Analysts’ Viewpoint on Market Scenario

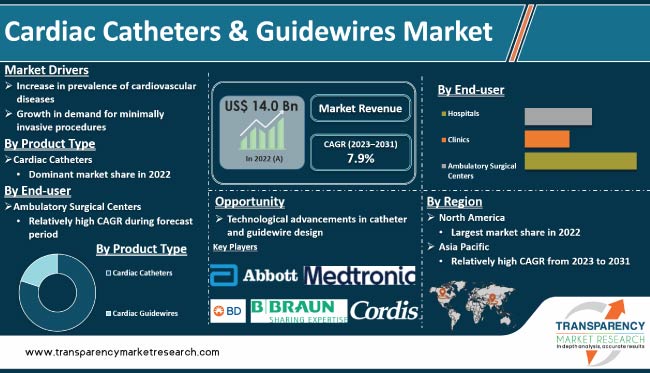

The global cardiac catheters & guidewires market size is expected to grow at a steady pace in the near future due to the rise in demand for minimally invasive procedures and technological advancements in catheterization and guidewire technology. Surge in prevalence of cardiovascular diseases is boosting the demand for cardiac catheters and guidewires.

Shift toward minimally invasive procedures is a key trend in the cardiac catheters and guidewires industry. Minimally invasive procedures offer several advantages over traditional open surgery, including faster recovery times, reduced pain, and fewer complications. Robotic-assisted catheterization procedures are also gaining traction in the industry. Robotic-assisted procedures provide high precision and accuracy, thereby improving procedural outcomes.

Cardiac catheters and guidewires are essential tools used in cardiac catheterization procedures to diagnose and treat various heart conditions. Cardiac catheterization involves threading a thin catheter and guidewire through a blood vessel and into the heart, thus allowing doctors to measure pressure, sample blood, and perform interventions.

Guidewire acts as a guide for the catheter and allows for precise navigation within the vessels. Cardiac catheters and guidewires are designed to be minimally invasive, allowing for quicker recovery time and reduced risk of complications compared to traditional open-heart surgery. Advancements in technology have made cardiac catheterization procedures increasingly safe and effective, thus allowing for improved outcomes for patients with various heart conditions.

Cardiac catheters and guidewires are employed in a variety of procedures, including the treatment of coronary artery disease, peripheral artery disease, and structural heart disease. They are also used in the diagnosis and treatment of congenital heart defects and heart valve disease.

Cardiovascular Diseases (CVDs) are among the leading causes of morbidity and mortality worldwide. According to the World Health Organization, CVDs account for 31% of all global deaths, with an estimated 17.9 million deaths each year. As per the American Heart Association, CVDs are the leading cause of death in the U.S., accounting for one in every three deaths.

Lifestyle changes, such as unhealthy diets, sedentary lifestyles, and smoking, propel the risk of CVDs. Elderly people are at high risk of CVDs. Thus, increase in geriatric population and rise in incidence of CVDs are likely to spur cardiac catheters & guidewires market growth in the near future.

Minimally invasive procedures are less painful and require shorter hospital stays than traditional open-heart surgery, thus resulting in reduced recovery times and lower healthcare costs. These procedures involve the use of catheters and guidewires to navigate the blood vessels and perform interventions, making them an integral part of the cardiovascular care pathway.

Angioplasty is one of the most common minimally invasive procedures performed. It involves the use of a balloon-tipped catheter to open blocked arteries in the heart.

Increase in awareness about the benefits of minimally invasive procedures, advancements in related technologies, and availability of skilled healthcare professionals are augmenting the cardiac catheters & guidewires market development. Additionally, the COVID-19 pandemic has accelerated the adoption of minimally invasive procedures, as patients and healthcare professionals are hesitant to undergo or perform traditional open-heart surgery due to the risk of infection.

Technological advancements in design of catheters and guidewires are improving their accuracy, precision, and safety, making them less invasive and more effective. R&D of advanced materials and coatings is facilitating the introduction of advanced catheters and guidewires that offer greater precision and control during cardiac procedures. Usage of composite materials offers more flexible and durable catheters, which can navigate through complex anatomies with greater ease and accuracy.

Development of specialized coatings, such as hydrophilic coatings, is enhancing the lubricity of catheters and guidewires. This helps reduce friction during navigation and improves the overall accuracy of these devices. Usage of 3D imaging and robotics is allowing for more precise placement of catheters and guidewires, thereby reducing the risk of complications and improving patient outcomes. These advancements are expected to drive the cardiac catheters & guidewires market progress in the near future.

The cardiac catheters segment is estimated to dominate the global landscape during the forecast period. The segment accounted for more than 80.0% share in 2022.

Growth of the segment can be ascribed to the increase in incidence of cardiovascular diseases, rise in geriatric population, and surge in demand for minimally invasive surgeries. Additionally, advancements in technology have led to the development of more sophisticated cardiac catheters. This is further boosting their demand.

North America is projected to hold the largest market share from 2023 to 2031. Increase in prevalence of cardiovascular diseases, presence of advanced healthcare infrastructure, and rise in adoption of minimally invasive procedures are driving market dynamics of the region. According to the Centers for Disease Control and Prevention (CDC), heart disease is the leading cause of death in the U.S. It accounts for more than 650,000 deaths each year.

The industry in Asia Pacific is expected to grow at a rapid pace in the near future. Rise in cases of cardiovascular diseases, increase in healthcare expenditure, and growth in awareness about minimally invasive procedures are boosting cardiac catheters & guidewires market statistics in the region.

The global business is highly competitive and fragmented, with a large number of players operating in the market. These players are constantly engaged in research and development activities to introduce new products and increase their cardiac catheters & guidewires market share.

Abbott, Boston Scientific Corporation, Getinge AB, Johnson & Johnson, Terumo Medical Corporation, BIOTRONIK, Medtronic, QXMédical, Teleflex Incorporated, B. Braun SE, BD (Becton, Dickinson and Company), Cardinal Health, Merit Medical Systems, NIPRO, and BrosMed Medical Co., Ltd. are key entities operating in this sector.

These vendors have been profiled in the market report based on various factors including company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

|

Attribute |

Detail |

|

Market Size in 2022 |

US$ 14.0 Bn |

|

Forecast (Value) in 2031 |

More than US$ 27.9 Bn |

|

Growth Rate (CAGR) |

7.9% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 14.0 Bn in 2022.

It is projected to reach more than US$ 27.9 Bn by the end of 2031.

The CAGR is anticipated to be 7.9% from 2023 to 2031.

The cardiac catheters segment accounted for the largest share in 2022.

North America is expected to account for leading share from 2023 to 2031.

Abbott, Boston Scientific Corporation, Getinge AB, Johnson & Johnson, Terumo Medical Corporation, BIOTRONIK, Medtronic, QXMédical, Teleflex Incorporated, B. Braun SE, BD (Becton, Dickinson and Company), Cardinal Health, Merit Medical Systems, NIPRO, and BrosMed Medical Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cardiac Catheters & Guidewires Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cardiac Catheters & Guidewires Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Disease Prevalence & Incidence Rate Globally with Key Countries

5.2. Technological Advancements

5.3. Regulatory Scenario by Region/Globally

5.4. COVID-19 Pandemic Impact on Industry

6. North America Cardiac Catheters & Guidewires Market Analysis and Forecast

6.1. Introduction

6.1.1. Key Findings

6.2. Market Value Forecast By Product Type, 2017 - 2031

6.2.1. Cardiac Catheters

6.2.1.1. Electrophysiology Catheters

6.2.1.2. PTCA Balloon Catheters

6.2.1.3. IVUS Catheters

6.2.1.4. PTA Balloon Catheters

6.2.1.5. Guide Extension Catheters

6.2.1.6. Others

6.2.2. Cardiac Guidewires

6.3. Market Value Forecast By End-user, 2017 - 2031

6.3.1. Hospitals

6.3.2. Clinics

6.3.3. Ambulatory Surgical Centers

6.4. Market Value Forecast By Country, 2017 - 2031

6.4.1. U.S.

6.4.2. Canada

6.5. Market Attractiveness Analysis

6.5.1. By Product Type

6.5.2. By End-user

6.5.3. By Country

7. Europe Cardiac Catheters & Guidewires Market Analysis and Forecast

7.1. Introduction

7.1.1. Key Findings

7.2. Market Value Forecast By Product Type, 2017 - 2031

7.2.1. Cardiac Catheters

7.2.1.1. Electrophysiology Catheters

7.2.1.2. PTCA Balloon Catheters

7.2.1.3. IVUS Catheters

7.2.1.4. PTA Balloon Catheters

7.2.1.5. Guide Extension Catheters

7.2.1.6. Others

7.2.2. Cardiac Guidewires

7.3. Market Value Forecast By End-user, 2017 - 2031

7.3.1. Hospitals

7.3.2. Clinics

7.3.3. Ambulatory Surgical Centers

7.4. Market Value Forecast By Country, 2017 - 2031

7.4.1. Germany

7.4.2. U.K.

7.4.3. France

7.4.4. Spain

7.4.5. Italy

7.4.6. Rest of Europe

7.5. Market Attractiveness Analysis

7.5.1. By Product Type

7.5.2. By End-user

7.5.3. By Country

8. Asia Pacific Cardiac Catheters & Guidewires Market Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.2. Market Value Forecast By Product Type, 2017 - 2031

8.2.1. Cardiac Catheters

8.2.1.1. Electrophysiology Catheters

8.2.1.2. PTCA Balloon Catheters

8.2.1.3. IVUS Catheters

8.2.1.4. PTA Balloon Catheters

8.2.1.5. Guide Extension Catheters

8.2.1.6. Others

8.2.2. Cardiac Guidewires

8.3. Market Value Forecast By End-user, 2017 - 2031

8.3.1. Hospitals

8.3.2. Clinics

8.3.3. Ambulatory Surgical Centers

8.4. Market Value Forecast By Country, 2017 - 2031

8.4.1. China

8.4.2. Japan

8.4.3. Rest of Asia Pacific

8.5. Market Attractiveness Analysis

8.5.1. By Product Type

8.5.2. India

8.5.3. Australia & New ZealandBy End-user

8.5.2. By Country

9. Latin America Cardiac Catheters & Guidewires Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast By Product Type, 2017 - 2031

9.2.1. Cardiac Catheters

9.2.1.1. Electrophysiology Catheters

9.2.1.2. PTCA Balloon Catheters

9.2.1.3. IVUS Catheters

9.2.1.4. PTA Balloon Catheters

9.2.1.5. Guide Extension Catheters

9.2.1.6. Others

9.2.2. Cardiac Guidewires

9.3. Market Value Forecast By End-user, 2017 - 2031

9.3.1. Hospitals

9.3.2. Clinics

9.3.3. Ambulatory Surgical Centers

9.4. Market Value Forecast By Country, 2017 - 2031

9.4.1. Brazil

9.4.2. Mexico

9.4.3. Rest of Latin America

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By End-user

9.5.3. By Country

10. Middle East & Africa Cardiac Catheters & Guidewires Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Product Type, 2017 - 2031

10.2.1. Cardiac Catheters

10.2.1.1. Electrophysiology Catheters

10.2.1.2. PTCA Balloon Catheters

10.2.1.3. IVUS Catheters

10.2.1.4. PTA Balloon Catheters

10.2.1.5. Guide Extension Catheters

10.2.1.6. Others

10.2.2. Cardiac Guidewires

10.3. Market Value Forecast By End-user, 2017 - 2031

10.3.1. Hospitals

10.3.2. Clinics

10.3.3. Ambulatory Surgical Centers

10.4. Market Value Forecast By Country, 2017 - 2031

10.4.1. GCC Countries

10.4.2. South Africa

10.4.3. Rest of Middle East & Africa

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By End-user

10.5.3. By Country

11. Competition Landscape

11.1. Market Player – Competition Matrix (By Tier and Size of Companies)

11.2. Market Share Analysis By Company (2022)

11.3. Company Profiles

11.3.1. Abbott

11.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.1.2. Product Type Portfolio

11.3.1.3. Financial Overview

11.3.1.4. SWOT Analysis

11.3.1.5. Strategic Overview

11.3.2. Boston Scientific Corporation

11.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.2.2. Product Type Portfolio

11.3.2.3. Financial Overview

11.3.2.4. SWOT Analysis

11.3.2.5. Strategic Overview

11.3.3. Getinge AB

11.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.3.2. Product Type Portfolio

11.3.3.3. Financial Overview

11.3.3.4. SWOT Analysis

11.3.3.5. Strategic Overview

11.3.4. Johnson & Johnson

11.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.4.2. Product Type Portfolio

11.3.4.3. Financial Overview

11.3.4.4. SWOT Analysis

11.3.4.5. Strategic Overview

11.3.5. Terumo Medical Corporation

11.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.5.2. Product Type Portfolio

11.3.5.3. Financial Overview

11.3.5.4. SWOT Analysis

11.3.5.5. Strategic Overview

11.3.6. BIOTRONIK

11.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.6.2. Product Type Portfolio

11.3.6.3. Financial Overview

11.3.6.4. SWOT Analysis

11.3.6.5. Strategic Overview

11.3.7. Medtronic

11.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.7.2. Product Type Portfolio

11.3.7.3. Financial Overview

11.3.7.4. SWOT Analysis

11.3.7.5. Strategic Overview

11.3.8. QXMédical

11.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.8.2. Product Type Portfolio

11.3.8.3. Financial Overview

11.3.8.4. SWOT Analysis

11.3.8.5. Strategic Overview

11.3.9. Teleflex Incorporated

11.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.9.2. Product Type Portfolio

11.3.9.3. Financial Overview

11.3.9.4. SWOT Analysis

11.3.9.5. Strategic Overview

11.3.10. B. Braun SE

11.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.10.2. Product Type Portfolio

11.3.10.3. Financial Overview

11.3.10.4. SWOT Analysis

11.3.10.5. Strategic Overview

11.3.11. BD (Becton, Dickinson and Company)

11.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.11.2. Product Type Portfolio

11.3.11.3. Financial Overview

11.3.11.4. SWOT Analysis

11.3.11.5. Strategic Overview

11.3.12. Cardinal Health

11.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.12.2. Product Type Portfolio

11.3.12.3. Financial Overview

11.3.12.4. SWOT Analysis

11.3.12.5. Strategic Overview

11.3.13. Merit Medical Systems

11.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.13.2. Product Type Portfolio

11.3.13.3. Financial Overview

11.3.13.4. SWOT Analysis

11.3.13.5. Strategic Overview

11.3.14. NIPRO

11.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.14.2. Product Type Portfolio

11.3.14.3. Financial Overview

11.3.14.4. SWOT Analysis

11.3.14.5. Strategic Overview

11.3.15. BrosMed Medical Co., Ltd.

11.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.15.2. Product Type Portfolio

11.3.15.3. Financial Overview

11.3.15.4. SWOT Analysis

11.3.15.5. Strategic Overview

List of Tables

Table 01: Global Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 05: North America Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: North America Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: Europe Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 08: Europe Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Asia Pacific Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 11: Asia Pacific Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Asia Pacific Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Latin America Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 14: Latin America Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: Latin America Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Middle East & Africa Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 17: Middle East & Africa Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 18: Middle East & Africa Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Cardiac Catheters & Guidewires Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 03: Global Cardiac Catheters & Guidewires Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 04: Global Cardiac Catheters & Guidewires Market Value Share Analysis, by End-user, 2022 and 2031

Figure 05: Global Cardiac Catheters & Guidewires Market Attractiveness Analysis, by End-user, 2023–2031

Figure 06: Global Cardiac Catheters & Guidewires Market Value Share Analysis, by Region, 2022 and 2031

Figure 07: Global Cardiac Catheters & Guidewires Market Attractiveness Analysis, by Region, 2023–2031

Figure 08: North America Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: North America Cardiac Catheters & Guidewires Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 10: North America Cardiac Catheters & Guidewires Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 11: North America Cardiac Catheters & Guidewires Market Value Share Analysis, by End-user, 2022 and 2031

Figure 12: North America Cardiac Catheters & Guidewires Market Attractiveness Analysis, by End-user, 2023–2031

Figure 13: North America Cardiac Catheters & Guidewires Market Value Share Analysis, by Country, 2022 and 2031

Figure 14: North America Cardiac Catheters & Guidewires Market Attractiveness Analysis, by Country, 2023–2031

Figure 15: Europe Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: Europe Cardiac Catheters & Guidewires Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 17: Europe Cardiac Catheters & Guidewires Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 18: Europe Cardiac Catheters & Guidewires Market Value Share Analysis, by End-user, 2022 and 2031

Figure 19: Europe Cardiac Catheters & Guidewires Market Attractiveness Analysis, by End-user, 2023–2031

Figure 20: Europe Cardiac Catheters & Guidewires Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 21: Europe Cardiac Catheters & Guidewires Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 22: Asia Pacific Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: Asia Pacific Cardiac Catheters & Guidewires Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 24: Asia Pacific Cardiac Catheters & Guidewires Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 25: Asia Pacific Cardiac Catheters & Guidewires Market Value Share Analysis, by End-user, 2022 and 2031

Figure 26: Asia Pacific Cardiac Catheters & Guidewires Market Attractiveness Analysis, by End-user, 2023–2031

Figure 27: Asia Pacific Cardiac Catheters & Guidewires Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Asia Pacific Cardiac Catheters & Guidewires Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Latin America Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Latin America Cardiac Catheters & Guidewires Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 31: Latin America Cardiac Catheters & Guidewires Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 32: Latin America Cardiac Catheters & Guidewires Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Latin America Cardiac Catheters & Guidewires Market Attractiveness Analysis, by End-user, 2023–2031

Figure 34: Latin America Cardiac Catheters & Guidewires Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Latin America Cardiac Catheters & Guidewires Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 36: Middle East & Africa Cardiac Catheters & Guidewires Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Middle East & Africa Cardiac Catheters & Guidewires Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 38: Middle East & Africa Cardiac Catheters & Guidewires Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 39: Middle East & Africa Cardiac Catheters & Guidewires Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Middle East & Africa Cardiac Catheters & Guidewires Market Attractiveness Analysis, by End-user, 2023–2031

Figure 41: Middle East & Africa Cardiac Catheters & Guidewires Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Middle East & Africa Cardiac Catheters & Guidewires Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Global Cardiac Catheters & Guidewires Market Share Analysis, by Company, 2022