One platform, for all your alternatives

Explore opportunities beyond the public market and diversify your portfolio with alternatives in your tax-advantaged, self-directed IRA.

Explore

Making headlines in

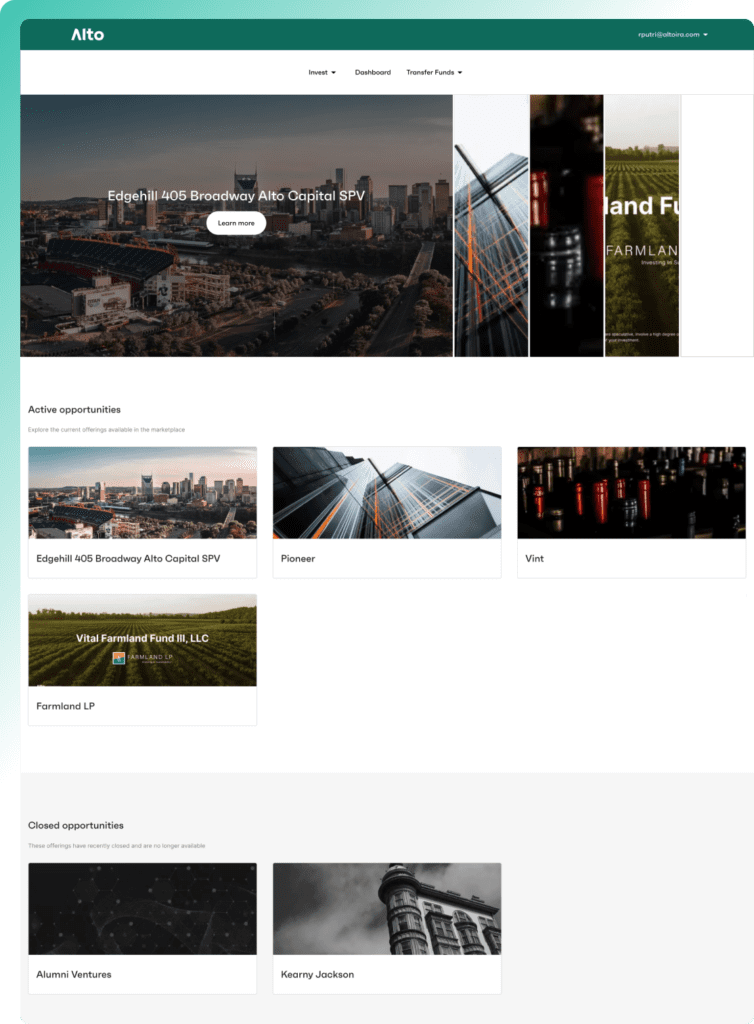

Alto Marketplace, provided by Alto Securities, LLC, is an alternative investment platform connecting sophisticated investors looking to diversify their portfolios with exclusive, highly sought-after issuers of alternative assets seeking the trillions of dollars of retirement assets currently in the U.S.

*Offerings are accessible through Alto Marketplace and are available only to accredited investors. Private Securities are intended for highly sophisticated investors and involve substantial risks. Offerings displayed are representative of the types of offerings available on the Alto Marketplace but may not reflect active offerings.

Explore current offerings

ALTO CAPITAL

Edgehill 405 Broadway Alto Capital SPV

Real estate opportunity in the namesake bar of Jon Bon Jovi in Nashville, Tennessee’s iconic Lower Broadway entertainment district.

Min. investment

$25,000

Term

2 months

Asset class

Real Estate SPV

ALTO SECURITIES

Pioneer

A venture firm of Y Combinator alumni investing in startups from Y Combinator, a leading accelerator.

ALTO SECURITIES

Farmland LP

Investing in regenerative agriculture.

Min. investment

$50,000

Term

1 year

Asset class

Farmland

ALTO SECURITIES

Vinovest Capital Whisky Fund Alto Capital SPV

Rare whisky investing with a digital-native firm.

Min. investment

$25,000

Term

1 year

Asset class

Whiskey Fund SPV

ALTO CAPITAL

Edgehill 405 Broadway Alto Capital SPV

Real estate opportunity in the namesake bar of Jon Bon Jovi in Nashville, Tennessee’s iconic Lower Broadway entertainment district.

Min. investment

$25,000

Term

2 months

Asset class

Real Estate SPV

ALTO SECURITIES

Pioneer

A venture firm of Y Combinator alumni investing in startups from Y Combinator, a leading accelerator.

Integrated Partners

Alto connects IRAs to some of the most esteemed alternatives platforms available today. After selecting an investment, investors can simply pay for an offering with their self-directed IRA and let Alto do the rest.

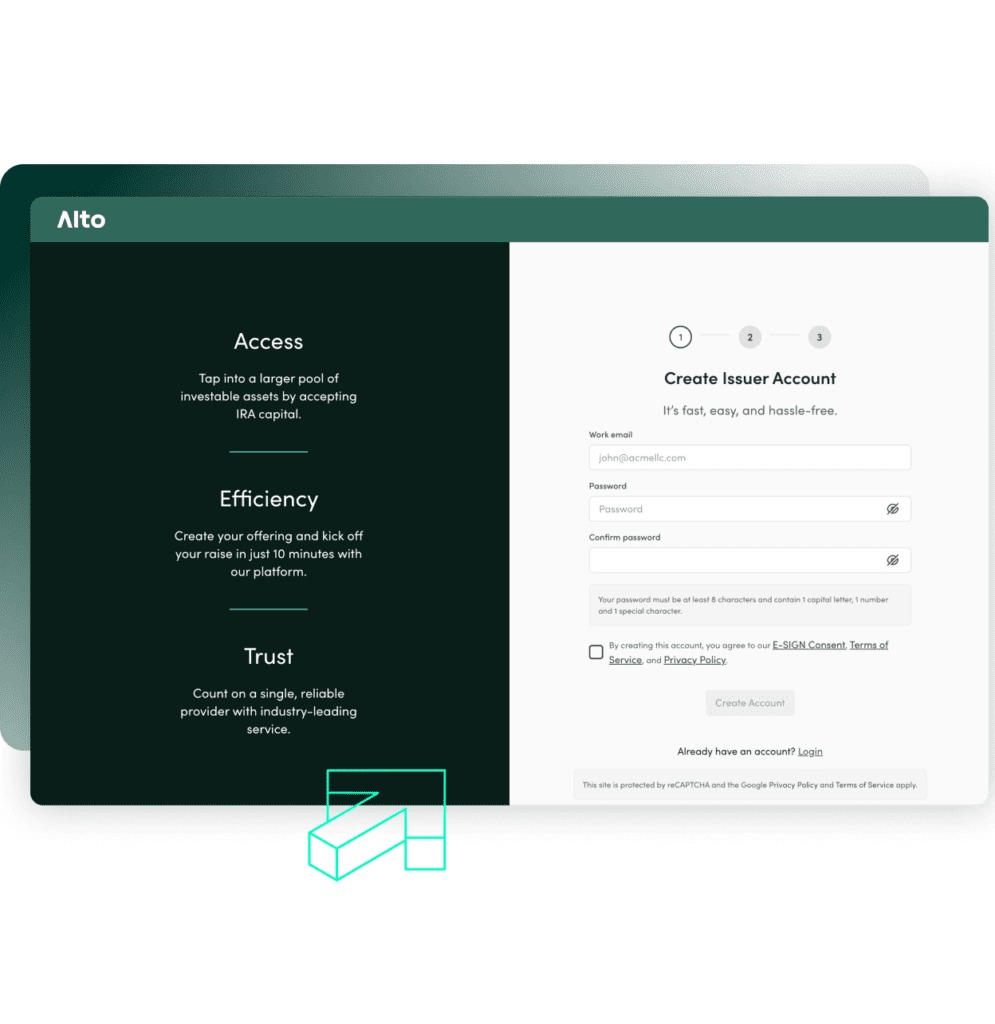

Private Raise Portal

Raising capital for alternative assets has long been known as a cumbersome, paper-intensive process. Alto modernizes the sector with a simple, single-login digital interface that makes raising IRA capital more efficient.

Cryptocurrency

Buy, sell, and trade over 200 cryptocurrencies with all the tax advantages of your Alto CryptoIRA®, enabled via our direct integration with Coinbase.

Simplicity | Security | Optionality

- Tax benefits

- Mobile app

- On-call support

- Transparent fees

- Secure storage

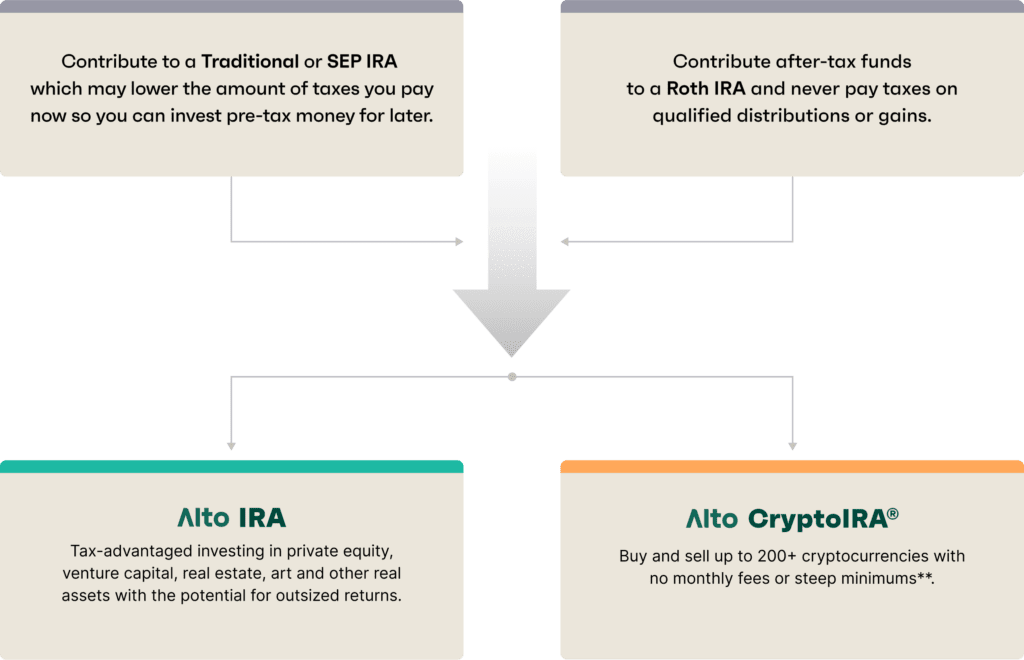

Defer and even eliminate taxes on your investments*

Alto provides investors with a self-directed IRA that serves as a powerful way to shield investment returns from capital gains taxes.

(IRS rules and regulations apply)

Increased returns

Alternative investments can increase compounded long-term and risk-adjusted returns.

Tax advantages

Defer or eliminate taxes on your capital gains and income earned from investments in your Alto IRA or Alto CryptoIRA.*

Diversification

Alternative assets reduce a portfolio’s correlation to public markets, which can protect against shocks or drawdowns when volatility hits public equities.

Access

Alto investors have the access, control, and optionality to invest in the opportunities that interest them most.

Speed

Alto provides a paperless online investment experience that streamlines the private investment process.

Support

Alto’s industry-leading Investor Relations and Support teams are devoted to facilitating your chosen investments and providing unparalleled customer service.

*Traditional IRAs and SEP IRAs generally are tax-deferred; Roth IRAs generally can be tax-free. Tax-free treatment subject to Roth IRA holding period and other restrictions. Tax treatment of contributions and distributions subject to applicable regulations. Consult your tax advisor before investing.

**Quantity and selection of tokens/coins available from CryptoIRA exchange partners may vary from state to state.

We invest in security so you can invest with confidence

Alto enthusiastically operates under strict regulatory oversight to ensure compliance with fair and transparent business practices.

Cash funded IRAs are maintained in FDIC-insured accounts with our banking partners.

Crypto held by Coinbase is kept 1:1 in institutional-grade hot and cold storage.

Alto enables and encourages two-factor authentication (2FA).

Start investing in alternatives, in minutes

Create

Fund

Invest

Xkrich

“The overall experience of setting up and funding my new Alto account was very easy and straightforward. After waiting the necessary period for the funds to be transferred over from my external account, I was "up and trading" within a relatively short period of time. The entire process proved to be painless with very clear communication provided along the way. Great service!”

Daniel Rosenbaum

"I have now made four investments through ALTO IRA. Everything has been smooth and when I needed questions answered, they were answered and actions commenced within MINUTES. I have three other Self-Directed IRA vendors, and ALTO is the best (by a lot)."

Mark

“The staff was professional and caring. Special thanks to Jenn Smith! She is an angel”