Analysts’ Viewpoint on Market Scenario

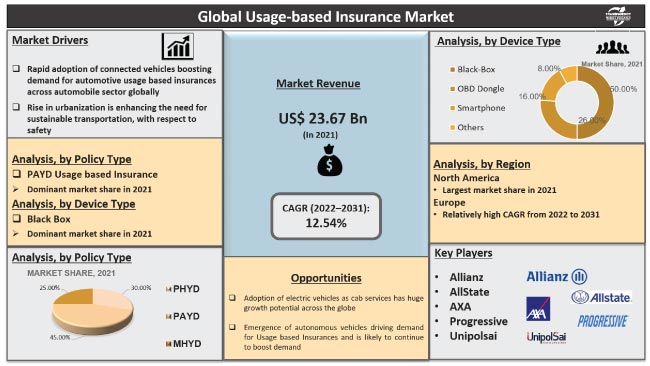

Rise in demand for connected vehicles and electric/hybrid vehicles is a key factor driving the user-based insurance market.

Increase in focus on highly precise products, which meet regulatory requirements or different legal aspects to ensure safety and reduce the chances of any malpractice, is also augmenting the demand for usage-based motor insurance. Furthermore, growth in demand for SUVs among the young population is boosting the demand for usage-based auto insurance. Key players such as Allianz, AllState, Aviva, AXA, Generalli, Gropama, and Insure the Box are focusing on upgrading policies for automotive such as Pay How You Drive (PHYD), Pay As You Drive (PAYD), and Manage How You Drive (MHYD) in order to offer their clients a product portfolio that is innovative, cost effective and diverse.

Manufacturers are also offering cutting-edge benefits and tapping into incremental opportunities to broaden their revenue streams.

Usage-based insurance is a vehicle insurance created to calculate the premium for the vehicle by observing how the drivers operate the vehicle. A wireless device is installed in the car to follow the vehicle's behavior. It transmits information to the insurance provider each time the premium is due. Increase in demand for automobiles across the globe is a key factor propelling the demand for usage-based car insurance. Real-time car monitoring and rise in interest in linked automobiles are also fueling the demand for car insurance based on usage.

The global usage-based insurance market is projected to grow at a rapid pace during the forecast period, owing to the increase in adoption of IoT, ADAS, as well as electric vehicles, and hybrid electric vehicles across the globe. The market is also estimated to grow significantly owing to the rise in purchasing power of the people and high demand for real-time data evaluation across the globe.

Request a sample to get extensive insights into the Market

Telematics has become commonplace in the automotive industry. Through usage-based insurance, vehicle telematics helps align insurance prices, and enhance driving behavior and road safety. The telematics sector has been growing, as governments across the globe, especially in the European Union and Russia, are planning to impose telematics regulations.

Rise in need for automobiles to be more connected and intelligent is also driving the demand for usage-based insurance telematics. According to a whitepaper from LexisNexis Risk Solutions, 85%–92% of people who bought automobile insurance in 2020 had a telematics-enabled coverage.

Electrification of vehicles is structurally transforming the transportation industry. Usage-based insurance works on real time data collection. It ensures the authenticity of insurance premiums so that insurance authorities can get accurate information of vehicle operation.

Rise in production of electric and hybrid electric vehicles across the globe is driving the demand for electric vehicle UBI. Additionally, government authorities are introducing various policies and initiatives to minimize the dependence on crude oils and boost the adoption rate of electric vehicles. This is also augmenting the user-based car insurance market size.

Increase in adoption of smart and connected technologies such as sensor-based detection systems and infrared sensors is a major factor driving the usage-based insurance market. These new technologies help enhance the on-road driving experience and safety.

Urbanization is likely to support sustainable growth by boosting productivity and encouraging the emergence of new concepts and innovations. Urban population accounts for major share of electric and autonomous vehicles. Increase in purchasing power of the people is also driving the market for safety features-enabled vehicles and services. In turn, this is likely to boost the market.

In terms of policy type, the pay as you drive (PAYD) segment held significant share of the global usage-based insurance market in 2021. Under the PAYD model, the premium amount is determined by the number of miles covered by the customer's vehicle. Odometers mounted in the car and connected to wireless devices are typically used to track the number of miles driven.

The pay how you drive (PHYD) segment is also anticipated to grow significantly during the forecast period. Here, the premium is assessed using information gathered by monitoring an individual’s driving habits. These include aspects such as acceleration, braking, location, and driving time.

Based on device type, the black box segment held dominant share of the global usage-based insurance market in 2021. The segment is expected to maintain its dominance during the forecast period. Higher accuracy is the primary factor driving the black box segment. Black box also captures large amount of data. Most car owner desire the conventional UBI technology known as the black box. Thus, demand for black box is likely to rise in the near future.

Europe, especially Italy, has the highest penetration rate of black box. The initial cost of the service is expected to be higher, as these gadgets are costly and need professional installment. The UBI market is also observing a transition from black box to an embedded system. As a result, the UBI technology is anticipated to be used widely in the near future.

In terms of volume, North America held around 50% share of the global usage-based insurance market in 2021, owing to the rise in interest in Mobility as a Service and expanding partnerships between telematics and insurance providers in the region.

The market for usage-based insurance in North America is also anticipated to be driven by the presence of top UBI firms such as Progressive Casualty Insurance Company, Allstate Insurance Company, State Farm Automobile Mutual Insurance Company, and Liberty Mutual Insurance Company in the U.S.

Europe is also a prominent market for automotive insurance. The region held around 37% share of the global market in 2021. Rise in demand for passenger vehicles and presence of key vehicle manufacturers are factors boosting the demand for usage-based insurance in the region.

Asia Pacific accounts for a considerable share of the market, owing to the presence of highly populated countries such as China and India, which are also the fastest growing economies in the world.

The global usage-based insurance market is fairly consolidated, with the largest players controlling a majority of the share. Most usage-based insurance companies are investing significantly in comprehensive research and development activities.

Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by major players. Allianz, AllState, Aviva, AXA, Generalli, Gropama, Insure the Box, Liberty Mutual, MAIF, The Progressive Corporation, State Farm, Octo Telematics, CoverBox, TrueMotion, Nexar, MyDrive Solutions, Zendrive, Dash, and Cobra Automotive Technologies are the prominent entities operating in the market.

Request a custom report on Usage-based Insurance Market

Each of these players has been profiled in the usage-based insurance market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 23.67 Bn |

|

Market Forecast Value in 2031 |

US$ 77.14 Bn |

|

Growth Rate (CAGR) |

12.54% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

Units for Volume US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, industry trend analysis, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The market was valued at US$ 23.67 Bn in 2021.

The industry is expected to grow at a CAGR of 12.54% by 2031.

The market would be worth US$ 77.14 Bn in 2031.

The U.S. is a prominent market for usage-based insurance due to high demand for advanced transport infrastructure in the country.

Pay as you drive (PAYD) is expected to be the fastest-growing segment of the global usage-based insurance market.

North America is the most lucrative region of the global usage-based insurance market and holds dominant market share.

Allianz, AllState, Aviva, AXA, Generalli, Gropama, Insure the Box, Liberty Mutual, MAIF, Progressive, State Farm, Octo Telematics, and CoverBox.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

3. Industry Ecosystem Analysis

3.1. Value Chain Analysis

3.2. Gross Margin Analysis

4. COVID-19 Impact Analysis – Usage-based Insurance Market

5. Pricing Analysis

5.1. Cost Structure Analysis

5.2. Profit Margin Analysis

6. Global Usage-based Insurance Market, By Policy Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Policy Type

6.2.1. Pay How You Drive (PHYD)

6.2.2. Pay As You Drive (PAYD)

6.2.3. Manage How You Drive (MHYD)

7. Global Usage-based Insurance Market, By Device Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Device Type

7.2.1. Black Box

7.2.2. OBD Dongle

7.2.3. Smartphone

7.2.4. Others

8. Global Usage-based Insurance Market, By Vehicle Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

8.2.1. Passenger Vehicle

8.2.2. Commercial Vehicle

9. Global Usage-based Insurance Market, By Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Usage-based Insurance Market

10.1. Market Snapshot

10.2. North America Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Policy Type

10.2.1. Pay How You Drive (PHYD)

10.2.2. Pay As You Drive (PAYD)

10.2.3. Manage How You Drive (MHYD)

10.3. North America Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Device Type

10.3.1. Black Box

10.3.2. OBD Dongle

10.3.3. Smartphone

10.3.4. Others

10.4. North America Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

10.4.1. Passenger Vehicle

10.4.2. Commercial Vehicle

10.5. Key Country Analysis – North America Usage-based Insurance Market Size Analysis & Forecast, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.5.3. Mexico

11. Europe Usage-based Insurance Market

11.1. Market Snapshot

11.2. Europe Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Policy Type

11.2.1. Pay How You Drive (PHYD)

11.2.2. Pay As You Drive (PAYD)

11.2.3. Manage How You Drive (MHYD)

11.3. Europe Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Device Type

11.3.1. Black Box

11.3.2. OBD Dongle

11.3.3. Smartphone

11.3.4. Others

11.4. Europe Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.4.1. Passenger Vehicle

11.4.2. Commercial Vehicle

11.5. Key Country Analysis – Europe Usage-based Insurance Market Size Analysis & Forecast, 2017-2031

11.5.1. Germany

11.5.2. U. K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Nordic Countries

11.5.7. Russia & CIS

11.5.8. Rest of Europe

12. Asia Pacific Usage-based Insurance Market

12.1. Market Snapshot

12.2. Asia Pacific Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Policy Type

12.2.1. Pay How You Drive (PHYD)

12.2.2. Pay As You Drive (PAYD)

12.2.3. Manage How You Drive (MHYD)

12.3. Asia Pacific Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Device Type

12.3.1. Black Box

12.3.2. OBD Dongle

12.3.3. Smartphone

12.3.4. Others

12.4. Asia Pacific Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.4.1. Passenger Vehicle

12.4.2. Commercial Vehicle

12.5. Key Country Analysis – Asia Pacific Usage-based Insurance Market Size Analysis & Forecast, 2017-2031

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. ASEAN Countries

12.5.5. South Korea

12.5.6. ANZ

12.5.7. Rest of Asia Pacific

13. Middle East & Africa Usage-based Insurance Market

13.1. Market Snapshot

13.2. Middle East & Africa Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Policy Type

13.2.1. Pay How You Drive (PHYD)

13.2.2. Pay As You Drive (PAYD)

13.2.3. Manage How You Drive (MHYD)

13.3. Middle East & Africa Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Device Type

13.3.1. Black Box

13.3.2. OBD Dongle

13.3.3. Smartphone

13.3.4. Others

13.4. Middle East & Africa Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.4.1. Passenger Vehicle

13.4.2. Commercial Vehicle

13.5. Key Country Analysis – Middle East & Africa Usage-based Insurance Market Size Analysis & Forecast, 2017-2031

13.5.1. GCC

13.5.2. South Africa

13.5.3. Turkey

13.5.4. Rest of Middle East & Africa

14. South America Usage-based Insurance Market

14.1. Market Snapshot

14.2. South America Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Policy Type

14.2.1. Pay How You Drive (PHYD)

14.2.2. Pay As You Drive (PAYD)

14.2.3. Manage How You Drive (MHYD)

14.3. South America Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Device Type

14.3.1. Black Box

14.3.2. OBD Dongle

14.3.3. Smartphone

14.3.4. Others

14.4. South America Usage-based Insurance Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

14.4.1. Passenger Vehicle

14.4.2. Commercial Vehicle

14.5. Key Country Analysis – South America Usage-based Insurance Market Size Analysis & Forecast, 2017-2031

14.5.1. Brazil

14.5.2. Argentina

14.5.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2021

15.2. Pricing comparison among Key Players

15.3. Company Analysis for Each Player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. Allianz

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. AllState

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. Aviva

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. AXA

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. Generalli

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Gropama

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. Insure the Box

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Liberty Mutual

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. MAIF

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Progressive

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. State Farm

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. Uniposai

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. Uniqa

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Other Key Players

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

List of Tables

Table 1: Global Usage-based Insurance Market Volume (Units) Forecast, by Policy Type, 2017‒2031

Table 2: Global Usage-based Insurance Market Value (US$ Bn) Forecast, by Policy Type, 2017‒2031

Table 3: Global Usage-based Insurance Market Volume (Units) Forecast, by Device Type, 2017‒2031

Table 4: Global Usage-based Insurance Market Value (US$ Bn) Forecast, by Device Type, 2017‒2031

Table 5: Global Usage-based Insurance Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 6: Global Usage-based Insurance Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 7: Global Usage-based Insurance Market Volume (Units) Forecast, by Region, 2017‒2031

Table 8: Global Usage-based Insurance Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 9: North America Usage-based Insurance Market Volume (Units) Forecast, by Policy Type, 2017‒2031

Table 10: North America Usage-based Insurance Market Value (US$ Bn) Forecast, by Policy Type, 2017‒2031

Table 11: North America Usage-based Insurance Market Volume (Units) Forecast, by Device Type, 2017‒2031

Table 12: North America Usage-based Insurance Market Value (US$ Bn) Forecast, by Device Type, 2017‒2031

Table 13: North America Usage-based Insurance Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 14: North America Usage-based Insurance Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 15: North America Usage-based Insurance Market Volume (Units) Forecast, by Country, 2017‒2031

Table 16: North America Usage-based Insurance Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 17: Europe Usage-based Insurance Market Volume (Units) Forecast, by Policy Type, 2017‒2031

Table 18: Europe Usage-based Insurance Market Value (US$ Bn) Forecast, by Policy Type, 2017‒2031

Table 19: Europe Usage-based Insurance Market Volume (Units) Forecast, by Device Type, 2017‒2031

Table 20: Europe Usage-based Insurance Market Value (US$ Bn) Forecast, by Device Type, 2017‒2031

Table 21: Europe Usage-based Insurance Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 22: Europe Usage-based Insurance Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 23: Europe Usage-based Insurance Market Volume (Units) Forecast, by Country, 2017‒2031

Table 24: Europe Usage-based Insurance Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Asia Pacific Usage-based Insurance Market Volume (Units) Forecast, by Policy Type, 2017‒2031

Table 26: Asia Pacific Usage-based Insurance Market Value (US$ Bn) Forecast, by Policy Type, 2017‒2031

Table 27: Asia Pacific Usage-based Insurance Market Volume (Units) Forecast, by Device Type, 2017‒2031

Table 28: Asia Pacific Usage-based Insurance Market Value (US$ Bn) Forecast, by Device Type, 2017‒2031

Table 29: Asia Pacific Usage-based Insurance Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 30: Asia Pacific Usage-based Insurance Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 31: Asia Pacific Usage-based Insurance Market Volume (Units) Forecast, by Country, 2017‒2031

Table 32: Asia Pacific Usage-based Insurance Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 33: Middle East & Africa Usage-based Insurance Market Volume (Units) Forecast, by Policy Type, 2017‒2031

Table 34: Middle East & Africa Usage-based Insurance Market Value (US$ Bn) Forecast, by Policy Type, 2017‒2031

Table 35: Middle East & Africa Usage-based Insurance Market Volume (Units) Forecast, by Device Type, 2017‒2031

Table 36: Middle East & Africa Usage-based Insurance Market Value (US$ Bn) Forecast, by Device Type, 2017‒2031

Table 37: Middle East & Africa Usage-based Insurance Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 38: Middle East & Africa Usage-based Insurance Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 39: Middle East & Africa Usage-based Insurance Market Volume (Units) Forecast, by Country, 2017‒2031

Table 40: Middle East & Africa Usage-based Insurance Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: South America Usage-based Insurance Market Volume (Units) Forecast, by Policy Type, 2017‒2031

Table 42: South America Usage-based Insurance Market Value (US$ Bn) Forecast, by Policy Type, 2017‒2031

Table 43: South America Usage-based Insurance Market Volume (Units) Forecast, by Device Type, 2017‒2031

Table 44: South America Usage-based Insurance Market Value (US$ Bn) Forecast, by Device Type, 2017‒2031

Table 45: South America Usage-based Insurance Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 46: South America Usage-based Insurance Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 47: South America Usage-based Insurance Market Volume (Units) Forecast, by Country, 2017‒2031

Table 48: South America Usage-based Insurance Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Usage-based Insurance Market Volume (Units) Forecast, by Policy Type, 2017‒2031

Figure 2: Global Usage-based Insurance Market Value (US$ Bn) Forecast, by Policy Type, 2017‒2031

Figure 3: Global Usage-based Insurance Market, Incremental Opportunity, by Policy Type, Value (US$ Bn), 2022‒2031

Figure 4: Global Usage-based Insurance Market Volume (Units) Forecast, by Device Type, 2017‒2031

Figure 5: Global Usage-based Insurance Market Value (US$ Bn) Forecast, by Device Type, 2017‒2031

Figure 6: Global Usage-based Insurance Market, Incremental Opportunity, by Device Type, Value (US$ Bn), 2022‒2031

Figure 7: Global Usage-based Insurance Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 8: Global Usage-based Insurance Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 9: Global Usage-based Insurance Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 10: Global Usage-based Insurance Market Volume (Units) Forecast, by Region, 2017‒2031

Figure 11: Global Usage-based Insurance Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Figure 12: Global Usage-based Insurance Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022‒2031

Figure 13: North America Usage-based Insurance Market Volume (Units) Forecast, by Policy Type, 2017‒2031

Figure 14: North America Usage-based Insurance Market Value (US$ Bn) Forecast, by Policy Type, 2017‒2031

Figure 15: North America Usage-based Insurance Market, Incremental Opportunity, by Policy Type, Value (US$ Bn), 2022‒2031

Figure 16: North America Usage-based Insurance Market Volume (Units) Forecast, by Device Type, 2017‒2031

Figure 17: North America Usage-based Insurance Market Value (US$ Bn) Forecast, by Device Type, 2017‒2031

Figure 18: North America Usage-based Insurance Market, Incremental Opportunity, by Device Type, Value (US$ Bn), 2022‒2031

Figure 19: North America Usage-based Insurance Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 20: North America Usage-based Insurance Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 21: North America Usage-based Insurance Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 22: North America Usage-based Insurance Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 23: North America Usage-based Insurance Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 24: North America Usage-based Insurance Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 25: Europe Usage-based Insurance Market Volume (Units) Forecast, by Policy Type, 2017‒2031

Figure 26: Europe Usage-based Insurance Market Value (US$ Bn) Forecast, by Policy Type, 2017‒2031

Figure 27: Europe Usage-based Insurance Market, Incremental Opportunity, by Policy Type, Value (US$ Bn), 2022‒2031

Figure 28: Europe Usage-based Insurance Market Volume (Units) Forecast, by Device Type, 2017‒2031

Figure 29: Europe Usage-based Insurance Market Value (US$ Bn) Forecast, by Device Type, 2017‒2031

Figure 30: Europe Usage-based Insurance Market, Incremental Opportunity, by Device Type, Value (US$ Bn), 2022‒2031

Figure 31: Europe Usage-based Insurance Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 32: Europe Usage-based Insurance Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 33: Europe Usage-based Insurance Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 34: Europe Usage-based Insurance Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 35: Europe Usage-based Insurance Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 36: Europe Usage-based Insurance Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 37: Asia Pacific Usage-based Insurance Market Volume (Units) Forecast, by Policy Type, 2017‒2031

Figure 38: Asia Pacific Usage-based Insurance Market Value (US$ Bn) Forecast, by Policy Type, 2017‒2031

Figure 39: Asia Pacific Usage-based Insurance Market, Incremental Opportunity, by Policy Type, Value (US$ Bn), 2022‒2031

Figure 40: Asia Pacific Usage-based Insurance Market Volume (Units) Forecast, by Device Type, 2017‒2031

Figure 41: Asia Pacific Usage-based Insurance Market Value (US$ Bn) Forecast, by Device Type, 2017‒2031

Figure 42: Asia Pacific Usage-based Insurance Market, Incremental Opportunity, by Device Type, Value (US$ Bn), 2022‒2031

Figure 43: Asia Pacific Usage-based Insurance Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 44: Asia Pacific Usage-based Insurance Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 45: Asia Pacific Usage-based Insurance Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 46: Asia Pacific Usage-based Insurance Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 47: Asia Pacific Usage-based Insurance Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 48: Asia Pacific Usage-based Insurance Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 49: Middle East & Africa Usage-based Insurance Market Volume (Units) Forecast, by Policy Type, 2017‒2031

Figure 50: Middle East & Africa Usage-based Insurance Market Value (US$ Bn) Forecast, by Policy Type, 2017‒2031

Figure 51: Middle East & Africa Usage-based Insurance Market, Incremental Opportunity, by Policy Type, Value (US$ Bn), 2022‒2031

Figure 52: Middle East & Africa Usage-based Insurance Market Volume (Units) Forecast, by Device Type, 2017‒2031

Figure 53: Middle East & Africa Usage-based Insurance Market Value (US$ Bn) Forecast, by Device Type, 2017‒2031

Figure 54: Middle East & Africa Usage-based Insurance Market, Incremental Opportunity, by Device Type, Value (US$ Bn), 2022‒2031

Figure 55: Middle East & Africa Usage-based Insurance Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 56: Middle East & Africa Usage-based Insurance Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 57: Middle East & Africa Usage-based Insurance Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 58: Middle East & Africa Usage-based Insurance Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 59: Middle East & Africa Usage-based Insurance Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 60: Middle East & Africa Usage-based Insurance Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 61: South America Usage-based Insurance Market Volume (Units) Forecast, by Policy Type, 2017‒2031

Figure 62: South America Usage-based Insurance Market Value (US$ Bn) Forecast, by Policy Type, 2017‒2031

Figure 63: South America Usage-based Insurance Market, Incremental Opportunity, by Policy Type, Value (US$ Bn), 2022‒2031

Figure 64: South America Usage-based Insurance Market Volume (Units) Forecast, by Device Type, 2017‒2031

Figure 65: South America Usage-based Insurance Market Value (US$ Bn) Forecast, by Device Type, 2017‒2031

Figure 66: South America Usage-based Insurance Market, Incremental Opportunity, by Device Type, Value (US$ Bn), 2022‒2031

Figure 67: South America Usage-based Insurance Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 68: South America Usage-based Insurance Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 69: South America Usage-based Insurance Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 70: South America Usage-based Insurance Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 71: South America Usage-based Insurance Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 72: South America Usage-based Insurance Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031