Analysts’ Viewpoint

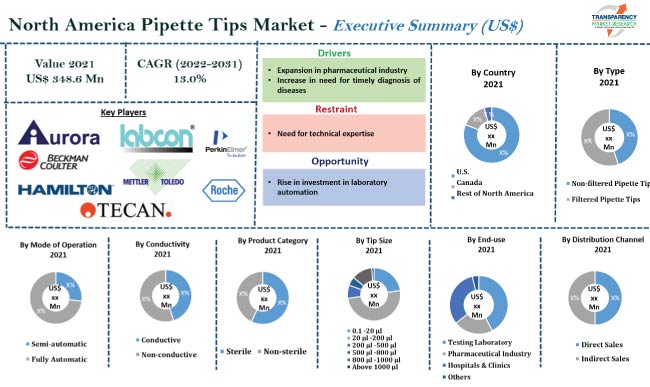

Expansion in the pharmaceutical sector is expected to augment the North America pipette tips market size. Emergence of COVID-19 led to rapid growth in demand for disposable pipette tips in diagnostic laboratories and other clinical settings. Increase in need for timely diagnosis of diseases is likely to propel market expansion in the next few years.

Rise in investment in laboratory automation is likely to offer lucrative growth opportunities for vendors in the industry. Vendors are launching next-generation pipette tips in different sizes and volumes. They are also developing new designs to meet customer needs and increase their North America pipette tips market share.

Pipette tips are used to dispense liquids in laboratory settings. These tips are manufactured from molded plastics and have a capacity of around 0.01ul to 5mL. Pipette tips facilitate hassle-free liquid handling in several diagnostic laboratories. They also help reduce cross-contamination during the diagnosis of various diseases.

Micropipettes are employed in laboratories to dispense testing products. Non-sterile, sterile, filtered, and non-filtered are the various types of micropipette tips available in the North America pipette tips industry. End-users select pipette tips based on their specific needs and application areas. The degree of liquid retention or tip volume is one of the characteristics of selection.

Request a sample to get extensive insights into the North America Pipette Tips Market

Pipette tip is one of the most commonly used handheld instruments in research laboratories. It is employed to transfer small volumes of liquids. Micropipettes with tips are utilized to dispense liquids for PCR analyses. Laboratories that analyze industrial products also rely on micropipette tips to dispense various testing products. Thus, high demand for dispensing products in the healthcare sector is likely to contribute to North America pipette tips business growth in the next few years.

Pharmaceutical companies, diagnostics labs, and academic institutions are notable users of liquid handling systems. According to the Europe Federation of Pharmaceutical Industries and Associations, North America accounted for 49.1% share of global pharmaceutical sales in 2021 compared to 23.4% share for Europe. Thus, growth in the pharmaceutical sector is expected to boost the North America pipette tips market revenue in the near future.

According to IQVIA, a leading provider of biopharmaceutical development and commercial outsourcing services, 64.4% of sales of new medicines launched during the period 2016-2021 were in the U.S. market, compared with 16.8% in the European market (MIDAS May 2022). Additionally, several pharmaceutical companies in Canada are investing significantly in clinical trials in collaboration with domestic companies, universities, and government organizations. This is likely to boost the demand for pipette tips, thereby driving the North America pipette tips market trajectory.

According to the American Hospital Association, around 133 million people in the U.S. suffer from at least one chronic illness. Hence, rise in prevalence of chronic diseases and the resultant surge in the need for timely diagnosis is anticipated to fuel market progression in the near future. The healthcare sector in the U.S. and Canada is well-established and receives significant funding for further expansion.

Demand for laboratory tests to diagnose infectious diseases increased rapidly during the peak of the COVID-19 pandemic. Additionally, incidence of disorders, such as diabetes, cancer, and cardiovascular diseases, is rising due to changing lifestyles and aging population. These factors are projected to boost the North America pipette tips market development in the next few years.

Request a custom report on North America Pipette Tips Market

Several pharmaceutical and biotechnology companies are investing significantly in lab automation to meet the increase in demand for drugs, diagnostic kits, and therapies. Pipette tip manufacturers are utilizing automated systems for molding, inspection, assembly, and packaging of pipette tips. They are also investing in R&D activities to launch universal pipette tips that can be used with all major pipette brands. Vendors are collaborating with different companies to expand their product portfolio and regional presence.

According to the latest North America pipette tips market insights, the filtered pipette tips segment is estimated to dominate the industry during the forecast period. Filtered pipettes prevent aerosol formation.

Filtered tips provide protection against aerosol in both samples and pipettes. Thus, these tips are highly valued in ultrasensitive applications such as Polymerase Chain Reaction (PCR). Filtered pipette tips also limit cross-contamination in pipette shafts.

The U.S. is anticipated to hold the largest share during the forecast period. The country dominated the sector in 2021. Surge in adoption of high-quality labware and supplies and rise in investment in clinical trials are driving the North America pipette tips market revenue in the U.S.

Key vendors have been profiled in the market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments. Most vendors invest in R&D activities and adopt various organic and inorganic growth strategies to increase their revenue share. They also focus on the deployment of lean processes, proven methods, and innovative tools to increase their market presence.

Agilent Technologies, Inc., Aurora Biomed Inc., Beckman Coulter, Inc., Corning Incorporated, Hamilton Company, Labcon North America, Mettler Toledo, PerkinElmer Inc., F. Hoffmann-La Roche Ltd., Sorenson BioScience, Tecan Trading AG, and Thermo Fisher Scientific Inc. are key entities operating in the industry.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 348.6 Mn |

|

Market Forecast Value in 2031 |

US$ 1.2 Bn |

|

Growth Rate (CAGR) |

13.0% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Mn/Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, key Market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

Competition Dashboard and Revenue Share Analysis 2021 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, COVID-19 Response, Strategy & Business Overview) |

|

Country Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It stood at US$ 348.6 Mn in 2021.

It is expected to reach US$ 1.2 Bn by 2031.

Expansion in pharmaceutical industry and increase in need for timely diagnosis of diseases.

The filtered pipette tips type segment accounted for the largest share in 2021.

The U.S. accounted for about 85.0% share in 2021.

Agilent Technologies, Inc., Aurora Biomed Inc., Beckman Coulter, Inc., Corning Incorporated, Hamilton Company, Labcon North America, Mettler Toledo, PerkinElmer Inc., F. Hoffmann-La Roche Ltd., Sorenson BioScience, Tecan Trading AG, and Thermo Fisher Scientific Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side

5.2.2. Supply Side

5.3. Key Market Indicators

5.3.1. Overall Laboratory Equipment Industry Overview

5.4. Porter’s Five Forces Analysis

5.5. Industry SWOT Analysis

5.6. Value Chain Analysis

5.7. Covid-19 Impact Analysis

5.8. Regulatory Framework & Guidelines

5.9. Technological Overview

5.10. North America Pipette Tips Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projection (US$ Mn)

5.10.2. Market Volume Projection (Thousand Units)

6. North America Pipette Tips Market Analysis and Forecast, By Type

6.1. Pipette Tips Market Size (US$ Mn and Thousand Units) By Type, 2017 – 2031

6.1.1. Non-filtered Pipette Tips

6.1.2. Filtered Pipette Tips

6.2. Incremental Opportunity, By Type

7. North America Pipette Tips Market Analysis and Forecast, By Conductivity

7.1. Pipette Tips Market Size (US$ Mn and Thousand Units) By Conductivity, 2017 - 2031

7.1.1. Conductive

7.1.2. Non-conductive

7.2. Incremental Opportunity, By Conductivity

8. North America Pipette Tips Market Analysis and Forecast, By Tip Size

8.1. Pipette Tips Market Size (US$ Mn and Thousand Units) By Tip Size, 2017 - 2031

8.1.1. 0.1 -20 μl

8.1.2. 20 μl -200 μl

8.1.3. 200 μl -500 μl

8.1.4. 500 μl -800 μl

8.1.5. 800 μl -1000 μl

8.1.6. Above 1000 μl

8.2. Incremental Opportunity, By Tip Size

9. North America Pipette Tips Market Analysis and Forecast, By Mode of Operation

9.1. Pipette Tips Market Size (US$ Mn and Thousand Units), By Mode of Operation, 2017 - 2031

9.1.1. Semi-automatic

9.1.2. Fully Automatic

9.2. Incremental Opportunity, By Mode of Operation

10. North America Pipette Tips Market Analysis and Forecast, By Product Category

10.1. Pipette Tips Market Size (US$ Mn and Thousand Units), By Product Category, 2017 - 2031

10.1.1. Sterile

10.1.2. Non-sterile

10.2. Incremental Opportunity, By Product Category

11. North America Pipette Tips Market Analysis and Forecast, By End-use

11.1. Pipette Tips Market Size (US$ Mn and Thousand Units), By End-use, 2017 - 2031

11.1.1. Testing Laboratory

11.1.2. Pharmaceutical Industry

11.1.3. Hospitals & Clinics

11.1.4. Others

11.2. Incremental Opportunity, By End-use

12. North America Pipette Tips Market Analysis and Forecast, By Distribution Channel

12.1. Pipette Tips Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

12.1.1. Direct Sales

12.1.2. Indirect Sales

12.2. Incremental Opportunity, By Distribution Channel

13. North America Pipette Tips Market Analysis and Forecast, By Country

13.1. Pipette Tips Market Size (US$ Mn and Thousand Units), By Country, 2017 - 2031

13.1.1. U.S.

13.1.2. Canada

13.1.3. Rest of North America

13.2. Incremental Opportunity, By Country

14. U.S. Pipette Tips Market Analysis and Forecast

14.1. Country Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side Analysis

14.4.2. Supply Side Analysis

14.5. Pipette Tips Market Size (US$ Mn and Thousand Units) By Type, 2017 – 2031

14.5.1. Non-filtered Pipette Tips

14.5.2. Filtered Pipette Tips

14.6. Pipette Tips Market Size (US$ Mn and Thousand Units) By Conductivity, 2017 - 2031

14.6.1. Conductive

14.6.2. Non-conductive

14.7. Pipette Tips Market Size (US$ Mn and Thousand Units) By Tip Size, 2017 - 2031

14.7.1. 0.1 -20 μl

14.7.2. 20 μl -200 μl

14.7.3. 200 μl -500 μl

14.7.4. 500 μl -800 μl

14.7.5. 800 μl -1000 μl

14.7.6. Above 1000 μl

14.8. Pipette Tips Market Size (US$ Mn and Thousand Units), By Mode of Operation, 2017 - 2031

14.8.1. Semi-automatic

14.8.2. Fully Automatic

14.9. Pipette Tips Market Size (US$ Mn and Thousand Units), By Product Category, 2017 - 2031

14.9.1. Sterile

14.9.2. Non-sterile

14.10. Pipette Tips Market Size (US$ Mn and Thousand Units), By End-use, 2017 - 2031

14.10.1. Testing Laboratory

14.10.2. Pharmaceutical Industry

14.10.3. Hospitals & Clinics

14.10.4. Others

14.11. Pipette Tips Market (US$ Mn & Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.11.1. Direct Sales

14.11.2. Indirect Sales

14.12. Incremental Opportunity Analysis

15. Canada Pipette Tips Market Analysis and Forecast

15.1. Country Snapshot

15.2. Key Supplier Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Trends Analysis

15.4.1. Demand Side Analysis

15.4.2. Supply Side Analysis

15.5. Pipette Tips Market Size (US$ Mn and Thousand Units) By Type, 2017 – 2031

15.5.1. Non-filtered Pipette Tips

15.5.2. Filtered Pipette Tips

15.6. Pipette Tips Market Size (US$ Mn and Thousand Units) By Conductivity, 2017 - 2031

15.6.1. Conductive

15.6.2. Non-conductive

15.7. Pipette Tips Market Size (US$ Mn and Thousand Units) By Tip Size, 2017 - 2031

15.7.1. 0.1 -20 μl

15.7.2. 20 μl -200 μl

15.7.3. 200 μl -500 μl

15.7.4. 500 μl -800 μl

15.7.5. 800 μl -1000 μl

15.7.6. Above 1000 μl

15.8. Pipette Tips Market Size (US$ Mn and Thousand Units), By Mode of Operation, 2017 - 2031

15.8.1. Semi-automatic

15.8.2. Fully Automatic

15.9. Pipette Tips Market Size (US$ Mn and Thousand Units), By Product Category, 2017 - 2031

15.9.1. Sterile

15.9.2. Non-sterile

15.10. Pipette Tips Market Size (US$ Mn and Thousand Units), By End-use, 2017 - 2031

15.10.1. Testing Laboratory

15.10.2. Pharmaceutical Industry

15.10.3. Hospitals & Clinics

15.10.4. Others

15.11. Pipette Tips Market (US$ Mn & Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.11.1. Direct Sales

15.11.2. Indirect Sales

15.12. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Revenue Share Analysis (%), (2021)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Contact Details, Production & Sales Data, Revenue (*Subject to Data Availability), Strategy & Business Overview)

16.4. Product Mapping (Machine Specifications, Sump Size, Oil Drain Interval, etc.)

16.4.1. Agilent Technologies, Inc.

16.4.1.1. Company Overview

16.4.1.2. Sales Area/Geographical Presence

16.4.1.3. Contact Details

16.4.1.4. Production & Sales Data

16.4.1.5. Revenue (*Subject to Data Availability)

16.4.1.6. Strategy & Business Overview

16.4.2. Aurora Biomed Inc.

16.4.2.1. Company Overview

16.4.2.2. Sales Area/Geographical Presence

16.4.2.3. Contact Details

16.4.2.4. Production & Sales Data

16.4.2.5. Revenue (*Subject to Data Availability)

16.4.2.6. Strategy & Business Overview

16.4.3. Beckman Coulter, Inc.

16.4.3.1. Company Overview

16.4.3.2. Sales Area/Geographical Presence

16.4.3.3. Contact Details

16.4.3.4. Production & Sales Data

16.4.3.5. Revenue (*Subject to Data Availability)

16.4.3.6. Strategy & Business Overview

16.4.4. Corning Incorporated

16.4.4.1. Company Overview

16.4.4.2. Sales Area/Geographical Presence

16.4.4.3. Contact Details

16.4.4.4. Production & Sales Data

16.4.4.5. Revenue (*Subject to Data Availability)

16.4.4.6. Strategy & Business Overview

16.4.5. F. Hoffmann-La Roche Ltd.

16.4.5.1. Company Overview

16.4.5.2. Sales Area/Geographical Presence

16.4.5.3. Contact Details

16.4.5.4. Production & Sales Data

16.4.5.5. Revenue (*Subject to Data Availability)

16.4.5.6. Strategy & Business Overview

16.4.6. Hamilton Company

16.4.6.1. Company Overview

16.4.6.2. Sales Area/Geographical Presence

16.4.6.3. Contact Details

16.4.6.4. Production & Sales Data

16.4.6.5. Revenue (*Subject to Data Availability)

16.4.6.6. Strategy & Business Overview

16.4.7. Labcon North America

16.4.7.1. Company Overview

16.4.7.2. Sales Area/Geographical Presence

16.4.7.3. Contact Details

16.4.7.4. Production & Sales Data

16.4.7.5. Revenue (*Subject to Data Availability)

16.4.7.6. Strategy & Business Overview

16.4.8. Mettler Toledo

16.4.8.1. Company Overview

16.4.8.2. Sales Area/Geographical Presence

16.4.8.3. Contact Details

16.4.8.4. Production & Sales Data

16.4.8.5. Revenue (*Subject to Data Availability)

16.4.8.6. Strategy & Business Overview

16.4.9. PerkinElmer Inc.

16.4.9.1. Company Overview

16.4.9.2. Sales Area/Geographical Presence

16.4.9.3. Contact Details

16.4.9.4. Production & Sales Data

16.4.9.5. Revenue (*Subject to Data Availability)

16.4.9.6. Strategy & Business Overview

16.4.10. Sorenson BioScience

16.4.10.1. Company Overview

16.4.10.2. Sales Area/Geographical Presence

16.4.10.3. Contact Details

16.4.10.4. Production & Sales Data

16.4.10.5. Revenue (*Subject to Data Availability)

16.4.10.6. Strategy & Business Overview

16.4.11. Tecan Trading AG

16.4.11.1. Company Overview

16.4.11.2. Sales Area/Geographical Presence

16.4.11.3. Contact Details

16.4.11.4. Production & Sales Data

16.4.11.5. Revenue (*Subject to Data Availability)

16.4.11.6. Strategy & Business Overview

16.4.12. Thermo Fisher Scientific Inc.

16.4.12.1. Company Overview

16.4.12.2. Sales Area/Geographical Presence

16.4.12.3. Contact Details

16.4.12.4. Production & Sales Data

16.4.12.5. Revenue (*Subject to Data Availability)

16.4.12.6. Strategy & Business Overview

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. Mode of Operation

17.1.3. Conductivity

17.1.4. Product Category

17.1.5. Tip Size

17.1.6. End-use

17.1.7. Distribution Channel

17.1.8. Country

17.2. Understanding Procurement Process of Users

17.3. Prevailing Market Risks

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Pipette Tips Market Value, by Type, US$ Mn, 2017-2031

Table 2: North America Pipette Tips Market Volume, by Type, Thousand Units, 2017-2031

Table 3: North America Pipette Tips Market Value, by Mode of Operation, US$ Mn, 2017-2031

Table 4: North America Pipette Tips Market Volume, by Mode of Operation, Thousand Units, 2017-2031

Table 5: North America Pipette Tips Market Value, by Conductivity, US$ Mn, 2017-2031

Table 6: North America Pipette Tips Market Volume, by Conductivity, Thousand Units, 2017-2031

Table 7: North America Pipette Tips Market Value, by Product Category, US$ Mn, 2017-2031

Table 8: North America Pipette Tips Market Volume, by Product Category, Thousand Units, 2017-2031

Table 9: North America Pipette Tips Market Value, by Tip Size, US$ Mn, 2017-2031

Table 10: North America Pipette Tips Market Volume, by Tip Size, Thousand Units, 2017-2031

Table 11: North America Pipette Tips Market Value, by End-use, US$ Mn, 2017-2031

Table 12: North America Pipette Tips Market Volume, by End-use, Thousand Units, 2017-2031

Table 13: North America Pipette Tips Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 14: North America Pipette Tips Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Table 15: North America Pipette Tips Market Value, by Country, US$ Mn, 2017-2031

Table 16: North America Pipette Tips Market Volume, by Country, Thousand Units, 2017-2031

Table 17: U.S. Pipette Tips Market Value, by Type, US$ Mn, 2017-2031

Table 18: U.S. Pipette Tips Market Volume, by Type, Thousand Units, 2017-2031

Table 19: U.S. Pipette Tips Market Value, by Mode of Operation, US$ Mn, 2017-2031

Table 20: U.S. Pipette Tips Market Volume, by Mode of Operation, Thousand Units, 2017-2031

Table 21: U.S. Pipette Tips Market Value, by Conductivity, US$ Mn, 2017-2031

Table 22: U.S. Pipette Tips Market Volume, by Conductivity, Thousand Units, 2017-2031

Table 23: U.S. Pipette Tips Market Value, by Product Category, US$ Mn, 2017-2031

Table 24: U.S. Pipette Tips Market Volume, by Product Category, Thousand Units, 2017-2031

Table 25: U.S. Pipette Tips Market Value, by Tip Size, US$ Mn, 2017-2031

Table 26: U.S. Pipette Tips Market Volume, by Tip Size, Thousand Units, 2017-2031

Table 27: U.S. Pipette Tips Market Value, by End-use, US$ Mn, 2017-2031

Table 28: U.S. Pipette Tips Market Volume, by End-use, Thousand Units, 2017-2031

Table 29: U.S. Pipette Tips Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 30: U.S. Pipette Tips Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Table 31: Canada Pipette Tips Market Value, by Type, US$ Mn, 2017-2031

Table 32: Canada Pipette Tips Market Volume, by Type, Thousand Units, 2017-2031

Table 33: Canada Pipette Tips Market Value, by Mode of Operation, US$ Mn, 2017-2031

Table 34: Canada Pipette Tips Market Volume, by Mode of Operation, Thousand Units, 2017-2031

Table 35: Canada Pipette Tips Market Value, by Conductivity, US$ Mn, 2017-2031

Table 36: Canada Pipette Tips Market Volume, by Conductivity, Thousand Units, 2017-2031

Table 37: Canada Pipette Tips Market Value, by Product Category, US$ Mn, 2017-2031

Table 38: Canada Pipette Tips Market Volume, by Product Category, Thousand Units, 2017-2031

Table 39: Canada Pipette Tips Market Value, by Tip Size, US$ Mn, 2017-2031

Table 40: Canada Pipette Tips Market Volume, by Tip Size, Thousand Units, 2017-2031

Table 41: Canada Pipette Tips Market Value, by End-use, US$ Mn, 2017-2031

Table 42: Canada Pipette Tips Market Volume, by End-use, Thousand Units, 2017-2031

Table 43: Canada Pipette Tips Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 44: Canada Pipette Tips Market Volume, by Distribution Channel, Thousand Units, 2017-2031

List of Figures

Figure 1: North America Pipette Tips Market Value, by Type, US$ Mn, 2017-2031

Figure 2: North America Pipette Tips Market Volume, by Type, Thousand Units, 2017-2031

Figure 3: North America Pipette Tips Market Incremental Opportunity, by Type, 2021-2031

Figure 4: North America Pipette Tips Market Value, by Mode of Operation, US$ Mn, 2017-2031

Figure 5: North America Pipette Tips Market Volume, by Mode of Operation, Thousand Units, 2017-2031

Figure 6: North America Pipette Tips Market Incremental Opportunity, by Mode of Operation, 2021-2031

Figure 7: North America Pipette Tips Market Value, by Conductivity, US$ Mn, 2017-2031

Figure 8: North America Pipette Tips Market Volume, by Conductivity, Thousand Units, 2017-2031

Figure 9: North America Pipette Tips Market Incremental Opportunity, by Conductivity, 2021-2031

Figure 10: North America Pipette Tips Market Value, by Product Category, US$ Mn, 2017-2031

Figure 11: North America Pipette Tips Market Volume, by Product Category, Thousand Units, 2017-2031

Figure 12: North America Pipette Tips Market Incremental Opportunity, by Product Category, 2021-2031

Figure 13: North America Pipette Tips Market Value, by Tip Size, US$ Mn, 2017-2031

Figure 14: North America Pipette Tips Market Volume, by Tip Size, Thousand Units, 2017-2031

Figure 15: North America Pipette Tips Market Incremental Opportunity, by Tip Size, 2021-2031

Figure 16: North America Pipette Tips Market Value, by End-use, US$ Mn, 2017-2031

Figure 17: North America Pipette Tips Market Volume, by End-use, Thousand Units, 2017-2031

Figure 18: North America Pipette Tips Market Incremental Opportunity, by End-use, 2021-2031

Figure 19: North America Pipette Tips Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 20: North America Pipette Tips Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Figure 21: North America Pipette Tips Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 22: North America Pipette Tips Market Value, by Country, US$ Mn, 2017-2031

Figure 23: North America Pipette Tips Market Volume, by Country, Thousand Units, 2017-2031

Figure 24: North America Pipette Tips Market Incremental Opportunity, by Country, 2021-2031

Figure 25: U.S. Pipette Tips Market Value, by Type, US$ Mn, 2017-2031

Figure 26: U.S. Pipette Tips Market Volume, by Type, Thousand Units, 2017-2031

Figure 27: U.S. Pipette Tips Market Incremental Opportunity, by Type, 2021-2031

Figure 28: U.S. Pipette Tips Market Value, by Mode of Operation, US$ Mn, 2017-2031

Figure 29: U.S. Pipette Tips Market Volume, by Mode of Operation, Thousand Units, 2017-2031

Figure 30: U.S. Pipette Tips Market Incremental Opportunity, by Mode of Operation, 2021-2031

Figure 31: U.S. Pipette Tips Market Value, by Conductivity, US$ Mn, 2017-2031

Figure 32: U.S. Pipette Tips Market Volume, by Conductivity, Thousand Units, 2017-2031

Figure 33: U.S. Pipette Tips Market Incremental Opportunity, by Conductivity, 2021-2031

Figure 34: U.S. Pipette Tips Market Value, by Product Category, US$ Mn, 2017-2031

Figure 35: U.S. Pipette Tips Market Volume, by Product Category, Thousand Units, 2017-2031

Figure 36: U.S. Pipette Tips Market Incremental Opportunity, by Product Category, 2021-2031

Figure 37: U.S. Pipette Tips Market Value, by Tip Size, US$ Mn, 2017-2031

Figure 38: U.S. Pipette Tips Market Volume, by Tip Size, Thousand Units, 2017-2031

Figure 39: U.S. Pipette Tips Market Incremental Opportunity, by Tip Size, 2021-2031

Figure 40: U.S. Pipette Tips Market Value, by End-use, US$ Mn, 2017-2031

Figure 41: U.S. Pipette Tips Market Volume, by End-use, Thousand Units, 2017-2031

Figure 42: U.S. Pipette Tips Market Incremental Opportunity, by End-use, 2021-2031

Figure 43: U.S. Pipette Tips Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 44: U.S. Pipette Tips Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Figure 45: U.S. Pipette Tips Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 46: Canada Pipette Tips Market Value, by Type, US$ Mn, 2017-2031

Figure 47: Canada Pipette Tips Market Volume, by Type, Thousand Units, 2017-2031

Figure 48: Canada Pipette Tips Market Incremental Opportunity, by Type, 2021-2031

Figure 49: Canada Pipette Tips Market Value, by Mode of Operation, US$ Mn, 2017-2031

Figure 50: Canada Pipette Tips Market Volume, by Mode of Operation, Thousand Units, 2017-2031

Figure 51: Canada Pipette Tips Market Incremental Opportunity, by Mode of Operation, 2021-2031

Figure 52: Canada Pipette Tips Market Value, by Conductivity, US$ Mn, 2017-2031

Figure 53: Canada Pipette Tips Market Volume, by Conductivity, Thousand Units, 2017-2031

Figure 54: Canada Pipette Tips Market Incremental Opportunity, by Conductivity, 2021-2031

Figure 55: Canada Pipette Tips Market Value, by Product Category, US$ Mn, 2017-2031

Figure 56: Canada Pipette Tips Market Volume, by Product Category, Thousand Units, 2017-2031

Figure 57: Canada Pipette Tips Market Incremental Opportunity, by Product Category, 2021-2031

Figure 58: Canada Pipette Tips Market Value, by Tip Size, US$ Mn, 2017-2031

Figure 59: Canada Pipette Tips Market Volume, by Tip Size, Thousand Units, 2017-2031

Figure 60: Canada Pipette Tips Market Incremental Opportunity, by Tip Size, 2021-2031

Figure 61: Canada Pipette Tips Market Value, by End-use, US$ Mn, 2017-2031

Figure 62: Canada Pipette Tips Market Volume, by End-use, Thousand Units, 2017-2031

Figure 63: Canada Pipette Tips Market Incremental Opportunity, by End-use, 2021-2031

Figure 64: Canada Pipette Tips Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 65: Canada Pipette Tips Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Figure 66: Canada Pipette Tips Market Incremental Opportunity, by Distribution Channel, 2021-2031