Silver Elephant mined and trucked its first shipment of Paca silver oxide materials to Andean Precious Metals. Congratulations!

Silver Elephant's Paca project is located in Potosi, Bolivia, 107 km northeast of the San Cristobal silver mine, 171 km southwest of New Pacific’s Silver Sands discovery, and 180km from Andean Precious Metals' Manquiri project.

Silver Elephant’s Pulacayo project is located in Potosi, Bolivia, 107 km northeast of the San Cristobal silver mine, 171 km southwest of New Pacific’s Silver Sands discovery, and 139 km north of Pan American Silver’s San Vicente silver mine.

The Pulacayo project consists of the Pulacayo deposit and the Paca deposit (7km north of the Pulacayo deposit).

Silver Elephant's 100% controlled Pulacayo Project is located in Bolivia, South America. The Project hosts a NI 43-101 Indicated resource of 48Mt @ 69g/t Ag, 1.3% Zn, 0.7% Pb (Resource Estimate prepared by Mercator Geological Services on October 2020).

| Pulacayo Project Resource Estimate Oct 13, 2020* | |||||

| Deposit | Category | k Tonnes | Ag M oz | Zn M lbs | Pb M lbs |

| Pulacayo | Indicated | 26,350 | 70.2 | 903.7 | 386.0 |

| Inferred | 1,670 | 7.2 | 71.8 | 18.4 | |

| Paca | Indicated | 21,690 | 37.0 | 485.8 | 304.2 |

| Inferred | 3,395 | 6.0 | 51.1 | 43.7 | |

| Total | Indicated | 48,040 | 106.7 | 1,384.7 | 690.2 |

| Inferred | 5,065 | 13.1 | 122.8 | 61.9 | |

The NI 43-101 report by Mercator estimates a resource of over 1 million tonnes of high-grade silver in oxide form, from surface to 30m deep grading over 200g/t. Silver Elephant is working on district-scale environmental permitting to allow mining operations of up to 50,000 tonnes per day at Pulacayo and Paca. Numerous prospective targets with mineralization expressions have been identified at the Pulacayo project. The Company has commenced activities to explore these areas.

| Zone | Category | Tonnes | Ag g/t | Ag Moz | Zn % | Pb % | |

| Phase 1 | Oxide (In-pit) | Indicated | 800,000 | 231 | 5.9 | ||

| Inferred | 235,000 | 159 | 1.2 | ||||

| Phase 2 | Sulfide (In-pit) | Indicated | 1,810,000 | 256 | 14.9 | 1.22 | 1.22 |

| Inferred | 190,000 | 338 | 2.1 | 0.61 | 0.98 |

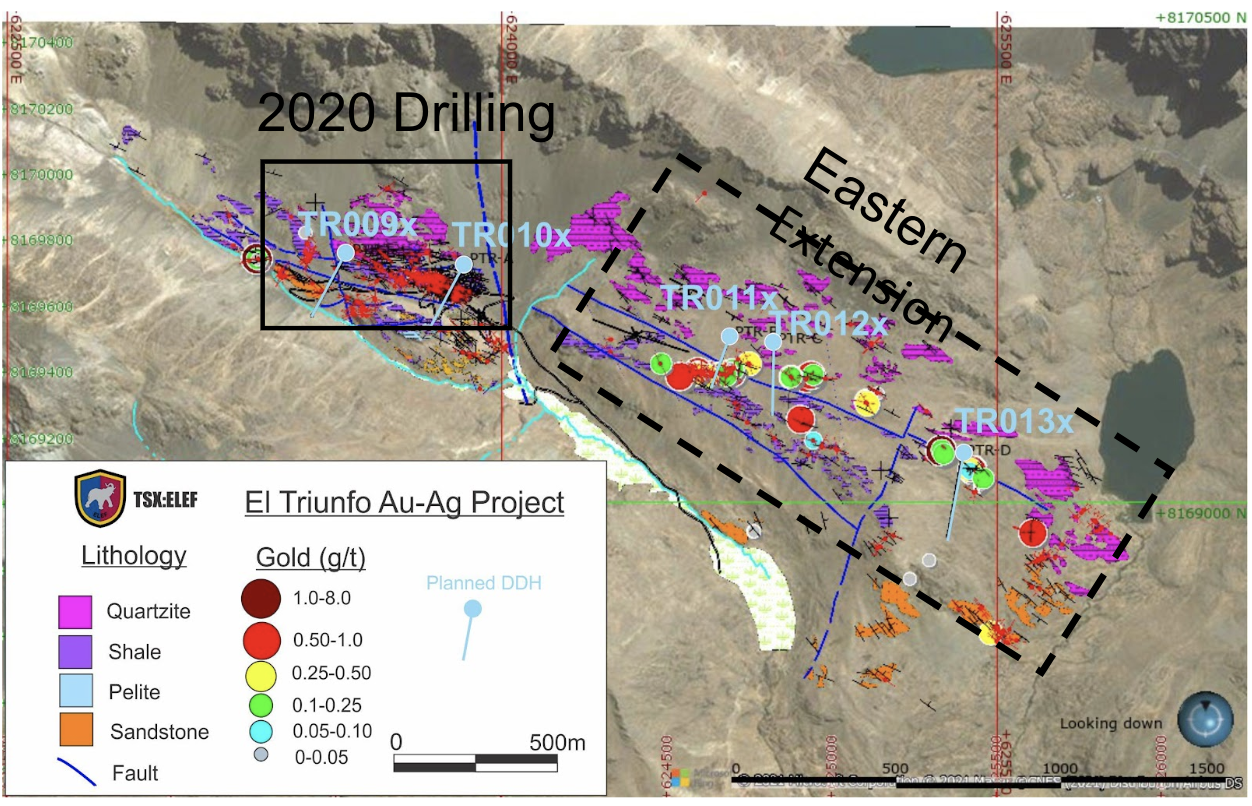

Silver Elephant's 100% owned El Triunfo Project is located in the department of La Paz, Bolivia. The company first drilled 49m of 0.42 g/t Au, 35g/t Ag, 1.2% Zn, 0.8% Pb in 2020.