Insights and Predictions From the Recruiters, HR Professionals, and Talent Acquisition Experts on the Front Lines of the Job Market Today

Job Market Overview

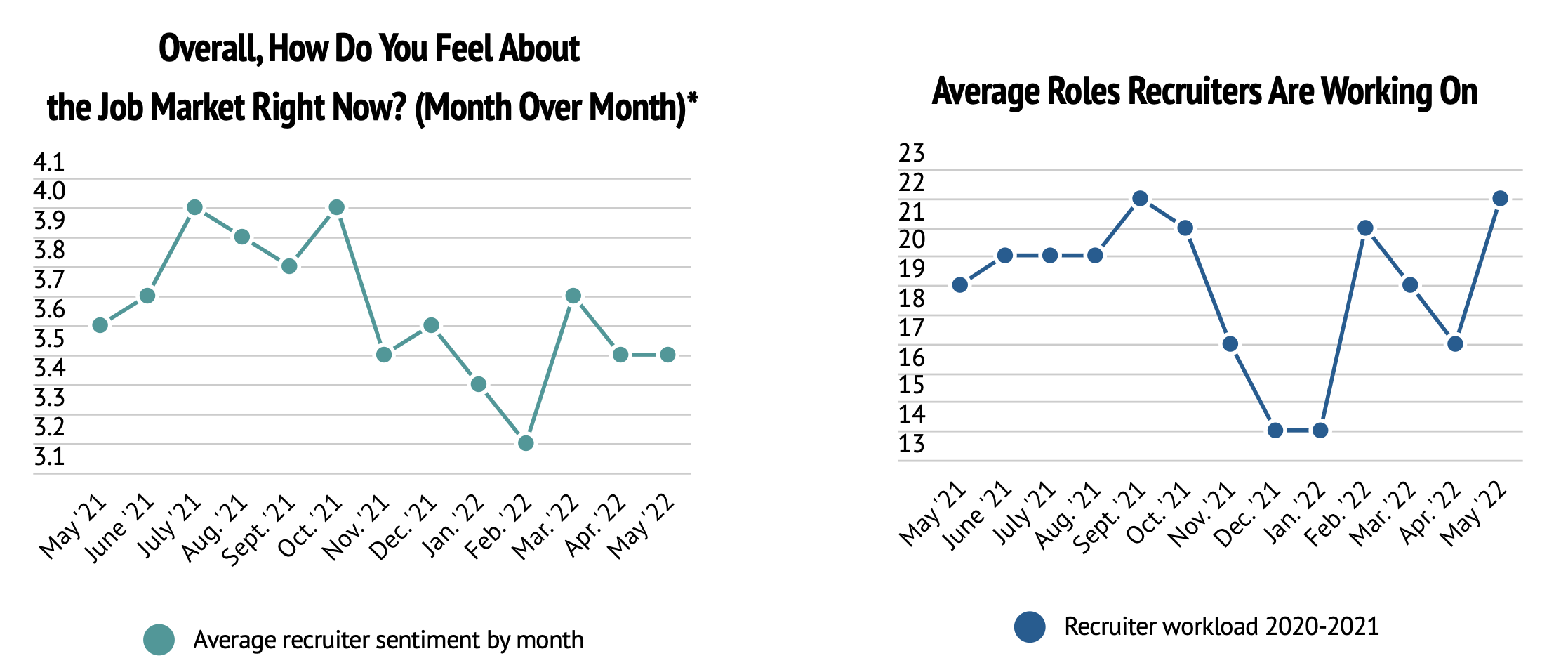

The average recruiter sentiment held steady this month just shy of where it was this time last year. The average amount of roles recruiters are working on saw a sharp increase this month, jumping from 17 roles to 22 roles.

Candidate Close Up

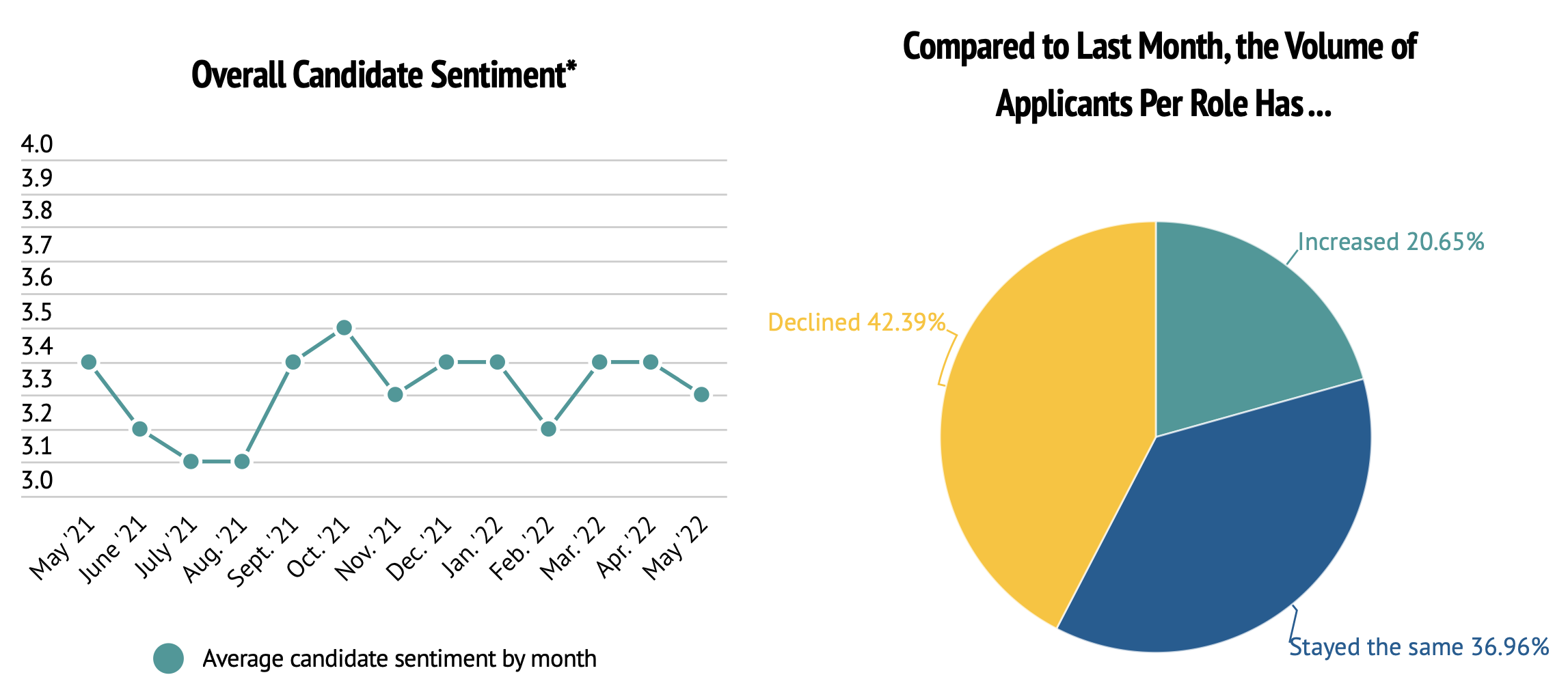

Candidate sentiment took a slight dip in May, failing to break past a 3.4 all year. The majority of recruiters reported applicant volume decreasing this month, increasing 21 percent since April.

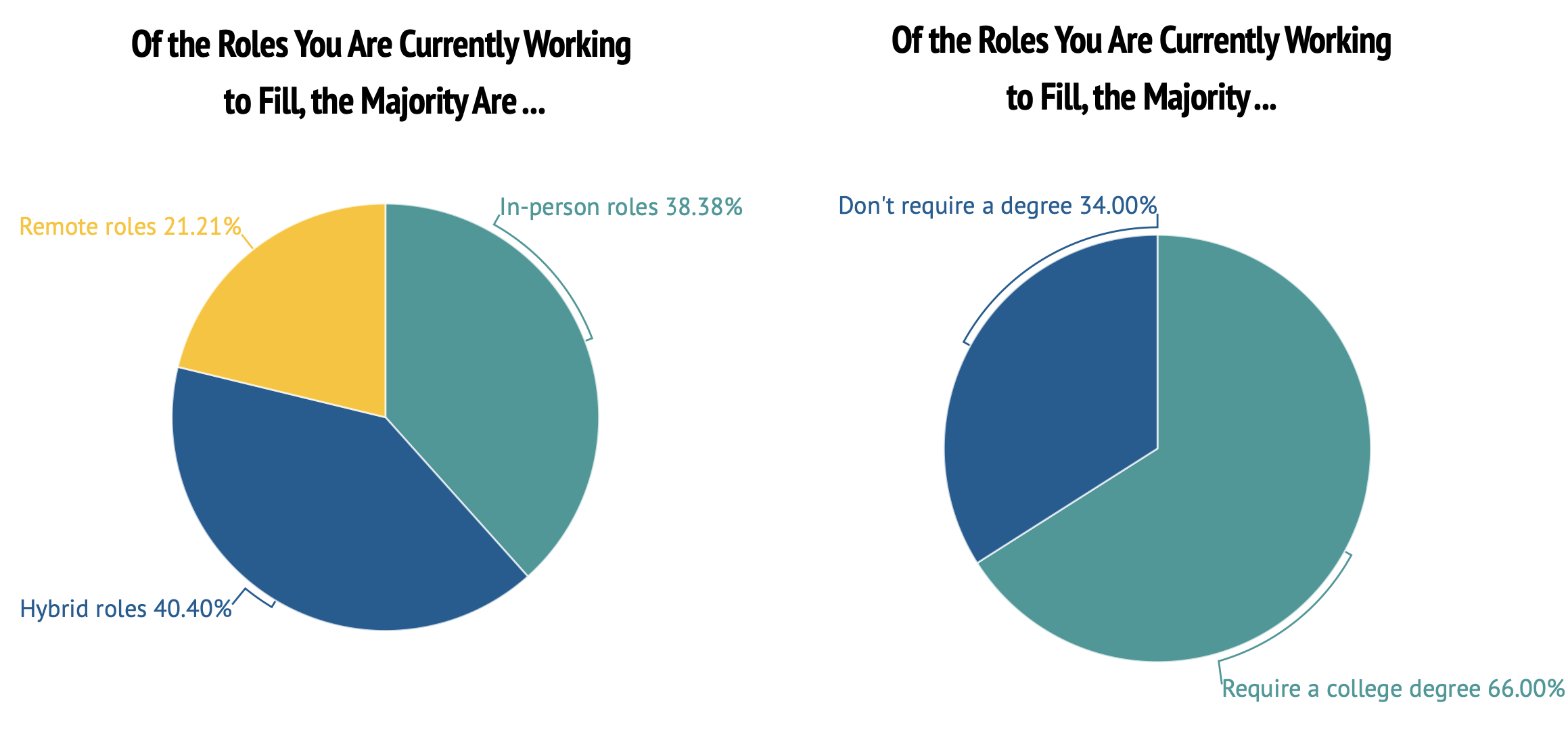

Remote roles continue to decrease as hybrid and in person roles pick up steam. Since January 2022, remote roles have decreased by 52 percent.

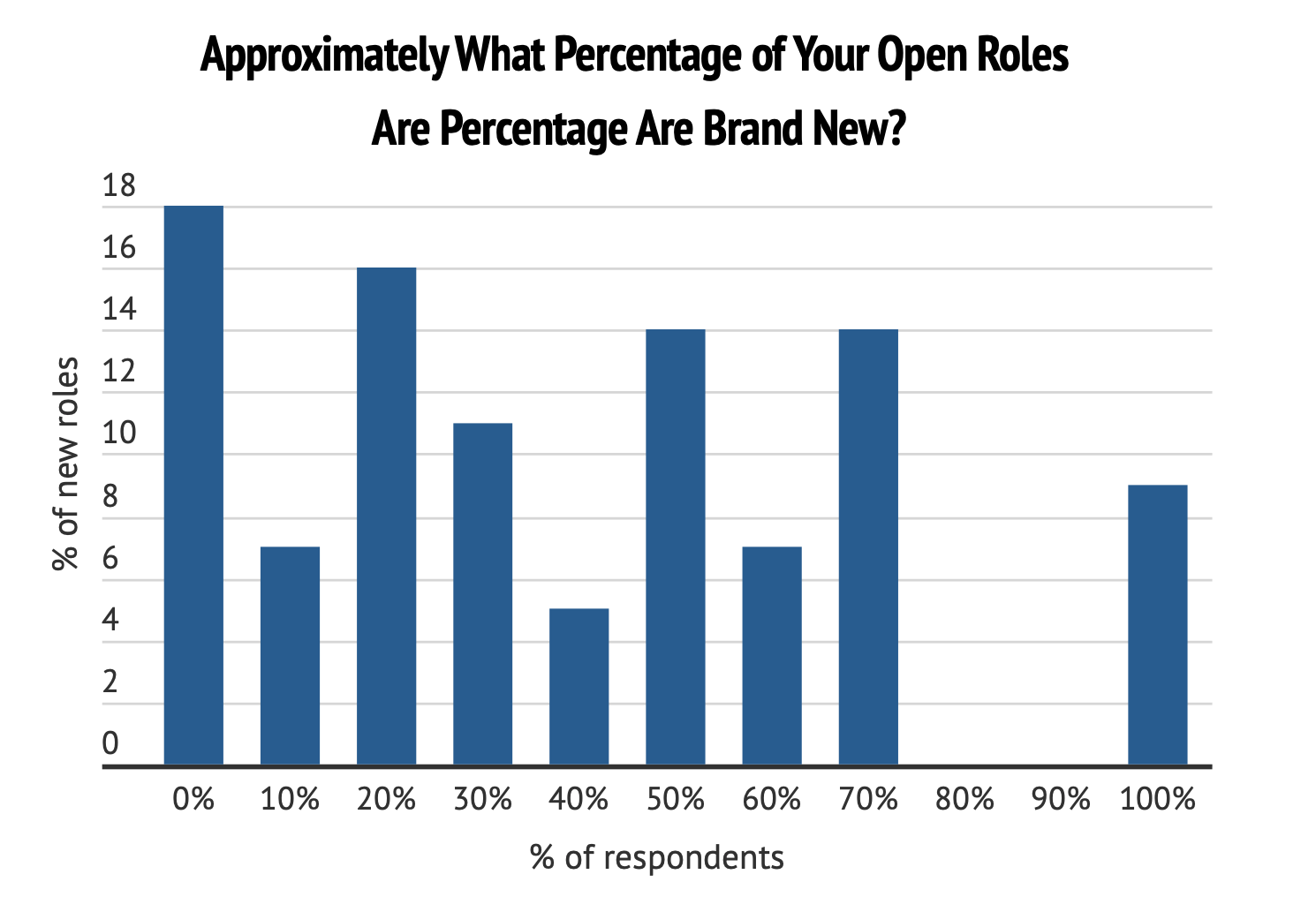

Our Recruiter Index tracks how many of the roles recruiters are working on are backfill vs. new roles. This month, 9 percent of recruiters said that 100 percent of their roles were brand new roles, down from 13 percent in April.

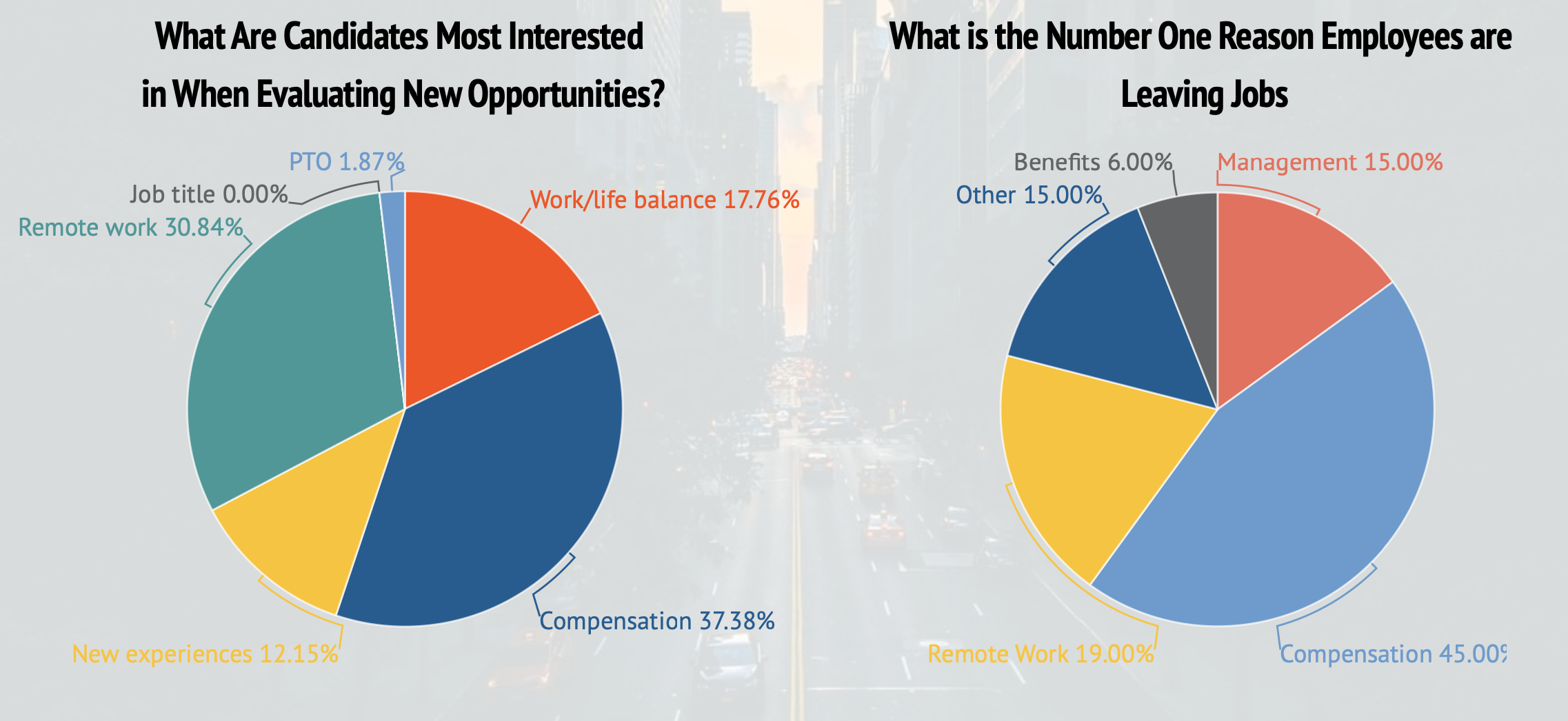

Compensation witnessed a large increase this month when it comes to priorities, increasing by 67 percent since March. In correlation, compensation was the number one reason employees are leaving their current jobs, followed by remote work.

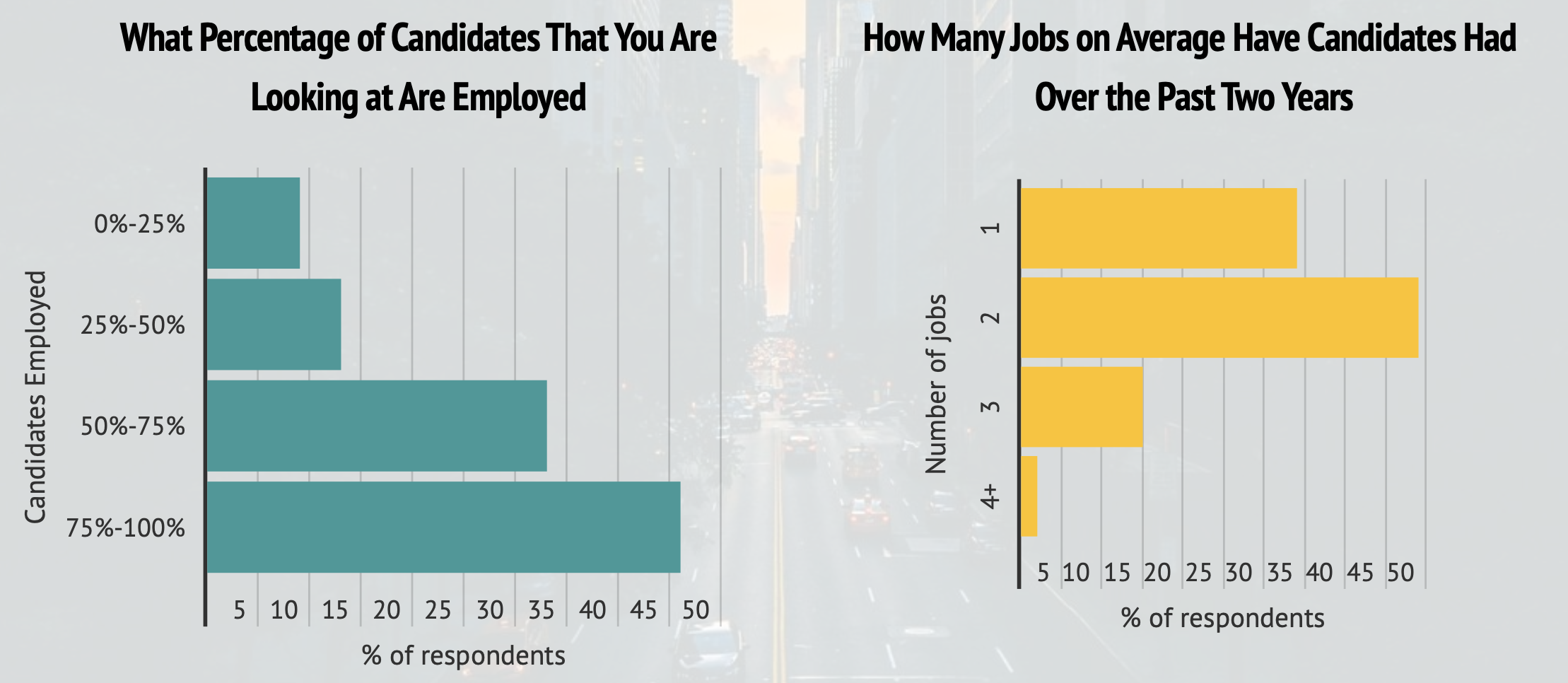

Nearly half of recruiters have reported candidates having two jobs over the past two years, and 15 percent have reported candidates having three jobs - showing that the job hopper economy is in full swing. Of the candidates, recruiters are working with, 46 percent reported 75-100 percent of the candidates they are interviewing are currently employed.

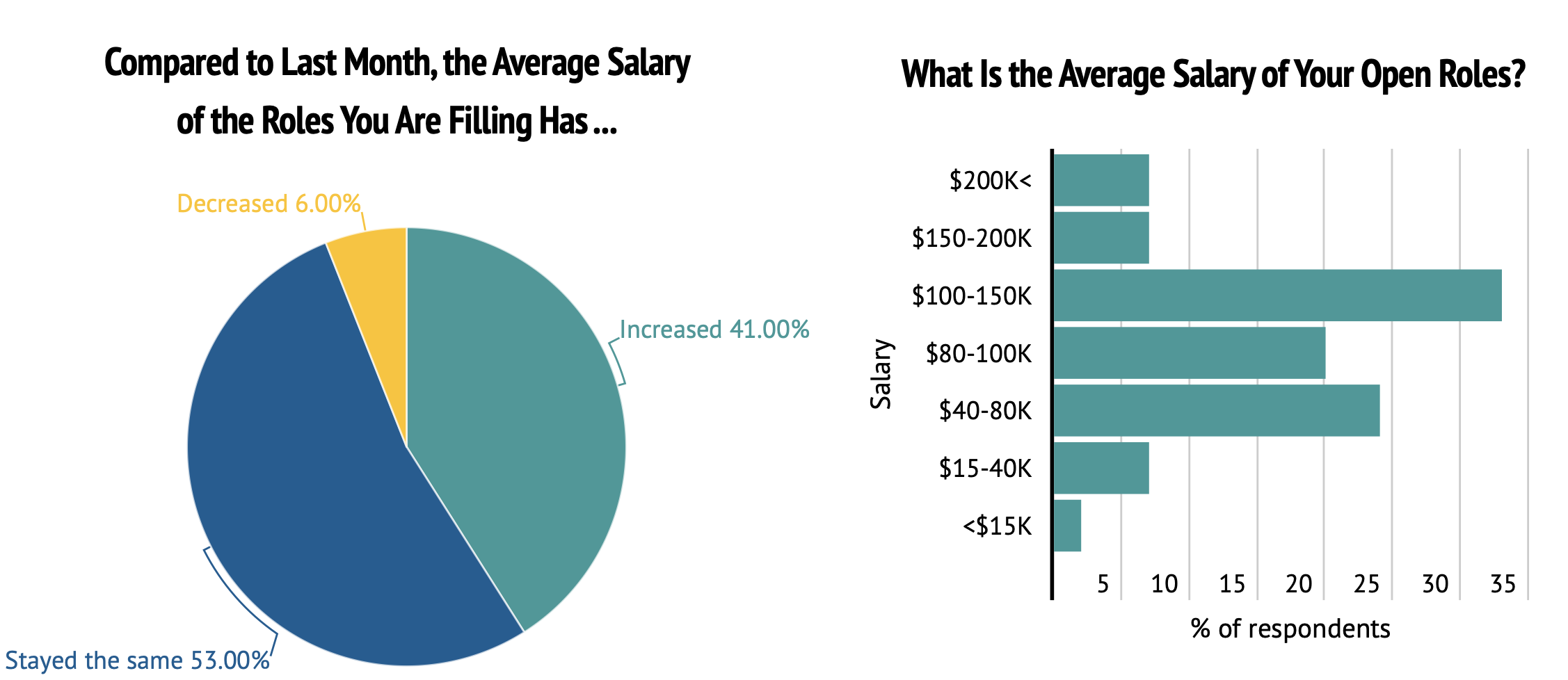

The majority of recruiters reported salaries remaining the same in May (53 percent), while 41 percent reported an increase in salaries. In terms of specific salary ranges, we saw increases in the ranges $40K-$80K (+6 percentage points), $80K-$100K (+2 percentage points), and $200K< (+2 percentage points).

Most Active Industries

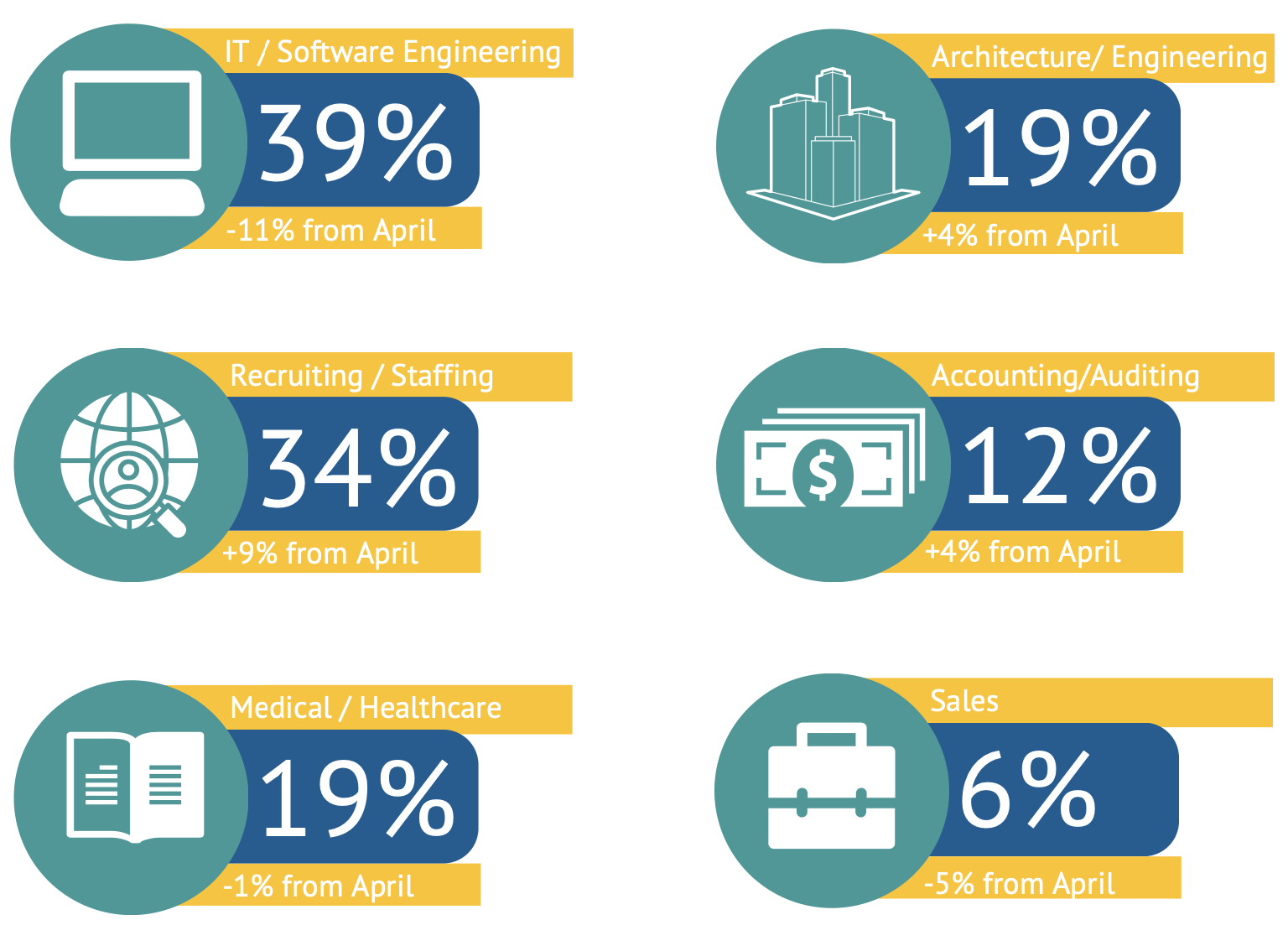

We asked recruiters across all verticals to identify the top three industries where demand for talent was highest in May.

IT / Software Engineering maintains the number one spot in May for the third month in a row.

Recruiting and staffing held on to its number two spot with 34 percent of recruiters naming it the most in demand industry. Following IT and Recruiting is Medical / Healthcare and Architecture.

Key Takeaways

-

The average recruiter worked on 22 open roles in May 2022, witnessing a sharp incline from 17 open roles in April.

-

The average recruiter sentiment by month is calculated by asking how recruiters feel about the current job market. This month it held steady at 3.5.

-

Candidate sentiment, a measure of how open candidates are to new roles, took a slight dip to 3.3.

-

Hybrid roles and in-person roles continued to overtake remote roles, with 40 percent of recruiters working on hybrid roles.

-

Remote roles have decreased by 52 percent since January 2022.

-

Only 9 percent of recruiters reported 100 percent of their roles being brand new.

-

Compensation witnessed a large increase this month when it comes to candidates' priorities, jumping 67 percent since March.

-

Compensation and remote work continue to be the top reasons employees are leaving their current jobs.

-

The recruiting/staffing industry remains one of the top industries in demand, holding steady at the number two spot.