There’s a couple of different ways of looking at the recent transactions involving RTD coffee brands La Colombe and High Brew. The first is that, when you add in the recent sale of Yasso ice cream treats, is that there’s been some thaw in the CPG M&A slowdown.

But the paired deals last month of cold brew brands High Brew (majority sale to Latin American beverage house BeLIV) and La Colombe ($300 million for a 33 percent stake to KDP), are also evidence of the slow road and many detours cold brew brands are going to continue to face on the road to a final exit.

High Brew’s quiet deal arrived for a brand that, despite hard work, an experienced team, and a head start with a solid strategy, ultimately failed to reach its commercial potential via a sale to one of the beverage giants. La Colombe, the majority of which is still owned by Chobani founder Hamdi Ulukaya, raked in a lot of growth capital but still has a long way to go in terms of category dominance. Both brands will continue to be important players in cold brew, but overall the transaction news seemed to go over like, well, lukewarm Joe.

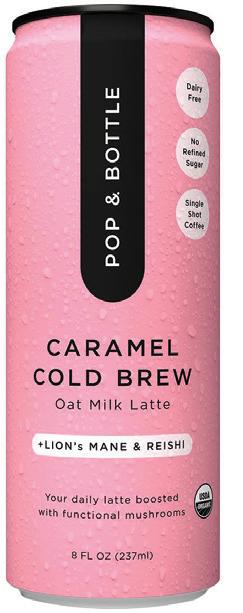

It wasn’t supposed to be this way. Think back just a few years ago, when the coffee business all of a sudden seemed to expand from just the Pepsi/Starbucks distributed Frappuccinos to all manner of cold brewed, concentrated, refrigerated, bottled, canned, ambient and exotic riffs on coffee, with specialty “third wave” shops like Blue Bottle, Stumptown, and Cuvee joining RTD entrepreneurs from Grady’s, Rise, Nitro, Pop & Bottle, Wandering Bear, Califia, Lucky Jack, and more.

Early exits for specific product types - Chameleon, for example, on the strength of its concentrate focus, sold to Nestle early on - coupled with a massive jump in overall quality and a growing thirst for caffeine among consumers ratcheted up interest among entrepreneurs, brands, and investors. Like craft beer, this new wave of canned coffee showed improved taste and hyped up caffeine levels, encouraging founders who could take an alternative attitude and aggressive branding to the store at a very tidy margin, one whose high price point had been buoyed by years of consumers getting accustomed to the prices at fancy chains.

So why haven’t we seen more coffee entrepreneurs sell their brands? After all, there have been so many launches and such incredible innovation, from snap-chilling to Nitro-infusion to functional additions like mushrooms, protein, Ashwagandha, flavor variety, milk and alt-milk variations, small cans, big bottles, shots and plastic reproductions of the typical Greek diner to-go cup.

Oh. Maybe that’s why? At least, over proliferation of varieties, while something that might be great for consumers, isn’t something that has helped the brands. Too many great choices, and too many small variations, with so many changes that they hamper loyalty and repeat purchase. Bulletproof leaned into the keto-diet associated MCT craze, which traded taste for functionality. Forto, another early coffee brand that touted its heavy caffeine content and received investment from KDP, also had flavor problems.

Meanwhile, the pandemic wreaked havoc on the plans of so many of these brands. Just as energy drinks were hit during the pause in grab-and-go business as so many workers stayed

home, so too were RTD coffee pick-me-ups. Coffee was easier to make at home, and the rise of brands like Chamberlain Coffee, which started as a D2C bean and bag play, helped distract an in-home audience from the stuff available in stores.

For some reason, aside from the North American Coffee Partnership that brought you the RTD Frappuccino, big beverage companies haven’t been able to wrap their heads around coffee distribution. KDP, after all, makes billions of dollars selling coffee machines and pods, but still hasn’t been able to get an RTD brand off the ground (we’ll see how they do with La Colombe). Ditto for Coke, which bought European brand Costa coffee but has still spent years beating the bushes for a domestic brand.

Also -- and this is something that hurt the HPP juice explosion as well – coffee is available everywhere, in so many forms, and just as juice brands competed with the superior products available fresh, the expansion of high-end coffee joints (many of whom also sell their own premium iced drinks) are an effective competitor to the RTDs. Beyond that, the primary consumption state, at least if you’re not from Boston and addicted to Dunkin’s Iced Coffee, is hot, not cold. The founder cohort in RTD has done a remarkable job of rewiring consumer brains to improve the viability of cold coffee as an option, but for most use occasions, a hot cup of Joe still rules, Additionally, in the cold box, while many coffee brands saw themselves making inroads as substitutes for energy drinks, that category is also finding its way into the coffee space as well. Monster Energy’s Java Monster is a huge seller in its own right (and it’s locked down trademarks against competitor Super Coffee abroad) and as with the Frappuccino, it appeals to a generation of C-Store consumers who feel like their coffee energy should come in the form of a sweet treat.

There is one insurgent brand, Black Rifle Coffee Co., that has at least partially cut through the clutter, although its ultimate ability to consolidate share is in question because it’s a polarizing brand. BRCC effectively rode early political rhetoric and a bean, cafe, and eventually RTD strategy into a position among category leaders. But after going public via a SPAC, it’s faced a variety of legal challenges and is now judged as much by share price as it is by revenue. Still, its founders cashed in on the brand’s potential in a category where few founders have been able to say the same.

Whether there are more deals to come in the space is likely to be the topic of many discussions running late into the evening. At least there’s plenty of product around to keep the conversationalists alert.

By Barry Nathanson

By Barry Nathanson

www.bevnet.com/magazine

Barry J. Nathanson PUBLISHER bnathanson@bevnet.com

Jeffrey Klineman EDITOR-IN-CHIEF jklineman@bevnet.com

Martín Caballero MANAGING EDITOR mcaballero@bevnet.com

Ray Latif CONTRIBUTING EDITOR rlatif@bevnet.com

Brad Avery REPORTER bavery@bevnet.com

Justin Kendall NEWS EDITOR, BREWBOUND jkendall@bevnet.com

Carol Ortenberg EDITOR, NOSH cortenberg@bevnet.com

Adrianne DeLuca REPORTER adeluca@bevnet.com

SALES

John McKenna DIRECTOR OF SALES jmckenna@bevnet.com

Adam Stern SENIOR ACCOUNT SPECIALIST astern@bevnet.com

John Fischer ACCOUNT SPECIALIST jfischer@bevnet.com

Jon Landis BUSINESS DEVELOPMENT MANAGER jlandis@bevnet.com

ART & PRODUCTION

In two weeks I will be turning 75, so allow me to be a bit philosophical. It’s unfathomable to grasp that number, yet here it is. I still think of myself as the hippie I was, spending my twenties on the road. I have been blessed with good health, good friends and, most of all, a great family. They are my reason for being. Having both kids, their spouses, and my granddaughter all living within a half mile of us is the most joyful feeling of all. I’ve also been blessed professionally, spending 32 years involved in the beverage industry. As you get to this stage, most people have a greater appreciation of what’s important in life, personally and professionally. I’m lucky, I guess, in that I’ve always had that appreciation, I’m lucky, I guess.

I still wake up every day excited about coming to my satellite office in midtown Manhattan. I spend my day immersed in the business of beverages. I touch and am touched by so many people that I come in contact with, that the day seems to fly by. I love to hear/see the excitement of a new launch, reposition, new branding and packaging. When someone has a successful funding raise, I’m as happy as they are. I want everyone to succeed. I’m flattered that so many want my advice or taste buds when they are putting

together their game plan. I guess seeing and sampling thousands of products qualifies me as an expert. I always try to be honest and transparent in sharing my opinion. Whenever possible I serve as a conduit to bringing people together, be it suppliers, investors, personnel hires and creative sorts that can assist in bringing brands to life. Sometimes, just being a sounding board or shoulder to cry on is one of my most important roles.

I have witnessed the evolution of an industry over these 32 years. I’ve seen generations of beverage marketers come and go. There are so many legends I’ve come to know, and I don’t know that their time will ever be seen again. The climate has changed and so have the larger than life personalities. It’s more of a business now. I guess that’s progress. I’ve seen categories created, formulations unimaginable years ago. branding brilliance and the long overdue movement towards healthier products. The brands coming out are a touchstone of what beverages should be.

I’ve been blessed to be involved in such a great industry, with the greatest of people. It’s been a beverage life well lived; only 25 more years to go before I celebrate a century with you all. Maybe then I’ll get back on the road again.

Aaron Willette DESIGN MANAGER

Nathan Brescia DIRECTOR OF PHOTOGRAPHY BEVNET.COM, INC.

John F. (Jack) Craven CHAIRMAN

John Craven CEO & EDITORIAL DIRECTOR jcraven@bevnet.com

HEADQUARTERS 65 Chapel Street Newton, MA 02458 617-231-8800

PUBLISHER’S OFFICE 1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

SUBSCRIPTIONS

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com

BPA Worldwide Member, June 2007

“Not with a bang but a whimper,” the poet T.S. Eliot wrote in “The Hollow Men.” With the pun intended, that pretty much sums up the end of Bang Energy’s run as an independent company. As I wrote this, a judge had just approved the sale of the assets of its owner, VPX Sports, to its largest creditor – and intense rival –Monster Beverage. A Federal Trade Commission that at least theoretically is more pugnacious these days certainly had ample grounds to question the potential anticompetitive impact of the #1 energy player buying what until recently was the #3, but the agency punted under pressure from Bang attorneys who warned that the company would spiral into liquidation during the weeks it took to make any such determination. What happens from here remains unclear: if the brand doesn’t slide into the bottling system of Monster’s strategic distributor Coca-Cola but rather into the beer houses Monster cultivates for its alcohol entries and its non-energy entries on the non-alcoholic side, it may retain a vestige of its clout as a profit-maker for the distributors outside the soft drink systems who’ve been so crucial to the path of innovation in non-alcoholic beverages. That’s probably a long shot, and in any case, it enters a Monster Beverage portfolio that already is stocked with the purported Bang-killer Reign and a plethora of lower-priced, “fighter” brands. That doesn’t augur well for the continued relevance of Bang.

So in most ways, it’s the end of an era. Or, as I wrote in my newsletter Beverage Business Insights, the end of an error. Really, a decade-long series of errors, from the branding to the overstepping of its now ousted owner and CEO Jack Owoc and his gratuitous taunting of the coCEOs of Monster. Still, if the whimpering end of the company as an independent player was a fairly predictable outcome of Owoc’s compounded errors, that still doesn’t much soften the sense of loss this event has brought for the brand that inaugurated the performance energy segment and unleashed a broad bout of innovation in a consolidating sector. Certainly, even as the clock ticked in the courtroom, there was no lack of beer wholesalers who thought that, in the right hands, the brand was ripe for resurrection.

So what are some of the errors I’m talking about? For starters, the branding itself was an error. (And not just because the B in Bang had to be quickly changed after Beats headphones marketers cried foul.) Though Owoc brilliantly leveraged his internal media machine to ride the efficacy of its core “super creatine” ingredient for all it was worth, that turned out to be a lie. There is no such thing as super creatine, as Monster’s attorneys showed in their successful lawsuit over the issue, and that case’s outcome helped to send Bang spiraling into bankruptcy protection last fall. That key identifier now has been stripped off the cans and scrubbed from most online communications, though it’s not clear how many Bang users have noticed or would even care at this stage. As another lawsuit funded by Monster showed, VPX erred in another way: in not taking seriously a warning from Bang brand licensor Orange Bang that it was abusing its rights, using brand far beyond the limited channels it had been granted. That yielded another adverse ruling that contributed to the bankruptcy.

Then there is the heightened 300-mg caffeine level ushered in by Bang and much imitated by other players. Was that another error? It’s too early to say on that one, although as of this writing there are ominous signs that this may be resurging as an issue among our guardians of public health, both institutional and self-appointed. By chance, Bang came along just before energy drink leaders were about to be summoned to Capitol Hill to address concerns that their products were causing health issues, particularly among vulnerable groups like kids. The major companies agreed to revamp their marketing codes and assured listening senators they would keep caffeine content to responsible levels. But that was before Bang ignited. As it did, that assurance got harder for them to uphold. By now, most leading brands except Red Bull have incorporated 300 mg products into their energy portfolios. After those hearings a decade ago, Congress ordered FDA to do a deep dive into the dangers of caffeine but the agency couldn’t find anything alarming and the issue subsided. Some in the energy business have warned all along that it could arise again and it is now, this

time in a segment with a lot more brands nudging closer to the FDA’s 400 mg recommended daily caffeine limit.

Finally, Owoc definitely erred in his unrestrained personal attacks on his actual and perceived adversaries. Those included his erstwhile distribution partner PepsiCo, whom he publicly “fired,” Trump-style, never mind that his contract didn’t allow him to do that, moving that already strained relationship into its toxic terminal phase. Owoc would have had ample warnings of the risks of that, given a rich history of beverage founders whose intemperate outbursts wore out their welcome at strategic allies. Just as fatally, those targets also included Monster’s co-leaders, Rodney Sacks and Hilton Schlosberg, whom Owoc continually called out on social media. Sacks (a highly successful lawyer before he became an entrepreneur) and Schlosberg were stocked with a formidable corporate arsenal with which to take Owoc to the wall legally, and they dismantled his legal defenses and quasi-defenses brilliantly in the two cases I mentioned earlier. The combined judgments, along with fallout from the unwinding of the Pepsi distribution alliance, put VPX into that financial death spiral that eliminated a true disruptor to the energy segment. Whatever happens to the brand now in the hands of its new, unsympathetic owner, it truly is the end of an era. Sure, Owoc probably had it coming, but among those I talk to, there isn’t much glee in this outcome.

Longtime beverage-watcher Gerry Khermouch is executive editor of Beverage Business Insights, a twice-weekly e-newsletter covering the nonalcoholic beverage sector.

Keurig Dr Pepper announced on July 20 that it is investing $300 million in Philadelphia-based coffee company La Colombe, making it the second largest investor in the brand – behind majority owner and chairman Hamdi Ulukaya –with a 33% equity stake.

The long-term licensing, manufacturing and distribution agreement positions KDP to expand its coffee portfolio with a trailblazer in the ready-to-drink category. La Colombe is expected to benefit from KPD’s distribution network and the beverage giant’s influence on the coffee pod segment while using the capital infusion to “accelerate growth and pay off debt,” the company reported in a press release.

According to the two companies, KDP will begin distributing La Colombe products later this year with a launch of a K-Cup line planned for sometime in 2024.

“We are excited to partner with Hamdi and the La Colombe team to drive value for both companies,” KDP chairman and CEO Bob Gamgort said in a statement. “This partnership will enable KDP to expand its reach into high growth ready-todrink and super premium coffee segments and will meaningfully increase La Colombe’s availability to consumers.”

The expansion of its premium and RTD offerings comes as KDP has seen a slight decline in its coffee business. On its most recent Q1 earnings call, KDP leadership reported that coffee segment net sales decreased -1.3% to $931 million during the quarter as net prices increased 5.3% and volume fell -6.6%.

The deal should allow KDP to stanch some of the losses that are coming in its K-Cup business – sales dropped -6% in 2022 – and gives it another shot at tapping into the RTD coffee category, which has grown significantly in the past few years, powered largely by innovative, premium brands like La Colombe itself, as well as rising competitors such as Califia, STOK and Black Rifle.

KDP has been steadily building out a premium coffee pod business, landing recent partnerships with Philz, Intelligentsia and BLK & Bold. While La Colombe serves as a

solid addition to its K-Cup business, the partnership represents an even more serious play in the RTD category for the strategic, with La Colombe’s vertically integrated canned coffee business giving it a new brand to pit against Starbucks’ Frappuccino and other brands like Monster and Super Coffee.

La Colombe started as a cafe and coffee roaster more than 30 years ago. The company initially made waves in retail with cold brew and single-serve nitro-infused lattes, the brainchild of co-founder and former CEO Todd Carmichael, who largely left the brand’s leadership team in 2021.

According to figures provided to BevNET by Circana, as of April 23, La Colombe’s RTD draft latte and other single-serve products had trailing 52week sales in combined retail channels (including C-Store, Grocery, Drug, Mass Market, Military and select Club and Dollar stores) of just over $28 million (a -4.3% decline over the previous 52-week period), while its ambient cold brew had sold just over $12 million during the same period (down -9.3%) and refrigerated coffee sales were at about $24 million, up 86% over the same time. Those retail figures don’t include the brand’s robust vending and on-premise sales, its cafes, ecommerce, or its roasting business.

The joint announcement noted that the $300 million investment represented a multiple of approximately three times La Colombe’s expected net sales for 2024. KDP will participate in any value created from the deal – something that worked well for the company with the sale of BodyArmor to Coca-Cola, for example, when the company took home approximately $800 million for its 12.5% stake.

“With a 30-year legacy of delivering the best coffee and exceptional brand experiences for our customers, we have become a beloved coffee brand with the highest standards of quality. This remarkable journey sets the stage for our continued expansion, and partnering with KDP is the ideal next step to accelerating our growth and continuing our mission of making people happy with coffee,” said Chuck Chupein, President of La Colombe.

As a pro fighter, Logan Paul has gone up against Damian Priest, Floyd Mayweather, and even his own PRIME co-founder KSI. But could his next public bout be with the senior Senator from New York?

In a letter sent to the agency on July 9, U.S. Senate majority leader Chuck Schumer (D-NY) called for the Food and Drug Administration to investigate PRIME’s energy drink line, arguing the beverage contains an “eye popping level of caffeine for a young kid’s body.”

Operated by Congo Brands, PRIME’s sports drink line launched in January 2022 and is now one of the fastest growing beverage brands in the country thanks to its nigh-instant popularity with Paul and KSI’s fanbase and has been particularly desired among kids and teens.

According to Circana, as of April 23, 2023 PRIME’s core hydration line had become the fifth largest brand in the sports drink category – just behind Electrolit, and catching up – reporting over $273.1 million in retail dollar sales at a four-digit growth rate. The brand has also launched internationally, including the U.K., Australia and more.

But it’s PRIME’s canned energy drink, introduced in January, that has Schumer calling for an investigation. The line contains 200 mg of caffeine per 12 oz. can, which places it well above products like Red Bull, Monster and Rockstar, but is about in line with the caffeine content offered by other next gen energy drinks like Celsius, Ghost and C4. It even rates well below the 300 mg per 16 oz. caffeine loads offered by Bang and Monster’s Reign.

The FDA considers up to 400 mg of caffeine per day as being safe for “healthy adults,” bearing in mind there is a wide variation in caffeine sensitivity person to person. On its website, the agency refers consumers to their healthcare providers to receive guidance on monitoring childrens’ caffeine intake.

The company is now defending its products and said it is open to talk with the FDA about industry guidelines. In a statement to BevNET, the brand said it is “very important to make the distinction” between its non-caffeinated PRIME Hydration line and the energy drinks, noting that PRIME Energy “con-

High Brew Coffee, one of the first “third-wave” canned cold brew brands in the U.S., was acquired by Latin American beverage portfolio company Beliv in late July.

Beliv has taken a 78% stake in the company, with the remaining 22% still owned by High Brew’s investors and its founder and CEO David Smith. Smith will remain with the brand as a consultant. Financial terms of the agreement were not disclosed.

“This acquisition is essential to continue developing a wellpositioned and solid portfolio, backed by a consumer-centric vision,” said Beliv founder and CEO Carlos Sluman in a press release. “With High Brew we are adding a disruptive product in a booming category, through its distribution to 15,000 sale points in the U.S. and the collaboration with 54 strategic partners”.

“Undoubtedly, we share the same identity, commitment and vocation,” Smith stated, adding that “sustainability will continue to be a differential value in the operation since High Brew needs the best beans to make the best coffee, and this means supporting all those who participate in the value chain.”

Founded in 2013, High Brew helped to kickstart the cold brew coffee trend in the U.S. In 2016, it received a $4 million investment from CAVU Venture Partners and entered into a stra-

tains a comparable amount of caffeine to other top selling energy drinks, all falling within the legal limit of the countries it’s sold in” and that the line is “not made for anyone under the age of 18.”

“As a brand, our top priority is consumer safety, so we welcome discussions with the FDA or any other organization regarding suggested industry changes they feel are necessary in order to protect consumers.”

Circana reported that PRIME Energy had surpassed $42.5 million in U.S. retail dollar sales in the 52-weeks ending April 23, after fewer than four full months on the market.

However, PRIME’s wide popularity with kids has already led schools in the U.K. and Australia to issue bans for the energy drink in school out of concern for student health.

Schumer claims there’s been little difference in the online marketing between PRIME’s caffeine free hydration line and its energy drink, arguing that the brand “feverishly targets” kids, and he suggested any FDA investigation should focus on both ingredients and marketing.

tegic distribution agreement with what at the time was Dr Pepper Snapple Group, prior to its transition into Keurig Dr Pepper (KDP). In 2018, the brand closed a $20 million Series C round.

Though its distribution arrangement with KDP has since ended, High Brew is sold in 15,000 retail locations nationwide –including Whole Foods, Sprouts, Albertsons/Safeway, Kroger, H-E-B, Costco, Raley’s, Wegmans and The Fresh Market – as well as online. The brand offers 11 flavors made with 100% Arabica beans.

According to the release, the deal fits into Beliv’s U.S. expansion strategy, which has focused on building a portfolio of better-for-you beverage brands through acquisition (such as its 2021 purchase of kombucha brand Big Easy) and innovation (plant-based energy line OCA).

While it proved pivotal to establishing the cold brew trend, High Brew has since seen much of its market share overtaken by competitors in the set like Starbucks, Danone North America’s STOK, La Colombe and Chobani.

Market research firm Circana reported retail dollar sales of High Brew cold brew coffees was down -31% to about $4.8 million in the 52-week period ending April 23. Ecommerce data was not included.

Blake Lively is the newest celebrity to jump into the booze world, although she’s already had one foot in the door.

Lively’s Betty Buzz, a sparkling mixer brand, announced in June its newest venture, Betty Booze, a low line of lowalc, premium sparkling cocktails.

The launch is part of the company’s strategy “to win new audiences and occasions by challenging conventions of taste in sparkling beverage – and beyond,” read a statement.

Betty Booze will debut with three 4.5% ABV cocktail offerings made from highquality fruits, spices, herbs, and spirits, that come in 4-packs of 12 oz cans for $14.99. Flavors include: Sparkling Tequila with Lime Shiso, Sparkling Tequila with Oak Smoked Lemonade, and Sparkling Bourbon with Apple Ginger Sour Cherry. The new product is rolling out in most key markets this year with plans to expand nationally by spring 2024.

The actor, who herself doesn’t drink

alcohol, worded her inspiration for the line carefully. Another high profile recent ready-to-drink cocktail launch, Jennifer Lopez’s Delola, received some criticism from fans who pointed to comments from Lopez referencing her alcohol-free lifestyle.

“These are the recipes I’ve been making for loved ones for years. But I have four kids now. And I’m tired. So here they are in a can. Enjoy. Responsibly… ish,” Lively said in a statement.

Known for her roles in shows like Gossip Girl and films such as The Sisterhood of the Traveling Pants, Lively, working alongside co-founder Andrew T. Chrisomalis, has found a niche in the mixer category, which grew double-digits following consumers making their own cocktails at home during COVID lockdowns. Mindful drinking trends have also helped fuel start-ups in the space.

Since 2021, Betty Buzz has reported year-over-year retail sales growth, ex-

tending its distribution to the UK and Canada, and becoming the official sponsor of the UK-based Wrexham Association Football Club (AFC), which is coowned by Lively’s husband actor and gin entrepreneur Ryan Renolds.

The move into low-ABV cocktails comes as the no/low $11 billion global business is projected to grow 7% in volume over the next four years, according to IWSR.

Equator Coffee is teaming with Swiss dairy giant Emmi AG on a joint venture that kicks off with the launch of a fourSKU line of premium refrigerated cold brews this summer.

For publicly traded Emmi Group, a more than century-old milk and cheese processor that raked in over $4 billion in revenue last year, the partnership with San Francisco Bay Area-based thirdwave coffee specialists Equator represents its entrance into the U.S. RTD market, but its international presence in the category is well established. The company’s Caffe Latte brand is a leader in Europe, selling over 200 million units annually of its mini to-go coffee cups, according to the company.

Former KeVita and Ugly Drinks exec Brett Lanford is leading the Emmi Equator RTD project, which formally launched in 2022, three years after Emmi’s leadership and Equator co-founders Helen Russell and Brooke McDonald agreed to form a U.S.-based LLC. The specialty coffee roaster has been around since 1995 and has developed traction in culinary circles through collaborations with chefs like Tanya Holland and Brandon Jew, but is previously untested in the RTD world.

“We believe that coffee is more than just a beverage,” said Russell in a press release. “It’s a way to connect with others, to create memories, and to build community. We’re delighted to team up with Emmi on a premium cold brew range that broadens our existing selection of specialty coffee and lets customers enjoy the experience they’ve come to expect from Equator Coffees while on the go.”

Despite Emmi’s success with Caffe Latte, its U.S. release takes a decidedly different approach, starting with the packaging. That may be due to copyright restrictions – Dyla Brands’ Forto coffee reportedly has the patent on coffee cup packaging for RTDs – but not according to Lanford, who identified glass bottles as one of the primary distinguishing factors gleaned from a year’s worth of R&D and consumer testing, along with Fair Trade and organic certification.

“The other thing that we heard [from consumers] was wanting something that tasted like it came from a cafe,” he said. “And so that was something we leaned into heavily: getting that right balance of coffee to milk to sugar ratio with our recipes so that you get that cafe experience you get that crafted beverage feel.”

The final result aims to align the straightforward (and sweeter) flavors favored by RTD fans with Equator’s serious coffee credentials: organic, Fair Trade certified cold brews in 8.5 oz glass bottles in four varieties– Pure Black, plus the dairy-based Hint of Milk and Sugar (16 grams of sugar), Velvet Mocha (18 grams) and Hint of Vanilla (16 grams). The suggested price is $3.99 to $4.99 each.

The Emmi Equator joint venture is just one of several divisions of the Swiss corporation operating independently in the U.S., and certainly the leanest. Lanford is leading the business alongside VP of sales Ryan Sowards, who joined the company after helping another glass bottle coffee brand – Lucky Jack – expand its reach from specialty to conventional grocery channels in the later 2010s. Each company will retain its existing sales teams for other parts of its respective businesses, whether wholesale coffee or dairy, while manufacturing of the RTDs is being handled by a California-based co-packer.

Getting an early start has paid off: Sowards was already talking with San Francisco area retailers about the prod-

uct while it was still being finalized, Lanford said, securing a slate of 270 stores to enter on day one, including Safeway, Whole Foods, Mollie Stone’s, Nugget and others. The line has since entered Erehwon in Los Angeles, with Bristol Farms set to come online next month. The company is also working with The Touch Agency as a broker.

In terms of marketing, Equator’s RTDs will be featured alongside the roaster’s whole bean coffees within existing social channels. The brand is also hoping that placements inside its 10 cafe locations across California will help lift awareness for the new product.

Even as momentum behind RTD cold brew continues, the venture faces a complex route to growth. Despite its partnership with an international goliath (JAB Group), fellow Bay Area specialty roaster Peet’s struggled to gain traction for its similarly positioned glass bottle, refrigerated cold brews, even with its own dedicated cold-chain distribution setup. Within single-serving coffees, La Colombe’s new partnership with Keurig Dr Pepper (KDP) may result in tighter competition for placements, although that product is shelf-stable.

“I just saw a white space here that Equator can be a national brand,” Lanford said. “There’s this great opportunity to introduce this beautiful, early stage third-wave coffee to the entire U.S. market and I just wanted to be a part of that.”

Founded in 1891, craft soda maker Boylan Bottling has proven it knows a thing or two about maintaining a national beverage business. And in revamping its sparkling fruit drink line MASH, it’s aiming to do it a second time.

Earlier this summer, Boylan announced a rebranding and new format for MASH, moving the product from proprietary 16 oz. plastic bottles to 12 oz. slim cans. As well, the products have been reformulated to remove artificial coloring and the line has been reduced from six flavors to four, with the updated offering featuring Ripe Mango Blood Orange, Pomegranate Blueberry, Grapefruit Citrus Zing and Watermelon Lemon Lime.

It’s a big change for MASH, which launched in 2008 as a lighter indulgence drink built around “smashing” together different fruit flavors. Each can contains 60-70 calories and is sweetened with fructose and sucralose.

According to Boylan Bottling COO Chase Slepak, MASH has been a small but profitable business for the company, however it has consistently struggled to break out beyond its cult favorite status in independent New York City delis and bodegas, where it has been serviced by DSD house Big Geyser. Outside of New York, the brand is sold as a grab-and-go beverage in quick service restaurants and in “very, very limited grocery” accounts with fewer than 10 distribution partners, Slepak added.

“I’ve heard multiple people refer to it as a bit of a sleeper brand,” Slepak told BevNET. “The liquid is great, but it just never really had mass appeal outside of the Northeast and in a few secondary markets.”

One big issue holding MASH back, Slepak said, was also what some at the company saw as its greatest strength: the unique squat plastic bottle. While the bottle design helped to entice consumers, it was difficult for retailers to fit onto glide racks, took up more ambient shelf space, and made multipacks impos-

sible to produce – effectively killing any chance for the brand to grow in conventional grocery stores.

Although moving into a canned format risks robbing MASH of a defining visual difference, the switch also has some big benefits beyond simplifying logistics. Aluminum packaging gives MASH a boost in its sustainability bonafides, while also giving it more flexibility in use occasions; the company noted that the new design has a “mocktail” feel, better positioning the product as a mixer or non-alcoholic alternative in addition to basic refreshment.

The cans have already begun rolling out to stores in New York through a prelaunch with Big Geyser and the company will support the rebranding this summer with a marketing campaign focused on bodegas, including point of sale displays and branded trucks. For a company that traditionally keeps its ad expenses as minimal as possible – it spends next to nothing annually to promote the core Boylan soda brand – the increased marketing support reflects a big investment in MASH.

According to brand and insights manager Cassidy Meyer, the new campaign

will kick off in August and will bill MASH as “the second best thing you’ll find in a bodega” – second only after the bodega cat, of course.

“It’s really targeting that younger consumer that likes the tongue-in-cheek self aware brand attitude,” Meyer said. “We know we’re not Coke or Pepsi, we’re not the functional beverage that will make your life 100 times better. We’re just a really good product that’ll go great with the sandwich that you’re grabbing.”

Boylan will also support MASH with new hires on the sales and marketing team, while Slepak noted that the brand has restructured its national accounts team to focus more on expanding MASH outside of NYC, with new distribution partners coming online this summer including a bigger push into Massachusetts.

“We’re in a unique situation where for a lot of the country it’s not a refresh, it’s a new product,” Slepak said. “For legitimately 90% of the U.S. it’s a new brand, but for that 10% legacy market where we’ve been very successful, it’s a refresh. So our strategies are very different, kind of by geography and market given those unique challenges.”

Oatly is pushing to simplify and streamline its operations after a disappointing quarterly earnings report saw the Swedish oat product maker slash its 2023 revenue forecast range from 23% to 28% to a dire 7% to 12%. Still, CEO Jean-Christophe Flatin said the company continues to make “progress towards our goal of achieving profitable growth in 2024.”

“As expected, we continued our sequential improvement of gross margin and increased our advertising investments to continue to fuel growth,” Flatin said, adding that he still expects the company to achieve its target Q4 gross margin percentage in the high 20s and hit positive adjusted EBITDA in 2024.

Overall, revenue increased 10.1% year-over-year to $196 million; on a constant currency basis, revenue was up 11.1%. Gross margin increased 340 basis points in the quarter (+19.2%), with volume rising 3%.

Oatly’s sagging business in Asia was a particular focus during the quarter; last year’s optimistic outlook was driven in part by predictions of a “large post-pandemic tailwind” in the region that “has not materialized,” admitted COO Daniel Ordoñez. However, revenue during Q2 dropped 14.9% ($6.5 million) to $37.2 million. In response, the company announced actions around “simplification of the portfolio of products and reduced operating costs.”

In the post-pandemic era, Flatin said, consumers have ”behaved differently than we had originally expected, and we need to adjust.”

Elsewhere, Oatly performed better. With supply issues seemingly addressed, revenue in the Americas was up 19.4% ($10.1 million) to $61.8 million in Q2, driven primarily by price increases across all customers and channels. Around 51.2% of Americas revenue was

from retail, compared to 55.3% in the same period last year. EBITDA improved $8.1 million to a loss of $12.6 million, down from a loss of $20.7 million.

The oat milk brand is targeting around $85 million in cost savings in 2024, with fewer project-related expenses, less spending on outside consulting and the elimination of certain jobs. Marketing will not be part of those cuts, however. Back in March, Ordonez noted that, with U.S. supply chain snags under control, “The reality is now we can unleash the power of the brand.”

Frozen plant-based meal brand Tattooed Chef has declared Chapter 11 bankruptcy, the publicly traded company announced via a press release on July 5.

“Our business has continued to be impacted by a challenging financing environment and an inability to raise additional capital,” Tattooed Chef chairman and CEO Salvatore “Sam” Galletti, stated in the press release. “The actions we are announcing today are designed to promote a fast, efficient, and value-maximizing sale, which will allow us to provide clarity on the future of the company for all our stakeholders.”

Filed in the U.S. Bankruptcy Court for the Central District of California, court documents indicate the company plans to pursue a sale of “substantially all of its assets” under Section 363 of the Bankruptcy Code. Next steps, lawyers said in the filing, are to list all assets and evaluate any bids received, a process that will be overseen by the bankruptcy court. In emergency motions, Tattooed Chef also petitioned for access to cash collateral and $3 million in loans in order to keep the business afloat and maintain its value for a future sale.

The company cited an inability to raise additional capital, either by selling additional shares or via “alternative financing and funding solutions.” In addition, the bankruptcy filing noted, the company explored various “reductions in expenses” such as reductions in its labor force. At this point, the company has more than 1,600 creditors.

“Due to the debtors’ restated financial statements, changes in the capital markets, and the general economic conditions affecting the Debtors’ market segment, the debtors were unable to obtain any new financing,” the filing noted. “[Between 2020 to 2022], the debtors’ liquidity became constrained and the debtors fell behind on payments to suppliers and other parties necessary to the continued operation and profitability of their business.”

For the fiscal year ending December 31, 2022, Tattooed Chef reported revenue of $230 million, up from $208 million the year prior, for a year-over-year growth rate of 11%. Still, net loss grew to $141 million for the fiscal year and adjusted EBITDA was negative $91.7 million. Though the company was able to reduce total operating expenses in the first quarter of 2023 by 37% compared to the same period in 2022, and reduced losses from Q4 of 2022, net revenue also declined by $8.6 million to $59 million.

Founded in 2017, Tattooed Chef produces an array of frozen products, including meals, pizza, burritos, smoothie bowls, sold under its Tattooed Chef brand as well as private label offerings. In total, the company sells 132 SKUs across 21,000 retailers and has 175 concepts and recipes in the R&D stage. Tattooed Chef was created, and went public, via a 2020 reverse merger between Ittella International and the publicly traded Forum Merger II Corporation, a transaction that valued the plant-based meal company at roughly $482 million.

Alongside Sam Galletti, his daughter, Sarah Galletti, serves as the company’s chief creative officer and largely acts as the public face of the company. In addition, the company has 800 full time employees in the U.S. and 140 full time employees in Italy.

From April 2021 through August 2022, Tattooed Chef spent over $66 million to acquire a sizable pool of assets including: Ittella Italy SRL (“Ittella Italy”), a 100,000 square foot processing plant in Italy; New Mexico Food Distributors; Karsten Tortilla Factory; Belmont Confections and Desert Premium Group. The debtors also lease processing facilities in California, New Mexico and Ohio; as well as storage facilities in Italy and California.

According to the court filing, at the time of Tattooed Chef’s IPO the brand had household awareness of under 6% and was only available in 4 major retailers, for less than 4,000 doors. By 2022, household awareness was at over 26% and door count had increased to around 20,000 doors. To try to further drive sales, earlier this year the company expanded beyond frozen into refrigerated snack bars and tortilla chips.

Still, this accelerated growth has come at a cost, with the bankruptcy document stating that Tattooed Chef has invested over $100 million into marketing and promotions over the three year time period. Revenue also did not keep pace, the company reported in the document, growing from $147 million in 2020 to $230 million in 2022.

The bankruptcy filing comes on the heels of other legal woes, with several lawsuits stemming from the company’s October 2022 disclosure that its 2021 annual report and first, second and third quarter earnings contained material errors such as overstating revenue and understating net losses. According to the allegations, even once the error was discovered, executives continued to downplay the scope of the company’s financial difficulties or the lack of internal controls that had led to the issue.

The bankruptcy news also follows several other notable closures by plant-based companies, with both The Meatless Farm and The Very Good Food Company running into financial difficulties in the last five months.

stick bars, frozen greek yogurt sandwiches, mochi and Poppables – a chocolate coated frozen yogurt snack that was recently relaunched as a better-for-you, Dibs-like competitor.

Frozen novelty brand Yasso announced it will be acquired by global conglomerate Unilever in a deal that is expected to close in the third quarter of this year.

Terms of the deal were not disclosed. Piper Sandler & Co. served as financial advisor to Yasso in the transaction, and Ropes & Gray served as the Company’s legal advisor.

“I am delighted to welcome Yasso to the Unilever family,” said Matt Close, president of ice cream for Unilever, in a statement. “It has built a strong customer appeal in the fast-growing, premium ‘better for you’ segment.

At NOSH Live last winter, Yasso CEO Craig Shiesley said the company estimated its 2022 sales would hit $240 million and said the brand was on track to eclipse $300 million in 2023. Unilever’s ice cream portfolio also includes Magnum, Breyer’s, Talenti and Ben & Jerry’s.

Yasso was founded in Boston by Amanda Klane and Drew Harrington in 2009 and backed by Castanea Partners, also an investor in ice cream brand Jeni’s. In 2019 the company brought on Shiesley as CEO and relocated to Colorado in order to focus on growing beyond its homebase in the Northeast.

Yasso is now distributed in thousands of retailers including Whole Foods Market, Walmart, CVS, Target, Kroger, Costco and Safeway with a low-calorie product line that includes stick bars, dipped

Though the emphasis on bars has remained constant since its founding, the brand’s portfolio has taken various shapes over the years and once included pints and smaller kids’ bars. In 2021, as it evaluated possible line extensions, Yasso launched popsicle brand Jüve and tested sales online as well as in a limited number of retailers; however, Jüve’s website now says the line has “melted away.”

For Unilever, adding Yasso will support the multinational’s planned “premiumization strategy” for its ice cream division. The brand will likely roll up to Russel Lilly, President North America Ice Cream at Unilever, a 17-year veteran of the company who has worked within the division for the last five years.

In January 2022 Unilever executives announced the company would be reorganized into five distinct business units, one of which would be dedicated solely to ice cream. Moving forward, each division would be “fully responsible and accountable for their strategy, growth, and profit delivery globally.”

The move was beneficial, Close noted in a recent Unilever blog post,

allowing the group to better focus its domain expertise and “get to market faster, make quicker decisions and take more experimental risks.” Digital solutions and delivery programs will be another core focal area for growth, he said, in order to offset a portion of the seasonality the category faces in retail and out-of-home. For example, last summer Unilever expanded the reach of its ghost storefront, The Ice Cream Shop, through a partnership with Instacart. That program now allows consumers across the country to have Unilever-owned treats delivered in as fast as 30 minutes.

There’s a lot of cash at stake given how much of Unilever’s overall sales come from ice cream. At last December’s annual investor presentation, Clouse said that at the end of 2021, Unilever’s ice cream business was valued at $7.7 billion and had grown 3% over the last three years.

In addition to looking for expansions in low-sugar and low-calorie spaces, the ice cream team saw the greatest opportunity for growth in its premium lines, where it could invest heavily in R&D and marketing. At the time of the presentation, Clouse said premium brands Ben & Jerry’s and Magnum alone were expected to represent 50% of Unilever’s share of ice cream sales by 2025.

Mars, Inc. has signed an agreement to acquire Kevin’s Natural Foods, adding the ready-to-eat meal business to its portfolio of better-for-you brands. The acquisition is expected to close during the third quarter of 2023.

Financial terms of the deal were not disclosed but a representative of Kevin’s said that the purchase includes the company’s Kevin’s California production facility.

“We have been hugely inspired by Kevin’s, a business whose mission fits squarely with our purpose: Better Food Today. A Better World Tomorrow,” Mars Food & Nutrition President Shaid Shah said in a statement. “We look forward to drawing on our experience of nurturing and scaling founder-led brands to help bring their products to even more people.”

Following the sale, Kevin’s will operate as a standalone business within Mars’ Food & Nutrition segment, reporting up to Shah. The sale will also enable an exit for the brand’s minority partners, investment firms TowerBrook Capital Partners L.P. and NewRoad Capital Partners.

The company declined to comment on whether its founders, Kevin McCray and Dan Costa, will continue on in their respective roles as COO and CEO after the sale has been completed.

“As a standalone business within Mars Food & Nutrition, we’ll be able to maintain the entrepreneurial spirit and authenticity of our brand while getting the support and capabilities to continue our long-term growth journey,” said CEO and co-founder Dan Costa in a company press release.

McCray launched Kevin’s as meal kit company Chef’s Menu in 2012, which evolved both its name and business model in 2019 alongside investment partners Dan Costa and Kelsie Costa-Olson of Innov8 Partners. The concept was inspired after McCray changed his own diet as a result of an auto-immune disorder. All of Kevin’s Natural Foods prod -

ucts are keto- and paleo-certified as well as dairy-, glutenand soy-free.

Interest in the ketogenic diet has declined in recent years as brands have pivoted away from marketing themselves as keto-based. Kevin’s has increasingly leaned into its paleodiet credentials expanding its refrigerated meals as well as shelf-stable sauces in the last year.

Rumors about an exit began to circulate in January when Axios reported that the company was seeking an IPO or a buyer for the business. Initially, the company rejected the claims. Last month, an anonymous source tipped Bloomberg that the ready-to-eat meal business was seeking a valuation between $700 million to $800 million.

In the four years since it was founded, Kevin’s has experienced “double-digit growth,” according to the company, and is available in over 17,000 retail locations in the U.S., U.K., Canada and Mexico, according to the company.

The multinational food maker has been building out its better-for-you snack portfolio with the acquisition of KIND in 2020, and subsequently Nature’s Bakery, and whole-fruit snack maker Trü Frü last December.

Tony’s Chocolonely has tapped into its existing shareholder base to raise $21.8 million (or €20 million) that will see the organization accelerate the growth of its mission, brand and B2B business, according to a June announcement. The round saw participation from majority shareholder Verlinvest, investment firm Jam Jar and holding company Genuine Chocolate, among others.

The Netherlands-based company still needs to secure Competition Authority approval from regulators in its home country in order for the round to

officially close. A few investors “will sell a small percentage of their stake” as part of the deal.

“This investment will help us accelerate our progress towards our mission of ending exploitation in the cocoa industry,” said CEO Douglas Lamont, in a press release. “I am delighted that all the funding was raised from within our existing shareholder base, who we know are all committed to supporting our long-term mission.”

Lamont can back up that long-term mission commitment claim too. Jam

Jar is run by the founders of Innocent Drinks, where Lamont’s was last CEO before joining Tony’s. Investor Genuine Chocolate is a holding company started by Tony’s former CEO Henk Jan Beltman.

The news also puts some weight behind Tony’s performance over the past twelve months and Lamont said the new funds will go toward accelerating that rapid global growth. The company operates both its branded chocolate business, Tony’s Chocolonely, and a global business-to-business ethical bean trad -

ing company, known as Tony’s Open Chain. The chocolate brand sells a wide range of flavors and formats including Big Bars (6.35 oz.), Small Bars (1.8 oz) and Tiny Tony’s (0.32 oz.) as well as cobranded and seasonal chocolates.

In late May, Tony’s locked in its mission for the long haul via a new corporate governance structure. Known as the Mission Lock, the independent foundation is chaired by Eat the Change Founder and CEO Seth Goldman and supported by two Mission Guardians, Anne Wil Dijkstra, ex-CoCaptain of Tony’s, and Ikeena Azuike, a former lawyer turned social activist and broadcaster. That new structure gives Goldman, Wil Dijkstra and Azuike the ultimate decision-making power over proposals that affect how Tony’s does business.

As it shored up its sourcing model, in February the sustainable and ethical cocoa company brought on a second processing partner, Baronie & Cémoi, to give its Open Chain brand partners additional options for intermediary

processors. Barry Callebaut, which has served as the company’s sole processing partner for the last decade, will continue to manufacture Tony’s transparently-sourced beans into chocolate.

Tony’s commitment to end modern slavery, child labor and deforestation has inspired numerous other companies to join the cause including wellness brand Huel, cheesecake maker

Pleese and mission-driven ice cream company, Ben & Jerry’s. Each has agreed to source a portion, or in the case of Huel all, of its cocoa through Tony’s Open Source chain in addition to introducing new products made with the transparent chocolate. With the new capital, Tony’s will have the bandwidth to bring in more mission-aligned names to that list.

For more stories, check out nosh.com

The collective craft beer community shared mixed emotions this summer when Japanese beer giant Sapporo announced plans to cease operations at Anchor Brewing, one of the nation’s oldest craft breweries.

The San Francisco craft brewery, which was acquired for $85 million by Sapporo in August 2017, cited “a combination of challenging economic factors and declining sales since 2016” for the decision to close and liquidate its business. Ultimately, the company said the economic pressure “made the business no longer sustainable.”

Workers at Anchor were given 60 day’s notice on July 12 “with intent to provide transition support and separation packages in line with company practices and policies,” according to a press release. Some workers found out about the news through media reports first, rather than the company directly, according to Anchor’s union workers on social media.

Production has ceased at the brewery, but packaging and distribution of remaining beer continued.

It was already a tumultuous year for Anchor, leading up to the big news. The company started the year with reports that union contract negotiations were delayed, with workers claiming Sapporo was not transparent on its purchase of Stone Brewing the year before, and the sale was muddying the waters for Anchor workers seeking better wages and benefits.

Later, Anchor announced it was pulling back its national distribution to just its home state of California and cutting production of its beloved seasonal offering, Christmas Ale. Those cost cutting measures were part of what the company termed “final attempts … to evaluate all possible outcomes” but “expenses simply continued to outstrip revenues, leaving the company with no other viable choice.”

Two days after the Anchor news dropped, Narragansett launched a petition to save Anchor.

In its change.org campaign memo, Narragansett wrote: “18 years ago, our community rallied together and provided unwavering support to resurrect our beloved company. Today, we are calling upon all craft beer enthusiasts and supporters to do the same for a fellow pioneer in the industry, Anchor Brewing Company.

“Being a good neighbor is not merely about existing alongside one another; it is about standing shoulder to shoulder during times of adversity,” the brewery continued. “We have an opportunity now to show our support and help save this iconic brewery. While the path forward is uncertain, be it Chapter 7, 11, or sale, we are starting this petition to create a community of like-minded crafter brewers and consumers interested in the preservation of Anchor Brewing Company. Again, we do not know where this conversation will take us, but we should have the conversation nonetheless.”

Narragansett highlighted the historical significance and influence of Anchor, as well as the economic impact of the

brewery closing, including the loss of more than 200 jobs. As of July 21, the petition had more than 6,000 signatures.

Shortly after, Anchor workers launched their own effort “to purchase the brewery and run it as a worker co-op,” Vine Pair’s Dave Infante reported, citing a letter sent by the union’s business agent to Sapporo USA president Mike Minami.

The letter from Pedro de Sá of the International Longshore and Warehouse Union Local 6, which represents the brewery’s union labor, stated:

“We are not asking for a handout or charity. All we want is a fair shot at being able to continue to do our jobs, make the beer we love, and keep this historic institution open. We do not want the brewery and brand we love to be sold off before we even had a chance.”

The union is giving Sapporo USA a deadline of Friday, July 21, to respond as to whether it will work with the union on a potential sale.

“Welp, here ya go,” Union members wrote in a post on Twitter. “Time to put everyone’s love of this brand to the test. Let’s work this out together and bring back what we’ve almost lost. Welp. Here ya go. Time to put everyone’s love of this brand to the test. Let’s work this out together and bring back what we’ve almost lost.”

Several other potential buyers have been listed by various publications, including a handful of investors in San Francisco. One of those investors even expressed the desire to create a reality T.V. show out of the purchase, documenting the journey of bringing Anchor back to life.

But the reality of any of these efforts is unknown. Sapporo seems determined to let the liquidation process go through unchanged, according to a statement from Anchor spokesman Sam Singer, first reported by Infante:

“It is heartening to see so many stepping forward to possibly carry on the tradition of an iconic San Francisco company and beer,” Singer said. “We remain hopeful that Anchor will be purchased and continue on into the future, but it will be in the hands of the liquidator to make that decision and is dependent on what is offered by potential purchasers.”

Anchor isn’t the only craft brewery facing union conflict this year.

In late June, Brewing Union of Georgia (BUG) updated its unfair labor practices (ULP) filings against Creature Comforts to include employee retaliation firing, after an employee of the Athens, Georgia-based brewery was allegedly fired for his union efforts.

Spencer “Spicy” Britton – who worked for Creature Comforts for more than six years – was fired from the company on June 12, after a more than 10-week suspension, for allegedly making threats against other employees, according to a BUG Instagram post. BUG has said the claims against Britton are false, and that the firing was actually a result of Britton and others’ involvement with the union.

“Spencer’s treatment has been really motivating because he’s a super beloved coworker and friend to so many people at the brewery,” Katie Britton, Creature Comforts brand marketing manager and one of the BUG organizers, told Brewbound. “To see someone that everybody’s like, ‘This is one of our the nicest people here’ and to see what’s being done, it’s been really enraging and motivating for people.”

Creature Comforts employees first announced union efforts in early January, forming BUG as an independent union to bring “positive workplace culture and core values” to Creature Comforts and other Georgia breweries. The majority

of the brewery’s employees signed a petition with the National Labor Relations Board (NLRB) to formalize the union and schedule an election.

Less than two weeks later, BUG filed two complaints against Creature Comforts with the NLRB, alleging ULP and failure to recognize the union. Brewery leadership denied the allegations.

“The charge contains false and baseless claims and shows that the Union lacks a fundamental understanding of the National Labor Relations Act,” Herron and Creature Comforts chief product officer Adam Beauchamp told Brewbound in a January statement. “We are confident that after reviewing the evidence, the NLRB will conclude that these claims are invalid. We are committed to continuing to communicate directly with our employees and to ensuring they feel supported and empowered to exercise their legal rights and engage in this process.”

In early February, a two-day pre-election hearing with the NLRB was held, with witnesses advocating for the union to be recognized. BUG is still waiting on the results of that hearing, as the NLRB has been “completely swamped” and the increase in labor movements across the country has “put them under water,” Britton said.

“We’re really frustrated with the company and angry with them for what they’ve been doing,” Britton said. “They took us to a hearing back in February be-

cause they knew it would delay us having an election, and the fact that they’ve continued to amp up their union busting within that time period of just waiting has been extremely frustrating.

“We keep saying every time something else happens that we’re baffled by, we’re like, ‘This is why we’re doing this, this is why we need this,’” they continued. “Because once we have this established, we can protect against these things happening.”

In April, BUG filed two additional ULP complaints against Creature Comforts, after Spencer Britton and another known union leader were suspended. The two employees were allegedly told not to speak to any other coworkers, with an investigation underway, and were escorted from the premises by police officers.

The continuation of alleged union busting hasn’t deterred employees from pushing for the union, but has rather “solidified how much we need this,” Katie Britton said.

“Everybody’s really fired up and angry about the firing of Spencer, and we’re just ready to have our election and be able to move forward,” Britton said.

On July 10, 40 workers at Leinenkugel’s Brewing Company, represented by Teamsters Local 662, went on strike after rejecting “the meager wage increases offered” by the Molson Coors-owned brewery, according to a press release.

“Leinenkugel’s has been brewing beer in Chippewa Falls for over 150 years, which is a point of pride for both the facility’s workers and the entire community,” Local 662 secretary-treasurer Tom Strickland said in the release. “That storied history of success wouldn’t have been possible without the hardworking Teamsters who keep this operation running. Molson Coors needs to respect these workers by agreeing to a fair contract.”

“We are sick of the corporate greed and want a fair and equitable pay increase,” added Leinenkugel’s maintenance technician Dann Jackson, who has worked at the brewery for 16 years. “We are underpaid given our qualifications and the number of different jobs that we do.”

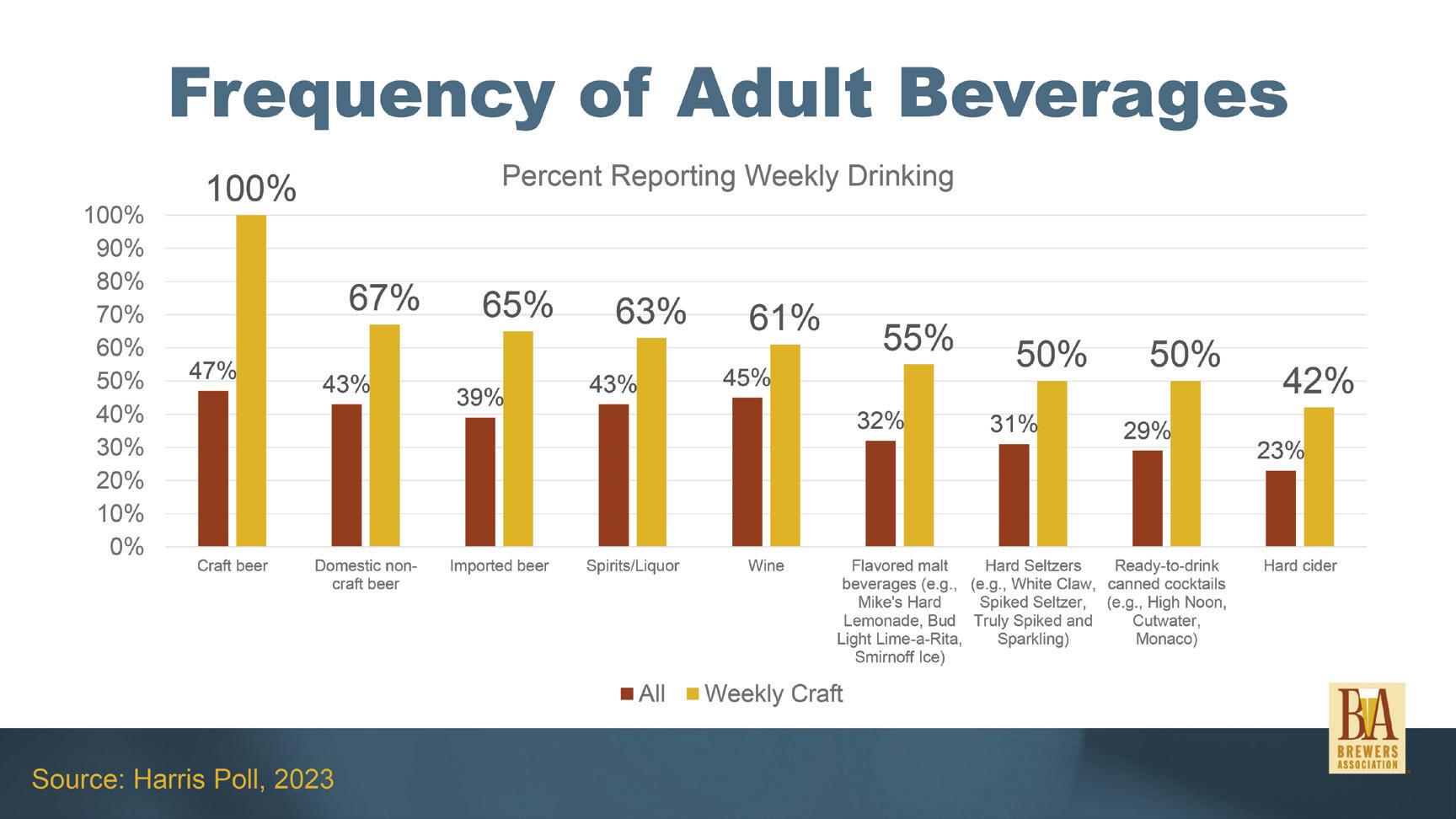

In craft beer data news, Brewers Association chief economist Bart Watson recently detailed the results of the BA’s annual Harris Poll evaluating craft consumer trends.

For the first time since at least 2015, an equal number of craft beer drinkers surveyed in the 2023 poll said they were drinking more craft beer in 2023 than the amount who said they were drinking less craft beer – about 25% each.

The survey includes responses from more than 2,000 craft consumers, defined as consumers who drink craft beer several times a year or more.

The amount of respondents who are drinking more craft beer has always outpaced those who are drinking less in previous surveys, dating back to at least 2015. One caveat is that the survey does not include consumers who have left the segment completely or no longer fit in the “craft consumer” definition.

The survey backed up other data, such as Scarborough USA data from 2020-2021, which showed the number of consumers who bought craft in the last 30 days was static versus the previous year, after steadily increasing in years prior, according to Watson.

Watson dove into why consumers are choosing craft more – or less – and other bev-alc attributes that factor into consumer buying decisions. Here are some of the highlights:

Of the respondents who said they were drinking less craft beer than last year – again, about a quarter of total respondents – the No. 1 reason cited for drinking less was they were drinking more of something else. More than half of respondents who are drinking less cited drinking more of other bev-alc products as the reason for the change, significantly above the next highest reason, “opting for a healthier lifestyle” (less than 30%).

The third largest reason was “cutting back on overall calories consumption,” followed by “cannot afford it anymore” due to higher prices and “less disposable income.”

The significance to craft producers is that breweries can do more to counteract the shift to other products, while inflation and interest in health are less in their control, according to Watson.

“You can’t control inflation,” Watson said. “You can control how your brand is positioned relative to other beverage-alcohol offerings.

“That gives some agency back to brewery owners as you’re thinking about the challenges and the headwinds that craft faces, that the No. 1 challenge is still that people are thinking more of something else” he continued.

When choosing which craft beer to purchase, flavor was the No. 1 reason – important to about 95% of respondents – followed by freshness (just over 90%).

Flavor has been in the mid- to high-90s every time the BA has conducted the survey, Watson said.

“If you’re not thinking about flavor as the No. 1 value proposition of craft, then you’re not where most customers are when they think about craft,” Watson said.

The emphasis on flavor could be the reason why craft lagers have struggled to get a foothold, but they could have success by leaning into consumers’ desire for “freshness,” Watson added.

The amount of craft consumers that care about whether a beer is locally made has been on a decline since 2021, with just over 60% of 2023 survey respondents saying locality was “somewhat” or “very” important.

That decline is expected to continue as younger consumers make up more of the bev-alc consumer base, Watson said.

Millennials were the generation that pushed the most for locality, emphasizing the importance of local business to local economies. Gen Z cares more about supporting a business that

supports causes they align with, rather than supporting a business just because it’s in the same area code. It’s a shift that’s happening across most consumer goods, not just beer, Watson said.

Younger legaldrinking-age (LDA) consumers also care more about ABV when making purchasing decisions, Watson said. The importance of high ABV and low ABV were both the highest with respondents aged 35-44, followed by respondents aged 21-34.

While younger LDA consumers being interested in higher

ABV beers isn’t a total surprise – possibly some “bang for your buck” buying – it is “interesting” that they’re also interested in low-ABV offerings more than 45-and-older consumers.

“These two youngest groups care the most about this, [which] to me suggests in the future this is going to be more important,” Watson said.

For more stories, check out brewbound.com

Lifestyle brand GHOST celebrated its seventh birthday with a new energy drink flavor, BUBBLICIOUS Cotton Candy. Like the rest of the brand’s energy drink line, each 16 oz. can packs 200mg of caffeine and has zero grams of sugar. The LTO will be exclusive to Kroger for 90 days in addition to hitting GNC shelves in the specialty space. For more information, visit ghostlifestyle.com.

Pro wrestling legend Ric Flair has unveiled his new mushroom-infused energy drink, Wooooo! Energy. Available in three flavors –Dragonfruit, Lemon and Strawberry Banana –the beverage features a blend of Lion’s Mane, Cordyceps, Chaga, Turkey Tail, Shiitake Maitake and Reishi mushrooms. Each 12 oz. can contains 150mg of caffeine and just 6 grams of sugar. Wooooo! Energy is available online for $30 per 6-pack. For more information, visit woooooenergy.com.

Kids snack and beverage brand good2grow has announced the launch of BIGGER, a larger, 10 oz. size of its juice compatible with the brand’s iconic, collectible licensed character tops. Available in two flavors at launch – Raspberry Lemonade and Orange Mango –good2grow BIGGER contains 65% more juice than the brand’s classic 6 oz. products. BIGGER is slated to hit the shelves of major retailers including Walmart, Target, Meijer, Publix and Casey’s this summer. For more information, visit good2grow.com.

Pressed has always been tied to health & wellness, but this time it’s approaching athletic performance and recovery a bit more headon with the launch of Hydration+ collection, which includes 2 juices and a high-electrolyte fitness shot. For the former two, there’s amped-up green juice Hydration+ Greens ($6.95) and Hydration+ Dragon Fruit ($6.95), alongside Hydration+ Watermelon Fitness Shot ($3.75) aimed at post-workout occasions. The line is the second “+” line from pressed, following Refresh+ earlier this summer. For more information, visit pressed.com.

GNC has dropped its first hydration and performance product, GNC AMP Amplified Hydration. The enhanced electrolyte mix is designed to support hydration, recovery and multi-action digestion, the brand claims. The first drop, currently available online and at GNC stores, features seasonal flavors Acai Berry, Tropical Punch and Lemon Lime. For more information, visit gnc.com.

C4 has again teamed up with the Wounded Warrior Project to launch its newest product, C4 x WWP Pre-Workout Powder. The new powder features 300mg of caffeine, citrulline, dual creatines and CarnoSyn Beta to increase alertness and combat fatigue. Available in two exclusive WWP flavors – Mango Foxtrot and Freedom Ice – C4 x WWP Pre-Workout Powder is available via the brand’s website for $44.99 per 11.1 oz. tub. For more information, visit cellucor.com/pages/c4-energy.

Liquid I.V. has unveiled its biggest product innovation to date, Hydration Multiplier SugarFree. Available in three flavors at launch –Lemon Lime, Green Grape and White Peach – the new, sugar-free offering features a blend of allulose and amino acids. Each packet delivers three times the amount of electrolytes as the leading sports drink, the brand claims. For more information, visit liquid-iv.com.

Coca-Cola has partnered with Riot Games, the publisher and developer of League of Legends, to create its newest Coca-Cola Creations offering, Coca-Cola Ultimate. The new LTO marks the company’s first collaboration with a gaming company on a Coca-Cola flavor. Described only as a “flavor that will give players an exhilarating taste as they queue up for a game,” the new offering marks the second Creations launch this year following Coca-Cola Move. Coca-Cola Ultimate is available in both regular and zero-sugar versions in the U.S. and Canada. Accompanying the product’s release, the company will release in-game and digital experiences to players across the globe. For more information, visit us.coca-cola.com.

To celebrate its nationwide launch with Sprouts, prebiotic soda brand VINA has unveiled two new Sprouts-exclusive flavors: Dr. Spice and Peach Pop. Both flavors feature 40mg of caffeine (sourced from yerba mate extract and green coffee beans) per 12 oz. can. In addition to Dr. Spice and Peach Pop, Sprouts will also carry the brand’s Pomegranate and Cherry Pop flavors. All four flavors have a SRP of $2.49 each. For more information, visit drinkvina.com.

Just in time for Summer, Shimmerwood has announced the return of its Chai Cherry seltzer. Like the rest of the brand’s flavors, Chai Cherry contains 5 milligrams of Maine-grown, full-spectrum CBD per can. Previously distributed in 11.5 oz. cans, the latest batches of Shimmer Seltzer fill to 12 oz. due in part to the brand’s relationship with Portland-based copacker Geary Brewing. Shimmerwood Chai Cherry is available via the brand’s website for $40 per 8-pack or $59 per 12-pack. For more information, visit shimmerwood.com.

Aura Bora has expanded its lineup of flavored sparkling waters with the addition of Raspberry Vanilla. The new flavor, formulated to taste like berries and cream, is a “refreshing and cooling summer treat,” according to the brand. Like the rest of Aura Bora’s products, the new sparkling water is calorie-free and contains no added sweeteners. Raspberry Vanilla is available via the brand’s website for $33 per 12-pack of 12 oz. cans. For more information, visit aurabora.com.

PepsiCo’s sparkling water entrant Bubly is debuting a Key Lime Pie flavor. The drink has zero calories and zero sugar, with natural flavors. Key Lime Pie is available in 12 oz. cans in individual and multipack formats. For more information visit bubly.com.

HOP WTR has expanded its portfolio of nonalcoholic sparkling waters with the addition of Ruby Red Grapefruit, crafted in partnership with brand ambassador Dustin Poirier. The new flavor joins the brands exist-

ing fruity lineup including Classic, Mango, Blood Orange, Peach and Ginger Limeade. HOP WTR Ruby Red Grapefruit is currently available for preorder via the brand’s website for $36.99 per 12-pack. For more information, visit hopwtr.com.

Vermont-based Barr Hill Gin has teamed up with The Beer Guy to launch its first canned cocktail, Gin & Tonic. The new offering is crafted with gin, tonic made from cinchona tree bark, lemongrass, citrus and Barr Hill honey. Bar Hill Gin & Tonic (9.3% ABV) is available at grocery stores, convenience stores and gas stations across Vermont for $19.99 per 4-pack of 12 oz. cans. For more information, visit barrhill.com.

Deep Eddy Vodka has expanded its lineup of hard seltzer with the addition of Deep Eddy Vodka + Tea Hard Seltzers. Available in three varieties at launch – Lemon Tea, Sweet Tea and Peach Tea – the new offerings are crafted with vodka, tea, juice and “a hint of bubbles.” Each 12 oz. can (4.5% ABV) contains 180 calories. Deep Eddy Vodka + Tea Hard Seltzers are available at retailers nationwide for $16.99 per 6-pack. For more information, visit deepeddyvodka.com.

Costa Tequila has unveiled its latest innovation, Costa Tequila Café. The new tequilabased coffee liqueur is made with Blue Weber Agave and Mexican coffee beans and features tasting notes of caramel and vanilla. Costa Tequila Café (35% ABV) is available for purchase via the brand’s website for $33.99 per 750ml bottle. For more information, visit costatequila.com.

Bacardi has turned up the heat with its newest flavored rum expression, Mango Chile. Inspired by the classic Mexican snack, the new expression is crafted with natural mango extracts, chili spice and Bacardi white rum. Bacardi Mango Chili is available at retailers, bars and restaurants nationwide for a SRP of $12.99 per 750ml bottle. For more information, visit bacardi.com/us/en.

Lots of financial action among cold brew brands this month, with transactions involving both High Brew and La Colombe, as well as the recent sale of Lucky Jack. So let’s take a look at the numbers as they stand, which tend to have some overlap between these two categories. Remember, a lot of these brands could be ambient, and still get put in the cold box.

SOURCE: Circana OmniMarket™️ Shared BWS - 52 Weeks Ending 06-18-23

SOURCE: Circana OmniMarket™️ Shared BWS - 52 Weeks Ending 06-18-23

Industry experts ranging from long-time entrepreneurs to grocery buyers and beverage investors shared their optimism about the road ahead for emerging brands, while also emphasizing the importance of a strong focus on business fundamentals and managing growth within the bandwidth of your current balance sheet. Those themes manifested in main stage discussions throughout BevNET Live Summer 2023 with topics ranging from online channel strategy to managing changes within established brands.

Tricia Wallwork, chair and CEO of family-owned Milo’s, never thought she’d be leading her family’s business, but in 2011, the former corporate lawyer and vegetarian took the helm at Milo’s – an operation that included a chain of hamburger restaurants and a now lucrative CPG line of sweet tea.

On stage this morning, Wallwork spoke about the complexities of navigating growth and change within a 77-yearold, family-run business. She explained that creating economic prosperity for her family, and the families of Milo’s nearly 700 associates, has remained the company’s north star since her grandfather opened the first restaurant in 1946.

“You’ve got to run a great business,” she stated. “We have done that by [being] really obsessed with customer service… making sure [we] deliver on time and in full, being honest with [our] customer about what we can do and can’t do.”

“It is also having those brutal conversations and being willing to say no, that is not what’s right for your category, that’s

not what’s right for our business, and it’s not what’s right for [our] shopper,” she continued. “When you do this, you unlock that honest relationship with your customers that, for us, has allowed us to be the category driver.”

Wallwork also credits that inward-looking nature and business success to its strategy employees. She highlighted that all Milo’s associates have roadmaps for growth within the organization, however, as the business has managed explosive growth that has also meant making difficult personnel decisions and shifting roles for individuals best suited to keep pace. She said the company aims to keep communication transparent across the entire business structure and that has allowed it to make those difficult decisions while retaining employees, and their trust.