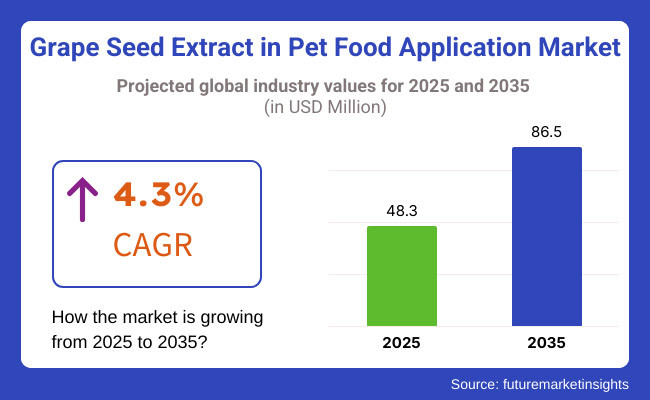

The global grade seed extract in pet food application market is set to experience USD 48.3 million in 2025. The industry is poised to register 4.3% CAGR from 2025 to 2035, witnessing USD 86.5 million by 2035.

This growth is mainly due to the increasing demand for natural and functional ingredients from pet owners, benefiting pet health & wellness. Antioxidant-content pet food products are becoming popular due to the increasing consumer awareness about the associated advantages, and manufacturers are remodeling production and supply chains to adapt to the change in consumer demand.

Because of its excellent high polyphenol rate, grape seed extract is becoming a staple in the pet food industry owing to its role in skin health support, immunity support, and stimulating anti-inflammatory activity. As the pet food industry continues to hone in on premium and organic recipes, companies are investing heavily in research and development to optimize the bioavailability of polyphenolic compounds found in grape seed extract to ensure these are effective on the digestive end.

Still, other companies such as Kemin Industries, Naturex, and others combine even more advanced extraction techniques to make their products, bringing quality to the same new affinity among pet food manufacturers.

Due to the increasing knowledge of consumers about the negative impacts of synthetic preservatives and artificial additives, manufacturers are emphasizing clean-label compositions. Consequently, grapefruit extract has been added to high-end pet food formulations where longevity and wellness are desired traits. Encapsulated grape seed extract is also sold to enhance stability and shelf life, making it a valuable addition to pet food applications.

Good growth curve aside, the industry still suffers from issues like manufacturing costs and lack of consumer awareness in specific markets. The need for high-end technology and effective quality control to ensure the production of high-quality polyphenols increases the manufacturing cost.

In addition, as developed markets make growing demand for natural constituents available, thereby reinforcing the use of such products, some developing regions may remain dependent on native outlay for pet food formulations owing to their price sensitivity. Investment in consumer education and cost-effective production solutions will be needed to continue to combat these issues.

This bodes well for upstream partners, indicating a highly productive future for the product in pet food applications. Producers have focused on using grape seeds from organic vineyards and green extraction processes in their sustainability efforts.

Explore FMI!

Book a free demo

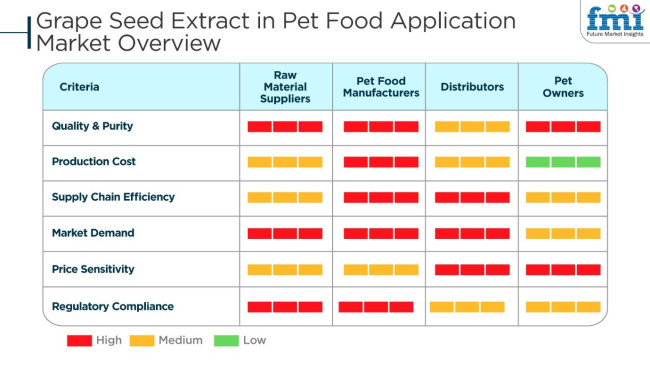

The grape seed extract in pet food application market is growing at a fast pace with increasing awareness of its antioxidant, anti-inflammatory, and immune-boosting effects in pets. Raw material suppliers emphasize high-quality extraction processes to maintain the purity and effectiveness of grape seed extract.

Manufacturers of pet foods highlight the incorporation of natural and functional ingredients in response to increasing demand for high-quality and health-focused pet food products. Distributors play an important role in making the supply chain effective, as they ensure timely availability to manufacturers and retailers.

Pet owners, due to growing health concerns and longevities for pets, choose pet foods supplemented with natural antioxidants to keep their pets' immune system healthy and overall well-being intact. Industry trends reflect the move toward clean-label, grain-free, and organic pet foods, and thus grape seed extract is a rich ingredient in the development of nutrient-rich and functional pet nutrition products in different segments of the industry.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global grape seed extract in pet food application industry. This analysis provides insights into key performance trends and revenue realization patterns, allowing stakeholders to anticipate industry shifts. The first half of the year (H1) spans from January to June, while the second half (H2) covers July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.7% |

| H2 (2024 to 2034) | 6.1% |

| H1 (2025 to 2035) | 5.8% |

| H2 (2025 to 2035) | 6.3% |

In the first half (H1) of the decade from 2025 to 2035, the industry is expected to grow at a CAGR of 5.7%, followed by an accelerated growth rate of 6.1% in the second half (H2) of the same decade. Moving into the subsequent period from H1 2025 to H2 2035, the CAGR is projected to rise to 6.3% in the first half and remain steady at 6.0% in the second half. The sector witnessed an increase of 10 BPS in the first half, while in the second half, it increased by 10 BPS.

Growing Emphasis on Sustainable Ingredient Sourcing

The global grape seed extract in pet food application market is witnessing a significant shift toward sustainability, with manufacturers prioritizing eco-friendly sourcing methods. As consumers become more conscious about the environmental impact of pet food ingredients, companies are focusing on ethically sourced grape seed extract derived from upcycled grape waste.

This approach not only minimizes agricultural waste but also aligns with the circular economy trend. Additionally, sustainable farming practices and transparency in ingredient sourcing are gaining traction, influencing purchasing decisions. Pet owners are increasingly seeking products that are free from synthetic additives and responsibly sourced, driving manufacturers to highlight their sustainability credentials.

The shift toward sustainable grape seed extract is also prompting companies to adopt third-party certifications and eco-friendly processing techniques, ensuring minimal environmental impact. This trend is expected to reshape the industry, encouraging companies to invest in greener solutions while maintaining product quality and efficacy in pet food formulations.

Rising Integration of Advanced Extraction Technologies

Innovations in extraction techniques are redefining the quality and efficacy of grape seed extract in pet food applications. Manufacturers are increasingly adopting advanced technologies such as cold-press extraction, supercritical CO₂ extraction, and ultrasonic-assisted methods to enhance the bioavailability of polyphenols and antioxidants in grape seed extract.

These advancements ensure that pet food formulations contain highly concentrated and stable active compounds, improving their functional benefits. The growing emphasis on natural, bioavailable ingredients has prompted research-driven developments that cater to the rising demand for premium pet food solutions.

Additionally, encapsulation technologies are being explored to enhance the stability and shelf life of grape seed extract, ensuring that its antioxidant properties remain effective throughout storage and consumption. As competition intensifies, companies leveraging innovative extraction techniques will gain a competitive edge by offering high-quality, functional pet food solutions that cater to health-conscious pet owners.

Evolving Price Dynamics Between Premium and Conventional Segments

The pricing structure of grape seed extract in pet food applications is witnessing a noticeable divergence between premium and conventional segments. The rising preference for natural and functional pet food ingredients has led to higher pricing for premium formulations incorporating high-purity grape seed extract. In contrast, conventional pet food brands continue to rely on cost-effective alternatives, creating a distinct pricing gap in the industry.

The influx of private-label brands offering budget-friendly pet food products with standard-grade grape seed extract is further intensifying price segmentation. Additionally, fluctuations in raw material costs and supply chain constraints are influencing industry prices, particularly for premium-grade extracts.

Manufacturers are adopting strategic pricing models, introducing differentiated product ranges that cater to both high-end consumers and cost-conscious buyers. This evolving pricing landscape is shaping purchasing behavior, encouraging companies to optimize their cost structures while maintaining quality and competitiveness in the industry.

The rising demand for natural and functional pet food ingredients has been a key driver of industry growth in recent years. Pet owners are now looking for products that are supplemented with antioxidants and polyphenols, and hence adoption of grape seed extract in pet food has picked up.

Increased awareness about pet health and wellness also boosted the industry, as manufacturers are marketing the advantages of grape seed extract such as enhanced immunity and anti-inflammatory effects. With consumers moving more toward premium and natural pet foods, the industry scenario is also showing optimism.

Product innovation and technologies for better extraction are also poised to enable industry growth during the next decade. With enhanced production facilities and supply chain infrastructures, producers are well-placed to address changing consumer needs of pet food brands.

Strategic branding and educational marketing efforts are also sustaining consumer confidence and brand loyalty, further propelling sales growth. The ongoing focus on natural, functional pet food ingredients will drive steady industry expansion throughout the forecast period.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand for grape extract for pet food as it is an effective antioxidant and possesses health properties. | More uses in specialty pet nutrition products. |

| North America and Europe led the industry. Several premium pet food firms explored natural antioxidants. | Increased demand in Asia Pacific and Latin America due to pet humanization trends and premium pet food segments growing. |

| Safety concerns related to grape toxicity in animals resulted in conservative use and minimal inclusion in formulas. | Scientific advancements and detailed extraction technologies increase safety, maintaining controlled levels of polyphenols for consumption safety. |

| Applied mostly in small batch, natural pet food and supplements. | Inclusion into mass industry pet food brands as a functional ingredient. There have also been clinical studies on safety and efficacy. |

| Supply chain constraints impacted consistency in procuring high-quality grape extracts for pet uses. | Enhanced extraction methods and sustainable procurement of grape byproducts from wine and juice processors. |

| Regulatory uncertainty regarding the safe dosage and labeling of grape-derived ingredients in pet foods. | Tighter regulations and more stringent guidelines on the use of grape extracts in pet formulations. |

| R&D aimed at proving antioxidant activity without negatively impacting toxicity levels. | More investment in specialized products, including breed-specific and age-specific pet food with grape extracts. |

The grape seed extract in pet food application market is being challenged due to several threats, namely regulatory scrutiny, pet safety concerns, raw material availability, competition, and supply chain instability.

The most serious among these threats is regulatory scrutiny. Ingredients for pet food need to conform to the safety rules prescribed by the FDA (USA), FEDIAF (Europe), and other global pet food authorities. GSE is distinct for having antioxidant and anti-inflammatory effects but is sometimes associated with polyphenol content and the risk of toxicity to certain pets which is also a reason for the potential regulation or ban.

One of the major challenges has been the concerns over pet safety. GSE is generally regarded as being safe for dogs and cats when consumed in controlled amounts. However, some reports suggest that polyphenol may in some situations lead to upset stomachs or liver damage. This uncertainty may create a reluctance among pet food manufacturers and veterinarians in the use of products resulting in the delay of the product.

Another element impacting the situation is the scarcity of raw materials. GSE is a winemaking and grape processing byproduct, thus, its supply is influenced by grape harvest cycles, ecological circumstances, and the wine industry's demand. Bad harvests or supply shortages may change the situation adversely and thus affect prices.

In addition, there are other options, such as omega-3 fatty acids, turmeric, and green tea extract, which compete as well as are effective in improving health by providing oxidative stress and inflammation relief in pets. These alternatives might be chosen by the brands due to lesser regulatory risks than GSE, and the higher credibility among the clients.

Increasing demand for clean-label, chemical-free pet food is driving global adoption of organic grape seed extract as pet owners increasingly move toward natural alternatives to conventional pet food products containing artificial flavors and preservatives.

Manufacturers are expanding organic-certified production as consumer demand grows, emphasizing purity, sustainability, and ethical sourcing. Companies have developed so-called premium brands of pet food that feature organic ingredients, such as Castor & Pollux and The Honest Kitchen, which have attributed their success to this trend. The segment also enjoys premium pricing, as pet owners seek high-quality, natural nutrition.

As regulatory scrutiny on such organic certification strips up, companies are also enhancing transparency across their supply chain, thereby cementing consumer trust. The sector is anticipated to see continued growth, especially in premium and specialty pet food segments, as sustainability, pet wellness, and holistic nutrition trends grow.

Dry pet food is the most popular option for its ease of use, affordability, and long shelf life. Manufacturers are using natural antioxidants, such as grape seed extract, to increase nutritional value and immune support, especially as the demand for functional pet food ingredients continues to surge.

As a result, pet owners are turning to fortified dry food that offers benefits for overall health, digestion, and immunity. High-end dry food recipes from popular brands, including Royal Canin, Hill’s Science Diet, and Blue Buffalo, incorporate grape seed extract to target joint health, coat shine, and antioxidant benefits.

With more consumers becoming aware of functional pet nutrition, dry food with grape seed extract is coming into play in mainstream and premium categories. Manufacturers are inventing new processes to improve flavor, digestibility, and retention of natural nutrients.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 23.8% |

| China | 7.1% |

| UK | 6.4% |

| India | 15.4% |

| Japan | 13.4% |

The USA represents one of the largest markets for grape seed extract in pet foods, which is expected to grow at a CAGR of 23.8% during the period 2025 to 2035, as per FMI. Rising pet adoption and increasing pet health and wellness interest drive industry expansion.

Pet owners proactively search for natural supplements that improve their pets' nutrition, and grape seed extract, abundant in antioxidants, is well set to take command. The organic and premium pet food industry is growing, emphasizing science-based ingredients. The regulatory environment to ensure the safety and effectiveness of the ingredients utilized in pet foods forces manufacturers to include functional ingredients such as grape seed extract.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Increase in pet ownership | Greater adoption of pets leads to greater demand for higher-level nutrition. |

| Greater demand for natural nutrients | Pet food requiring natural antioxidants is needed. |

| Greater premium pet food industry | There is a promotion for rising disposable incomes for premium pet nutrition demand. |

| Regulation supported | The regulation requires a stricter emphasis on safety and scientific rationale for pet food ingredients. |

As per FMI, the UK industry is poised to witness 6.4% CAGR from 2025 to 2035. The growth of conventional pet food is reshaping the industry, with owners specifically searching for foods that improve overall health and life expectancy. Grape seed extract, anti-inflammatory and antioxidant in nature, is fast becoming one of the top ingredients in premium pet food.

Quality and safety of the product are the concerns of the regulatory bodies, forcing the manufacturers to incorporate science-based ingredients. Increased interest in holistic pet care also influences functional ingredients in pet food products.

Growth Factors in The UK

| Key Drivers | Details |

|---|---|

| Consumer demand for organic merchandise | Increased consciousness drives demand for natural pet food ingredients. |

| Animal welfare focus | Global trends favor the incorporation of functional nutrients. |

| Strict regulatory requirements | Regulations that make ingredients applied in pet food safe and effective. |

| Rise of the premium dog food segment | Pet owners seek quality nutrition with established benefits. |

FMI states that the Chinese industry is expected to grow at a 7.1% CAGR during 2025 to 2035. Urbanization and the expanding middle-class economy have driven the pet adoption rate since consumers seek additional health-enhancing pet food. Traditional Chinese medicine relies on natural treatments, to which grape seed extract lends itself quite naturally as a pet food supplement.

Expansion in online pet food websites providing convenient access to pet foods drives industry growth. Companies are formulating functional ingredients to meet evolving consumer needs.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Increased pet ownership | Urbanization levels speed up, and disposable incomes per capita rise, precipitating more pet adoptions. |

| Preferred for functional ingredients | Traditional medicine increases demand for natural antioxidants such as grape seed extract. |

| E-commerce growth | More accessible regarding the availability of specialty pet food items over internet channels. |

| Companies invest in R&D | Developing nutritionally enhanced formulations. |

FMI expects the Indian industry to expand at 15.4% CAGR over the study period. Urbanization and increasing disposable incomes increased pet ownership, with more consumers spending on pet health and nutrition. People are increasingly aware of the need for antioxidants in animal food, thus driving the application of grape seed extract in food. Structured pet retailing and e-platform growth enhance the penetration of pet food brands in the value category.

India Growth Drivers

| Key Drivers | Details |

|---|---|

| Pet adoption growth | Increases with urbanization and lifestyle changes. |

| Increased emphasis on pet nutrition | The consumer is aware of the requirement for quality, functional ingredients. |

| Pet retail and online shopping growth | Additional distribution channels increase the proximity of premium pet food products. |

| Pet care spending growth | Rising disposable incomes allow for pet specialty food expenditure. |

FMI opines that the Japan industry will likely achieve a 13.4% CAGR during the study period. The aging pet population is driving demand for specialty diets to enhance longevity and health. Japanese pet owners will pay extra for pet health and thus will demand natural and functional ingredients. Grape seed extract, which is claimed to be rich in antioxidants, is widely used in premium pet food. Strict quality control standards in the Japanese pet food industry also propel the growth of the industry.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Aging pet population | There is an increasing demand for general health-enhancing and longevity-type pet food. |

| Demand for value-added products | Individuals invest in pet nutrition that has been scientifically proven using high-quality. |

| Unwavering quality standards | Regulatory bodies have high priority in ingredient performance and safety. |

| Increasing antioxidant demand | The notion of the benefits of grape seed extract is growing. |

Industry leaders include Kemin Industries, Polyphenolics, Indena S.p.A., and Botaniex Inc. Such companies rely on research-oriented ingredient development, regulatory compliance, and expanded supply chains to satisfy the ever-increasing demand.

Major offerings range from an abundance of antioxidants-enriched supplements for pets to functional kibble additives intended to alleviate inflammation, oxidative stress, and compromised cardiac health in pets. Additionally, companies are producing organic and clean-label grape seed extracts to be compatible with premium pet food trends.

Pet nutrition is now evolving as one of the major factors toward a shift to holistic pet nutrition and growing consumer awareness of plant supplier ingredients. Change in some regulatory perspectives is also inclined toward emphasizing transparency in pet food labeling. Other factors leading to a surge in natural supplements include e-commerce and direct-to-consumer pet wellness brands.

trategic Factors comprise investment in sustainable sourcing, clinical studies proving the health benefits, and partnerships with pet food manufacturers towards the incorporation of grape seed extract in premium and veterinary-formulated pet diets. Industry players even leverage marketing campaigns that educate pet owners on the functional benefits of plant-based antioxidants.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Kemin Industries | 18-22% |

| Polyphenolics | 12-16% |

| Indena S.p.A. | 10-14% |

| Botaniex Inc. | 9-13% |

| Nexira | 8-12% |

| Other Companies (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kemin Industries | Leading supplier of functional pet food ingredients, specializing in antioxidant-rich grape seed extracts. |

| Polyphenolics | Offers high-purity grape seed extracts with proven health benefits for pet food applications. |

| Indena S.p.A. | Focuses on sustainable extraction methods and clinical research-backed polyphenol solutions. |

| Botaniex Inc. | Provides organic and natural grape seed extracts, tailored for pet nutrition products. |

| Nexira | Specializes in botanical extracts, emphasizing clean-label and sustainable pet food ingredients. |

Key Company Insights

Kemin Industries (18-22%)

A worldwide pioneer in functional ingredients for pet food with a specialization in antioxidants as well as health-augmentation formulations.

Polyphenolics (12-16%)

Presents research-proven grape seed extracts that possess high concentrations of polyphenols with respect to pet health.

Indena S.p.A. (10-14%)

Introduces a concept that utilizes sustainable extraction procedures and clinically validated formulations based on polyphenols.

Botaniex Inc. (9-13%)

Enriches its arsenal of pet foods fortified with greenness and super purity grape seed extracts for pets.

Nexira (8-12%)

Offers a botanical extension aligned with sustainability and natural grape seed extraction for the pet industry.

Other Key Players (25-35% Combined)

The industry is expected to reach USD 48.3 million in 2025.

The industry is projected to reach USD 86.5 million by 2035.

Key companies include Kemin Industries, Polyphenolics, Indena S.p.A., Botaniex Inc., Nexira, Naturex, Maypro, Hangzhou Green Sky Biotechnology Co., Ltd., Royal Grapeseed, PureBulk, Inc., Organicway, and NZ Extracts.

The USA, slated to grow at 23.8% CAGR from 2025 to 2035, is poised for the fastest growth.

Dry food is experiencing high demand.

By nature, the industry is segmented into organic and conventional.

By animal type, the industry is segmented into cats, dogs, birds, horses, and rabbits.

By product type, the industry is segmented into wet food, dry food, treats and chews, and frozen.

The industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

A2 Infant Formula Market Analysis By Form Type, By Age Group, By Distribution Channel and By Region - Forecast from 2025 to 2035

Creatine supplement market analysis by form, end-use, sales channel, and Region - Growth, trends, and Forecast from 2025 to 2035

Ginger Beer Market Insights – Craft Brews & Market Expansion 2025 to 2035

Functional Mushroom Market Trends – Health Benefits & Industry Expansion 2025 to 2035

Comprehensive industry analysis and forecast by from, end use, derivative type and region.

Food Starch Market Insights - Growth & Demand Analysis 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.