Analysts’ Viewpoint

Aggressive advancements in the automotive industry and increased integration of electronics and automation components in vehicles to meet safety and comfort requirement according to the norms suggested by regulatory authorities are key factors that are projected to boost the automotive junction box market value. Light vehicle electrical systems have been fitted with smart junction boxes for the last few years. However, present-day automobiles, trucks, and SUVs are not best served either by widespread integration of electronics or by switching and shielding methods.

eFuse and SmartFET solutions offer cutting-edge power regulation and protection in compact, lightweight packaging, which are available as smart junction box (SJB) choices. Therefore, manufacturers are turning to electronic fuses (eFuses) to enhance efficiency, as the demand for vehicles increase. eFuses offer several advantages over conventional fuses due to their high-precision current measurement. Moreover, they allow for better control of battery charging and discharging.

An automotive junction box is a device designed to protect a connection or the junction of two or more wires carrying electrical current. This level of protection is required for dependable connections to develop and stay tight over several years. The junction box eliminates the need to run a wire from each outlet or switch back to the main service panel. Presently, junction boxes have the ability to house electronic modules. It is significantly simpler to find and fix any electrical issue that arises in the system when a junction box is used for every electrical connection. The junction box is used to protect each electrical connection and to make sure that it is simple to locate and access.

The COVID-19 pandemic compelled governments across the globe to halt production and manufacturing across industries, which also hampered the global automotive industry growth. However, the post pandemic recovery of the global automotive industry, especially increased sales of electric vehicles, has triggered market expansion.

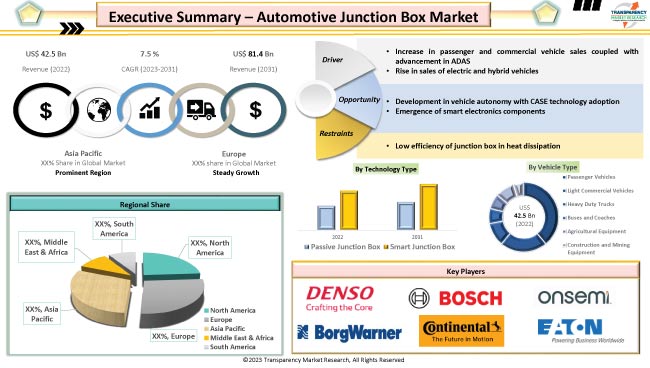

Substantial increase in sales of passenger and commercial vehicles post the pandemic has fueled the demand for automotive junction boxes. Additionally, increasing penetration of electronic components in vehicles is also a key factor boosting the automotive junction box industry growth at a significant pace. Furthermore, rise in EV sales along with surge in use of electric components, such as advanced electronics and sensory equipment, is likely to propel the automotive junction box market demand.

Thus, manufacturing of the automotive junction box is an evolving sector, and the demand for auto junction boxes is anticipated to increase following the growth of the CASE trend. Advanced computational capability and specialized peripherals offered by automotive MCUs are creating significant automotive junction box business opportunities for manufacturers operating in the market.

Rise in demand for electric vehicles owing to enactment of stringent emission norms is anticipated to propel the demand for automotive electric junction box, as more advanced electric components are used in electric vehicles to enhance safety features. Furthermore, automakers are incorporating more electric systems and components into their designs to enhance the quality and driving experience of their vehicles.

Manufacturers are incorporating several electronic devices and systems to enhance the efficiency of their vehicles and track the working of all major components in order to monitor faults in an effective manner. Penetration of electric power steering system is anticipated to increase considerable in the next few years owing to the numerous benefits offered by this technology over hydraulic power steering, such as low maintenance costs and support in delivering improved fuel efficiency

In terms of technology, the automotive junction box market segmentation comprises passive junction box and smart junction box. The smart junction box segment is projected to account for major automotive junction box market share during the forecast period. This is due to high penetration of micro-controller based technology to perform several vehicle control functions and increased deployment of cutting-edge electronics and telematics solutions even in a small, midsize, and economy level cars. Additionally, increase in disposable income across the world is propelling automotive sales in developing and middle-income countries, which is further boosting the future of automotive junction box market.

According to global automotive junction box market analysis, growing trend of connected, autonomous, shared and electric (CASE) mobility in the automobile industry and rising penetration of autonomy levels with advancements in ADAS, i.e. vehicle assisted technologies including the lane departure warning system, vehicle cruise control and blind spot detection system, are projected to fuel the automotive electric junction box market growth. Enhancements in the electric power steering (EPS) with ADAS technologies in passenger vehicles is also anticipated to positively boost the automotive junction box industry across the globe.

Asia Pacific is estimated to lead the global market during the forecast period. The market in Asia Pacific is expected to grow significantly due to rapid expansion of the manufacturing sector and the automobile industry in the region, where China is leading the charge of the mobility industry. Furthermore, the region is at the global forefront in supplying electric vehicles and its various components. Furthermore, consistent growth in EV sales in China, India, Japan, and South Korea as well as ASEAN countries is estimated to offer lucrative growth opportunities for APAC automotive junction box business growth.

Significant expansion witnessed by the Europe market could be attributed to higher sales of electric cars in the region. Growth of the market in the region is expected to be primarily driven by the strong automotive business in Germany, France, Italy, and the U.K., which are key markets with strong presence of several OEM and tire-1 suppliers in Europe with cutting-edge electric junction box research and development capabilities.

Furthermore, North America is currently witnessing stronger sales of SUVs and light commercial vehicles, which have even surpassed the passenger car sales volume. Manufacturers in the U.S. are majorly focusing on the adoption of automation in automobile applications to create highly effective, safer, and superior in-vehicle eco-systems. This is projected to have a significant impact on the U.S. automotive junction box market size.

Automotive manufacturers striving consistently to stay ahead in the market competition and are emphasizing on new product development and investing in R&D activities, which is consequently benefiting the market players. Expansion of product portfolios, mergers, and acquisitions are prominent strategies adopted by key players. Some of the key vendors in the automotive junction box market across the globe are Aisin Seiki Co. Ltd., BorgWarner Inc., Continental AG, Denso Corporation, Eaton Corporation Plc, Hilite International, Hitachi Astemo, Ltd., Onsemi, Maxwell Technologies Inc., Mechadyne International Ltd., Robert Bosch Gmbh, Schaeffler Technologies Ag & Co. AG, Valeo SA, Johnson Control Inc., and Mitsubishi Industrial Automation.

Key players in the automotive junction box market research report have been profiled on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 42.5 Bn |

|

Market Forecast Value in 2031 |

US$ 81.4 Bn |

|

Growth Rate (CAGR) |

7.5% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 42.5 Bn in 2022

It is expected to expand at a CAGR of 7.50 % by 2031

It is expected to reach a value of US$ 81.4 Bn in 2031

Rise in sales of passenger and commercial vehicles coupled with advancements in ADAS and increased sales of EVs and hybrid vehicles

Based on technology type, the smart junction box segment held major share of the market. In terms of vehicle type, the passenger vehicle segment accounted for dominant share in 2022

Asia Pacific was the most lucrative region for vendors in 2022.

Aisin Seiki Co. Ltd., BorgWarner Inc., Continental AG, Denso Corporation, Eaton Corporation Plc, Hilite International, Hitachi Astemo, Ltd., Onsemi, Maxwell Technologies Inc., Mechadyne International Ltd., Robert Bosch Gmbh, Schaeffler Technologies Ag & Co. AG, Valeo SA, Johnson Control Inc., and Mitsubishi Industrial Automation

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, volume in Thousand Units, value in US$ Mn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. CASE Trend Impact Analysis – Automotive Junction Box Market

4. Global Automotive Junction Box Market, by Technology Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Junction Box Market Size & Forecast, 2017-2031, by Technology Type

4.2.1. Passive Junction Box

4.2.2. Smart Junction Box

5. Global Automotive Junction Box Market, by Function

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Junction Box Market Size & Forecast, 2017-2031, by Function

5.2.1. Automotive Power Switching

5.2.2. Vehicle Body Control

6. Global Automotive Junction Box Market, by Component

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Junction Box Market Size & Forecast, 2017-2031, by Component

6.2.1. AC Power Plugs And Sockets

6.2.2. Cable Tray

6.2.3. Electrical Conduit

6.2.4. Mineral Insulated Copper-Clad Cable

6.2.5. Multi-Way Switching

6.2.6. Steel Wire Armored Cable

6.2.7. Ring Circuit

6.2.8. Thermoplastic-Sheathed Cable

7. Global Automotive Junction Box Market, by Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Junction Box Market Size & Forecast, 2017-2031, by Vehicle Type

7.2.1. Passenger Vehicles

7.2.1.1. Hatchback

7.2.1.2. Sedan

7.2.1.3. SUVs

7.2.2. Light Commercial Vehicles

7.2.3. Heavy Duty Trucks

7.2.4. Buses and Coaches

7.2.5. Agricultural Equipment

7.2.6. Construction and Mining Equipment

7.2.7. Others

8. Global Automotive Junction Box Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Junction Box Market Size & Forecast, 2017-2031, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Automotive Junction Box Market

9.1. Market Snapshot

9.2. Automotive Junction Box Market Size & Forecast, 2017-2031, by Technology Type

9.2.1. Passive Junction Box

9.2.2. Smart Junction Box

9.3. Automotive Junction Box Market Size & Forecast, 2017-2031, by Function

9.3.1. Automotive Power Switching

9.3.2. Vehicle Body Control

9.4. Automotive Junction Box Market Size & Forecast, 2017-2031, by Component

9.4.1. AC Power Plugs And Sockets

9.4.2. Cable Tray

9.4.3. Electrical Conduit

9.4.4. Mineral Insulated Copper-Clad Cable

9.4.5. Multi-Way Switching

9.4.6. Steel Wire Armored Cable

9.4.7. Ring Circuit

9.4.8. Thermoplastic-Sheathed Cable

9.5. Automotive Junction Box Market Size & Forecast, 2017-2031, by Vehicle Type

9.5.1. Passenger Vehicles

9.5.1.1. Hatchback

9.5.1.2. Sedan

9.5.1.3. SUVs

9.5.2. Light Commercial Vehicles

9.5.3. Heavy Duty Trucks

9.5.4. Buses and Coaches

9.5.5. Agricultural Equipment

9.5.6. Construction and Mining Equipment

9.5.7. Others

9.6. Key Country Analysis – North America Automotive Junction Box Market Size & Forecast, 2017-2031

9.6.1. U. S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Automotive Junction Box Market

10.1. Market Snapshot

10.2. Automotive Junction Box Market Size & Forecast, 2017-2031, by Technology Type

10.2.1. Passive Junction Box

10.2.2. Smart Junction Box

10.3. Automotive Junction Box Market Size & Forecast, 2017-2031, by Function

10.3.1. Automotive Power Switching

10.3.2. Vehicle Body Control

10.4. Automotive Junction Box Market Size & Forecast, 2017-2031, by Component

10.4.1. AC Power Plugs And Sockets

10.4.2. Cable Tray

10.4.3. Electrical Conduit

10.4.4. Mineral Insulated Copper-Clad Cable

10.4.5. Multi-Way Switching

10.4.6. Steel Wire Armored Cable

10.4.7. Ring Circuit

10.4.8. Thermoplastic-Sheathed Cable

10.5. Automotive Junction Box Market Size & Forecast, 2017-2031, by Vehicle Type

10.5.1. Passenger Vehicles

10.5.1.1. Hatchback

10.5.1.2. Sedan

10.5.1.3. SUVs

10.5.2. Light Commercial Vehicles

10.5.3. Heavy Duty Trucks

10.5.4. Buses and Coaches

10.5.5. Agricultural Equipment

10.5.6. Construction and Mining Equipment

10.5.7. Others

10.6. Key Country Analysis - Europe Automotive Junction Box Market Size & Forecast, 2017-2031

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Automotive Junction Box Market

11.1. Market Snapshot

11.2. Automotive Junction Box Market Size & Forecast, 2017-2031, by Technology Type

11.2.1. Passive Junction Box

11.2.2. Smart Junction Box

11.3. Automotive Junction Box Market Size & Forecast, 2017-2031, by Function

11.3.1. Automotive Power Switching

11.3.2. Vehicle Body Control

11.4. Automotive Junction Box Market Size & Forecast, 2017-2031, by Component

11.4.1. AC Power Plugs And Sockets

11.4.2. Cable Tray

11.4.3. Electrical Conduit

11.4.4. Mineral Insulated Copper-Clad Cable

11.4.5. Multi-Way Switching

11.4.6. Steel Wire Armored Cable

11.4.7. Ring Circuit

11.4.8. Thermoplastic-Sheathed Cable

11.5. Automotive Junction Box Market Size & Forecast, 2017-2031, by Vehicle Type

11.5.1. Passenger Vehicles

11.5.1.1. Hatchback

11.5.1.2. Sedan

11.5.1.3. SUVs

11.5.2. Light Commercial Vehicles

11.5.3. Heavy Duty Trucks

11.5.4. Buses and Coaches

11.5.5. Agricultural Equipment

11.5.6. Construction and Mining Equipment

11.5.7. Others

11.6. Key Country Analysis - Asia Pacific Automotive Junction Box Market Size & Forecast, 2017-2031, by Country

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Automotive Junction Box Market

12.1. Market Snapshot

12.2. Automotive Junction Box Market Size & Forecast, 2017-2031, by Technology Type

12.2.1. Passive Junction Box

12.2.2. Smart Junction Box

12.3. Automotive Junction Box Market Size & Forecast, 2017-2031, by Function

12.3.1. Automotive Power Switching

12.3.2. Vehicle Body Control

12.4. Automotive Junction Box Market Size & Forecast, 2017-2031, by Component

12.4.1. AC Power Plugs And Sockets

12.4.2. Cable Tray

12.4.3. Electrical Conduit

12.4.4. Mineral Insulated Copper-Clad Cable

12.4.5. Multi-Way Switching

12.4.6. Steel Wire Armored Cable

12.4.7. Ring Circuit

12.4.8. Thermoplastic-Sheathed Cable

12.5. Automotive Junction Box Market Size & Forecast, 2017-2031, by Vehicle Type

12.5.1. Passenger Vehicles

12.5.1.1. Hatchback

12.5.1.2. Sedan

12.5.1.3. SUVs

12.5.2. Light Commercial Vehicles

12.5.3. Heavy Duty Trucks

12.5.4. Buses and Coaches

12.5.5. Agricultural Equipment

12.5.6. Construction and Mining Equipment

12.5.7. Others

12.6. Key Country Analysis - Middle East & Africa Automotive Junction Box Market Size & Forecast, 2017-2031, by Country

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Automotive Junction Box Market

13.1. Market Snapshot

13.2. Automotive Junction Box Market Size & Forecast, 2017-2031, by Technology Type

13.2.1. Passive Junction Box

13.2.2. Smart Junction Box

13.3. Automotive Junction Box Market Size & Forecast, 2017-2031, by Function

13.3.1. Automotive Power Switching

13.3.2. Vehicle Body Control

13.4. Automotive Junction Box Market Size & Forecast, 2017-2031, by Component

13.4.1. AC Power Plugs And Sockets

13.4.2. Cable Tray

13.4.3. Electrical Conduit

13.4.4. Mineral Insulated Copper-Clad Cable

13.4.5. Multi-Way Switching

13.4.6. Steel Wire Armored Cable

13.4.7. Ring Circuit

13.4.8. Thermoplastic-Sheathed Cable

13.5. Automotive Junction Box Market Size & Forecast, 2017-2031, by Vehicle Type

13.5.1. Passenger Vehicles

13.5.1.1. Hatchback

13.5.1.2. Sedan

13.5.1.3. SUVs

13.5.2. Light Commercial Vehicles

13.5.3. Heavy Duty Trucks

13.5.4. Buses and Coaches

13.5.5. Agricultural Equipment

13.5.6. Construction and Mining Equipment

13.5.7. Others

13.6. Key Country Analysis - South America Automotive Junction Box Market Size & Forecast, 2017-2031

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1. Aisin Seiki Co. Ltd.

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. BorgWarner Inc.

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. Continental AG

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. Denso Corporation

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. Eaton Corporation Plc

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. Hilite International

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. Hitachi Astemo, Ltd.

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. Onsemi

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. Maxwell Technologies Inc

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. Mechadyne International Ltd

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. Robert Bosch Gmbh

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. Schaeffler Technologies Ag & Co. AG

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. Valeo SA

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

15.14. Johnson Control Inc

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Production Locations

15.14.4. Product Portfolio

15.14.5. Competitors & Customers

15.14.6. Subsidiaries & Parent Organization

15.14.7. Recent Developments

15.14.8. Financial Analysis

15.14.9. Profitability

15.14.10. Revenue Share

15.15. Mitsubishi Industrial Automation

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Production Locations

15.15.4. Product Portfolio

15.15.5. Competitors & Customers

15.15.6. Subsidiaries & Parent Organization

15.15.7. Recent Developments

15.15.8. Financial Analysis

15.15.9. Profitability

15.15.10. Revenue Share

15.16. Others

15.16.1. Company Overview

15.16.2. Company Footprints

15.16.3. Production Locations

15.16.4. Product Portfolio

15.16.5. Competitors & Customers

15.16.6. Subsidiaries & Parent Organization

15.16.7. Recent Developments

15.16.8. Financial Analysis

15.16.9. Profitability

15.16.10. Revenue Share

List of Tables

Table 1: Global Automotive Junction Box Market Volume (Thousand Units) Forecast, by Technology Type, 2017-2031

Table 2: Global Automotive Junction Box Market Value (US$ Bn) Forecast, by Technology Type, 2017-2031

Table 3: Global Automotive Junction Box Market Volume (Thousand Units) Forecast, by Function, 2017-2031

Table 4: Global Automotive Junction Box Market Value (US$ Bn) Forecast, by Function, 2017-2031

Table 5: Global Automotive Junction Box Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 6: Global Automotive Junction Box Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 7: Global Automotive Junction Box Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Automotive Junction Box Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 9: Global Automotive Junction Box Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 10: Global Automotive Junction Box Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 11: North America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Technology Type, 2017-2031

Table 12: North America Automotive Junction Box Market Value (US$ Bn) Forecast, by Technology Type, 2017-2031

Table 13: North America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Function, 2017-2031

Table 14: North America Automotive Junction Box Market Value (US$ Bn) Forecast, by Function, 2017-2031

Table 15: North America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 16: North America Automotive Junction Box Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 17: North America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 18: North America Automotive Junction Box Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 19: North America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 20: North America Automotive Junction Box Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Europe Automotive Junction Box Market Volume (Thousand Units) Forecast, by Technology Type, 2017-2031

Table 22: Europe Automotive Junction Box Market Value (US$ Bn) Forecast, by Technology Type, 2017-2031

Table 23: Europe Automotive Junction Box Market Volume (Thousand Units) Forecast, by Function, 2017-2031

Table 24: Europe Automotive Junction Box Market Value (US$ Bn) Forecast, by Function, 2017-2031

Table 25: Europe Automotive Junction Box Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 26: Europe Automotive Junction Box Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 27: Europe Automotive Junction Box Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 28: Europe Automotive Junction Box Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 29: Europe Automotive Junction Box Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 30: Europe Automotive Junction Box Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 31: Asia Pacific Automotive Junction Box Market Volume (Thousand Units) Forecast, by Technology Type, 2017-2031

Table 32: Asia Pacific Automotive Junction Box Market Value (US$ Bn) Forecast, by Technology Type, 2017-2031

Table 33: Asia Pacific Automotive Junction Box Market Volume (Thousand Units) Forecast, by Function, 2017-2031

Table 34: Asia Pacific Automotive Junction Box Market Value (US$ Bn) Forecast, by Function, 2017-2031

Table 35: Asia Pacific Automotive Junction Box Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 36: Asia Pacific Automotive Junction Box Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 37: Asia Pacific Automotive Junction Box Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 38: Asia Pacific Automotive Junction Box Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 39: Asia Pacific Automotive Junction Box Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 40: Asia Pacific Automotive Junction Box Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 41: Middle East & Africa Automotive Junction Box Market Volume (Thousand Units) Forecast, by Technology Type, 2017-2031

Table 42: Middle East & Africa Automotive Junction Box Market Value (US$ Bn) Forecast, by Technology Type, 2017-2031

Table 43: Middle East & Africa Automotive Junction Box Market Volume (Thousand Units) Forecast, by Function, 2017-2031

Table 44: Middle East & Africa Automotive Junction Box Market Value (US$ Bn) Forecast, by Function, 2017-2031

Table 45: Middle East & Africa Automotive Junction Box Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 46: Middle East & Africa Automotive Junction Box Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 47: Middle East & Africa Automotive Junction Box Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 48: Middle East & Africa Automotive Junction Box Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 49: Middle East & Africa Automotive Junction Box Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 50: Middle East & Africa Automotive Junction Box Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 51: South America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Technology Type, 2017-2031

Table 52: South America Automotive Junction Box Market Value (US$ Bn) Forecast, by Technology Type, 2017-2031

Table 53: South America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Function, 2017-2031

Table 54: South America Automotive Junction Box Market Value (US$ Bn) Forecast, by Function, 2017-2031

Table 55: South America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 56: South America Automotive Junction Box Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 57: South America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 58: South America Automotive Junction Box Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 59: South America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: South America Automotive Junction Box Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Junction Box Market Volume (Thousand Units) Forecast, by Technology Type, 2017-2031

Figure 2: Global Automotive Junction Box Market Value (US$ Bn) Forecast, by Technology Type, 2017-2031

Figure 3: Global Automotive Junction Box Market, Incremental Opportunity, by Technology Type, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Junction Box Market Volume (Thousand Units) Forecast, by Function, 2017-2031

Figure 5: Global Automotive Junction Box Market Value (US$ Bn) Forecast, by Function, 2017-2031

Figure 6: Global Automotive Junction Box Market, Incremental Opportunity, by Function, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Junction Box Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 8: Global Automotive Junction Box Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 9: Global Automotive Junction Box Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Junction Box Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Automotive Junction Box Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Automotive Junction Box Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Junction Box Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Junction Box Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Automotive Junction Box Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 16: North America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Technology Type, 2017-2031

Figure 17: North America Automotive Junction Box Market Value (US$ Bn) Forecast, by Technology Type, 2017-2031

Figure 18: North America Automotive Junction Box Market, Incremental Opportunity, by Technology Type, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Function, 2017-2031

Figure 20: North America Automotive Junction Box Market Value (US$ Bn) Forecast, by Function, 2017-2031

Figure 21: North America Automotive Junction Box Market, Incremental Opportunity, by Function, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 23: North America Automotive Junction Box Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 24: North America Automotive Junction Box Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 26: North America Automotive Junction Box Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 27: North America Automotive Junction Box Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 29: North America Automotive Junction Box Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: North America Automotive Junction Box Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: Europe Automotive Junction Box Market Volume (Thousand Units) Forecast, by Technology Type, 2017-2031

Figure 32: Europe Automotive Junction Box Market Value (US$ Bn) Forecast, by Technology Type, 2017-2031

Figure 33: Europe Automotive Junction Box Market, Incremental Opportunity, by Technology Type, Value (US$ Bn), 2023-2031

Figure 34: Europe Automotive Junction Box Market Volume (Thousand Units) Forecast, by Function, 2017-2031

Figure 35: Europe Automotive Junction Box Market Value (US$ Bn) Forecast, by Function, 2017-2031

Figure 36: Europe Automotive Junction Box Market, Incremental Opportunity, by Function, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Junction Box Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 38: Europe Automotive Junction Box Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 39: Europe Automotive Junction Box Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 40: Europe Automotive Junction Box Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 41: Europe Automotive Junction Box Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 42: Europe Automotive Junction Box Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 43: Europe Automotive Junction Box Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 44: Europe Automotive Junction Box Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 45: Europe Automotive Junction Box Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Automotive Junction Box Market Volume (Thousand Units) Forecast, by Technology Type, 2017-2031

Figure 47: Asia Pacific Automotive Junction Box Market Value (US$ Bn) Forecast, by Technology Type, 2017-2031

Figure 48: Asia Pacific Automotive Junction Box Market, Incremental Opportunity, by Technology Type, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Automotive Junction Box Market Volume (Thousand Units) Forecast, by Function, 2017-2031

Figure 50: Asia Pacific Automotive Junction Box Market Value (US$ Bn) Forecast, by Function, 2017-2031

Figure 51: Asia Pacific Automotive Junction Box Market, Incremental Opportunity, by Function, Value (US$ Bn), 2023-2031

Figure 52: Asia Pacific Automotive Junction Box Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 53: Asia Pacific Automotive Junction Box Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 54: Asia Pacific Automotive Junction Box Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Junction Box Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 56: Asia Pacific Automotive Junction Box Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 57: Asia Pacific Automotive Junction Box Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Automotive Junction Box Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific Automotive Junction Box Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific Automotive Junction Box Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Automotive Junction Box Market Volume (Thousand Units) Forecast, by Technology Type, 2017-2031

Figure 62: Middle East & Africa Automotive Junction Box Market Value (US$ Bn) Forecast, by Technology Type, 2017-2031

Figure 63: Middle East & Africa Automotive Junction Box Market, Incremental Opportunity, by Technology Type, Value (US$ Bn), 2023-2031

Figure 64: Middle East & Africa Automotive Junction Box Market Volume (Thousand Units) Forecast, by Function, 2017-2031

Figure 65: Middle East & Africa Automotive Junction Box Market Value (US$ Bn) Forecast, by Function, 2017-2031

Figure 66: Middle East & Africa Automotive Junction Box Market, Incremental Opportunity, by Function, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Automotive Junction Box Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 68: Middle East & Africa Automotive Junction Box Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 69: Middle East & Africa Automotive Junction Box Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 70: Middle East & Africa Automotive Junction Box Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 71: Middle East & Africa Automotive Junction Box Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 72: Middle East & Africa Automotive Junction Box Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Automotive Junction Box Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 74: Middle East & Africa Automotive Junction Box Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 75: Middle East & Africa Automotive Junction Box Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 76: South America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Technology Type, 2017-2031

Figure 77: South America Automotive Junction Box Market Value (US$ Bn) Forecast, by Technology Type, 2017-2031

Figure 78: South America Automotive Junction Box Market, Incremental Opportunity, by Technology Type, Value (US$ Bn), 2023-2031

Figure 79: South America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Function, 2017-2031

Figure 80: South America Automotive Junction Box Market Value (US$ Bn) Forecast, by Function, 2017-2031

Figure 81: South America Automotive Junction Box Market, Incremental Opportunity, by Function, Value (US$ Bn), 2023-2031

Figure 82: South America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 83: South America Automotive Junction Box Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 84: South America Automotive Junction Box Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 85: South America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 86: South America Automotive Junction Box Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 87: South America Automotive Junction Box Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 88: South America Automotive Junction Box Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: South America Automotive Junction Box Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: South America Automotive Junction Box Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031