Analysts’ Viewpoint on the Market Scenario

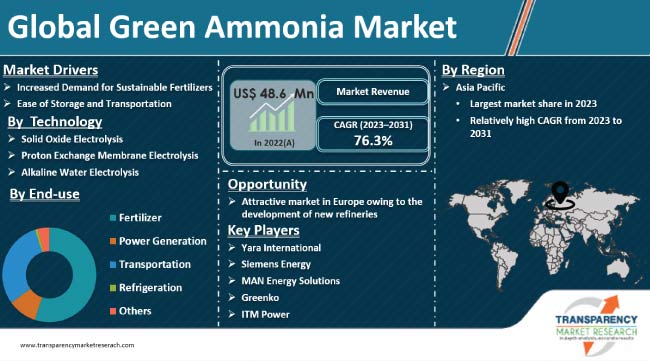

Concerns about the environmental impact of conventional ammonia, derived from crude oil with hydrogen as key element, are growing considerably. Green ammonia, which is made from renewable sources, such as solar and wind power, has a lower carbon footprint and can help reduce greenhouse gas emissions. Demand for green ammonia, a more sustainable but functionally equivalent alternative to fossil-based ammonia, is projected to grow substantially during the forecast period. Several countries such as Germany and the U.S. have enacted regulations and policies that promote the use of renewable chemicals and reduce emissions.

Green ammonia can help industries comply with these regulations and improve their sustainability credentials. Manufacturers are investing in research activities to develop new catalysts, membranes, and electrolysers that are more efficient. Green ammonia companies are also partnering with other businesses in the value chain, such as transportation companies, energy producers, and chemical manufacturers, to cater to the increased market demand for green ammonia.

Renewable ammonia is produced from renewable hydrogen, which in turn is produced via water electrolysis using renewable electricity. This hydrogen is converted into ammonia using nitrogen that is separated from air. This method doesn't produce carbon dioxide, making it sustainable for widespread applications.

Traditional methods of producing ammonia are highly energy-intensive and contribute significantly to greenhouse gas emissions, which has led to growing interest in ‘green ammonia’ production. According to a report by the International Renewable Energy Agency (IRENA), the potential for renewable energy to produce green ammonia is significant. The report estimates that, by 2050, renewable energy could provide over 90% of the energy needed to produce ammonia.

Ammonia can be employed in diverse applications in industry, primarily as a key component in nitrogen fertilizers that are critical to maintaining soil fertility in various parts of the world. However, ammonia is also utilized as a refrigerant in indoor ice-skating facilities.

It is a highly versatile and important chemical, with global production estimated to reach over 190 million tons by 2023. According to the green ammonia market analysis, in terms of revenue, the green ammonia market value is expected to reach US$ 21.4 Bn by 2031.

Demand for fertilizers continues to rise, globally, driven by growth of agricultural production, particularly in Asia and Africa. According to the Food and Agriculture Organization, total fertilizer consumption increased by 5.4% year-on-year from 2021 to 2022, with further growth expected in the future. However, the widespread use of chemical fertilizers and pesticides has led to a decline in soil quality, thereby creating a need for sustainable agricultural technologies.

Chemical producers are switching to sustainable and green products, such as green ammonia, to cater to this demand. This trend is expected to significantly boost sales of green ammonia in the coming years. Additionally, ammonia is a key ingredient in the green ammonia production process, such as fertilizers, hence increased demand for fertilizers is likely to result in a substantial increase in ammonia consumption.

Initially, only a small number of buyers may be able to afford the premium cost of green ammonia. However, as market acceptance grows, more buyers may begin to adopt this sustainable alternative. In the long term, this would lead to a widespread adoption of green ammonia in fertilizer and industrial markets and consequently, boost the global green ammonia industry growth.

Ammonia can be used to transport much larger amounts of energy in less space because, relative to volume, the energy density of ammonia is much greater than that of liquid hydrogen. Ammonia already liquefies at -33 °C and can be stored and transported more easily. Liquid hydrogen, on the other hand, consumes up to an additional 40% of the energy content to be transported in this way due to the need for extreme cooling.

The transport of green ammonia is therefore not only easier, but also safer and more cost-effective than that of green hydrogen. Several projects are currently testing the usage of ammonia as a marine fuel. Yara is planning to supply a retrofitted North Sea supply vessel with ammonia as a marine fuel by 2024. Tammonia also offers a promising solution for export of sustainable green energy from remote locations with an abundance of wind, sun or geothermal energy to more metropolitan areas.

Owing to all these favorable reasons, in the long term, renewable ammonia is likely to become the main commodity for transporting renewable energy between continents.

There are several technologies being used to produce green ammonia, such as alkaline water electrolysis and proton exchange membrane electrolysis techniques. Among them, solid oxide electrolysis (SOE) is considered the most efficient. Solid oxide electrolysis cells (SOECs) operate at high temperatures, typically ranging from 700°C to 900°C, and can achieve high conversion efficiencies.

Renewable ammonia synthesis from high-temperature electrolysis, specifically solid oxide electrolysis, typically consumes around 30 GJ per tons of ammonia. This energy consumption is expected to decrease to 26 GJ per ton in the long term, resulting in around a 60% to 70% energy conversion efficiency. The lower energy consumption, as compared to low-temperature electrolysis, is due to more efficient hydrogen ammonia production and greater heat integration across the process. This is due to the fact that high temperatures allow for the use of less expensive electrode materials and result in lower resistance and increased cell performance.

SOECs can also be operated in a reversible mode, which means they can switch between producing hydrogen and generating electricity depending on the demand for each. These prominent advantages are expected to contribute to the high preference for SOECs to produce green ammonia.

Analysis of the regional green ammonia market forecast reveals that Asia Pacific is estimated to dominate the global demand for green ammonia during the forecast period. China, Middle East and India are expected to be key markets in the next few years, due to high industrial activities and the presence of large-scale operating plants and several projects undergoing construction in these countries and sub-region.

North America also held a significant green ammonia market share in 2022. The can be attributed primarily to growing investment in bio-oil projects in the U.S.

Meanwhile, Australia, Brazil, and South Africa have emerged as a notable markets in the last few years. These countries and regions are actively investing in green ammonia for chemical feedstock and alternate renewable fuel.

The global green ammonia business is highly consolidated, with a small number of large-scale vendors controlling majority share and influencing the green ammonia market dynamics. Major companies are investing significantly in comprehensive research and development activities, primarily to create environment-friendly products. Several key players are following the green ammonia market trends and collaborating strategically to accelerate product innovation and expand their business lines in regional and international markets.

The commercialization of green ammonia has further boosted revenue generation in the market, prompting leading players to expand their production units in untapped markets, particularly in developing countries. Yara International, Siemens Energy, MAN Energy Solutions, Greenko, and ITM Power are the key entities operating in the market.

In the green ammonia industry research report, key players have been profiled based on various parameters such as company overview, business strategies, product portfolio, financial overview, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 48.6 Mn |

|

Market Forecast Value in 2031 |

US$ 8.1 Bn |

|

Growth Rate (CAGR) |

76.3 % |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2021 |

|

Quantitative Units |

US$ Mn/Bn for Value & Kilo Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Green Ammonia market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 48.6 Mn in 2022

It is expected to grow at a CAGR of 76.3% from 2023 to 2031

Increased demand for sustainable fertilizers and ease of storage and transportation

Solid oxide electrolysis was the largest technology segment and its value is anticipated to grow at a CAGR of 76.3% during the forecast period

Asia Pacific was the most lucrative region and held major share of the global green ammonia business in 2022

Yara International, Siemens Energy, MAN Energy Solutions, Greenko, and ITM Power

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Green Ammonia Market Analysis and Forecasts, 2022-2031

2.6.1. Global Green Ammonia Market Volume (Kilo Tons)

2.6.2. Global Green Ammonia Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Green Ammonia

3.2. Impact on the Demand of Green Ammonia– Pre & Post Crisis

4. Production Output Analysis (Kilo Tons), 2021

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East and Africa˙

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2022-2031

6.1. Price Trend Analysis by Technology

6.2. Price Trend Analysis by Region

7. Green Ammonia Market Analysis and Forecast, by Technology, 2022–2031

7.1. Introduction and Definitions

7.2. Global Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

7.2.1. Solid Oxide Electrolysis

7.2.2. Proton Exchange Membrane Electrolysis

7.2.3. Alkaline Water Electrolysis

7.3. Global Green Ammonia Market Attractiveness, by Technology

8. Global Green Ammonia Market Analysis and Forecast, by End-use, 2022–2031

8.1. Introduction and Definitions

8.2. Global Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

8.2.1. Fertilizer

8.2.2. Power Generation

8.2.3. Transportation

8.2.4. Refrigeration

8.2.5. Others

8.3. Global Green Ammonia Market Attractiveness, by End-use

9. Global Green Ammonia Market Analysis and Forecast, by Region, 2022–2031

9.1. Key Findings

9.2. Global Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2022–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Green Ammonia Market Attractiveness, by Region

10. North America Green Ammonia Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. North America Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

10.3. North America Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

10.4. North America Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2022–2031

10.4.1. U.S. Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

10.4.2. U.S. Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

10.4.3. Canada Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

10.4.4. Canada Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

10.5. North America Green Ammonia Market Attractiveness Analysis

11. Europe Green Ammonia Market Analysis and Forecast, 2022–2031

11.1. Key Findings

11.2. Europe Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

11.3. Europe Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

11.4. Europe Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

11.4.1. Germany Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

11.4.2. Germany. Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

11.4.3. France Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

11.4.4. France. Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

11.4.5. U.K. Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

11.4.6. U.K. Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

11.4.7. Italy Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

11.4.8. Italy Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

11.4.9. Russia & CIS Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

11.4.10. Russia & CIS Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

11.4.11. Rest of Europe Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

11.4.12. Rest of Europe Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

11.5. Europe Green Ammonia Market Attractiveness Analysis

12. Asia Pacific Green Ammonia Market Analysis and Forecast, 2022–2031

12.1. Key Findings

12.2. Asia Pacific Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology

12.3. Asia Pacific Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

12.4. Asia Pacific Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

12.4.1. China Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

12.4.2. China Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

12.4.3. Japan Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

12.4.4. Japan Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

12.4.5. India Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

12.4.6. India Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

12.4.7. ASEAN Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

12.4.8. ASEAN Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

12.4.9. Rest of Asia Pacific Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

12.4.10. Rest of Asia Pacific Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

12.5. Asia Pacific Green Ammonia Market Attractiveness Analysis

13. Latin America Green Ammonia Market Analysis and Forecast, 2022–2031

13.1. Key Findings

13.2. Latin America Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

13.3. Latin America Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

13.4. Latin America Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

13.4.1. Brazil Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

13.4.2. Brazil Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

13.4.3. Mexico Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

13.4.4. Mexico Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

13.4.5. Rest of Latin America Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

13.4.6. Rest of Latin America Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

13.5. Latin America Green Ammonia Market Attractiveness Analysis

14. Middle East & Africa Green Ammonia Market Analysis and Forecast, 2022–2031

14.1. Key Findings

14.2. Middle East & Africa Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

14.3. Middle East & Africa Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

14.4. Middle East & Africa Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

14.4.1. GCC Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

14.4.2. GCC Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

14.4.3. South Africa Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

14.4.4. South Africa Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

14.4.5. Rest of Middle East & Africa Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2022–2031

14.4.6. Rest of Middle East & Africa Green Ammonia Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

14.5. Middle East & Africa Green Ammonia Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Green Ammonia Company Market Share Analysis, 2021

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Yara International

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.2. Siemens Energy

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.3. MAN Energy Solutions

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.4. thyssenkrupp

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.5. Haldor Topsoe

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.6. Greenko

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.7. ACME Group

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.8. CF Industries

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.9. Jakson Green

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.10. Hyphen Hydrogen

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.11. ITM Power

15.2.11.1. Company Revenue

15.2.11.2. Business Overview

15.2.11.3. Product Segments

15.2.11.4. Geographic Footprint

15.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.12. Nel Hydrogen Solutions

15.2.12.1. Company Revenue

15.2.12.2. Business Overview

15.2.12.3. Product Segments

15.2.12.4. Geographic Footprint

15.2.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.13. Others

15.2.13.1. Company Revenue

15.2.13.2. Business Overview

15.2.13.3. Product Segments

15.2.13.4. Geographic Footprint

15.2.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 2: Global Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 3: Global Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 4: Global Green Ammonia Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 5: Global Green Ammonia Market Volume (Kilo Tons) Forecast, by Region, 2022–2031

Table 6: Global Green Ammonia Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 7: North America Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 8: North America Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 9: North America Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 10: North America Green Ammonia Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 11: North America Green Ammonia Market Volume (Kilo Tons) Forecast, by Country, 2022–2031

Table 12: North America Green Ammonia Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 13: U.S. Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 14: U.S. Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 15: U.S. Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 16: U.S. Green Ammonia Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 17: Canada Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 18: Canada Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 19: Canada Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 20: Canada Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 21: Europe Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 22: Europe Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 23: Europe Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 24: Europe Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 25: Europe Green Ammonia Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 26: Europe Green Ammonia Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 27: Germany Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 28: Germany Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 29: Germany Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 30: Germany Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 31: France Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 32: France Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 33: France Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 34: France Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 35: U.K. Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 36: U.K. Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 37: U.K. Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 38: U.K. Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 39: Italy Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 40: Italy Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 41: Italy Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 42: Italy Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 43: Spain Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 44: Spain Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 45: Spain Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 46: Spain Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 47: Russia & CIS Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 48: Russia & CIS Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 49: Russia & CIS Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 50: Russia & CIS Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 51: Rest of Europe Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 52: Rest of Europe Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 53: Rest of Europe Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 54: Rest of Europe Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 55: Asia Pacific Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 56: Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 57: Asia Pacific Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 58: Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 59: Asia Pacific Green Ammonia Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 60: Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 61: China Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 62: China Green Ammonia Market Value (US$ Mn) Forecast, by Technology 2022–2031

Table 63: China Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 64: China Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 65: Japan Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 66: Japan Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 67: Japan Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 68: Japan Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 69: India Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 70: India Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 71: India Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 72: India Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 73: ASEAN Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 74: ASEAN Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 75: ASEAN Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 76: ASEAN Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 77: Rest of Asia Pacific Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 78: Rest of Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 79: Rest of Asia Pacific Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 80: Rest of Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 81: Latin America Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 82: Latin America Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 83: Latin America Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 84: Latin America Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 85: Latin America Green Ammonia Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 86: Latin America Green Ammonia Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 87: Brazil Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 88: Brazil Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 89: Brazil Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 90: Brazil Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 91: Mexico Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 92: Mexico Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 93: Mexico Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 94: Mexico Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 95: Rest of Latin America Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 96: Rest of Latin America Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 97: Rest of Latin America Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 98: Rest of Latin America Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 99: Middle East & Africa Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 100: Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 101: v Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 102: Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 103: Middle East & Africa Green Ammonia Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 104: Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 105: GCC Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 106: GCC Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 107: GCC Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 108: GCC Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 109: South Africa Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 110: South Africa Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 111: South Africa Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 112: South Africa Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 113: Rest of Middle East & Africa Green Ammonia Market Volume (Kilo Tons) Forecast, by Technology, 2022–2031

Table 114: Rest of Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2022–2031

Table 115: Rest of Middle East & Africa Green Ammonia Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 116: Rest of Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2022–2031

List of Figures

Figure 1: Global Green Ammonia Market Volume Share Analysis, by Technology, 2021, 2027, and 2031

Figure 2: Global Green Ammonia Market Attractiveness, by Technology

Figure 3: Global Green Ammonia Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 4: Global Green Ammonia Market Attractiveness, by End-use

Figure 5: Global Green Ammonia Market Volume Share Analysis, by Region, 2021, 2027, and 2031

Figure 6: Global Green Ammonia Market Attractiveness, by Region

Figure 7: North America Green Ammonia Market Volume Share Analysis, by Technology, 2021, 2027, and 2031

Figure 8: North America Green Ammonia Market Attractiveness, by Technology

Figure 9: North America Green Ammonia Market Attractiveness, by Technology

Figure 10: North America Green Ammonia Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 11: North America Green Ammonia Market Attractiveness, by End-use

Figure 12: North America Green Ammonia Market Attractiveness, by Country and Sub-region

Figure 13: Europe Green Ammonia Market Volume Share Analysis, by Technology, 2021, 2027, and 2031

Figure 14: Europe Green Ammonia Market Attractiveness, by Technology

Figure 15: Europe Green Ammonia Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 16: Europe Green Ammonia Market Attractiveness, by End-use

Figure 17: Europe Green Ammonia Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 18: Europe Green Ammonia Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Green Ammonia Market Volume Share Analysis, by Technology, 2021, 2027, and 2031

Figure 20: Asia Pacific Green Ammonia Market Attractiveness, by Technology

Figure 21: Asia Pacific Green Ammonia Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 22: Asia Pacific Green Ammonia Market Attractiveness, by End-use

Figure 23: Asia Pacific Green Ammonia Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 24: Asia Pacific Green Ammonia Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Green Ammonia Market Volume Share Analysis, by Technology, 2021, 2027, and 2031

Figure 26: Latin America Green Ammonia Market Attractiveness, by Technology

Figure 27: Latin America Green Ammonia Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 28: Latin America Green Ammonia Market Attractiveness, by End-use

Figure 29: Latin America Green Ammonia Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 30: Latin America Green Ammonia Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Green Ammonia Market Volume Share Analysis, by Technology, 2021, 2027, and 2031

Figure 32: Middle East & Africa Green Ammonia Market Attractiveness, by Technology

Figure 33: Middle East & Africa Green Ammonia Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 34: Middle East & Africa Green Ammonia Market Attractiveness, by End-use

Figure 35: Middle East & Africa Green Ammonia Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 36: Middle East & Africa Green Ammonia Market Attractiveness, by Country and Sub-region