Finding the right structured settlement company to use for your lawsuit or other annuity payouts can be complex. We are here to provide recommendations. To give you some clarity on the topic through an explanation of which companies you should use and which ones you should not. The process can be complex when entering a transfer of payment rights. Our guide for selling a structured settlement will help you with the buyout, engaging the right help, and a comparison of the best institutions in the marketplace today. We have our top choice listed below with the other reviewed companies listed below our number one pick.

Top Structured Settlement Buyer:

District Settlement Finance – 844-933-2377

Known for having excellent customer support from California to DC

- Has upfront cash offers for buyouts

- Best offer guarantee

- Provides instant quotes

- Buyer of structured settlements, Annuities, and Lottery Payments

District Settlement Finance is a boutique firm with annuity and structure settlement experts who offer personalized buyout offers to fit your best interest. Their team of diverse representatives speak English and Spanish to help their growing base of Latin clientele. When you speak to a District Settlement Finance representative, they will go over your needs and future goals. The Annuity specialists believe in a fast and transparent process to help guide each client from the time of notary signings to the day of court. While it’s not an easy process our review of 14 different structured settlement companies finds that District Settlement Finance is the top firm to work with when selling a structured settlement.

Website: https://districtsettlement.com/

Understanding Structured Settlements

A structured settlement is a method of payment for victims and plaintiffs of legal disputes and usually comes from the defendant or their insurer. Some common occasions where one may end up with a structured settlement are:

- Personal injury cases

- Wrongful death lawsuits

- Train Accidents

- Other tort or commercial liability claims

Payments from a structured settlement are made to the recipient in periodic installments and hence the name are structured. They serve as an alternative to a lump-sum settlement where all funds would instead transfer in a single installment. As a financial product, they are most comparable to an annuity; others may refer to them as such and those that hold the payments are more concerned about their money than they are the nomenclature.

The benefit of a structured settlement is two-fold. For the recipient, the structure provides a steady income stream, reducing some of the financial planning burdens that might come with a lump-sum settlement. For defendants and payors, a structured settlement lessens the immediate financial burden from the liability. This allows defendants to make quicker payments because there is a lower risk of the need to liquidate assets to meet obligations and in almost all cases the insurance company is the one that makes the monthly, quarterly, or yearly payments. Ideally, the structure also helps defendants to pay victims a larger overall settlement over a longer period compared to a lesser lump sum.

Assemble a Team of Professionals to Advise on Structured Settlement Options

The value proposition of agreeing to a structured settlement as opposed to a lump-sum or court award will depend on several factors such as:

- The nature of a particular offer

- The financial needs of the victim

- The merits of the case

- The Damage and Harm done to plaintiff

Enlisting the help of experienced professionals, including lawyers, accountants, settlement planners, and financial advisors, may provide useful guidance in weighing the value of a structured settlement offer vs a lump sum payout. Consulting with a settlement planner or financial planner prior to signing can help ensure you make an informed choice about how the deal will impact your finances and quality of life. Working with your hired team will also be helpful should you ever need to consider selling or leveraging your structured settlement, a topic we discuss in greater detail below.

Selling an Annuity to a Structured Settlement Company

As mentioned above, the primary benefit of a structured settlement is that recipients do not have to worry about complex financial planning because their payments come in scheduled installments. In other words, they only need to financially plan out as far as their next installment. However, this payment structure is not always convenient for the immediate needs of a plaintiff in life after the lawsuit has been settled. The possible downside is that benefactors of a structured settlement lack the autonomy and power that comes from being able to access the full value of their settlement right away. Some examples where quick access to a lump sum of funds could be especially useful include:

- Buying a house (or at least having the funds to secure a down payment)

- Paying off large debts (e.g., medical bills, credits cards, student loans)

- Making other major purchases or investments (e.g., school tuition or starting a business)

When these situations arise, an option is to sell the rights to guaranteed payments from a structured settlement to a third party known as a structured settlement company on the secondary market. These structured settlement companies are financial institutions that offer lump-sum distributions to plaintiffs in exchange for the rights to their structured settlement payment rights. Again, prospective sellers of a structured settlement will want to consult their attorneys and financial advisors to thoroughly vet their options considering their unique needs and financial situation.

Key Considerations for Choosing a Structured Settlement Company

For most plaintiffs, a structured settlement will be one of their greatest assets. Naturally, it’s important to go slow, carefully review options, and make an informed decision. Do not rush to an agreement with a structured settlement buyer that may offer faster payment but at a greatly reduced value. To help navigate the pros and cons of structured settlement companies, consider the following factors.

Customer Service

Selling a structured settlement is not an easy decision to make. Working with a structured settlement company that offers superior customer service can go a long way in giving you comfort over your choice. You will rely on these representatives to field questions, provide information, and be a resource throughout the entire process. Some useful items for evaluating an institution’s customer service are:

- Does the company have extended availability beyond standard business hours that will give you the flexibility to discuss your matter at your leisure?

- Will you be able to create a written record of your interactions through email or chat systems? A valuable option in complex buyouts.

- Will you have a single point of contact who is well-informed about your case and will prevent you from having to repeat yourself to new representatives each time you have a question?

- Will they explain how interest rates can affect and change your buyout offers

- Do they use a Guardian Ad-Litem for cases or do they recommend any IPAs?

Court Denial Rates

Just because a person agrees to sell the rights to their structured settlement does not mean they will necessarily be able to complete the transaction. Structured settlement protection acts are commonplace in both state and federal law and require that parties obtain court approval before finalizing a structured buyout. This requirement exists to protect the owners of structured settlements from scams and other predatory activity.

A useful tactic for avoiding bad actors when selling a structured settlement is to review the institution’s denial rate. This is a measure of how often a court accepts or denies their buyout offers. An organization with a low denial rate may indicate that its offers are largely fair and above board. Most institutions will make their denial rates readily available for customers, and sellers should be skeptical of those who don’t.

You may also wonder what factors ultimately go into a court’s decision to deny a proposed structured settlement buyout. The standard that courts use is in the best interest of the recipient and may require a hearing or other court appearance to evaluate whether that standard is met. Judges will look to the following to determine if a buyout is in your best interest:

- Whether you understand the terms of the buyout (e.g., agreeing to take less money overall to receive a lump sum)

- If you had an opportunity to receive independent counsel (Independent Professional Advisor)

- If the buyout would result in financial hardship to you or your dependents

- The reason you want the lump sum now

Total Dollars Purchased from Structured Settlements

Another metric for evaluating the quality of a structured settlement company is its total dollars purchased from acquired settlements. Theoretically, the higher this number, the more court-approved buyouts they’ve processed. However, knowing the number of buyouts processed to reach the total dollars purchased figure is also useful in knowing how representative that number is.

Is the Structured Settlement Company Direct Funded or Does It Use a Broker?

When researching different structured settlement companies, you will come across two different types. Those that are direct-funded and those that operate as a broker to fund your buyout with another organization’s funds. Each comes with its own set of advantages and drawbacks and it’s more important that you understand those considerations when shopping your settlement.

Working through a broker may work to your advantage depending on how they receive payment. Brokers that receive flat commission fees for successful buyouts may be less incentivized to find the best deal compared to brokers that receive a fee as a percentage of the buyout value. Conversely, direct-funded structured settlement companies may be able to offer higher amounts because they do not have to pay a broker for the transaction. However, you may have to do more research and leg work to find the best deal and know what the current market is. With the way interest rates are trending for 2023 the firms that paid the most last year may not be able to come close with a similar offer now.

How Will Discount Rates and Fees Affect Structured Settlement Company Payouts

Aside from potential fees, other administrative cost, legal fees, IPA fees, (e.g., court costs, recording fees, escrow) and discount rates will likely apply to your buyout. These expenses cut into the final amount of your payout and could potentially vary on a wide margin from one institution to the next.

The discount rate is how the structured settlement company makes money from the buyout and effectively represents the premium you are paying to liquidate your settlement. These rates, while negotiable, can range anywhere from 10% to 30% of a person’s settlement amount. For example, a 25% discount rate applied to a $250,000 settlement amount would net a person only $187,500 before subtracting other fees.

Using a Structured Settlement Company for Lottery Winnings, Single Premium Investment Annuities, or Retirement Annuities

Companies that purchase structured settlements also buy other types of annuity contracts such as those received from lottery winnings or retirement annuities. Most states allow lottery winners to sell their rights to a related annuity, but it’s important to confirm with counsel about the applicable law in your case before pursuing this option.

Retirement annuities are an insurance product that provides insureds with guaranteed income once they hit non-working age and can be fixed or variable. Many retirement annuities prevent you from receiving distributions until you hit a certain age (or greatly penalize you for premature withdrawals). You may be able to assign or sell those interests in exchange for lump sum payments with structured settlement companies when the need arises.

Our Reviews of Top Structured Settlement Companies

District Settlement Finance as stated above is our top pick for selling a structure settlement payment. DSF covers all fees, so you never see a bill. When comparing providers that charge fees separately it can feel like your final payout was drained by hidden fees and that’s not fair. District Settlement Finance also charges you no fees and can even help you with up front cash payments when entering into a transaction to sell your future monthly payments.

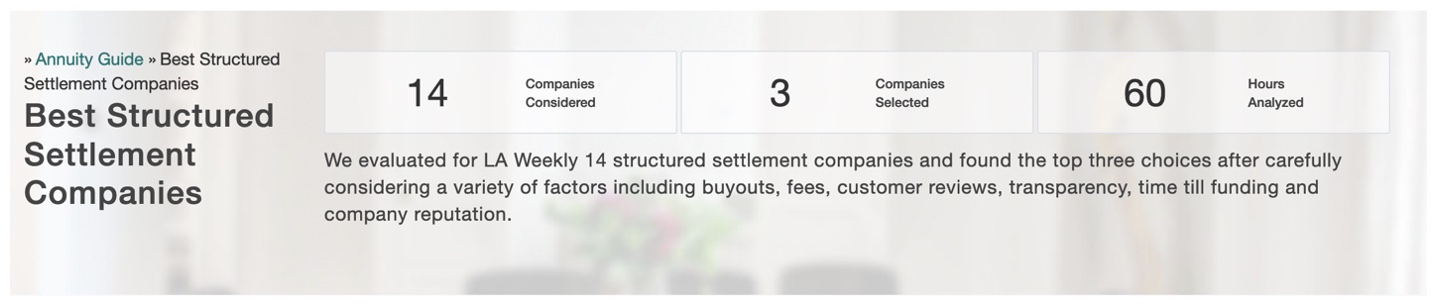

Out of the 14 companies that we reviewed over 60 hours we have 3 other companies that we’ve selected for structuredsettlement quotes. For the LA Weekly readers and those in the greater Los Angeles area that have settlement payments that they want to sell here is the guide to use.

Peachtree Financial Solutions Review

Peachtree Financial Services offers a flexible approach for customers who want to sell their structured settlement contract rights. Customers can sell all or a portion of their structured settlements and will receive additional information on available options upon review with a representative. According to their FAQs, you will work with a single customer service representative through the entire transfer process.

Peachtree Financial Services acknowledges that the process of a structured settlement buyout can take some time. However, they may offer some solutions to assist, like a cash advance, depending on your needs. To complete the transaction, you will need a copy of the settlement agreement or annuity contract in addition to your government ID and proof of residency. Peachtree Financial currently offers prospective applicants a $100 gift card simply for getting a free quote.

Stone Street Capital Review

Stone Street Capital is a Bethesda, Maryland based company. Located right outside of Washington, D.C. they prioritize helping customers understand and process their buyout options as quickly as possible. They offer free, fast quotes based on the value of your settlement contract and make cash advances available to qualifying customers. Another selling point is their willingness to craft a customized buyout or transfer solution that best meets your needs. Their website specifically mentions their interest in structured settlements from personal injury, wrongful death, medical malpractice, and other insurance claims.

Fairfield Funding Review

Fairfield Funding promotes its status as an A+ accredited business with the BBB that has over 10 years of service as a company. They offer quotes for individuals looking to sell structured settlements, lottery winnings, and other annuities. Participants can receive cash in as little as five days, but Fairfield Funding’s FAQs state the process to complete a transaction can take between 45 to 90 days because of state law. They are a direct-funder and claim to handle all the legal compliance needed for the buyout.

J.G. Wentworth Review

J.G. Wentworth is a recognizable name in the financial service industry and offers both free quotes as well as cash advances up to $5,000 for customers looking to sell structured settlements, annuities, or lottery winnings. They boast a Top Rating from Consumer Affairs in addition to an “Excellent” rating from TrustPilot. Their website states that completion of a structured settlement transfer can take approximately 60 to 90 days.

500 Cash Out Review

A smaller company that focuses more on litigation financing and pre-settlement loans prior to settling your case. They offer $500 cash hence the name 500 Cash Out. You get the funds with no major stipulations if they can consult with you about either your current personal injury case or one that has been settled and you are the beneficiary receiving payments.

Frequently Asked Questions

Can You Sell a Structured Settlement During a Divorce?

You may not be able to sell a structured settlement if you are in the process of a divorce depending on the state’s property laws and other family law issues. Consult a family law attorney about how the divorce impacts your interests in the structured settlement and your ability to sell it. You can contact one of the recommended annuity firms and they can consult with you based on the state that you are in and the intricacies of your transaction.

Can You Cancel a Structured Settlement Buyout After the Fact?

Your ability to cancel a previously agreed buyout of your structured settlement will depend on the nature of the contract (i.e., purchase or assignment agreement) and any applicable state or structure settlement protection act statues in the state in which you are doing the transaction. Ask your lawyer about cancellation rights related to a structured settlement buyout before signing any paperwork.

Are the Funds from a Structured Settlement Buyout Taxable?

The taxability of payment from a structured settlement buyout could depend on the nature of the structured settlement (e.g., funds from a personal injury lawsuit versus lottery winnings). Additionally, different states may have different tax laws that apply to payment from a structured settlement. Another factor could be the value of the payout compared to the value of the original settlement amount.

Key Takeaways on Pursuing a Structured Settlement

Your structured settlement is a valuable asset and choosing to sell it is a decision that will carry significant consequences for the future. Involve your team of professional advisors, and if you don’t have any, consider hiring some. Carefully, weigh the reasons for wanting a buyout and meet with as many different structured settlement companies in person at their office as possible to find the best quote and company to work with.

Advertising disclosure: We may receive compensation for some of the links in our stories. Thank you for supporting LA Weekly and our advertisers.