type, 2017 - 2031

Table 3: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, 2017 - 2031

Table 4: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, 2017 - 2031

Table 5: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Sensor Type, 2017 - 2031

Table 6: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Sensor Type, 2017 - 2031

Table 7: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Application, 2017 - 2031

Table 8: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Application, 2017 - 2031

Table 9: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, by Application, 2017 - 2031

Table 10: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, by Application, 2017 - 2031

Table 11: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by End-use, 2017 - 2031

Table 12: Global Industrial Camera Market, Value (US$ Bn) Forecast, by End-use, 2017 - 2031

Table 13: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Distribution channel, 2017 - 2031

Table 14: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Distribution channel, 2017 - 2031

Table 15: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Region, 2017 - 2031

Table 16: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Region, 2017 - 2031

Table 17: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by Product Type, 2017 - 2031

Table 18: North America Industrial Camera Market, Value (US$ Bn) Forecast, by Product Type, 2017 - 2031

Table 19: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, 2017 - 2031

Table 20: North America Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, 2017 - 2031

Table 21: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by Sensor Type, 2017 - 2031

Table 22: North America Industrial Camera Market, Value (US$ Bn) Forecast, by Sensor Type, 2017 - 2031

Table 23: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by Application, 2017 - 2031

Table 24: North America Industrial Camera Market, Value (US$ Bn) Forecast, by Application, 2017 - 2031

Table 25: North America Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, by Application, 2017 - 2031

Table 26: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, by Application, 2017 – 2031

Table 27: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by End-use,2017 - 2031

Table 28: North America Industrial Camera Market, Value (US$ Bn) Forecast, by End-use, 2017 - 2031

Table 29: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by Distribution channel, 2017 - 2031

Table 30: North America Industrial Camera Market, Value (US$ Bn) Forecast, by Distribution channel, 2017 - 2031

Table 31: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by Product Type, 2017 - 2031

Table 32: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by Product Type, 2017 - 2031

Table 33: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, 2017 - 2031

Table 34: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, 2017 - 2031

Table 35: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by Sensor Type, 2017 - 2031

Table 36: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by Sensor Type, 2017 - 2031

Table 37: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by Application, 2017 - 2031

Table 38: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by Application, 2017 - 2031

Table 39: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard by Application, 2017 - 2031

Table 40: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard by Application, 2017 - 2031

Table 41: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by End-use, 2017 - 2031

Table 42: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by End-use, 2017 - 2031

Table 43: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by Distribution channel, 2017 - 2031

Table 44: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by Distribution channel, 2017 - 2031

Table 45: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by Product Type, 2017 - 2031

Table 46: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by Product Type, 2017 - 2031

Table 47: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, 2017 - 2031

Table 48: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, 2017 - 2031

Table 49: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by Sensor Type, 2017 - 2031

Table 50: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by Sensor Type, 2017 - 2031

Table 51: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by Application, 2017 - 2031

Table 52: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by Application, 2017 - 2031

Table 53: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard by Application, 2017 - 2031

Table 54: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard by Application, 2017 - 2031

Table 55: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by End-use, 2017 - 2031

Table 56: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by End-use, 2017 - 2031

Table 57: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by Distribution channel, 2017 - 2031

Table 58: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by Distribution channel, 2017 - 2031

Table 59: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by Product Type, 2017 - 2031

Table 60: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by Product Type, 2017 - 2031

Table 61: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, 2017 - 2031

Table 62: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, 2017 - 2031

Table 63: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by Sensor Type, 2017 - 2031

Table 64: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by Sensor Type, 2017 - 2031

Table 65: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by Application, 2017 - 2031

Table 66: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by Application, 2017 - 2031

Table 67: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard by Application, 2017 - 2031

Table 68: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard by Application, 2017 - 2031

Table 69: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by End-use, 2017 - 2031

Table 70: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by End-use, 2017 - 2031

Table 71: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by Distribution channel, 2017 – 2031

Table 72: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by Distribution channel, 2017 - 2031

Table 73: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by Product Type, 2017 - 2031

Table 74: South America Industrial Camera Market, Value (US$ Bn) Forecast, by Product Type, 2017 - 2031

Table 75: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, 2017 - 2031

Table 76: South America Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, 2017 - 2031

Table 77: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by Sensor Type, 2017 - 2031

Table 78: South America Industrial Camera Market, Value (US$ Bn) Forecast, by Sensor Type, 2017 - 2031

Table 79: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by Application, 2017 - 2031

Table 80: South America Industrial Camera Market, Value (US$ Bn) Forecast, by Application, 2017 - 2031

Table 81: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard by Application, 2017 - 2031

Table 82: South America Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard by Application, 2017 – 2031

Table 83: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by End-use, 2017 - 2031

Table 84: South America Industrial Camera Market, Value (US$ Bn) Forecast, by End-use, 2017 - 2031

Table 85: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by Distribution channel, 2017 - 2031

Table 86: South America Industrial Camera Market, Value (US$ Bn) Forecast, by Distribution channel, 2017 - 2031

List Of Figures

Figure 1: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Product Type, 2017 - 2031

Figure 2: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Product Type, 2017 - 2031

Figure 3: Global Industrial Camera Market, by Product Type, Incremental Opportunity, 2022 - 2031

Figure 4: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, 2017 - 2031

Figure 5: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, 2017 - 2031

Figure 6: Global Industrial Camera Market, by Interface Standard, Incremental Opportunity, 2022 - 2031

Figure 7: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Sensor Type, 2017 - 2031

Figure 8: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Sensor Type, 2017 - 2031

Figure 9: Global Industrial Camera Market, by Sensor Type, Incremental Opportunity, 2022 - 2031

Figure 10: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Application, 2017 - 2031

Figure 11: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Application, 2017 - 2031

Figure 12: Global Industrial Camera Market, by Application, Incremental Opportunity, 2022 - 2031

Figure 13: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, by Application, 2017 - 2031

Figure 14: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, by Application, 2017 - 2031

Figure 15: Global Industrial Camera Market, by Interface Standard, by Application, Incremental Opportunity, 2022 - 2031

Figure 16: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by End-use, 2017 - 2031

Figure 17: Global Industrial Camera Market, Value (US$ Bn) Forecast, by End-use, 2017 - 2031

Figure 18: Global Industrial Camera Market, by End-use, Incremental Opportunity, 2022 - 2031

Figure 19: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Distribution channel, 2017 - 2031

Figure 20: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Distribution channel, 2017 - 2031

Figure 21: Global Industrial Camera Market, by Distribution channel, Incremental Opportunity, 2022 - 2031

Figure 22: Global Industrial Camera Market, Volume (Thousand Units) Forecast, by Region, 2017 - 2031

Figure 23: Global Industrial Camera Market, Value (US$ Bn) Forecast, by Region, 2017 - 2031

Figure 24: Global Industrial Camera Market, by Region, Incremental Opportunity, 2022 - 2031

Figure 25: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by Product Type, 2017 - 2031

Figure 26: North America Industrial Camera Market, Value (US$ Bn) Forecast, by Product Type, 2017 - 2031

Figure 27: North America Industrial Camera Market, by Product Type, Incremental Opportunity, 2022 - 2031

Figure 28: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, 2017 - 2031

Figure 29: North America Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, 2017 - 2031

Figure 30: North America Industrial Camera Market, by Interface Standard, Incremental Opportunity, 2022 - 2031

Figure 31: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by Sensor Type, 2017 - 2031

Figure 32: North America Industrial Camera Market, Value (US$ Bn) Forecast, by Sensor Type, 2017 - 2031

Figure 33: North America Industrial Camera Market, by Sensor Type, Incremental Opportunity, 2022 - 2031

Figure 34: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by Application, 2017 - 2031

Figure 35: North America Industrial Camera Market, Value (US$ Bn) Forecast, by Application, 2017 - 2031

Figure 36: North America Industrial Camera Market, by Application, Incremental Opportunity, 2022 - 2031

Figure 37: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, by Application, 2017 - 2031

Figure 38: North America Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, by Application, 2017 - 2031

Figure 39: North America Industrial Camera Market, by Interface Standard, by Application, Incremental Opportunity, 2017 - 2031

Figure 40: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by End-use, 2017 - 2031

Figure 41: North America Industrial Camera Market, Value (US$ Bn) Forecast, by End-use, 2017 - 2031

Figure 42: North America Industrial Camera Market, by End-use, Incremental Opportunity, 2022 - 2031

Figure 43: North America Industrial Camera Market, Volume (Thousand Units) Forecast, by Distribution channel, 2017 - 2031

Figure 44: North America Industrial Camera Market, Value (US$ Bn) Forecast, by Distribution channel, 2017 - 2031

Figure 45: North America Industrial Camera Market, by Distribution channel, Incremental Opportunity, 2022 - 2031

Figure 46: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by Product Type, 2017 - 2031

Figure 47: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by Product Type, 2017 - 2031

Figure 48: Europe Industrial Camera Market, by product, Incremental Opportunity, 2022 - 2031

Figure 49: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, 2017 - 2031

Figure 50: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, 2017 - 2031

Figure 51: Europe Industrial Camera Market, by Interface Standard, Incremental Opportunity, 2022 - 2031

Figure 52: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by Sensor Type, 2017 - 2031

Figure 53: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by Sensor Type, 2017 - 2031

Figure 54: Europe Industrial Camera Market, by Sensor Type, Incremental Opportunity, 2022 - 2031

Figure 55: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by Application, 2017 - 2031

Figure 56: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by Application, 2017 - 2031

Figure 57: Europe Industrial Camera Market, by Application, Incremental Opportunity, 2022 - 2031

Figure 58: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, by Application, 2017 - 2031

Figure 59: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, by Application, 2017 - 2031

Figure 60: Europe Industrial Camera Market, by Interface Standard, by Application, Incremental Opportunity, 2022 - 2031

Figure 61: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by End-use, 2017 - 2031

Figure 62: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by End-use, 2017 - 2031

Figure 63: Europe Industrial Camera Market, by End-use, Incremental Opportunity, 2022 - 2031

Figure 64: Europe Industrial Camera Market, Volume (Thousand Units) Forecast, by Distribution channel, 2017 - 2031

Figure 65: Europe Industrial Camera Market, Value (US$ Bn) Forecast, by Distribution channel, 2017 - 2031

Figure 66: Europe Industrial Camera Market, by Distribution channel, Incremental Opportunity, 2022 - 2031

Figure 67: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by Product Type, 2017 - 2031

Figure 68: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by Product Type, 2017 - 2031

Figure 69: Asia Pacific Industrial Camera Market, by product, Incremental Opportunity, 2022 - 2031

Figure 70: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, 2017 - 2031

Figure 71: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, 2017 - 2031

Figure 72: Asia Pacific Industrial Camera Market, by Interface Standard, Incremental Opportunity, 2022 - 2031

Figure 73: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by Sensor Type, 2017 - 2031

Figure 74: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by Sensor Type, 2017 - 2031

Figure 75: Asia Pacific Industrial Camera Market, by Sensor Type, Incremental Opportunity, 2022 - 2031

Figure 76: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by Application, 2017 - 2031

Figure 77: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by Application, 2017 - 2031

Figure 78: Asia Pacific Industrial Camera Market, by Application, Incremental Opportunity, 2022 - 2031

Figure 79: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, by Application, 2017 - 2031

Figure 80: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, by Application, 2017 - 2031

Figure 81: Asia Pacific Industrial Camera Market, by Interface Standard, by Application, Incremental Opportunity, 2022 - 2031

Figure 82: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by End-use, 2017 - 2031

Figure 83: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by End-use, 2017 - 2031

Figure 84: Asia Pacific Industrial Camera Market, by End-use, Incremental Opportunity, 2022 - 2031

Figure 85: Asia Pacific Industrial Camera Market, Volume (Thousand Units) Forecast, by Distribution channel, 2017 - 2031

Figure 86: Asia Pacific Industrial Camera Market, Value (US$ Bn) Forecast, by Distribution channel, 2017 - 2031

Figure 87: Asia Pacific Industrial Camera Market, by Distribution channel, Incremental Opportunity, 2022 - 2031

Figure 88: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by Product Type, 2017 - 2031

Figure 89: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by Product Type, 2017 - 2031

Figure 90: Middle East & Africa Industrial Camera Market, by product, Incremental Opportunity, 2022 - 2031

Figure 91: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, 2017 - 2031

Figure 92: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, 2017 - 2031

Figure 93: Middle East & Africa Industrial Camera Market, by Interface Standard, Incremental Opportunity, 2022 - 2031

Figure 94: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by Sensor Type, 2017 - 2031

Figure 95: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by Sensor Type, 2017 - 2031

Figure 96: Middle East & Africa Industrial Camera Market, by Sensor Type, Incremental Opportunity, 2022 - 2031

Figure 97: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by Application, 2017 - 2031

Figure 98: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by Application, 2017 - 2031

Figure 99: Middle East & Africa Industrial Camera Market, by Application, Incremental Opportunity, 2022 - 2031

Figure 100: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, by Application, 2017 - 2031

Figure 101: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, by Application, 2017 - 2031

Figure 102: Middle East & Africa Industrial Camera Market, by Application, Incremental Opportunity, 2022 - 2031

Figure 103: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by End-use, 2017 - 2031

Figure 104: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by End-use, 2017 - 2031

Figure 105: Middle East & Africa Industrial Camera Market, by End-use, Incremental Opportunity, 2022 - 2031

Figure 106: Middle East & Africa Industrial Camera Market, Volume (Thousand Units) Forecast, by Distribution channel, 2017 - 2031

Figure 107: Middle East & Africa Industrial Camera Market, Value (US$ Bn) Forecast, by Distribution channel, 2017 - 2031

Figure 108: Middle East & Africa Industrial Camera Market, by Distribution channel, Incremental Opportunity, 2022 - 2031

Figure 109: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by Product Type, 2017 - 2031

Figure 110: South America Industrial Camera Market, Value (US$ Bn) Forecast, by Product Type, 2017 - 2031

Figure 111: South America Industrial Camera Market, by product, Incremental Opportunity, 2022 - 2031

Figure 112: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, 2017 - 2031

Figure 113: South America Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, 2017 - 2031

Figure 114: South America Industrial Camera Market, by Interface Standard, Incremental Opportunity, 2022 - 2031

Figure 115: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by Sensor Type, 2017 - 2031

Figure 116: South America Industrial Camera Market, Value (US$ Bn) Forecast, by Sensor Type, 2017 - 2031

Figure 117: South America Industrial Camera Market, by Sensor Type, Incremental Opportunity, 2022 - 2031

Figure 118: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by Application, 2017 - 2031

Figure 119: South America Industrial Camera Market, Value (US$ Bn) Forecast, by Application, 2017 - 2031

Figure 120: South America Industrial Camera Market, by Application, Incremental Opportunity, 2022 - 2031

Figure 121: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by Interface Standard, by Application, 2017 - 2031

Figure 122: South America Industrial Camera Market, Value (US$ Bn) Forecast, by Interface Standard, by Application, 2017 - 2031

Figure 123: South America Industrial Camera Market, by Interface Standard, by Application, Incremental Opportunity, 2017 - 2031

Figure 124: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by End-use, 2017 - 2031

Figure 125: South America Industrial Camera Market, Value (US$ Bn) Forecast, by End-use, 2017 - 2031

Figure 126: South America Industrial Camera Market, by End-use, Incremental Opportunity, 2022 - 2031

Figure 127: South America Industrial Camera Market, Volume (Thousand Units) Forecast, by Distribution channel, 2017 - 2031

Figure 128: South America Industrial Camera Market, Value (US$ Bn) Forecast, by Distribution channel, 2017 - 2031

Figure 129: South America Industrial Camera Market, by Distribution channel, Incremental Opportunity, 2022 - 2031