Analysts’ Viewpoint on Reusable/Washable Hygiene Products Market Scenario

Rise in awareness about personal hygiene and personal health has made people more conscious while purchasing products and commodities. Reusable feminine hygiene and incontinence products are environment-friendly and provide leakage protection. The market for reusable or washable hygiene items, including period pants and reusable party liners, is anticipated to grow significantly in the next few years. Companies in the market have been adopting novel technologies to produce reusable sanitary pads and diapers with high absorbency, usability, sustainability, and quality. They are offering impermeable, chlorine-free, and chemical fragrance-free pads and reusable/washable panty liners. The reusable/washable hygiene products market has been growing at a rapid pace since the last few years. Therefore, companies have been striving to incorporate more efficient reusable/washable absorbent materials in the production of reusable/washable hygiene products to gain more revenue opportunities.

Reusable/washable hygiene products are organic and eco-friendly versions of day-to-day hygiene absorbent products such as menstruation hygiene, adult incontinence, and baby diapers. These products can be washed and reused akin to any other clothing product. Rise in plastic landfills and increase in pollution due to higher usage of disposable diapers and sanitary products are expected to drive the demand for reusable/washable hygiene products in the next few years. Reusable/washable hygiene products are not only safer for the planet, but are also considered to be easy on the pockets of customers, as they possess a longer shelf-life. This is anticipated to drive the reusable/washable hygiene products market in the near future.

Request a sample to get extensive insights into the Reusable/Washable Hygiene Products Market

Up to 90% of the material used in single-use disposable sanitary napkins, which are disposed of in landfills, is plastic. Every year, India discards approximately 12.3 billion or 113,000 tons of used sanitary pads and diapers in landfills, adding to the country's plastic pollution. Reusable or washable hygiene goods such as washable feminine hygiene products are becoming more popular as long-lasting substitutes. Future business opportunities in reusable/washable hygiene products are being driven by the rise in demand for eco-friendly products around the world. According to the Women's Environmental Network, nearly 2 billion feminine hygiene products are flushed down the British toilets annually. Consumer interest in reusable sanitary protection items has increased over the last few years due to media campaigns highlighting the negative environmental effect of disposable tampons and pads. As a result, companies making sustainable menstrual products are striving to develop solutions that meet this demand. In 2020, 15% of women who were on their period chose to use green products. Additionally, governments of various countries have taken initiatives to encourage reusable/washable hygiene products manufacturers & suppliers to replace non-biodegradable products with ecologically friendly ones. UNICEF actively takes initiatives to raise awareness about washable feminine hygiene products in numerous cities and countries around the world.

Rise in concern related to health and hygiene among the people is a primary factor driving the demand for reusable or washable hygiene products. The monthly menstruation cycle is one of the major concerns related to women's health. Many businesses are now focusing on reusable or washable hygiene products such as period panties to provide women all over the world with better hygiene options. Furthermore, adults with urine incontinence use adult diapers. Aging population across the globe is expected to grow at an unprecedented rate in the next few years. This is anticipated to propel the demand for washable or reusable hygiene products such as adult diapers. Around 617 million (8.5%) of the world's population is 65 years of age or older. This is likely to increase to about 1.6 billion (17%) by 2050. The population of adults above the age of 65 has been rising primarily due to the decline in fertility rates and increase in life expectancy.

Request a custom report on Reusable/Washable Hygiene Products Market

In terms of product type, the global reusable/washable hygiene products market has been classified into feminine hygiene, adult incontinence, and baby diapers. The baby diapers segment is anticipated to dominate the global reusable/washable hygiene products market during the forecast period. However, demand for reusable feminine hygiene products is projected to rise at the fastest pace during the forecasted period. Demand for reusable/washable sanitary pads is increasing across the globe. In the feminine hygiene industry, single-use products such as tampons and sanitary pads have raised serious environmental concerns, resulting in a gradual shift toward reusable hygiene products. It has been found that disposable pads take around 500 years to biodegrade. Hundreds of millions of such menstrual hygiene products are sold annually across the globe. Hence, manufacturers in the global reusable/washable hygiene products market are considering various initiatives to reduce the hazardous impact of disposable hygiene products.

Cotton has been used in personal hygiene absorbent products since a long time. Bio-cotton is one of the commonly used insert materials that is grown and processed under stringent ecological conditions. Demand for cotton-based products is expected to rise at a rapid pace in the near future due to the benefits of cotton insert materials. The usage of hemp-based inserts in reusable adult incontinence products is also likely to increase, as hemp insert materials are known to possess excellent absorbent properties and fast drying ability.

Asia Pacific is the largest market for reusable/washable hygiene products in the world. Revenue of the reusable or washable hygiene products market in Asia Pacific is expected to be higher in underdeveloped regions than in developed regions. This can be ascribed to the larger population base in Asian countries and significantly wide options of sales channels for manufacturers.

The market in Europe is expected to grow during the forecast period due to high per capita income levels in the region combined with greater health concerns among the people. Technological improvements such as superabsorbent fiber technology, introduction of organic goods, and elimination of chemicals in reusable/washable hygiene products are also projected to drive the market in Europe during the forecast period. Middle East & Africa and South America are smaller markets with growing demand for reusable/washable hygiene products.

The global reusable/washable hygiene products market is fragmented, with the presence of several local brands that control majority of the share. Emergence of new players has led to innovations in reusable/washable hygiene products, thus driving research and development activities in the market. Prominent companies are investing significantly in comprehensive research and development activities, primarily to develop washable & reusable feminine hygiene kits, reusable personal hygiene products, etc. Mergers and acquisitions are some of the strategies adopted by key players. Beck's Classic Manufacturing Inc., Charlie Banana, GladRags Corporation, AFRIpads (U) Ltd., PANTYPROP INC, Zorbies Incontinence Underwear, Thinx, Inc., All Together Enterprises, Bambino Mio, and Saalt are some of the prominent entities operating in this market.

Each of these players has been profiled in the reusable/washable hygiene products market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

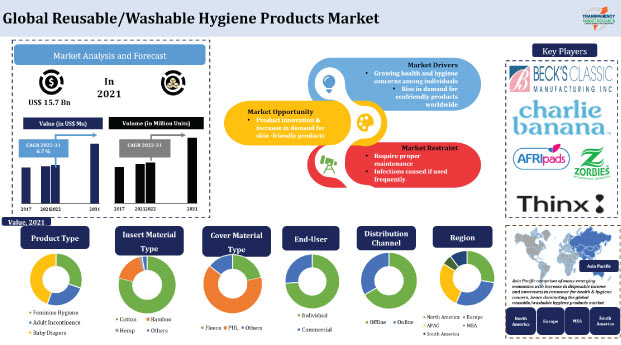

Market Size Value in 2021 |

US$ 15.7 Bn |

|

Market Forecast Value in 2031 |

US$ 29.9 Bn |

|

Growth Rate (CAGR) |

6.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global reusable/washable hygiene products market stood at US$ 15.7 Bn in 2021.

The global reusable/washable hygiene products market is estimated to grow at a CAGR of 6.7% during 2022-2031.

The global reusable/washable hygiene products market is likely to reach US$ 29.9 Bn by 2031.

The feminine hygiene segment is expected to grow at the fastest rate during the forecast period.

Asia Pacific is expected to hold the highest CAGR during the forecast period.

Rise in demand for eco-friendly products worldwide and growth in health and hygiene concerns among individuals.

Beck's Classic Manufacturing Inc., Charlie Banana, GladRags Corporation, AFRIpads (U) Ltd., PANTYPROP INC, Zorbies Incontinence Underwear, Thinx, Inc., All Together Enterprises, Bambino Mio, and Saalt.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Personal Hygiene Market

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Raw Material Analysis

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. COVID-19 Impact Analysis

5.9. Global Reusable/Washable Hygiene Products Market Analysis and Forecast, 2017- 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Million Units)

6. Global Reusable/Washable Hygiene Products Market Analysis and Forecast, by Product Type

6.1. Global Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Product Type, 2017- 2031

6.1.1. Feminine Hygiene

6.1.1.1. Reusable Sanitary Napkins

6.1.1.2. Menstrual Cups

6.1.1.3. Period Panties

6.1.2. Adult Incontinence

6.1.2.1. Diaper

6.1.2.2. Underwears

6.1.2.3. Bed & Chair Protection

6.1.3. Baby Diapers

6.2. Incremental Opportunity, by Product Type

7. Global Reusable/Washable Hygiene Products Market Analysis and Forecast, by Insert Material Type

7.1. Global Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Material Insert Material Type, 2017- 2031

7.1.1. Cotton

7.1.2. Bamboo

7.1.3. Hemp

7.1.4. Others (Zorb, Microfiber, etc.)

7.2. Incremental Opportunity, by Insert Material Type

8. Global Reusable/Washable Hygiene Products Market Analysis and Forecast, by Cover Material Type

8.1. Global Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Cover Material Type, 2017- 2031

8.1.1. Fleece

8.1.2. PUL

8.1.3. Others (Micro fleece, Suede cloth, etc.)

8.2. Incremental Opportunity, by Cover Material Type

9. Global Reusable/Washable Hygiene Products Market Analysis and Forecast, by End-User

9.1. Global Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by End-User, 2017- 2031

9.1.1. Individual

9.1.2. Commercial

9.1.2.1. Hospitals

9.1.2.2. Care Centres

9.1.2.3. Others

9.2. Incremental Opportunity, End-User

10. Global Reusable/Washable Hygiene Products Market Analysis and Forecast, by Distribution Channel

10.1. Global Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Distribution Channel, 2017- 2031

10.1.1. Online

10.1.2. Offline

10.1.2.1. Hypermarket/Supermarket

10.1.2.2. Pharmaceutical Stores

10.1.2.3. Others (Departmental Stores, Discount Stores, etc.)

10.2. Incremental Opportunity, by Distribution Channel

11. Global Reusable/Washable Hygiene Products Market Analysis and Forecast, by Region

11.1. Global Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Region, 2017- 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, by Region

12. North America Reusable/Washable Hygiene Products Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Consumer Buying Behaviour

12.4. Demographic Overview

12.5. Key Trends Analysis

12.5.1. Supply side

12.5.2. Demand Side

12.6. Price Trend Analysis

12.6.1. Weighted Average Selling Price (US$)

12.7. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Product Type, 2017- 2031

12.7.1. Feminine Hygiene

12.7.1.1. Reusable Sanitary Napkins

12.7.1.2. Menstrual Cups

12.7.1.3. Period Panties

12.7.2. Adult Incontinence

12.7.2.1. Diaper

12.7.2.2. Underwears

12.7.2.3. Bed & Chair Protection

12.7.3. Baby Diapers

12.8. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Material Insert Material Type, 2017- 2031

12.8.1. Cotton

12.8.2. Bamboo

12.8.3. Hemp

12.8.4. Others

12.9. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Cover Material Type, 2017- 2031

12.9.1. Fleece

12.9.2. PUL

12.9.3. Others

12.10. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by End-User, 2017- 2031

12.10.1. Individual

12.10.2. Commercial

12.10.2.1. Hospitals

12.10.2.2. Care Centres

12.10.2.3. Others

12.11. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Distribution Channel, 2017- 2031

12.11.1. Online

12.11.2. Offline

12.11.2.1. Hypermarket/Supermarket

12.11.2.2. Pharmaceutical Stores

12.11.2.3. Others (Departmental Stores, Discount Stores, etc.)

12.12. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Country, 2017- 2031

12.12.1. U.S.

12.12.2. Canada

12.12.3. Rest of North America

12.13. Incremental Opportunity Analysis

13. Europe Reusable/Washable Hygiene Products Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Consumer Buying Behaviour

13.4. Demographic Overview

13.5. Key Trends Analysis

13.5.1. Supply side

13.5.2. Demand Side

13.6. Price Trend Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Product Type, 2017- 2031

13.7.1. Feminine Hygiene

13.7.1.1. Reusable Sanitary Napkins

13.7.1.2. Menstrual Cups

13.7.1.3. Period Panties

13.7.2. Adult Incontinence

13.7.2.1. Diaper

13.7.2.2. Underwears

13.7.2.3. Bed & Chair Protection

13.7.3. Baby Diapers

13.8. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Material Insert Material Type, 2017- 2031

13.8.1. Cotton

13.8.2. Bamboo

13.8.3. Hemp

13.8.4. Others

13.9. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Cover Material Type, 2017- 2031

13.9.1. Fleece

13.9.2. PUL

13.9.3. Others

13.10. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by End-User, 2017- 2031

13.10.1. Individual

13.10.2. Commercial

13.10.2.1. Hospitals

13.10.2.2. Care Centres

13.10.2.3. Others

13.11. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Distribution Channel, 2017- 2031

13.11.1. Online

13.11.2. Offline

13.11.2.1. Hypermarket/Supermarket

13.11.2.2. Pharmaceutical Stores

13.11.2.3. Others (Departmental Stores, Discount Stores, etc.)

13.12. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Country, 2017- 2031

13.12.1. U.K.

13.12.2. Germany

13.12.3. France

13.12.4. Rest of Europe

13.13. Incremental Opportunity Analysis

14. Asia Pacific Reusable/Washable Hygiene Products Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Consumer Buying Behaviour

14.4. Demographic Overview

14.5. Key Trends Analysis

14.5.1. Supply side

14.5.2. Demand Side

14.6. Price Trend Analysis

14.6.1. Weighted Average Selling Price (US$)

14.7. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Product Type, 2017- 2031

14.7.1. Feminine Hygiene

14.7.1.1. Reusable Sanitary Napkins

14.7.1.2. Menstrual Cups

14.7.1.3. Period Panties

14.7.2. Adult Incontinence

14.7.2.1. Diaper

14.7.2.2. Underwears

14.7.2.3. Bed & Chair Protection

14.7.3. Baby Diapers

14.8. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Material Insert Material Type, 2017- 2031

14.8.1. Cotton

14.8.2. Bamboo

14.8.3. Hemp

14.8.4. Others

14.9. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Cover Material Type, 2017- 2031

14.9.1. Fleece

14.9.2. PUL

14.9.3. Others

14.10. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by End-User, 2017- 2031

14.10.1. Individual

14.10.2. Commercial

14.10.2.1. Hospitals

14.10.2.2. Care Centres

14.10.2.3. Others

14.11. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Distribution Channel, 2017- 2031

14.11.1. Online

14.11.2. Offline

14.11.2.1. Hypermarket/Supermarket

14.11.2.2. Pharmaceutical Stores

14.11.2.3. Others (Departmental Stores, Discount Stores, etc.)

14.12. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Country, 2017- 2031

14.12.1. China

14.12.2. India

14.12.3. Japan

14.12.4. Rest of Asia Pacific

14.13. Incremental Opportunity Analysis

15. Middle East & Africa Reusable/Washable Hygiene Products Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. Consumer Buying Behaviour

15.4. Demographic Overview

15.5. Key Trends Analysis

15.5.1. Supply side

15.5.2. Demand Side

15.6. Price Trend Analysis

15.6.1. Weighted Average Selling Price (US$)

15.7. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Product Type, 2017- 2031

15.7.1. Feminine Hygiene

15.7.1.1. Reusable Sanitary Napkins

15.7.1.2. Menstrual Cups

15.7.1.3. Period Panties

15.7.2. Adult Incontinence

15.7.2.1. Diaper

15.7.2.2. Underwears

15.7.2.3. Bed & Chair Protection

15.7.3. Baby Diapers

15.8. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Material Insert Material Type, 2017- 2031

15.8.1. Cotton

15.8.2. Bamboo

15.8.3. Hemp

15.8.4. Others

15.9. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Cover Material Type, 2017- 2031

15.9.1. Fleece

15.9.2. PUL

15.9.3. Others

15.10. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by End-User, 2017- 2031

15.10.1. Individual

15.10.2. Commercial

15.10.2.1. Hospitals

15.10.2.2. Care Centres

15.10.2.3. Others

15.11. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Distribution Channel, 2017- 2031

15.11.1. Online

15.11.2. Offline

15.11.2.1. Hypermarket/Supermarket

15.11.2.2. Pharmaceutical Stores

15.11.3. Others (Departmental Stores, Discount Stores, etc.)

15.12. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Country, 2017- 2031

15.12.1. GCC

15.12.2. South Africa

15.12.3. Rest of Middle East & Africa

15.13. Incremental Opportunity Analysis

16. South America Reusable/Washable Hygiene Products Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Brand Analysis

16.3. Consumer Buying Behaviour

16.4. Demographic Overview

16.5. Key Trends Analysis

16.5.1. Supply side

16.5.2. Demand Side

16.6. Price Trend Analysis

16.6.1. Weighted Average Selling Price (US$)

16.7. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Product Type, 2017- 2031

16.7.1. Feminine Hygiene

16.7.1.1. Reusable Sanitary Napkins

16.7.1.2. Menstrual Cups

16.7.1.3. Period Panties

16.7.2. Adult Incontinence

16.7.2.1. Diaper

16.7.2.2. Underwears

16.7.2.3. Bed & Chair Protection

16.7.3. Baby Diapers

16.8. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Material Insert Material Type, 2017- 2031

16.8.1. Cotton

16.8.2. Bamboo

16.8.3. Hemp

16.8.4. Others

16.9. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Cover Material Type, 2017- 2031

16.9.1. Fleece

16.9.2. PUL

16.9.3. Others

16.10. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by End-User, 2017- 2031

16.10.1. Individual

16.10.2. Commercial

16.10.2.1. Hospitals

16.10.2.2. Care Centres

16.10.2.3. Others

16.11. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Distribution Channel, 2017- 2031

16.11.1. Online

16.11.2. Offline

16.11.2.1. Hypermarket/Supermarket

16.11.2.2. Pharmaceutical Stores

16.11.2.3. Others (Departmental Stores, Discount Stores, etc.)

16.12. Reusable/Washable Hygiene Products Market Size (US$ Mn) (Million Units), by Country, 2017- 2031

16.12.1. Brazil

16.12.2. Rest of South America

16.13. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Competition Dashboard

17.2. Market Share Analysis % (2021)

17.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

17.3.1. Becks Classic Manufacturing Inc.

17.3.1.1. Company Overview

17.3.1.2. Product Portfolio

17.3.1.3. Financial Information

17.3.1.4. (Subject to Data Availability)

17.3.1.5. Business Strategies / Recent Developments

17.3.2. Charlie Banana

17.3.2.1. Company Overview

17.3.2.2. Product Portfolio

17.3.2.3. Financial Information

17.3.2.4. (Subject to Data Availability)

17.3.2.5. Business Strategies / Recent Developments

17.3.3. GladRags Corporation

17.3.3.1. Company Overview

17.3.3.2. Product Portfolio

17.3.3.3. Financial Information

17.3.3.4. (Subject to Data Availability)

17.3.3.5. Business Strategies / Recent Developments

17.3.4. AFRIpads (U) Ltd.

17.3.4.1. Company Overview

17.3.4.2. Product Portfolio

17.3.4.3. Financial Information

17.3.4.4. (Subject to Data Availability)

17.3.4.5. Business Strategies / Recent Developments

17.3.5. Pantyprop Inc.

17.3.5.1. Company Overview

17.3.5.2. Product Portfolio

17.3.5.3. Financial Information

17.3.5.4. (Subject to Data Availability)

17.3.5.5. Business Strategies / Recent Developments

17.3.6. Zorbies Incontinence Underwear

17.3.6.1. Company Overview

17.3.6.2. Product Portfolio

17.3.6.3. Financial Information

17.3.6.4. (Subject to Data Availability)

17.3.6.5. Business Strategies / Recent Developments

17.3.7. Thinx Inc.

17.3.7.1. Company Overview

17.3.7.2. Product Portfolio

17.3.7.3. Financial Information

17.3.7.4. (Subject to Data Availability)

17.3.7.5. Business Strategies / Recent Developments

17.3.8. All Together Enterprise

17.3.8.1. Company Overview

17.3.8.2. Product Portfolio

17.3.8.3. Financial Information

17.3.8.4. (Subject to Data Availability)

17.3.8.5. Business Strategies / Recent Developments

17.3.9. Bambino Mio

17.3.9.1. Company Overview

17.3.9.2. Product Portfolio

17.3.9.3. Financial Information

17.3.9.4. (Subject to Data Availability)

17.3.9.5. Business Strategies / Recent Developments

17.3.10. Saalt

17.3.10.1. Company Overview

17.3.10.2. Product Portfolio

17.3.10.3. Financial Information

17.3.10.4. (Subject to Data Availability)

17.3.10.5. Business Strategies / Recent Developments

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.1.1. Product Type

18.1.2. Material Type

18.1.3. End-User

18.1.4. Distribution Channel

18.1.5. Geography

18.2. Understanding the Buying Process of the Customers

18.3. Prevailing Market Risks

18.4. Preferred Sales & Marketing Strategy

List Of Tables

Table 1: Global Reusable/Washable Hygiene Products Market Value, by Product Type,US$ Mn, 2017-2031

Table 2: Global Reusable/Washable Hygiene Products Market Volume, by Product Type,Million Units,2017-2031

Table 3: Global Reusable/Washable Hygiene Products Market Value, by Insert Material Type, US$ Mn, 2017-2031

Table 4: Global Reusable/Washable Hygiene Products Market Volume, by Insert Material Type, Million Units,2017-2031

Table 5: Global Reusable/Washable Hygiene Products Market Value, by Cover Material Type, US$ Mn, 2017-2031

Table 6: Global Reusable/Washable Hygiene Products Market Volume, by Cover Material Type, Million Units,2017-2031

Table 7: Global Reusable/Washable Hygiene Products Market Value, by End-User, US$ Mn, 2017-2031

Table 8: Global Reusable/Washable Hygiene Products Market Volume, by End-User, Million Units,2017-2031

Table 9: Global Reusable/Washable Hygiene Products Market Value, by Distribution Channels$ Mn, 2017-2031

Table 10: Global Reusable/Washable Hygiene Products Market Volume, by Distribution Channel Million Units,2017-2031

Table 11: Global Reusable/Washable Hygiene Products Market Value, by Region, US$ Mn, 2017-2031

Table 12: Global Reusable/Washable Hygiene Products Market Volume, by Region, Million Units,2017-2031

Table 13: North America Reusable/Washable Hygiene Products Market Value, by Product Type,US$ Mn, 2017-2031

Table 14: North America Reusable/Washable Hygiene Products Market Volume, by Product Type,Million Units,2017-2031

Table 15: North America Reusable/Washable Hygiene Products Market Value, by Insert Material Type, US$ Mn, 2017-2031

Table 16: North America Reusable/Washable Hygiene Products Market Volume, by Insert Material Type, Million Units,2017-2031

Table 17: North America Reusable/Washable Hygiene Products Market Value, by Cover Material Type, US$ Mn, 2017-2031

Table 18: North America Reusable/Washable Hygiene Products Market Volume, by Cover Material Type, Million Units,2017-2031

Table 19: North America Reusable/Washable Hygiene Products Market Value, by End-User, US$ Mn, 2017-2031

Table 20: North America Reusable/Washable Hygiene Products Market Volume, by End-User, Million Units,2017-2031

Table 21: North America Reusable/Washable Hygiene Products Market Value, by Distribution channel US$ Mn, 2017-2031

Table 22: North America Reusable/Washable Hygiene Products Market Volume, by Distribution Channel Million Units,2017-2031

Table 23: North America Reusable/Washable Hygiene Products Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 24: North America Reusable/Washable Hygiene Products Market Volume, by Country/Sub-Region, Million Units,2017-2031

Table 25: Europe Reusable/Washable Hygiene Products Market Value, by Product Type,US$ Mn, 2017-2031

Table 26: Europe Reusable/Washable Hygiene Products Market Volume, by Product Type,Million Units,2017-2031

Table 27: Europe Reusable/Washable Hygiene Products Market Value, by Insert Material Type, US$ Mn, 2017-2031

Table 28: Europe Reusable/Washable Hygiene Products Market Volume, by Insert Material Type, Million Units,2017-2031

Table 29: Europe Reusable/Washable Hygiene Products Market Value, by Cover Material Type, US$ Mn, 2017-2031

Table 30: Europe Reusable/Washable Hygiene Products Market Volume, by Cover Material Type, Million Units,2017-2031

Table 31: Europe Reusable/Washable Hygiene Products Market Value, by End-User, US$ Mn, 2017-2031

Table 32: Europe Reusable/Washable Hygiene Products Market Volume, by End-User, Million Units,2017-2031

Table 33: Europe Reusable/Washable Hygiene Products Market Value, by Distribution channel US$ Mn, 2017-2031

Table 34: Europe Reusable/Washable Hygiene Products Market Volume, by Distribution Channel Million Units,2017-2031

Table 35: Europe Reusable/Washable Hygiene Products Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 36: Europe Reusable/Washable Hygiene Products Market Volume, by Country/Sub-Region, Million Units,2017-2031

Table 37: Asia Pacific Reusable/Washable Hygiene Products Market Value, by Product Type,US$ Mn, 2017-2031

Table 38: Asia Pacific Reusable/Washable Hygiene Products Market Volume, by Product Type,Million Units,2017-2031

Table 39: Asia Pacific Reusable/Washable Hygiene Products Market Value, by Insert Material Type, US$ Mn, 2017-2031

Table 40: Asia Pacific Reusable/Washable Hygiene Products Market Volume, by Insert Material Type, Million Units,2017-2031

Table 41: Asia Pacific Reusable/Washable Hygiene Products Market Value, by Cover Material Type, US$ Mn, 2017-2031

Table 42: Asia Pacific Reusable/Washable Hygiene Products Market Volume, by Cover Material Type, Million Units,2017-2031

Table 43: Asia Pacific Reusable/Washable Hygiene Products Market Value, by End-User, US$ Mn, 2017-2031

Table 44: Asia Pacific Reusable/Washable Hygiene Products Market Volume, by End-User, Million Units,2017-2031

Table 45: Asia Pacific Reusable/Washable Hygiene Products Market Value, by Distribution channel US$ Mn, 2017-2031

Table 46: Asia Pacific Reusable/Washable Hygiene Products Market Volume, by Distribution Channel Million Units,2017-2031

Table 47: Asia Pacific Reusable/Washable Hygiene Products Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 48: Asia Pacific Reusable/Washable Hygiene Products Market Volume, by Country/Sub-Region, Million Units,2017-2031

Table 49: MEA Reusable/Washable Hygiene Products Market Value, by Product Type,US$ Mn, 2017-2031

Table 50: MEA Reusable/Washable Hygiene Products Market Volume, by Product Type,Million Units,2017-2031

Table 51: MEA Reusable/Washable Hygiene Products Market Value, by Insert Material Type, US$ Mn, 2017-2031

Table 52: MEA Reusable/Washable Hygiene Products Market Volume, by Insert Material Type, Million Units,2017-2031

Table 53: MEA Reusable/Washable Hygiene Products Market Value, by Cover Material Type, US$ Mn, 2017-2031

Table 54: MEA Reusable/Washable Hygiene Products Market Volume, by Cover Material Type, Million Units,2017-2031

Table 55: MEA Reusable/Washable Hygiene Products Market Value, by End-User, US$ Mn, 2017-2031

Table 56: MEA Reusable/Washable Hygiene Products Market Volume, by End-User, Million Units,2017-2031

Table 57: MEA Reusable/Washable Hygiene Products Market Value, by Distribution channel US$ Mn, 2017-2031

Table 58: MEA Reusable/Washable Hygiene Products Market Volume, by Distribution Channel Million Units,2017-2031

Table 59: MEA Reusable/Washable Hygiene Products Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 60: MEA Reusable/Washable Hygiene Products Market Volume, by Country/Sub-Region, Million Units,2017-2031

Table 61: South America Reusable/Washable Hygiene Products Market Value, by Product Type,US$ Mn, 2017-2031

Table 62: South America Reusable/Washable Hygiene Products Market Volume, by Product Type,Million Units,2017-2031

Table 63: South America Reusable/Washable Hygiene Products Market Value, by Insert Material Type, US$ Mn, 2017-2031

Table 64: South America Reusable/Washable Hygiene Products Market Volume, by Insert Material Type, Million Units,2017-2031

Table 65: South America Reusable/Washable Hygiene Products Market Value, by Cover Material Type, US$ Mn, 2017-2031

Table 66: South America Reusable/Washable Hygiene Products Market Volume, by Cover Material Type, Million Units,2017-2031

Table 67: South America Reusable/Washable Hygiene Products Market Value, by End-User, US$ Mn, 2017-2031

Table 68: South America Reusable/Washable Hygiene Products Market Volume, by End-User, Million Units,2017-2031

Table 69: South America Reusable/Washable Hygiene Products Market Value, by Distribution channel US$ Mn, 2017-2031

Table 70: South America Reusable/Washable Hygiene Products Market Volume, by Distribution Channel Million Units,2017-2031

Table 71: South America Reusable/Washable Hygiene Products Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 72: South America Reusable/Washable Hygiene Products Market Volume, by Country/Sub-Region, Million Units,2017-2031

List Of Figures

Figure 1: Global Reusable/Washable Hygiene Products Market Value, by Product Type, US$ Mn, 2017-2031

Figure 2: Global Reusable/Washable Hygiene Products Market Volume, by Product Type, Million Units, 2017-2031

Figure 3: Global Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Product Type, 2021 - 2031

Figure 4: Global Reusable/Washable Hygiene Products Market Value, by Insert Material Type, US$ Mn, 2017-2031

Figure 5: Global Reusable/Washable Hygiene Products Market Volume, by Insert Material Type, Million Units, 2017-2031

Figure 6: Global Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Insert Material Type, 2021 - 2031

Figure 7: Global Reusable/Washable Hygiene Products Market Value, by Cover Material Type, US$ Mn, 2017-2031

Figure 8: Global Reusable/Washable Hygiene Products Market Volume, by Cover Material Type, Million Units, 2017-2031

Figure 9: Global Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Cover Material Type, 2021 - 2031

Figure 10: Global Reusable/Washable Hygiene Products Market Value, by End-User, US$ Mn, 2017-2031

Figure 11: Global Reusable/Washable Hygiene Products Market Volume, by End-User, Million Units, 2017-2031

Figure 12: Global Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by End-User, 2021 - 2031

Figure 13: Global Reusable/Washable Hygiene Products Market Value, by Distribution Channel US$ Mn, 2017-2031

Figure 14: Global Reusable/Washable Hygiene Products Market Volume, by Distribution Channel Million Units, 2017-2031

Figure 15: Global Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Distribution Channel2021 - 2031

Figure 16: Global Reusable/Washable Hygiene Products Market Value, by Region, US$ Mn, 2017-2031

Figure 17: Global Reusable/Washable Hygiene Products Market Volume, by Region, Million Units, 2017-2031

Figure 18: Global Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Region, 2021 - 2031

Figure 19: North America Reusable/Washable Hygiene Products Market Value, by Product Type, US$ Mn, 2017-2031

Figure 20: North America Reusable/Washable Hygiene Products Market Volume, by Product Type, Million Units, 2017-2031

Figure 21: North America Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Product Type, 2021 - 2031

Figure 22: North America Reusable/Washable Hygiene Products Market Value, by Insert Material Type, US$ Mn, 2017-2031

Figure 23: North America Reusable/Washable Hygiene Products Market Volume, by Insert Material Type, Million Units, 2017-2031

Figure 24: North America Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Insert Material Type, 2021 - 2031

Figure 25: North America Reusable/Washable Hygiene Products Market Value, by Cover Material Type, US$ Mn, 2017-2031

Figure 26: North America Reusable/Washable Hygiene Products Market Volume, by Cover Material Type, Million Units, 2017-2031

Figure 27: North America Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Cover Material Type, 2021 - 2031

Figure 28: North America Reusable/Washable Hygiene Products Market Value, by End-User, US$ Mn, 2017-2031

Figure 29: North America Reusable/Washable Hygiene Products Market Volume, by End-User, Million Units, 2017-2031

Figure 30: North America Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by End-User, 2021 - 2031

Figure 31: North America Reusable/Washable Hygiene Products Market Value, by Distribution Channel US$ Mn, 2017-2031

Figure 32: North America Reusable/Washable Hygiene Products Market Volume, by Distribution Channel Million Units, 2017-2031

Figure 33: North America Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Distribution Channel2021 - 2031

Figure 34: North America Reusable/Washable Hygiene Products Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 35: North America Reusable/Washable Hygiene Products Market Volume, by Country/Sub-Region, Million Units, 2017-2031

Figure 36: North America Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Country/Sub-Region, 2021 - 2031

Figure 37: Europe Reusable/Washable Hygiene Products Market Value, by Product Type, US$ Mn, 2017-2031

Figure 38: Europe Reusable/Washable Hygiene Products Market Volume, by Product Type, Million Units, 2017-2031

Figure 39: Europe Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Product Type, 2021 - 2031

Figure 40: Europe Reusable/Washable Hygiene Products Market Value, by Insert Material Type, US$ Mn, 2017-2031

Figure 41: Europe Reusable/Washable Hygiene Products Market Volume, by Insert Material Type, Million Units, 2017-2031

Figure 42: Europe Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Insert Material Type, 2021 - 2031

Figure 43: Europe Reusable/Washable Hygiene Products Market Value, by Cover Material Type, US$ Mn, 2017-2031

Figure 44: Europe Reusable/Washable Hygiene Products Market Volume, by Cover Material Type, Million Units, 2017-2031

Figure 45: Europe Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Cover Material Type, 2021 - 2031

Figure 46: Europe Reusable/Washable Hygiene Products Market Value, by End-User, US$ Mn, 2017-2031

Figure 47: Europe Reusable/Washable Hygiene Products Market Volume, by End-User, Million Units, 2017-2031

Figure 48: Europe Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by End-User, 2021 - 2031

Figure 49: Europe Reusable/Washable Hygiene Products Market Value, by Distribution Channel US$ Mn, 2017-2031

Figure 50: Europe Reusable/Washable Hygiene Products Market Volume, by Distribution Channel Million Units, 2017-2031

Figure 51: Europe Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Distribution Channel2021 - 2031

Figure 52: Europe Reusable/Washable Hygiene Products Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 53: Europe Reusable/Washable Hygiene Products Market Volume, by Country/Sub-Region, Million Units, 2017-2031

Figure 54: Europe Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Country/Sub-Region, 2021 - 2031

Figure 55: Asia Pacific Reusable/Washable Hygiene Products Market Value, by Product Type, US$ Mn, 2017-2031

Figure 56: Asia Pacific Reusable/Washable Hygiene Products Market Volume, by Product Type, Million Units, 2017-2031

Figure 57: Asia Pacific Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Product Type, 2021 - 2031

Figure 58: Asia Pacific Reusable/Washable Hygiene Products Market Value, by Insert Material Type, US$ Mn, 2017-2031

Figure 59: Asia Pacific Reusable/Washable Hygiene Products Market Volume, by Insert Material Type, Million Units, 2017-2031

Figure 60: Asia Pacific Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Insert Material Type, 2021 - 2031

Figure 61: Asia Pacific Reusable/Washable Hygiene Products Market Value, by Cover Material Type, US$ Mn, 2017-2031

Figure 62: Asia Pacific Reusable/Washable Hygiene Products Market Volume, by Cover Material Type, Million Units, 2017-2031

Figure 63: Asia Pacific Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Cover Material Type, 2021 - 2031

Figure 64: Asia Pacific Reusable/Washable Hygiene Products Market Value, by End-User, US$ Mn, 2017-2031

Figure 65: Asia Pacific Reusable/Washable Hygiene Products Market Volume, by End-User, Million Units, 2017-2031

Figure 66: Asia Pacific Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by End-User, 2021 - 2031

Figure 67: Asia Pacific Reusable/Washable Hygiene Products Market Value, by Distribution Channel US$ Mn, 2017-2031

Figure 68: Asia Pacific Reusable/Washable Hygiene Products Market Volume, by Distribution Channel Million Units, 2017-2031

Figure 69: Asia Pacific Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Distribution Channel2021 - 2031

Figure 70: Asia Pacific Reusable/Washable Hygiene Products Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 71: Asia Pacific Reusable/Washable Hygiene Products Market Volume, by Country/Sub-Region, Million Units, 2017-2031

Figure 72: Asia Pacific Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Country/Sub-Region, 2021 - 2031

Figure 73: MEA Reusable/Washable Hygiene Products Market Value, by Product Type, US$ Mn, 2017-2031

Figure 74: MEA Reusable/Washable Hygiene Products Market Volume, by Product Type, Million Units, 2017-2031

Figure 75: MEA Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Product Type, 2021 - 2031

Figure 76: MEA Reusable/Washable Hygiene Products Market Value, by Insert Material Type, US$ Mn, 2017-2031

Figure 77: MEA Reusable/Washable Hygiene Products Market Volume, by Insert Material Type, Million Units, 2017-2031

Figure 78: MEA Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Insert Material Type, 2021 - 2031

Figure 79: MEA Reusable/Washable Hygiene Products Market Value, by Cover Material Type, US$ Mn, 2017-2031

Figure 80: MEA Reusable/Washable Hygiene Products Market Volume, by Cover Material Type, Million Units, 2017-2031

Figure 81: MEA Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Cover Material Type, 2021 - 2031

Figure 82: MEA Reusable/Washable Hygiene Products Market Value, by End-User, US$ Mn, 2017-2031

Figure 83: MEA Reusable/Washable Hygiene Products Market Volume, by End-User, Million Units, 2017-2031

Figure 84: MEA Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by End-User, 2021 - 2031

Figure 85: MEA Reusable/Washable Hygiene Products Market Value, by Distribution Channel US$ Mn, 2017-2031

Figure 86: MEA Reusable/Washable Hygiene Products Market Volume, by Distribution Channel Million Units, 2017-2031

Figure 87: MEA Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Distribution Channel2021 - 2031

Figure 88: MEA Reusable/Washable Hygiene Products Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 89: MEA Reusable/Washable Hygiene Products Market Volume, by Country/Sub-Region, Million Units, 2017-2031

Figure 90: MEA Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Country/Sub-Region, 2021 - 2031

Figure 91: South America Reusable/Washable Hygiene Products Market Value, by Product Type, US$ Mn, 2017-2031

Figure 92: South America Reusable/Washable Hygiene Products Market Volume, by Product Type, Million Units, 2017-2031

Figure 93: South America Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Product Type, 2021 - 2031

Figure 94: South America Reusable/Washable Hygiene Products Market Value, by Insert Material Type, US$ Mn, 2017-2031

Figure 95: South America Reusable/Washable Hygiene Products Market Volume, by Insert Material Type, Million Units, 2017-2031

Figure 96: South America Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Insert Material Type, 2021 - 2031

Figure 97: South America Reusable/Washable Hygiene Products Market Value, by Cover Material Type, US$ Mn, 2017-2031

Figure 98: South America Reusable/Washable Hygiene Products Market Volume, by Cover Material Type, Million Units, 2017-2031

Figure 99: South America Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Cover Material Type, 2021 - 2031

Figure 100: South America Reusable/Washable Hygiene Products Market Value, by End-User, US$ Mn, 2017-2031

Figure 101: South America Reusable/Washable Hygiene Products Market Volume, by End-User, Million Units, 2017-2031

Figure 102: South America Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by End-User, 2021 - 2031

Figure 103: South America Reusable/Washable Hygiene Products Market Value, by Distribution Channel US$ Mn, 2017-2031

Figure 104: South America Reusable/Washable Hygiene Products Market Volume, by Distribution Channel Million Units, 2017-2031

Figure 105: South America Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Distribution Channel2021 - 2031

Figure 106: South America Reusable/Washable Hygiene Products Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 107: South America Reusable/Washable Hygiene Products Market Volume, by Country/Sub-Region, Million Units, 2017-2031

Figure 108: South America Reusable/Washable Hygiene Products Market Incremental Opportunity Analysis, by Country/Sub-Region, 2021 - 2031