Analysts’ Viewpoint on Conventional and Rapid Prototyping Market Scenario

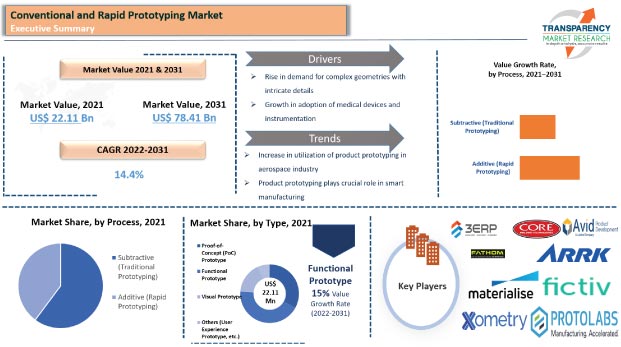

Prototyping plays a vital role in converting a virtual model into physical output. It is the final and important aspect in the product development process. Prototyping allows for design testing and evaluation; and identification and elimination of potential issues before mass manufacture. It highlights any challenges with the initial design, associated mechanisms or electronics, functionality, and manufacturing process. The conventional and rapid prototyping market is projected to grow at a significant CAGR of 14.4% during the forecast period. Industry leaders are engaged in providing innovative product prototyping services in order to gain competitive edge. CNC machining has been widely used for prototyping for several decades; however, additive manufacturing (3D printing) is gaining traction. It is being used by numerous small- and medium-sized enterprises. Key technologies such as FDM, SLS and MJF are also being extensively deployed in SME enterprises.

Product prototyping is used to rapidly produce physical part of the product directly from its CAD model, using subtractive and additive manufacturing methods. It can be used for any product development cycle for components or sub-components. Product prototype and design testing is an integral part of new product development. Product prototyping is widely adopted for visual prototyping, concept modeling, functional prototyping, pre-production prototyping, and production tool prototyping. It offers several benefits such as reduction in design & development time, decrease in overall product development cost, and elimination or reduction of risk. It enables functionality testing at low cost, and improves and increases user involvement during design stages of product development.

Request a sample to get extensive insights into the Conventional and Rapid Prototyping Market

High volume of production and geometrical complexity of components are hampering the usage of traditional prototyping methods. Hence, customers are compelled to adopt processes and instruments that drive the final cost of the element being manufactured. Additive manufacturing techniques offer significant competitive advantages; they adapt to the geometrical complexity and bespoke design of the part that is to be created. Elegant geometrical forms, hollow interiors, internal channels, varied thicknesses, and irregular shapes can be manufactured accurately by 3D printing technologies using a geometrical template created from a 3D CAD. Products that are exactly the same or completely different can be obtained without affecting the process or incurring additional expenditure. This customization is one of the most important current developments in the production of high-value products.

Additive prototyping also offers various benefits that include light weight products, multilateral products, ergonomic products, efficient and short production runs, and fewer assembly errors. Several key players are launching innovative 3D printing services to gain competitive edge. In January 2020, Zortrax launched 3D printing service to expand the company’s entire product portfolio. The service includes prototyping, tooling, or end-use product application. The company aims to expand its printing capability in order to cater to a wide range of applications, from dental and jewelry products to electronic housings and automotive parts.

Surgical fasteners, scalpels, retractors, and display systems are some of the medical devices that have been upgraded with the use of 3D technology. Prototyping technology is employed in the manufacture of medical equipment in addition to the design of these devices. Additive technologies are suitable for devices that need to be customized for a specific patient. Stereolithography or selective laser sintering is used to design a majority of hearing aids. Replacement of teeth is another area where rapid prototyping service is used.

Rapid prototyping materials are used in prosthetics. Prostheses are also custom-made for patients. Rapid prototyping materials are used to create models of complex organs in the body. Surgeons employ these models to acquire a realistic sense of structures before performing a surgical procedure. Stereolithography is a widely utilized technology for this application. The model's most trustworthy features, such as transparency and color resin developments, enable a clear distinction between tumors and any other external growth in the body. In August 2021, Trelleborg Group announced the launch of its Healthcare & Medical Rapid Development Center for design, rapid prototyping, development, and serial production. It ensures cost control and scalability of customers’ solutions. This Rapid Development Center has been built to accelerate time to market, reduce the production cost of parts that are already in the market, and enhance the transition from design to serial production of products.

Rapid prototyping is also employed in tissue engineering and manufacture of biologically active implants. Selective laser sintering of ceramics is used in this application. This is boosting the adoption of conventional and rapid prototyping in the medical sector.

In terms of process, the global conventional and rapid prototyping market has been bifurcated into subtractive (traditional prototyping) and additive (rapid prototyping). The subtractive (traditional prototyping) segment held major share of 60.21% of the market in 2021. It is projected to grow at a CAGR of 14.1% during the forecast period.

The CNC machining sub-segment of the subtractive segment accounted for prominent share of 62.18% in 2021. Subtractive prototyping yields higher structural integrity, which is important if the prototype is to be used in product testing.

In terms of type, the global conventional and rapid prototyping market has been classified into proof-of-concept (PoC) prototype, functional prototype, visual prototype, and others. The functional prototype segment dominated the global conventional and rapid prototyping market with 43.18% share in 2021. Furthermore, the segment is expected to grow at a CAGR of 15% during the forecast period. Functional prototype is usually a subsystem of a product and enables the testing of functional aspects. Functional prototypes offer a new way for design engineers to test designs before manufacturing them on a large scale. Creating functional or quick visual prototypes is an essential step of the development process. The making of a functional and working prototype is an essential part of any product development. It is integral to the process of testing, trials, pitching, and market research for many companies.

North America dominated the global conventional and rapid prototyping market with 34.36% share in 2021. The market in the region is estimated to grow at a CAGR of 15.1% during the forecast period. Rise in expenditure on lifecycle stage and research and development, particularly in the U.S. and Canada, is primarily driving the market in North America.

Asia Pacific and Europe are also key regions of the global conventional and rapid prototyping market. These regions held value share of 30.27% and 25.80%, respectively, in 2021. Automotive, healthcare, and consumer goods & electronics industries in Asia Pacific and Europe are witnessing a surge in demand for conventional and rapid prototyping.

Middle East & Africa is a larger market for conventional and rapid prototyping than South America. The market in Middle East & Africa is projected to grow at a CAGR of 12.2% during the forecast period.

The global conventional and rapid prototyping market is highly fragmented, with a large number of large-scale and small scale vendors controlling a majority of the share. Most of the firms are investing significantly in comprehensive research and development activities. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. ARRK North America, Inc., Avid Product Development, LLC, CADX Tools & Technologies Pvt. Ltd., Core Molding Technologies, Inc., Fathom Digital Manufacturing Corporation, Fictiv, IMAGE MODEL Company Limited, Materialise NV, Model Solution Co., Ltd., Proto Labs, Inc., ProtoCAM, Renishaw plc, Sandvik AB, Star Rapid., Ltd, Xometry Europe GmbH, and Quickparts are the prominent entities operating in the market.

Request a custom report on Conventional and Rapid Prototyping Market

Each of these players has been profiled in the conventional and rapid prototyping market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 22.11 Bn |

|

Market Forecast Value in 2031 |

US$ 78.41 Bn |

|

Growth Rate (CAGR) |

14.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The conventional and rapid prototyping market stood at US$ 22.11 Bn in 2021.

The conventional and rapid prototyping market is estimated to grow at a CAGR of 14.4% during the forecast period.

The conventional and rapid prototyping market is expected to reach US$ 78.41 Bn by 2031.

Prominent players operating in the conventional and rapid prototyping market are ARRK North America, Inc., Avench Systems INC, Avid Product Development, LLC, CADX TOOLS & TECHNOLOGIES PVT LTD., Model Solution Co., Ltd., Star Rapid., Ltd., Protolabs, and ProtoCAM.

The U.S. accounted for around 27% share of the global conventional and rapid prototyping market in 2021.

In terms of revenue, the subtractive (traditional prototyping) segment dominated the market with 60.2% share in 2021.

Rise in utilization of conventional and rapid prototyping in the aerospace industry and growth in adoption of conventional and rapid prototyping for medical implants are the prominent trends in the market.

North America is a highly lucrative region of the global conventional and rapid prototyping market.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Conventional and Rapid Prototyping Market Overview

2.2. Regional Outline

2.3. Market Dynamics Snapshot

2.4. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Manufacturing Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

4.6. Covid-19 Impact and Recovery Analysis

5. Conventional and Rapid Prototyping Market Analysis, by Process

5.1. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

5.1.1. Subtractive (Traditional Prototyping)

5.1.1.1. CNC Machining

5.1.1.2. Injection Molding

5.1.2. Additive (Rapid Prototyping)

5.1.2.1. Stereolithography (SLA)

5.1.2.2. Selective Laser Sintering (SLS)

5.1.2.3. Fused Deposition Modeling (FDM)

5.1.2.4. Multi Jet Fusion

5.1.2.5. Others (DLP, EBM, etc.)

5.2. Market Attractiveness Analysis, by Process

6. Conventional and Rapid Prototyping Market Analysis, by Type

6.1. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

6.1.1. Proof-of-Concept (PoC) Prototype

6.1.2. Functional Prototype

6.1.3. Visual Prototype

6.1.4. Others (User Experience Prototype, etc.)

6.2. Market Attractiveness Analysis, by Type

7. Conventional and Rapid Prototyping Market Analysis, by Material

7.1. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

7.1.1. Metal

7.1.2. Polymer

7.1.3. Ceramic

7.1.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

7.2. Market Attractiveness Analysis, by Material

8. Conventional and Rapid Prototyping Market Analysis, by End-use Industry

8.1. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

8.1.1. Aerospace & Defense

8.1.2. Consumer Goods & Electronics

8.1.3. Automotive

8.1.4. Healthcare

8.1.5. Others (Film and Animation, Architecture, etc.)

8.2. Market Attractiveness Analysis, by End-use Industry

9. Conventional and Rapid Prototyping Market Analysis and Forecast, by Region

9.1. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Conventional and Rapid Prototyping Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

10.3.1. Subtractive (Traditional Prototyping)

10.3.1.1. CNC Machining

10.3.1.2. Injection Molding

10.3.2. Additive (Rapid Prototyping)

10.3.2.1. Stereolithography (SLA)

10.3.2.2. Selective Laser Sintering (SLS)

10.3.2.3. Fused Deposition Modeling (FDM)

10.3.2.4. Multi Jet Fusion

10.3.2.5. Others (DLP, EBM, etc.)

10.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

10.4.1. Proof-of-Concept (PoC) Prototype

10.4.2. Functional Prototype

10.4.3. Visual Prototype

10.4.4. Others (User Experience Prototype, etc.)

10.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

10.5.1. Metal

10.5.2. Polymer

10.5.3. Ceramic

10.5.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

10.6. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

10.6.1. Aerospace & Defense

10.6.2. Consumer Goods & Electronics

10.6.3. Automotive

10.6.4. Healthcare

10.6.5. Others (Film and Animation, Architecture, etc.)

10.7. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Process

10.8.2. By Type

10.8.3. By Material

10.8.4. By End-use Industry

10.8.5. By Country and Sub-region

11. U.S. Conventional and Rapid Prototyping Market Analysis and Forecast

11.1. Market Snapshot

11.2. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

11.2.1. Subtractive (Traditional Prototyping)

11.2.1.1. CNC Machining

11.2.1.2. Injection Molding

11.2.2. Additive (Rapid Prototyping)

11.2.2.1. Stereolithography (SLA)

11.2.2.2. Selective Laser Sintering (SLS)

11.2.2.3. Fused Deposition Modeling (FDM)

11.2.2.4. Multi Jet Fusion

11.2.2.5. Others (DLP, EBM, etc.)

11.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

11.3.1. Proof-of-Concept (PoC) Prototype

11.3.2. Functional Prototype

11.3.3. Visual Prototype

11.3.4. Others (User Experience Prototype, etc.)

11.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

11.4.1. Metal

11.4.2. Polymer

11.4.3. Ceramic

11.4.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

11.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

11.5.1. Aerospace & Defense

11.5.2. Consumer Goods & Electronics

11.5.3. Automotive

11.5.4. Healthcare

11.5.5. Others (Film and Animation, Architecture, etc.)

11.6. Market Attractiveness Analysis

11.6.1. By Process

11.6.2. By Type

11.6.3. By Material

11.6.4. By End-use Industry

12. Canada Conventional and Rapid Prototyping Market Analysis and Forecast

12.1. Market Snapshot

12.2. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

12.2.1. Subtractive (Traditional Prototyping)

12.2.1.1. CNC Machining

12.2.1.2. Injection Molding

12.2.2. Additive (Rapid Prototyping)

12.2.2.1. Stereolithography (SLA)

12.2.2.2. Selective Laser Sintering (SLS)

12.2.2.3. Fused Deposition Modeling (FDM)

12.2.2.4. Multi Jet Fusion

12.2.2.5. Others (DLP, EBM, etc.)

12.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

12.3.1. Proof-of-Concept (PoC) Prototype

12.3.2. Functional Prototype

12.3.3. Visual Prototype

12.3.4. Others (User Experience Prototype, etc.)

12.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

12.4.1. Metal

12.4.2. Polymer

12.4.3. Ceramic

12.4.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

12.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

12.5.1. Aerospace & Defense

12.5.2. Consumer Goods & Electronics

12.5.3. Automotive

12.5.4. Healthcare

12.5.5. Others (Film and Animation, Architecture, etc.)

12.6. Market Attractiveness Analysis

12.6.1. By Process

12.6.2. By Type

12.6.3. By Material

12.6.4. By End-use Industry

13. Europe Conventional and Rapid Prototyping Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

13.3.1. Subtractive (Traditional Prototyping)

13.3.1.1. CNC Machining

13.3.1.2. Injection Molding

13.3.2. Additive (Rapid Prototyping)

13.3.2.1. Stereolithography (SLA)

13.3.2.2. Selective Laser Sintering (SLS)

13.3.2.3. Fused Deposition Modeling (FDM)

13.3.2.4. Multi Jet Fusion

13.3.2.5. Others (DLP, EBM, etc.)

13.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

13.4.1. Proof-of-Concept (PoC) Prototype

13.4.2. Functional Prototype

13.4.3. Visual Prototype

13.4.4. Others (User Experience Prototype, etc.)

13.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

13.5.1. Metal

13.5.2. Polymer

13.5.3. Ceramic

13.5.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

13.6. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

13.6.1. Aerospace & Defense

13.6.2. Consumer Goods & Electronics

13.6.3. Automotive

13.6.4. Healthcare

13.6.5. Others (Film and Animation, Architecture, etc.)

13.7. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.7.1. U.K.

13.7.2. Germany

13.7.3. France

13.7.4. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Process

13.8.2. By Type

13.8.3. By Material

13.8.4. By End-use Industry

13.8.5. By Country and Sub-region

14. U.K. Conventional and Rapid Prototyping Market Analysis and Forecast

14.1. Market Snapshot

14.2. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

14.2.1. Subtractive (Traditional Prototyping)

14.2.1.1. CNC Machining

14.2.1.2. Injection Molding

14.2.2. Additive (Rapid Prototyping)

14.2.2.1. Stereolithography (SLA)

14.2.2.2. Selective Laser Sintering (SLS)

14.2.2.3. Fused Deposition Modeling (FDM)

14.2.2.4. Multi Jet Fusion

14.2.2.5. Others (DLP, EBM, etc.)

14.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

14.3.1. Proof-of-Concept (PoC) Prototype

14.3.2. Functional Prototype

14.3.3. Visual Prototype

14.3.4. Others (User Experience Prototype, etc.)

14.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

14.4.1. Metal

14.4.2. Polymer

14.4.3. Ceramic

14.4.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

14.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

14.5.1. Aerospace & Defense

14.5.2. Consumer Goods & Electronics

14.5.3. Automotive

14.5.4. Healthcare

14.5.5. Others (Film and Animation, Architecture, etc.)

14.6. Market Attractiveness Analysis

14.6.1. By Process

14.6.2. By Type

14.6.3. By Material

14.6.4. By End-use Industry

15. Germany Conventional and Rapid Prototyping Market Analysis and Forecast

15.1. Market Snapshot

15.2. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

15.2.1. Subtractive (Traditional Prototyping)

15.2.1.1. CNC Machining

15.2.1.2. Injection Molding

15.2.2. Additive (Rapid Prototyping)

15.2.2.1. Stereolithography (SLA)

15.2.2.2. Selective Laser Sintering (SLS)

15.2.2.3. Fused Deposition Modeling (FDM)

15.2.2.4. Multi Jet Fusion

15.2.2.5. Others (DLP, EBM, etc.)

15.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

15.3.1. Proof-of-Concept (PoC) Prototype

15.3.2. Functional Prototype

15.3.3. Visual Prototype

15.3.4. Others (User Experience Prototype, etc.)

15.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

15.4.1. Metal

15.4.2. Polymer

15.4.3. Ceramic

15.4.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

15.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

15.5.1. Aerospace & Defense

15.5.2. Consumer Goods & Electronics

15.5.3. Automotive

15.5.4. Healthcare

15.5.5. Others (Film and Animation, Architecture, etc.)

15.6. Market Attractiveness Analysis

15.6.1. By Process

15.6.2. By Type

15.6.3. By Material

15.6.4. By End-use Industry

16. France Conventional and Rapid Prototyping Market Analysis and Forecast

16.1. Market Snapshot

16.2. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

16.2.1. Subtractive (Traditional Prototyping)

16.2.1.1. CNC Machining

16.2.1.2. Injection Molding

16.2.2. Additive (Rapid Prototyping)

16.2.2.1. Stereolithography (SLA)

16.2.2.2. Selective Laser Sintering (SLS)

16.2.2.3. Fused Deposition Modeling (FDM)

16.2.2.4. Multi Jet Fusion

16.2.2.5. Others (DLP, EBM, etc.)

16.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

16.3.1. Proof-of-Concept (PoC) Prototype

16.3.2. Functional Prototype

16.3.3. Visual Prototype

16.3.4. Others (User Experience Prototype, etc.)

16.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

16.4.1. Metal

16.4.2. Polymer

16.4.3. Ceramic

16.4.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

16.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

16.5.1. Aerospace & Defense

16.5.2. Consumer Goods & Electronics

16.5.3. Automotive

16.5.4. Healthcare

16.5.5. Others (Film and Animation, Architecture, etc.)

16.6. Market Attractiveness Analysis

16.6.1. By Process

16.6.2. By Type

16.6.3. By Material

16.6.4. By End-use Industry

17. Asia Pacific Conventional and Rapid Prototyping Market Analysis and Forecast

17.1. Market Snapshot

17.2. Drivers and Restraints: Impact Analysis

17.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

17.3.1. Subtractive (Traditional Prototyping)

17.3.1.1. CNC Machining

17.3.1.2. Injection Molding

17.3.2. Additive (Rapid Prototyping)

17.3.2.1. Stereolithography (SLA)

17.3.2.2. Selective Laser Sintering (SLS)

17.3.2.3. Fused Deposition Modeling (FDM)

17.3.2.4. Multi Jet Fusion

17.3.2.5. Others (DLP, EBM, etc.)

17.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

17.4.1. Proof-of-Concept (PoC) Prototype

17.4.2. Functional Prototype

17.4.3. Visual Prototype

17.4.4. Others (User Experience Prototype, etc.)

17.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

17.5.1. Metal

17.5.2. Polymer

17.5.3. Ceramic

17.5.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

17.6. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

17.6.1. Aerospace & Defense

17.6.2. Consumer Goods & Electronics

17.6.3. Automotive

17.6.4. Healthcare

17.6.5. Others (Film and Animation, Architecture, etc.)

17.7. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

17.7.1. China

17.7.2. Japan

17.7.3. South Korea

17.7.4. India

17.7.5. ASEAN

17.7.6. Rest of Asia Pacific

17.8. Market Attractiveness Analysis

17.8.1. By Process

17.8.2. By Type

17.8.3. By Material

17.8.4. By End-use Industry

17.8.5. By Country and Sub-region

18. China Conventional and Rapid Prototyping Market Analysis and Forecast

18.1. Market Snapshot

18.2. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

18.2.1. Subtractive (Traditional Prototyping)

18.2.1.1. CNC Machining

18.2.1.2. Injection Molding

18.2.2. Additive (Rapid Prototyping)

18.2.2.1. Stereolithography (SLA)

18.2.2.2. Selective Laser Sintering (SLS)

18.2.2.3. Fused Deposition Modeling (FDM)

18.2.2.4. Multi Jet Fusion

18.2.2.5. Others (DLP, EBM, etc.)

18.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

18.3.1. Proof-of-Concept (PoC) Prototype

18.3.2. Functional Prototype

18.3.3. Visual Prototype

18.3.4. Others (User Experience Prototype, etc.)

18.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

18.4.1. Metal

18.4.2. Polymer

18.4.3. Ceramic

18.4.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

18.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

18.5.1. Aerospace & Defense

18.5.2. Consumer Goods & Electronics

18.5.3. Automotive

18.5.4. Healthcare

18.5.5. Others (Film and Animation, Architecture, etc.)

18.6. Market Attractiveness Analysis

18.6.1. By Process

18.6.2. By Type

18.6.3. By Material

18.6.4. By End-use Industry

19. Japan Conventional and Rapid Prototyping Market Analysis and Forecast

19.1. Market Snapshot

19.2. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

19.2.1. Subtractive (Traditional Prototyping)

19.2.1.1. CNC Machining

19.2.1.2. Injection Molding

19.2.2. Additive (Rapid Prototyping)

19.2.2.1. Stereolithography (SLA)

19.2.2.2. Selective Laser Sintering (SLS)

19.2.2.3. Fused Deposition Modeling (FDM)

19.2.2.4. Multi Jet Fusion

19.2.2.5. Others (DLP, EBM, etc.)

19.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

19.3.1. Proof-of-Concept (PoC) Prototype

19.3.2. Functional Prototype

19.3.3. Visual Prototype

19.3.4. Others (User Experience Prototype, etc.)

19.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

19.4.1. Metal

19.4.2. Polymer

19.4.3. Ceramic

19.4.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

19.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

19.5.1. Aerospace & Defense

19.5.2. Consumer Goods & Electronics

19.5.3. Automotive

19.5.4. Healthcare

19.5.5. Others (Film and Animation, Architecture, etc.)

19.6. Market Attractiveness Analysis

19.6.1. By Process

19.6.2. By Type

19.6.3. By Material

19.6.4. By End-use Industry

20. India Conventional and Rapid Prototyping Market Analysis and Forecast

20.1. Market Snapshot

20.2. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

20.2.1. Subtractive (Traditional Prototyping)

20.2.1.1. CNC Machining

20.2.1.2. Injection Molding

20.2.2. Additive (Rapid Prototyping)

20.2.2.1. Stereolithography (SLA)

20.2.2.2. Selective Laser Sintering (SLS)

20.2.2.3. Fused Deposition Modeling (FDM)

20.2.2.4. Multi Jet Fusion

20.2.2.5. Others (DLP, EBM, etc.)

20.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

20.3.1. Proof-of-Concept (PoC) Prototype

20.3.2. Functional Prototype

20.3.3. Visual Prototype

20.3.4. Others (User Experience Prototype, etc.)

20.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

20.4.1. Metal

20.4.2. Polymer

20.4.3. Ceramic

20.4.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

20.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

20.5.1. Aerospace & Defense

20.5.2. Consumer Goods & Electronics

20.5.3. Automotive

20.5.4. Healthcare

20.5.5. Others (Film and Animation, Architecture, etc.)

20.6. Market Attractiveness Analysis

20.6.1. By Process

20.6.2. By Type

20.6.3. By Material

20.6.4. By End-use Industry

21. South Korea Conventional and Rapid Prototyping Market Analysis and Forecast

21.1. Market Snapshot

21.2. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

21.2.1. Subtractive (Traditional Prototyping)

21.2.1.1. CNC Machining

21.2.1.2. Injection Molding

21.2.2. Additive (Rapid Prototyping)

21.2.2.1. Stereolithography (SLA)

21.2.2.2. Selective Laser Sintering (SLS)

21.2.2.3. Fused Deposition Modeling (FDM)

21.2.2.4. Multi Jet Fusion

21.2.2.5. Others (DLP, EBM, etc.)

21.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

21.3.1. Proof-of-Concept (PoC) Prototype

21.3.2. Functional Prototype

21.3.3. Visual Prototype

21.3.4. Others (User Experience Prototype, etc.)

21.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

21.4.1. Metal

21.4.2. Polymer

21.4.3. Ceramic

21.4.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

21.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

21.5.1. Aerospace & Defense

21.5.2. Consumer Goods & Electronics

21.5.3. Automotive

21.5.4. Healthcare

21.5.5. Others (Film and Animation, Architecture, etc.)

21.6. Market Attractiveness Analysis

21.6.1. By Process

21.6.2. By Type

21.6.3. By Material

21.6.4. By End-use Industry

22. ASEAN Conventional and Rapid Prototyping Market Analysis and Forecast

22.1. Market Snapshot

22.2. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

22.2.1. Subtractive (Traditional Prototyping)

22.2.1.1. CNC Machining

22.2.1.2. Injection Molding

22.2.2. Additive (Rapid Prototyping)

22.2.2.1. Stereolithography (SLA)

22.2.2.2. Selective Laser Sintering (SLS)

22.2.2.3. Fused Deposition Modeling (FDM)

22.2.2.4. Multi Jet Fusion

22.2.2.5. Others (DLP, EBM, etc.)

22.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

22.3.1. Proof-of-Concept (PoC) Prototype

22.3.2. Functional Prototype

22.3.3. Visual Prototype

22.3.4. Others (User Experience Prototype, etc.)

22.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

22.4.1. Metal

22.4.2. Polymer

22.4.3. Ceramic

22.4.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

22.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

22.5.1. Aerospace & Defense

22.5.2. Consumer Goods & Electronics

22.5.3. Automotive

22.5.4. Healthcare

22.5.5. Others (Film and Animation, Architecture, etc.)

22.6. Market Attractiveness Analysis

22.6.1. By Process

22.6.2. By Type

22.6.3. By Material

22.6.4. By End-use Industry

23. Middle East & Africa Conventional and Rapid Prototyping Market Analysis and Forecast

23.1. Market Snapshot

23.2. Drivers and Restraints: Impact Analysis

23.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

23.3.1. Subtractive (Traditional Prototyping)

23.3.1.1. CNC Machining

23.3.1.2. Injection Molding

23.3.2. Additive (Rapid Prototyping)

23.3.2.1. Stereolithography (SLA)

23.3.2.2. Selective Laser Sintering (SLS)

23.3.2.3. Fused Deposition Modeling (FDM)

23.3.2.4. Multi Jet Fusion

23.3.2.5. Others (DLP, EBM, etc.)

23.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

23.4.1. Proof-of-Concept (PoC) Prototype

23.4.2. Functional Prototype

23.4.3. Visual Prototype

23.4.4. Others (User Experience Prototype, etc.)

23.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

23.5.1. Metal

23.5.2. Polymer

23.5.3. Ceramic

23.5.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

23.6. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

23.6.1. Aerospace & Defense

23.6.2. Consumer Goods & Electronics

23.6.3. Automotive

23.6.4. Healthcare

23.6.5. Others (Film and Animation, Architecture, etc.)

23.7. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

23.7.1. GCC

23.7.2. South Africa

23.7.3. Rest of Middle East & Africa

23.8. Market Attractiveness Analysis

23.8.1. By Process

23.8.2. By Type

23.8.3. By Material

23.8.4. By End-use Industry

23.8.5. By Country and Sub-region

24. South America Conventional and Rapid Prototyping Market Analysis and Forecast

24.1. Market Snapshot

24.2. Drivers and Restraints: Impact Analysis

24.3. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Process, 2017–2031

24.3.1. Subtractive (Traditional Prototyping)

24.3.1.1. CNC Machining

24.3.1.2. Injection Molding

24.3.2. Additive (Rapid Prototyping)

24.3.2.1. Stereolithography (SLA)

24.3.2.2. Selective Laser Sintering (SLS)

24.3.2.3. Fused Deposition Modeling (FDM)

24.3.2.4. Multi Jet Fusion

24.3.2.5. Others (DLP, EBM, etc.)

24.4. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

24.4.1. Proof-of-Concept (PoC) Prototype

24.4.2. Functional Prototype

24.4.3. Visual Prototype

24.4.4. Others (User Experience Prototype, etc.)

24.5. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Material, 2017–2031

24.5.1. Metal

24.5.2. Polymer

24.5.3. Ceramic

24.5.4. Others (Plaster and Starch, Foundry Sand Parts, etc.)

24.6. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

24.6.1. Aerospace & Defense

24.6.2. Consumer Goods & Electronics

24.6.3. Automotive

24.6.4. Healthcare

24.6.5. Others (Film and Animation, Architecture, etc.)

24.7. Conventional and Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

24.7.1. Brazil

24.7.2. Rest of South America

24.8. Market Attractiveness Analysis

24.8.1. By Process

24.8.2. By Type

24.8.3. By Material

24.8.4. By End-use Industry

24.8.5. By Country and Sub-region

25. Competition Assessment

25.1. Global Conventional and Rapid Prototyping Market Competition Matrix - a Dashboard View

25.1.1. Global Conventional and Rapid Prototyping Market Company Share Analysis, by Value (2020)

25.1.2. Technological Differentiator

26. Company Profiles (Global Manufacturers/Suppliers)

26.1. 3E Rapid Prototyping Ltd.

26.1.1. Overview

26.1.2. Product Portfolio

26.1.3. Sales Footprint

26.1.4. Key Subsidiaries or Distributors

26.1.5. Strategy and Recent Developments

26.1.6. Key Financials

26.2. ARRK North America, Inc.

26.2.1. Overview

26.2.2. Product Portfolio

26.2.3. Sales Footprint

26.2.4. Key Subsidiaries or Distributors

26.2.5. Strategy and Recent Developments

26.2.6. Key Financials

26.3. Avench Systems INC

26.3.1. Overview

26.3.2. Product Portfolio

26.3.3. Sales Footprint

26.3.4. Key Subsidiaries or Distributors

26.3.5. Strategy and Recent Developments

26.3.6. Key Financials

26.4. Avid Product Development, LLC,

26.4.1. Overview

26.4.2. Product Portfolio

26.4.3. Sales Footprint

26.4.4. Key Subsidiaries or Distributors

26.4.5. Strategy and Recent Developments

26.4.6. Key Financials

26.5. CADX TOOLS & TECHNOLOGIES PVT LTD.

26.5.1. Overview

26.5.2. Product Portfolio

26.5.3. Sales Footprint

26.5.4. Key Subsidiaries or Distributors

26.5.5. Strategy and Recent Developments

26.5.6. Key Financials

26.6. Graphler Technology Solutions

26.6.1. Overview

26.6.2. Product Portfolio

26.6.3. Sales Footprint

26.6.4. Key Subsidiaries or Distributors

26.6.5. Strategy and Recent Developments

26.6.6. Key Financials

26.7. Model Solution Co., Ltd.

26.7.1. Overview

26.7.2. Product Portfolio

26.7.3. Sales Footprint

26.7.4. Key Subsidiaries or Distributors

26.7.5. Strategy and Recent Developments

26.7.6. Key Financials

26.8. Star Rapid., Ltd

26.8.1. Overview

26.8.2. Product Portfolio

26.8.3. Sales Footprint

26.8.4. Key Subsidiaries or Distributors

26.8.5. Strategy and Recent Developments

26.8.6. Key Financials

26.9. Protolabs

26.9.1. Overview

26.9.2. Product Portfolio

26.9.3. Sales Footprint

26.9.4. Key Subsidiaries or Distributors

26.9.5. Strategy and Recent Developments

26.9.6. Key Financials

26.10. Fictiv's

26.10.1. Overview

26.10.2. Product Portfolio

26.10.3. Sales Footprint

26.10.4. Key Subsidiaries or Distributors

26.10.5. Strategy and Recent Developments

26.10.6. Key Financials

26.11. ProtoCAM.

26.11.1. Overview

26.11.2. Product Portfolio

26.11.3. Sales Footprint

26.11.4. Key Subsidiaries or Distributors

26.11.5. Strategy and Recent Developments

26.11.6. Key Financials

26.12. Fathom Digital Manufacturing

26.12.1. Overview

26.12.2. Product Portfolio

26.12.3. Sales Footprint

26.12.4. Key Subsidiaries or Distributors

26.12.5. Strategy and Recent Developments

26.12.6. Key Financials

26.13. Core Molding Technologies, Inc.

26.13.1. Overview

26.13.2. Product Portfolio

26.13.3. Sales Footprint

26.13.4. Key Subsidiaries or Distributors

26.13.5. Strategy and Recent Developments

26.13.6. Key Financials

26.14. Materialise NV

26.14.1. Overview

26.14.2. Product Portfolio

26.14.3. Sales Footprint

26.14.4. Key Subsidiaries or Distributors

26.14.5. Strategy and Recent Developments

26.14.6. Key Financials

26.15. Ant Studio Co., Ltd.

26.15.1. Overview

26.15.2. Product Portfolio

26.15.3. Sales Footprint

26.15.4. Key Subsidiaries or Distributors

26.15.5. Strategy and Recent Developments

26.15.6. Key Financials

26.16. IMAGE MODEL Company Limited

26.16.1. Overview

26.16.2. Product Portfolio

26.16.3. Sales Footprint

26.16.4. Key Subsidiaries or Distributors

26.16.5. Strategy and Recent Developments

26.16.6. Key Financials

26.17. Empire Group USA, Inc.

26.17.1. Overview

26.17.2. Product Portfolio

26.17.3. Sales Footprint

26.17.4. Key Subsidiaries or Distributors

26.17.5. Strategy and Recent Developments

26.17.6. Key Financials

26.18. Kayra Global

26.18.1. Overview

26.18.2. Product Portfolio

26.18.3. Sales Footprint

26.18.4. Key Subsidiaries or Distributors

26.18.5. Strategy and Recent Developments

26.18.6. Key Financials

26.19. Xometry Europe GmbH

26.19.1. Overview

26.19.2. Product Portfolio

26.19.3. Sales Footprint

26.19.4. Key Subsidiaries or Distributors

26.19.5. Strategy and Recent Developments

26.19.6. Key Financials

26.20. Quickparts

26.20.1. Overview

26.20.2. Product Portfolio

26.20.3. Sales Footprint

26.20.4. Key Subsidiaries or Distributors

26.20.5. Strategy and Recent Developments

26.20.6. Key Financials

26.21. Sandvik AB

26.21.1. Overview

26.21.2. Product Portfolio

26.21.3. Sales Footprint

26.21.4. Key Subsidiaries or Distributors

26.21.5. Strategy and Recent Developments

26.21.6. Key Financials

26.22. Renishaw plc.

26.22.1. Overview

26.22.2. Product Portfolio

26.22.3. Sales Footprint

26.22.4. Key Subsidiaries or Distributors

26.22.5. Strategy and Recent Developments

26.22.6. Key Financials

26.23. Fado Sp. z o.o.

26.23.1. Overview

26.23.2. Product Portfolio

26.23.3. Sales Footprint

26.23.4. Key Subsidiaries or Distributors

26.23.5. Strategy and Recent Developments

26.23.6. Key Financials

26.24. Dassault Systèmes SE

26.24.1. Overview

26.24.2. Product Portfolio

26.24.3. Sales Footprint

26.24.4. Key Subsidiaries or Distributors

26.24.5. Strategy and Recent Developments

26.24.6. Key Financials

26.25. Axis Prototypes

26.25.1. Overview

26.25.2. Product Portfolio

26.25.3. Sales Footprint

26.25.4. Key Subsidiaries or Distributors

26.25.5. Strategy and Recent Developments

26.25.6. Key Financials

26.26. Kickr Design, LLC

26.26.1. Overview

26.26.2. Product Portfolio

26.26.3. Sales Footprint

26.26.4. Key Subsidiaries or Distributors

26.26.5. Strategy and Recent Developments

26.26.6. Key Financials

27. Recommendation

27.1. Opportunity Assessment

27.1.1. By Process

27.1.2. By Type

27.1.3. By Material

27.1.4. By End-use Industry

27.1.5. By Region

List of Tables

Table 01: Global Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 02: Global Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 03: Global Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 04: Global Conventional and Rapid Prototyping Market Size & Forecast, by Region, Value (US$ Bn), 2017‒2031

Table 05: North America Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 06: North America Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 07: North America Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 08: North America Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 09: North America Conventional and Rapid Prototyping Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Table 10: U.S. Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 11: U.S. Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 12: U.S. Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 13: U.S. Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 14: Canada Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 15: Canada Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 16: Canada Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 17: Canada Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 18: Europe Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 19: Europe Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 20: Europe Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 21: Europe Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 22: Europe Conventional and Rapid Prototyping Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Table 23: U.K. Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 24: U.K. Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 25: U.K. Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 26: U.K. Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 27: Germany Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 28: Germany Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 29: Germany Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 30: Germany Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 31: France Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 32: France Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 33: France Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 34: France Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 35: Asia Pacific Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 36: Asia Pacific Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 37: Asia Pacific Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 38: Asia Pacific Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 39: Asia Pacific Conventional and Rapid Prototyping Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Table 40: China Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 41: China Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 42: China Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 43: China Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 44: Japan Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 45: Japan Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 46: Japan Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 47: Japan Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 48: South Korea Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 49: South Korea Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 50: South Korea Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 51: South Korea Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 52: India Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 53: India Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 54: India Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 55: India Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 56: ASEAN Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 57: ASEAN Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 58: ASEAN Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 59: ASEAN Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 60: Middle East & Africa Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 61: Middle East & Africa Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 62: Middle East & Africa Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 63: Middle East & Africa Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 64: Middle East & Africa Conventional and Rapid Prototyping Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Table 65: South America Conventional and Rapid Prototyping Market Size & Forecast, by Process, Value (US$ Bn), 2017‒2031

Table 66: South America Conventional and Rapid Prototyping Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 67: South America Conventional and Rapid Prototyping Market Size & Forecast, by Material, Value (US$ Bn), 2017‒2031

Table 68: South America Conventional and Rapid Prototyping Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 69: South America Conventional and Rapid Prototyping Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017‒2031

List of Figures

Figure 01: Global Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 02: Global Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 03: Global Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 04: Global Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 05: Global Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 06: Global Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 07: Global Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 08: Global Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 09: Global Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 10: Global Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 11: Global Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 12: Global Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 13: Global Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 14: Global Conventional and Rapid Prototyping Market Projections by Region, Value (US$ Bn), 2017‒2031

Figure 15: Global Conventional and Rapid Prototyping Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022‒2031

Figure 16: Global Conventional and Rapid Prototyping Market Share Analysis, by Region, 2021 and 2031

Figure 17: North America Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 18: North America Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 19: North America Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 20: North America Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 21: North America Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 22: North America Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 23: North America Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 24: North America Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 25: North America Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 26: North America Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 27: North America Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 28: North America Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 29: North America Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 30: North America Conventional and Rapid Prototyping Market Projections by Country, Value (US$ Bn), 2017‒2031

Figure 31: North America Conventional and Rapid Prototyping Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 32: North America Conventional and Rapid Prototyping Market Share Analysis, by Country, 2021 and 2031

Figure 33: U.S. Conventional and Rapid Prototyping Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 34: U.S. Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 35: U.S. Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 36: U.S. Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 37: U.S. Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 38: U.S. Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 39: U.S. Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 40: U.S. Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 41: U.S. Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 42: U.S. Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 43: U.S. Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 44: U.S. Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 45: U.S. Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 46: U.S. Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 47: Canada Conventional and Rapid Prototyping Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 48: Canada Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 49: Canada Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 50: Canada Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 51: Canada Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 52: Canada Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 53: Canada Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 54: Canada Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 55: Canada Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 56: Canada Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 57: Canada Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 58: Canada Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 59: Canada Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 60: Canada Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 61: Europe Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 62: Europe Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 63: Europe Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 64: Europe Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 65: Europe Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 66: Europe Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 67: Europe Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 68: Europe Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 69: Europe Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 70: Europe Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 71: Europe Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 72: Europe Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 73: Europe Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 74: Europe Conventional and Rapid Prototyping Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 75: Europe Conventional and Rapid Prototyping Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Bn), 2022‒2031

Figure 76: Europe Conventional and Rapid Prototyping Market Share Analysis, by Country and Sub-region, 2021 and 2031

Figure 77: U.K. Conventional and Rapid Prototyping Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 78: U.K. Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 79: U.K. Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 80: U.K. Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 81: U.K. Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 82: U.K. Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 83: U.K. Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 84: U.K. Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 85: U.K. Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 86: U.K. Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 87: U.K. Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 88: U.K. Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 89: U.K. Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 90: U.K. Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 91: Germany Conventional and Rapid Prototyping Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 92: Germany Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 93: Germany Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 94: Germany Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 95: Germany Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 96: Germany Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 97: Germany Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 98: Germany Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 99: Germany Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 100: Germany Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 101: Germany Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 102: Germany Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 103: Germany Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 104: Germany Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 105: France Conventional and Rapid Prototyping Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 106: France Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 107: France Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 108: France Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 109: France Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 110: France Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 111: France Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 112: France Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 113: France Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 114: France Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 115: France Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 116: France Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 117: France Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 118: France Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 119: Asia Pacific Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 120: Asia Pacific Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 121: Asia Pacific Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 122: Asia Pacific Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 123: Asia Pacific Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 124: Asia Pacific Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 125: Asia Pacific Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 126: Asia Pacific Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 127: Asia Pacific Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 128: Asia Pacific Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 129: Asia Pacific Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 130: Asia Pacific Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 131: Asia Pacific Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 132: Asia Pacific Conventional and Rapid Prototyping Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 133: Asia Pacific Conventional and Rapid Prototyping Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Bn), 2022‒2031

Figure 134: Asia Pacific Conventional and Rapid Prototyping Market Share Analysis, by Country and Sub-region, 2021 and 2031

Figure 135: China Conventional and Rapid Prototyping Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 136: China Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 137: China Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 138: China Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 139: China Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 140: China Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 141: China Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 142: China Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 143: China Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 144: China Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 145: China Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 146: China Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 147: China Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 148: China Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 149: Japan Conventional and Rapid Prototyping Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 150: Japan Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 151: Japan Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 152: Japan Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 153: Japan Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 154: Japan Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 155: Japan Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 156: Japan Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 157: Japan Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 158: Japan Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 159: Japan Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 160: Japan Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 161: Japan Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 162: Japan Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 163: South Korea Conventional and Rapid Prototyping Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 164: South Korea Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 165: South Korea Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 166: South Korea Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 167: South Korea Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 168: South Korea Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 169: South Korea Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 170: South Korea Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 171: South Korea Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 172: South Korea Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 173: South Korea Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 174: South Korea Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 175: South Korea Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 176: South Korea Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 177: India Conventional and Rapid Prototyping Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 178: India Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 179: India Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 180: India Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 181: India Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 182: India Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 183: India Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 184: India Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 185: India Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 186: India Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 187: India Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 188: India Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 189: India Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 190: India Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 191: ASEAN Conventional and Rapid Prototyping Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 192: ASEAN Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 193: ASEAN Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 194: ASEAN Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 195: ASEAN Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 196: ASEAN Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 197: ASEAN Conventional and Rapid Prototyping Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 198: ASEAN Conventional and Rapid Prototyping Market Share Analysis, by Type, 2021 and 2031

Figure 199: ASEAN Conventional and Rapid Prototyping Market Projections by Material, Value (US$ Bn), 2017‒2031

Figure 200: ASEAN Conventional and Rapid Prototyping Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022‒2031

Figure 201: ASEAN Conventional and Rapid Prototyping Market Share Analysis, by Material, 2021 and 2031

Figure 202: ASEAN Conventional and Rapid Prototyping Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 203: ASEAN Conventional and Rapid Prototyping Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 204: ASEAN Conventional and Rapid Prototyping Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 205: Middle East & Africa Conventional and Rapid Prototyping Market, Year-on-Year Growth, Overview, 2021‒2031

Figure 206: Middle East & Africa Conventional and Rapid Prototyping Market Projections by Process, Value (US$ Bn), 2017‒2031

Figure 207: Middle East & Africa Conventional and Rapid Prototyping Market, Incremental Opportunity, by Process, Value (US$ Bn), 2022‒2031

Figure 208: Middle East & Africa Conventional and Rapid Prototyping Market Share Analysis, by Process, 2021 and 2031

Figure 209: Middle East & Africa Conventional and Rapid Prototyping Market Projections by Type, Value (US$ Bn), 2017‒2031