On-chain Order Book (CLOB)

Zero Counterparty Risk

With DBOE, option buyers can trade with confidence knowing there's zero counterparty risk.

Non-custodial / Web3 principle

Our platform is non-custodial ensuring a secure and decentralised trading environment.

High Capital Efficiency

DBOE provides high capital efficiency for option sellers, maximising their potential returns.

Portfolio Margin

Portfolio margin is one component of DBOE ecosystem that is in the development phase as of now.

DBOE Academy/Paper Trading Environment

Enhance your options trading skills in a cost-free and risk-free practice environment designed.

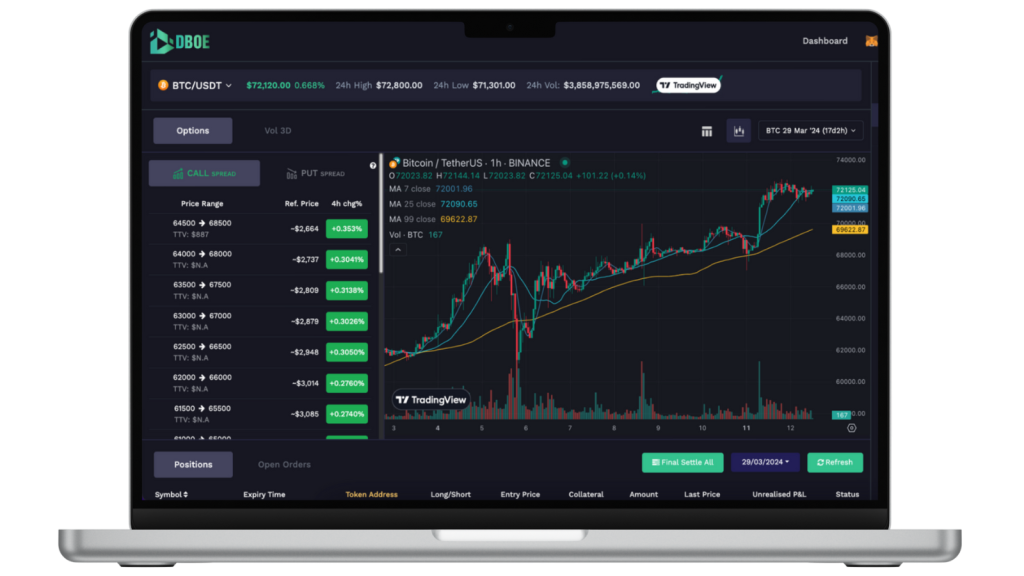

DBOE is a non-custodial decentralised exchange that offers an innovative European-Options trading platform within the crypto space. DBOE adopts a comprehensive approach by listing options on top market cap crypto assets such as BTC, ETH, SOL, LINK, MATIC, AVAX, and BNB. It integrates a fully on-chain Central Limit Order Book (CLOB) to ensure deep liquidity, facilitating efficient trading.

Furthermore, DBOE offers traders four distinct positions: Long Call, Long Put, Short Call, and Short Put Options. This provides traders with the flexibility to hedge against market volatility, speculate on price movements, and execute other sophisticated trading strategies.

DBOE distinguishes itself as a safe, secure, and cost-effective platform with zero counterparty risk. It provides users with a user-friendly interface, enabling them to engage in lightning-fast trades with minimal transaction fees.

DBOE Spot revolutionises cryptocurrency trading, allowing users to trade digital assets directly from their wallets, removing the need for intermediaries. By integrating CLOB technology, DBOE Spot combines blockchain’s decentralisation with the efficiency of a centralised order book, enabling transparent and secure trading directly on the blockchain.

Key Advantages:

DBOE Token Staking involves depositing your DBOE tokens into a safe and secure smart contract. Similar to depositing money into a savings account, you will receive interest as a return. There are multiple pools with different maturity dates for you to choose from. This service is designed to incentivize long-term vested interest among the community in the project, making it suitable for both retail and institutional investors.

Benefits of Staking at DBOE:

Certain tokens are considered ‘liquidity tokens’ by DBOE as they are either quoting or base tokens used on DBOE Spot platform. Currently, DBOE accepts USDT, USDC, LINK, WMATIC, WETH and XSGD as ‘Liquidity Tokens’. DBOE reserves the right to change this without notice in the future.

When users swap their liquidity tokens, they will receive “d-tokens” in their wallet with a ratio of 1 for 1. Users can then unswap on this platform after the minimum holding period to get back their original liquidity tokens and some DBOE points depending on their holding period and the amount of their liquidity token being swapped.

The benefits to DBOE is to deepen the liquidity depth the “Dedicated Market Making” (DMM) could provide and show to the market. However, benefits to the users are as follow:

DBOE offers token holders the right to vote on DBOE’s development. All token holders are empowered to partake in pivotal decision-making processes alongside the DBOE Board. This inclusive approach ensures that the community’s voice is heard and considered in shaping the future of DBOE.

Find more details here: https://dboe.gitbook.io/documentation/dboe/tokenomics

In 2022, we launched DBOE Academy as our first effort to promote understanding and use of blockchain and cryptocurrency among students and newcomers to the crypto world. With DBOE Academy, we believe that it’s important for people to learn about blockchain and crypto financial products to empower themselves and prepare for the future.

Through DBOE Academy, we offer free courses and webinars that teach the basics of blockchain and its transformative potential. Additionally, we provide a paper trading platform on the Mainnet where students can practise trading with our own paper currency. We cover the transaction fees directly for students, so there’s no cost or risk involved. Moreover, students who excel in this program have a chance to win attractive prizes.

DBOE is a non-custodial decentralised exchange that offers an innovative European-Options trading platform within the crypto space. DBOE adopts a comprehensive approach by listing options on top market cap crypto assets such as BTC, ETH, SOL, LINK, MATIC, AVAX, and BNB. It integrates a fully on-chain Central Limit Order Book (CLOB) to ensure deep liquidity, facilitating efficient trading.

Furthermore, DBOE offers traders four distinct positions: Long Call, Long Put, Short Call, and Short Put Options. This provides traders with the flexibility to hedge against market volatility, speculate on price movements, and execute other sophisticated trading strategies.

DBOE distinguishes itself as a safe, secure, and cost-effective platform with zero counterparty risk. It provides users with a user-friendly interface, enabling them to engage in lightning-fast trades with minimal transaction fees.

DBOE Spot revolutionises cryptocurrency trading, allowing users to trade digital assets directly from their wallets, removing the need for intermediaries. By integrating CLOB technology, DBOE Spot combines blockchain’s decentralisation with the efficiency of a centralised order book, enabling transparent and secure trading directly on the blockchain.

Key Advantages:

DBOE Token Staking involves depositing your DBOE tokens into a safe and secure smart contract. Similar to depositing money into a savings account, you will receive interest as a return. There are multiple pools with different maturity dates for you to choose from. This service is designed to incentivize long-term vested interest among the community in the project, making it suitable for both retail and institutional investors.

Benefits of Staking at DBOE:

Certain tokens are considered ‘liquidity tokens’ by DBOE as they are either quoting or base tokens used on DBOE Spot platform. Currently, DBOE accepts USDT, USDC, LINK, WMATIC, WETH and XSGD as ‘Liquidity Tokens’. DBOE reserves the right to change this without notice in the future.

When users swap their liquidity tokens, they will receive “d-tokens” in their wallet with a ratio of 1 for 1. Users can then unswap on this platform after the minimum holding period to get back their original liquidity tokens and some DBOE points depending on their holding period and the amount of their liquidity token being swapped.

The benefits to DBOE is to deepen the liquidity depth the “Dedicated Market Making” (DMM) could provide and show to the market. However, benefits to the users are as follow:

DBOE offers token holders the right to vote on DBOE’s development. All token holders are empowered to partake in pivotal decision-making processes alongside the DBOE Board. This inclusive approach ensures that the community’s voice is heard and considered in shaping the future of DBOE.

Find more details here: https://dboe.gitbook.io/documentation/dboe/tokenomics

In 2022, we launched DBOE Academy as our first effort to promote understanding and use of blockchain and cryptocurrency among students and newcomers to the crypto world. With DBOE Academy, we believe that it’s important for people to learn about blockchain and crypto financial products to empower themselves and prepare for the future.

Through DBOE Academy, we offer free courses and webinars that teach the basics of blockchain and its transformative potential. Additionally, we provide a paper trading platform on the Mainnet where students can practise trading with our own paper currency. We cover the transaction fees directly for students, so there’s no cost or risk involved. Moreover, students who excel in this program have a chance to win attractive prizes.

Step 1

Select a chain from Chain List (other chains for live trading, Nautilus for paper trading).

Step 2

Use price chart and volatility chart to identify the market.

Step 3

Step 4

Enable Option, Enable USDT and Send Order

FOUNDER

TECH LEAD

HEAD OF BD

HEAD OF MARKETING

HEAD OF UX & STRATEGY

HEAD OF OPS

Active period:

May 2022 - Mar 2024

We are in closed Beta phase, please comeback later or SUBSCRIBE for latest updates!

We are in closed Beta phase, please comeback later or SUBSCRIBE for latest updates!