!! UPDATE: The EU Council announced the approval of the Corporate Sustainability Reporting Directive on the 28th of November, 2022 !!

On 21 April 2021, the European Commission adopted the Sustainable Finance Package, including a proposal for the Corporate Sustainability Reporting Directive (CSRD). The CSRD reforms and significantly expands the reporting obligations of companies. It extends the reporting requirements and makes it compulsory for big to small and medium-sized enterprises based on a harmonised reporting standard. The extended scope will mean that from 2024, more than 50,000 European companies will have to disclose detailed ESG (Environmental, Social, and Corporate Governance) information.

What is CSRD about?

The CSRD will replace the Non-Financial Reporting Directive (NFRD) after 2024. Under the current working version of the CSRD, a significantly larger number of companies in the EU will be required to report on their non-financial sustainability performance compared to the previous NFRD. Typical sustainability issues to be reported include environmental rights, social rights, human rights, and governance factors.

The CSRD proposal:

- extends the scope to all large companies and all companies listed on regulated markets (for example banks and insurance companies)

- requires the audit (assurance) of reported information

- introduces more detailed reporting requirements according to EU sustainability reporting standards

The European Commission’s proposal for a Corporate Sustainability Reporting Directive (CSRD) forces the adoption of EU sustainability reporting standards. The European Financial Reporting Advisory Group (EFRAG) will be responsible for establishing these European standards, following technical advice from several European agencies. The standards will be tailored to EU policies while building on and contributing to international standardisation initiatives.

Who is affected by the CSRD?

Who is affected by the CSRD?

The CSRD will apply to all large companies and entities with securities listed on regulated markets in the EU, except micro-enterprises. Large companies are entities that exceed the thresholds for at least two of the following three criteria: 1) balance sheet total: €20 million, 2) net turnover: €40 million, 3) the average number of employees in the financial year: 250.

These companies are also responsible for assessing the information at the level of their subsidiaries.

Large companies are not the only ones required to publish their sustainability reports. The EU proposes that listed small and medium-sized companies could also be affected, but they will be subject to simpler rules than large companies. An opt-out will be possible for SMEs during a transitional period, meaning that they will be exempted from the application of the directive until 2028.

For non-European companies, the requirement to provide a sustainability report applies to all companies generating a net turnover of €150 million in the EU and with at least one subsidiary or branch. These companies must report their ESG impacts, namely environmental, social and governance impacts, as defined in this directive.

Audit and certification

The proposal first introduces a common EU-wide audit requirement for reported sustainability information. This should ensure that the information provided is accurate and reliable. This will go a long way to addressing investors’ concerns about the reliability of sustainability information that companies publish today.

The CSRD also introduces a certification requirement for sustainability reporting and improved accessibility of information by requiring its publication in a dedicated section of the company management reports. Reporting must be certified by an accredited independent auditor or certifier. The reporting of non-European companies must also be certified by a European auditor or by one established in a third country.

The Commission’s proposal allows the Member States to open the sustainability assurance services market to “independent assurance providers.” This means that the Member States may choose to authorise companies that are not conventional auditors of financial information to audit sustainability information.

Costs for companies

The Commission’s proposal aims to reduce reporting costs for businesses in the medium and long term. While the proposed CSRD would imply additional costs in the short term for companies, most companies will face an increase in the expenses anyway because of the growing demand from investors and other stakeholders for corporate sustainability information. This problem is exacerbated by several overlapping standards and frameworks and inconsistent information requests from investors and other stakeholders. The Commission’s proposal represents an opportunity for an orderly and cost-effective solution to the problems posed by this increase in demand, based on consensus on essential information that companies must disclose.

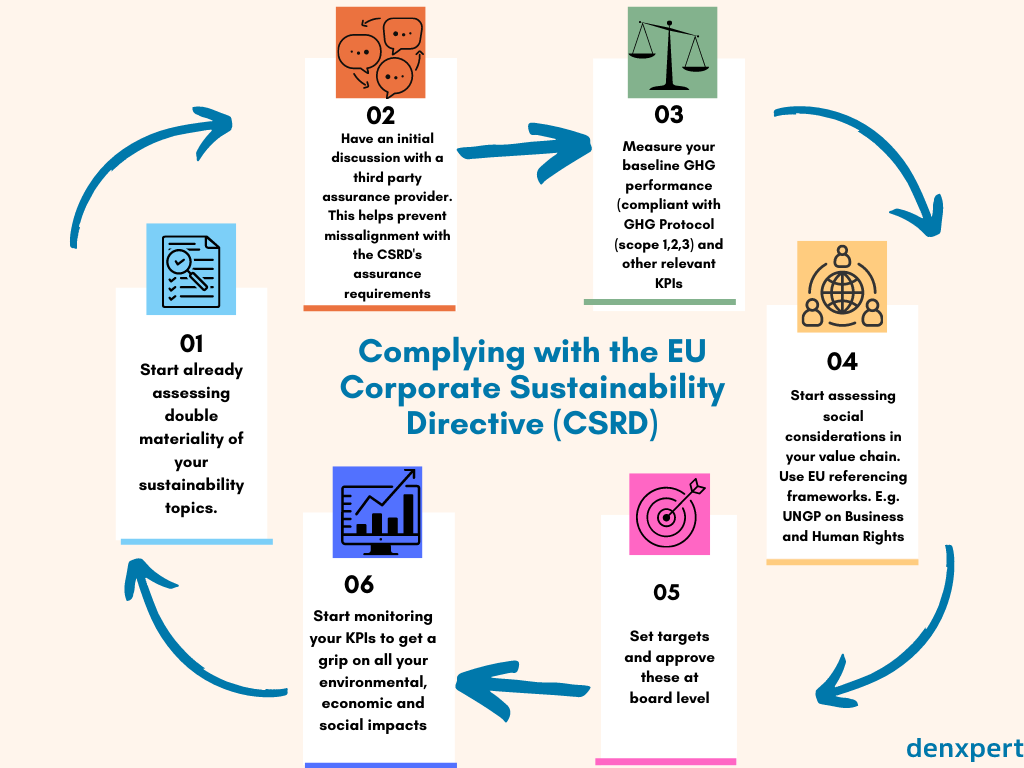

How can I prepare for CSRD compliance?

Different approaches to reporting can be taken depending on whether a company is preparing its first sustainability report or has already communicated its non-financial performance.

If the company is likely subject to the CSRD, it is worthwhile to carry out a gap analysis to show its current state of compliance. The next step is to draw up a plan to address the gaps so that the report is fully compliant with the CSRD by the deadline.

The final version of the reporting standard to facilitate CSRD compliance is expected in October 2022. Until then, the first steps can be taken based on the information available. A materiality analysis needs to be carried out, stakeholders need to be mapped, channels to learn about sustainability issues need to be developed, corporate governance structures need to be designed to meet expectations, and data collection methods need to be developed. Some companies may have other reporting obligations besides the CSRD, which need to be identified and a timetable set to meet these by the deadline.

Companies that have already reported on their non-financial performance are at an advantage, especially if they have prepared their reports under an international standard. However, it is also essential for these companies to review their reporting practices, considering the expected new requirements.

Roadmap

CSRD requires many EU companies to disclose information on how they operate and manage social and environmental challenges. This helps investors, civil society organisations, consumers, policymakers, and other stakeholders to evaluate the non-financial performance of larger companies and encourages these companies to develop a responsible approach to business.

In June 2022, the Council and European Parliament reached a provisional political agreement on the CSRD directive. The application of the regulation will take place in three stages:

- 01. January 2024 for companies already subject to the non-financial reporting directive

- 01. January 2025 for large companies that are not presently subject to the non-financial reporting directive

- 01. January 2026 for listed SMEs, small and non-complex credit institutions, and captive insurance undertakings.

If your company is likely subject to the CSRD directive and needs further discussion about the necessary steps, contact us here.