Gold falls on strengthening dollar, but the yellow metals still aims for third weekly gain y on haven demand amid ongoing concerns about the economic impact of a trade war stemming from U.S. President Donald Trump’s tariff policy. Continue reading →

Gold falls on strengthening dollar, but the yellow metals still aims for third weekly gain y on haven demand amid ongoing concerns about the economic impact of a trade war stemming from U.S. President Donald Trump’s tariff policy. Continue reading →

Gold holds solidly above $3000 near record levels early Wednesday as investors awaited further direction from the Federal Reserve. Continue reading →

Gold hovering near $3,000 an ounce, as it edged lower early Monday on profit taking after the yellow metal rallied to a record above the $3,000-an-ounce threshold for the first time in the previous session. Continue reading →

Gold breaches the psychological $3,000 mark overnight. Spot gold tipped across that benchmark early Friday as the yellow metal continued rallying on the previous day’s haven demand. Continue reading →

Gold steady despite this morning’s inflation report that came in lower than expected, with the bullion getting support from tariff concerns. Continue reading →

Gold eases early Monday as the dollar firms, after rallying last week on concerns about the global economic outlook. The yellow metal sticking just above the $2900 line. Continue reading →

Gold steadies after bobbling a bit on this morning’s U.S. jobs report as it heads for a weekly rally amid uncertainty around U.S. trade policy. The yellow metal made up for the ground it lost in overnight profit taking. Continue reading →

Gold ticks down, early Wednesday on tariff uncertainties while sticking above the $2900 line, after a two-day rally that focused on trade war fears. Investors now await this week’s U.S. jobs data. Continue reading →

Gold rose early Monday, rebounding after last week’s fall and attracting haven investors as U.S. President Donald Trump prepared to impose new tariffs against the nation’s largest trading partners. Continue reading →

Gold slumps on surging dollar and profit-taking, placing the bullion in line for its worst week this year. The yellow metal slipped further after the January inflation data came in flat. Continue reading →

Gold edges back up above the $2900 an ounce mark early Wednesday after hitting a one-week low in the previous session amid ongoing haven demand and uncertainty because of U.S. President Donald Trump’s policies. Continue reading →

Gold edging up near record high in Monday morning trading supported by a weaker dollar and haven demand triggered by weak economic data and inflation. Continue reading →

Gold heads for its eighth weekly gain on haven demand, despite falling from Thursday’s record high over $2950 an ounce. Continue reading →

Dillon Gage is launching an enhanced Fiztrade.com™ on February 19th. Tap into Fiztrade’s new, even faster electronic trading platform and put the pedal to the precious metal.

Upgrade your trading arsenal with FizTrade’s powerful features that have been fine-tuned for additional speed and user ease for over two decades.

When the enhanced FizTrade.com platform launches next Wednesday, February 19th, current FizTrade users will need to change their password before they can access their account.

When the enhanced FizTrade.com platform launches next Wednesday, February 19th, current FizTrade users will need to change their password before they can access their account.

We are adding multifactor identification, so there are additional steps to make the change. We encourage users to review our FizTrade Login Setup Tutorial before February 19th. Download the tutorial pdf here.

It should be quick and easy. If you have any questions, please email customercare@fiztrade.com.

Gold sticks near record high early Wednesday despite dipping as investors took profits from record prices and speculated on the prospect of a peace deal between Russia and Ukraine. Continue reading →

Gold advanced early Monday back over the $2900 threshhold on a softer dollar and concerns over President Trump’s threatened “reciprocal tariffs.” Continue reading →

Gold heads for seventh consecutive weekly gain on haven demand after U.S. President Donald Trump announced new tariffs against some of the country’s trading partners. Continue reading →

Gold fell after Fed Chairman Jerome Powell said that the central bank is in no rush to cut interest rates during his congressional testimony Tuesday. Even with the slip, the price of gold is still having a banner year, jumping 10% since the start of 2025 after growing 27% in 2024. Continue reading →

Gold hits a record high above $2,900 an ounce early Monday on U.S. President Donald Trump’s promised steel and aluminum tariffs, with plans to officially announce them later today, with the duties taking effect almost immediately. Continue reading →

Gold sticks near record high after jobs report amid haven demand from investors seeking refuge from U.S. President Donald Trump’s policies on the Middle East, trade and immigration. Continue reading →

Gold rose to an all-time high early Wednesday on concerns over the U.S. and China trade war. The two countries began tit-for-tat tariffs against each other’s products, spurring haven demand for the yellow metal. Continue reading →

Gold hits record high on Monday driven by safe-haven buying on tariffs which have added to concerns of inflation that would dent economic growth. Spot gold hitting a record of $2,818.58 while U.S. gold futures rose 0.7% to $2,855.90. Continue reading →

Gold hit record high early Friday over the $2800 benchmark on tariff fears and then returned over that mark on this morning’s PCE data. The yellow metal is poised for its best month since March 2024 amid concerns about possible U.S. tariffs, which President Donald Trump has said will kick in Saturday. Continue reading →

Gold steady ahead of the release of the Fed minutes later today as investors await further signals on the pace of interest rate cuts from the first Federal Reserve policy meeting of 2025. Continue reading →

Gold slumps from near an all-time high early Monday as the dollar strengthened ahead of the Fed meeting. The yellow metal also under pressure as the stock market experiences major sell off on news of China’s startup DeepSeek that is being touted as a competitive AI model for a fraction of the cost. Continue reading →

Gold rallied early Friday, trading near an all-time record high and poised for a weekly gain on haven demand, as investors sought a hedge against geopolitical and economic uncertainty from U.S. President Donald Trump’s new policies on tariffs, trade and immigration. Continue reading →

Gold extends gains to an 11-week high early Wednesday on a softer dollar and safe haven demand, making the yellow metal a more attractive asset for investors. Continue reading →

Gold steady early Monday in light holiday trading as investors awaited further direction ahead of U.S. President-elect Donald Trump’s inaugural address later in the day. Continue reading →

Gold slips in Friday morning trading, but still headed for its third consecutive weekly rise, as investors firmed bets that the Federal Reserve will resume interest rate cuts this year. Continue reading →

Gold rises on this morning’s consumer price index report that showed softer inflation, lifting spot prices near the $2700 benchmark, as investors gain hope for another Fed rate cut. Continue reading →

Gold softened early Monday as investors continue to digest Friday’s jobs report and the boosted dollar while awaiting this week’s key inflation reports for further direction. Underlying safe-haven demand amid uncertainty around President-elect Donald Trump’s policies curbed losses. Continue reading →

Gold aiming for best week in seven while hitting a four-week peak on Friday, boosting on safe-haven demand driven by uncertainty over the coming policies of President-elect Donald Trump. Continue reading →

Gold boosts on this morning’s key jobs report that shows slowing growth, leading to hopes of interest rate cuts. Talk of tariffs and a trade war are risk strengthening, which supports gold. Continue reading →

Gold dimmed by rising treasury yields in Monday trading, extending Friday’s losses, amid renewed concerns about inflation by Federal Reserve officials that may affect their upcoming decisions about interest rates. Continue reading →

Gold touches three-week high early Friday, extending the 2024 rally, before slipping on this morning’s ISM report. The yellow metal posted its biggest annual gain since 2010 as the yellow metal attracted haven investors seeking safe assets amid geopolitical and economic uncertainty. Continue reading →

Gold tips lower early Monday ahead of holiday as investors looked to January and with it both the change in U.S. presidential administrations and an upcoming Federal Reserve decision. Continue reading →

Gold eyes weekly rise early Friday in light holiday trading volumes as investors continued to mull the outlook for monetary policy following last week’s Federal Reserve interest rate cut while watching rising tensions in the Middle East. However, the bullion is getting pressure from rising Treasury yields. Continue reading →

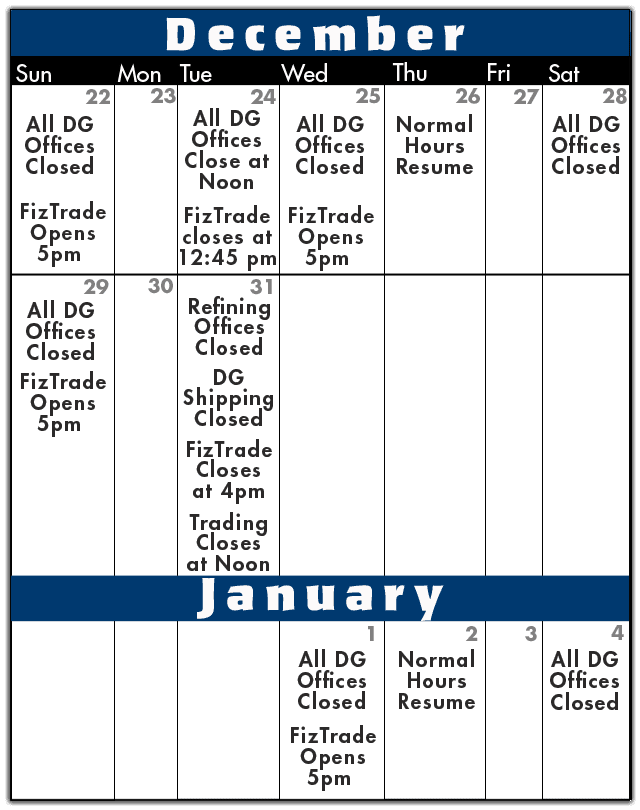

The calendar below details the Holiday Schedule for all Dillon Gage departments. All times are Central Daylight time.

We wish you and your family a very happy holiday season and look forward to serving you in 2025!

Gold drifts lower early Monday on a stronger dollar as investors parsed last week’s monetary policy decision by the Federal Reserve alongside the latest inflation report. Continue reading →

Gold claws back above the $2600 benchmark on this morning’s inflation data, but still looks headed for a weekly loss after the Fed signaled in its Wednesday meeting that the it wouldn’t cut interest rates as many times as had previously been expected in 2025. Continue reading →

Gold steady in Wednesday morning trading ahead of the Fed’s policy meeting and economic outlook statement this afternoon. Continue reading →

Gold tips up in Monday morning trading ahead of Fed meeting as investors awaited the minutes from the policymakers this week that set the stage for potential interest rate cuts in the year ahead. Continue reading →

Gold slips on profit-taking early Friday, but still headed for a weekly rally amid heightened expectations of an interest rate cut next week by the Federal Reserve. Continue reading →

Gold extends gains trading near a two-week high early Wednesday, after a U.S. inflation print showed that consumer prices rose in line with economists’ expectations. The yellow metal also getting support from haven demand driven by geopolitical risk. Continue reading →

Gold boosts on China Central bank purchases and strengthening expectations for an interest rate cut at the Federal Reserve’s meeting next week. China resumed gold purchases after a six-month pause. Continue reading →

Gold ticks up after a key jobs report shows higher numbers for November than expected, but the bullion appears to be aiming for a second consecutive weekly drop. Continue reading →

Gold ticked up early Wednesday on the first of this week’s jobs report as investors await comments from Federal Reserve Chairman Jerome Powell later today for direction on monetary policy. Continue reading →

Gold waned early Monday as the dollar strengthened against the euro on political tensions that may topple the government flared in France. Continue reading →

The Dillon Gage family wishes you and yours a very happy Thanksgiving! Dillon Gage will have the following reduced hours over the holiday weekend. (Note: all times CST)

FizTrade*:

● Thu. Nov. 28th: Open all day, EXCEPT closed Noon to 5 pm

● Fri. Nov. 29th: Closes at 12:15 pm

● Sun. Dec. 1st: Opens at 5 pm

Trading Room & Refinery:

● Thu. Nov. 28th: Closed

● Fri. Nov. 29th: Closed

● Mon. Dec. 2nd: Trading room opens at 7:30 am

We are thankful for your business.

*Based on CME hours and subject to change

Gold rises early Wednesday after the minutes of the Federal Reserve’s last policy meeting, which were released Tuesday, showed that the central bank is confident that inflation is easing and the labor market is strong, both conditions for additional interest rate cuts. Continue reading →

Gold slips early Monday on trader profit taking, after prices of the metal soared to a three-week peak last week. Continue reading →

Gold aims for its best week in a year, rising over 1% earlier in Friday’s session, as the conflict between Russia and Ukraine escalated, triggering haven demand. Continue reading →

Here are the 2024 American Eagle YTD sales totals for Gold and Silver American Eagles from the U.S. Mint as of 5pm on November 22nd. The following chart is updated weekly, or as data is provided by the mint. This chart shows the sales from the last report on October 25th. Continue reading →

Gold climbs back over one-week high, after losing ground in the early hours of Wednesday trading on a stronger dollar. Gold came back on bargain buying, supported by the apparent escalation in the conflict between Russia and Ukraine which is triggering some haven demand. Continue reading →

Gold rebounds early Monday, rallying from last week’s selloff on a flat dollar, putting the yellow metal back above the $2600 an ounce benchmark. The bullion was also buoyed by bargain hunters buying the dip. Continue reading →

Gold heads for a down week driven by Fed speculation. The yellow metal was little changed early Friday, but is poised for its worst week in more than three years, after Federal Reserve Chairman Jerome Powell said that the central bank doesn’t need to be “in a hurry” to cut interest rates because of strong economic growth. A rising dollar is also suppressing the bullion. Continue reading →

Gold ticks up on mild inflation report after hitting its lowest point in nearly two-months in the previous trading session. The yellow metal had already regained ground near the $2600 benchmark in early morning bargain hunting. Continue reading →

Gold down as dollar surges in early morning trading. The yellow metal extended declines early Monday after tumbling last week on rising bond yields and a stronger dollar after Donald Trump’s reelection to the White House. The dollar index rose 0.3% in early morning trading following last week’s weekly gain. Continue reading →

Gold steady after the Fed rate cut announcement on Wednesday and post-election volatility as Donald Trump prepared to return to the White House. The yellow metal dipped in early morning trading, but the bulls have since brought it back near the $2700 an ounce threshhold. Continue reading →

With the volatility in precious metal markets, we are experiencing a large increase in the volume of transactions, particularly with incoming shipments. When shipping packages to any Dillon Gage location, we request that you adhere to the following procedures:

Thank you for your assistance with this as it will help expedite the processing and payment of transactions. Packages that do not follow these guidelines may experience delays in processing and incur an additional fee.

Also, please note that purchase orders will be automatically updated for any merchandise that arrives and has a discrepancy of 5 oz or less of silver.