Analysts’ Viewpoint on Battery Monitoring IC Market Scenario

Currently, the global transportation industry is being driven by developments in battery technologies, which are being adopted across diverse products, ranging from portable power tools to plug-in hybrid electric automobiles and wireless devices. Battery management solutions (BMS) reduce cost, save space, and help to significantly extend the battery life of portable products while making them safe. Numerous players operating in the battery monitoring IC market provide monitoring, protection, cutoff, and balancing IC solutions regardless of the battery chemistry. Some players offer battery specific solutions majorly for lithium-ion, as they pose a higher risk when operated above or below the specified operating conditions. Thus, ICs play an important in battery safety, performance & longevity while designing a robust and smart BMS. Ever increasing number of battery operated devices being introduced in the market is estimated to offer significant opportunities for manufacturers in the battery monitoring IC market to boost their revenue streams.

Battery management systems are available in either master-slave or single board architecture and are used for overcharge/ deep discharge, over/under voltage, over current, over/under temperature, pre-charge, and short circuit protection. They have been integrated with specific algorithms such as SOC, SOH, cell/ module balancing, and real-time control over charge/ discharge current.

Rise in demand for battery management system for utility grid support, commercial and industrial facilities, residential energy storage, and specialty vehicle applications has fueled the battery monitoring IC market. Battery monitoring application-specific integrated circuits (ASICs) measure and transmit information about voltage, temperature and current flow to a battery control unit in order to maintain battery packs in that safe operating range.

Request a sample to get extensive insights into the Battery Monitoring IC Market

Adoption of electric vehicles is rising significantly owing to an increase in awareness about the benefits of electric vehicles. R&D initiatives are also estimated to improve the performance of electric vehicles in the next decade.

Several factors affect the functioning of the electric vehicle, which include cell voltage, battery life and health, safety, and charging-discharging rates. Rechargeable batteries in electric vehicles are connected to all these parameters in one way or another through automotive battery management system ICs. Therefore, it is necessary to integrate the best battery monitoring system and adjust several battery characteristics in order to obtain an efficient output from these batteries. These factors are expected to boost the electric vehicles market and propel the adoption of Li-ion battery protection ICs.

Use of large-scale battery arrays for backup and carry-through energy storage is increasing. Rechargeable batteries are increasingly being used to deliver higher voltages and more power in applications such as electric vehicles (EVs) and hybrid-electric vehicles (HEVs), power tools, lawn equipment, and uninterruptible power supplies. Important cell parameters to measure for effective management are terminal voltage, charge/discharge current, and temperature. The measuring performance required for modern battery packs is quite high each cell must be measured to within a few millivolts (mV), milliamps (mA), and degrees Celsius (°C).

Thus, multi-cell ICs are important in determining battery pack state-of-charge (SOC) and state-of-health (SOH) in order to provide information about how to monitor lithium battery or how to monitor battery charge and determine remaining battery pack capacity (run time) and overall life expectancy. A few battery control IC manufacturers have developed ICs that are designed to solve the issue of reading a single cell in a series string with accuracy despite high CMV and the harsh electrical environment. These ICs not only provide the basic readings but also address multiplexing, isolation, and timing skew technical issues.

Range of batteries are available according different chemical composition. Battery accounts for almost 30% of the electric vehicle cost. Every region is trying to meet the de-carbonization target. For instance, in the European Union, total annual battery capacity would need to scale from the current 60 gigawatt hours (GWh) to 900 GWh to meet the European Union’s 2030 de- carbonization targets. Thus, along with battery capacity, the need for battery monitoring ICs also tends increase the market value.

Lithium-ion is the most widely used technology for portable gadgets such as cell phones and laptop computers. This battery technology has recently gained popularity among electric car makers, owing to cost reductions in lithium-ion battery manufacturing and substantial incentives for sustainable transportation. The lithium-nickel-manganese-cobalt-oxide battery is the most often used type of lithium-ion battery.

Thus in NiCd, NiMH or Li-Ion/Li-Pol battery packs battery monitoring IC plays vital role in life extension, energy density, safety, cost reduction, and charging speed, among others.

Lithium-ion batteries are also projected to be widely adopted in the consumer electronics industry and automotive owing to cost reduction in lithium-ion batteries manufacturing and high incentives towards clean transportation. There is a standstill in the lithium-ion battery industry when it comes to environmental sustainability. Lithium-ion batteries are becoming increasingly necessary for EVs and hence, major disposal issues and their negative environmental effects have hampered the lithium-ion battery market and caused automakers to reevaluate their use.

Asia Pacific to dominate the global battery monitoring IC market and held major share in 2021. The market is expanding owing to the numerous industry participants operating in the region and significant amount of research and development activities being carried out on power battery management systems. Moreover, rising use of electric vehicles (EVs) and encouraging government initiatives are projected to further drive the market in the region.

Europe and North America are also major markets of battery monitoring ICs. Presence of major automotive manufacturers in the Europe and rapidly expanding consumer electronics industry in Asia Pacific drives the market in the respective regions.

Middle East & Africa is a larger market for battery monitoring IC, as compared to the market in South America, and the market in Middle East & Africa projected to expand at a moderate growth rate during the forecast period.

The global battery monitoring IC market is highly fragmented with a large number of large-scale and small-scale vendors offering different portfolio. A majority of end-use industries of battery monitoring IC are emphasizing on comprehensive research and development owing to the future business opportunities in battery monitoring IC, primarily to focus on high-end products. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Prominent battery monitoring IC manufacturers include Analog Devices, Texas Instruments Incorporated, NXP Semiconductors, Renesas Electronics Corporation, Monolithic Power Systems, Inc., Microchip Technology Inc. STMicroelectronics, Diodes Incorporated, ROHM Co., Ltd., and Infineon Technologies AG.

Request a custom report on Battery Monitoring IC Market

Each of these players has been profiled in the battery monitoring IC market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.6 Bn |

|

Market Forecast Value in 2031 |

US$ 4.8 Bn |

|

Growth Rate (CAGR) |

11.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

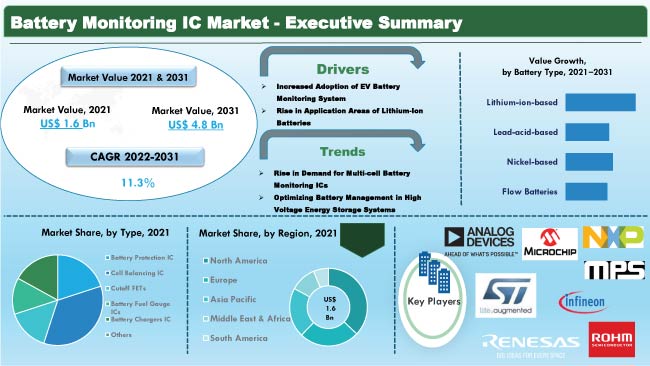

The battery monitoring IC market stood at US$ 1.6 Bn in 2021

The battery monitoring IC market estimated to rise at a CAGR of 11.3% during the forecast period

The battery monitoring IC market is expected to reach US$ 4.8 Bn by 2031

Analog Devices, Texas Instruments Incorporated, NXP Semiconductors, Renesas Electronics Corporation, Monolithic Power Systems, Inc., Microchip Technology Inc. STMicroelectronics, Diodes Incorporated, ROHM Co., Ltd., Infineon Technologies AG

The U.S. accounted for around 29.90 % share of the global battery monitoring IC market in 2021

The lithium-ion-based segment dominated the market with 42.5% share, in terms of revenue, in 2021

Increased adoption of EV battery monitoring system and rise in application areas of lithium-ion batteries

Asia Pacific is a highly lucrative region of the global battery monitoring IC market

1. Preface

1.1. Research Scope.

1.2. Battery Monitoring IC Market Overview

1.3. Market and Segments Definition

1.4. Market Taxonomy

1.5. Research Methodology

1.6. Assumption and Acronyms

2. Executive Summary

2.1. Global Battery Monitoring IC Market Analysis and Forecast

2.2. Regional Outline

2.3. Market Dynamics Snapshot

2.4. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Key Market Indicator

3.3. Drivers

3.4. Restraints

3.5. Opportunities

3.6. Trends

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

4.6. COVID-19 Impact Analysis

5. Global Battery Monitoring IC Market Analysis, by Battery Type

5.1. Global Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Battery Type, 2017‒2031

5.1.1. Lithium-ion-based

5.1.2. Lead-acid-based

5.1.3. Nickel-based

5.1.4. Flow Batteries

5.1.5. Others

5.2. Global Battery Monitoring IC Market Attractiveness Analysis, by Battery Type

6. Global Battery Monitoring IC Market Analysis, by Type

6.1. Global Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017‒2031

6.1.1. Battery Protection IC

6.1.2. Cell Balancing IC

6.1.3. Cutoff FETs

6.1.4. Battery Fuel Gauge ICs

6.1.5. Battery Chargers IC

6.1.6. Others

6.2. Global Battery Monitoring IC Market Attractiveness Analysis, by Type

7. Global Battery Monitoring IC Market Analysis, by Number of Cells

7.1. Global Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by Number of Cells, 2017‒2031

7.1.1. Upto 2

7.1.2. 2- 4

7.1.3. 4 - 10

7.1.4. 10 -16

7.1.5. Above 16

7.2. Global Battery Monitoring IC Market Attractiveness Analysis, by Number of Cells

8. Global Battery Monitoring IC Market Analysis, by Applications

8.1. Global Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by Applications, 2017‒2031

8.1.1. Power Tools

8.1.2. UPS System

8.1.3. Home Appliances

8.1.4. E-bikes

8.1.5. Electric Vehicle

8.1.6. Energy Storages Systems

8.1.7. Personal Electronics and Appliances

8.1.8. Others

8.2. Global Battery Monitoring IC Market Attractiveness Analysis, by Applications

9. Global Battery Monitoring IC Market Analysis, by End-use Industry

9.1. Global Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

9.1.1. Automotive and Transportation

9.1.2. Consumer Electronics

9.1.3. IT and Telecommunication

9.1.4. Energy and Utility

9.1.5. Others

9.2. Global Battery Monitoring IC Market Attractiveness Analysis, by End-use Industry

10. Global Battery Monitoring IC Market Analysis and Forecast, by Region

10.1. Global Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017 – 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Global Battery Monitoring IC Market Attractiveness Analysis, by Region

11. North America Battery Monitoring IC Market Analysis and Forecast

11.1. Market Snapshot

11.2. North America Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Battery Type, 2017‒2031

11.2.1. Lithium-ion-based

11.2.2. Lead-acid-based

11.2.3. Nickel-based

11.2.4. Flow Batteries

11.2.5. Others

11.3. North America Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017‒2031

11.3.1. Battery Protection IC

11.3.2. Cell Balancing IC

11.3.3. Cutoff FETs

11.3.4. Battery Fuel Gauge ICs

11.3.5. Battery Chargers IC

11.3.6. Others

11.4. North America Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by Number of Cells, 2017‒2031

11.4.1. Low Number of Cells (Up to 75V)

11.4.2. Medium Number of Cells (100 to 630V)

11.4.3. High Number of Cells (Above 1kV)

11.5. North America Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by Applications, 2017‒2031

11.5.1. Power Tools

11.5.2. UPS System

11.5.3. Home Appliances

11.5.4. E-bikes

11.5.5. Electric Vehicle

11.5.6. Energy Storages Systems

11.5.7. Personal Electronics and Appliances

11.5.8. Others

11.6. North America Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

11.6.1. Automotive and Transportation

11.6.2. Consumer Electronics

11.6.3. IT and Telecommunication

11.6.4. Energy and Utility

11.6.5. Others

11.7. North America Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

11.7.1. U.S.

11.7.2. Canada

11.7.3. Mexico

11.8. North America Battery Monitoring IC Market Attractiveness Analysis

11.8.1. By Battery Type.

11.8.2. By Type

11.8.3. By Number of Cells

11.8.4. By Applications

11.8.5. By End-use Industry

11.8.6. By Country & Sub-region

12. Europe Battery Monitoring IC Market Analysis and Forecast

12.1. Market Snapshot

12.2. Europe Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Battery Type, 2017‒2031

12.2.1. Lithium-ion-based

12.2.2. Lead-acid-based

12.2.3. Nickel-based

12.2.4. Flow Batteries

12.2.5. Others

12.3. Europe Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017‒2031

12.3.1. Battery Protection IC

12.3.2. Cell Balancing IC

12.3.3. Cutoff FETs

12.3.4. Battery Fuel Gauge ICs

12.3.5. Battery Chargers IC

12.3.6. Others

12.4. Europe Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by Number of Cells, 2017‒2031

12.4.1. Upto 2

12.4.2. 2- 4

12.4.3. 4 - 10

12.4.4. 10 -16

12.4.5. Above 16

12.5. Europe Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by Applications, 2017‒2031

12.5.1. Power Tools

12.5.2. UPS System

12.5.3. Home Appliances

12.5.4. E-bikes

12.5.5. Electric Vehicle

12.5.6. Energy Storages Systems

12.5.7. Personal Electronics and Appliances

12.5.8. Others

12.6. Europe Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

12.6.1. Automotive and Transportation

12.6.2. Consumer Electronics

12.6.3. IT and Telecommunication

12.6.4. Energy and Utility

12.6.5. Aerospace and Defense

12.6.6. Others

12.7. Europe Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

12.7.1. U.K.

12.7.2. Germany

12.7.3. France

12.7.4. Rest of Europe

12.8. Europe Battery Monitoring IC Market Attractiveness Analysis

12.8.1. By Battery Type.

12.8.2. By Type

12.8.3. By Number of Cells

12.8.4. By Applications

12.8.5. By End-use Industry

12.8.6. By Country & Sub-region

13. Asia Pacific Battery Monitoring IC Market Analysis and Forecast

13.1. Market Snapshot

13.2. Asia Pacific Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Battery Type, 2017‒2031

13.2.1. Lithium-ion-based

13.2.2. Lead-acid-based

13.2.3. Nickel-based

13.2.4. Flow Batteries

13.2.5. Others

13.3. Asia Pacific Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017‒2031

13.3.1. Battery Protection IC

13.3.2. Cell Balancing IC

13.3.3. Cutoff FETs

13.3.4. Battery Fuel Gauge ICs

13.3.5. Battery Chargers IC

13.3.6. Others

13.4. Asia Pacific Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by Number of Cells, 2017‒2031

13.4.1. Upto 2

13.4.2. 2- 4

13.4.3. 4 - 10

13.4.4. 10 -16

13.4.5. Above 16

13.5. Asia Pacific Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by Applications, 2017‒2031

13.5.1. Power Tools

13.5.2. UPS System

13.5.3. Home Appliances

13.5.4. E-bikes

13.5.5. Electric Vehicle

13.5.6. Energy Storages Systems

13.5.7. Personal Electronics and Appliances

13.5.8. Others

13.6. Asia Pacific Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

13.6.1. Automotive and Transportation

13.6.2. Consumer Electronics

13.6.3. IT and Telecommunication

13.6.4. Energy and Utility

13.6.5. Others

13.7. Asia Pacific Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

13.7.1. China

13.7.2. India

13.7.3. Japan

13.7.4. South Korea

13.7.5. ASEAN

13.7.6. Rest of Asia Pacific

13.8. Asia Pacific Battery Monitoring IC Market Attractiveness Analysis

13.8.1. By Battery Type.

13.8.2. By Type

13.8.3. By Number of Cells

13.8.4. By Applications

13.8.5. By End-use Industry

13.8.6. By Country & Sub-region

14. Middle East & Africa (MEA) Battery Monitoring IC Market Analysis and Forecast

14.1. Market Snapshot

14.2. MEA Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Battery Type, 2017‒2031

14.2.1. Lithium-ion-based

14.2.2. Lead-acid-based

14.2.3. Nickel-based

14.2.4. Flow Batteries

14.2.5. Others

14.3. MEA Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017‒2031

14.3.1. Battery Protection IC

14.3.2. Cell Balancing IC

14.3.3. Cutoff FETs

14.3.4. Battery Fuel Gauge ICs

14.3.5. Battery Chargers IC

14.3.6. Others

14.4. MEA Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by Number of Cells, 2017‒2031

14.4.1. Upto 2

14.4.2. 2- 4

14.4.3. 4 - 10

14.4.4. 10 -16

14.4.5. Above 16

14.5. MEA Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by Applications, 2017‒2031

14.5.1. Power Tools

14.5.2. UPS System

14.5.3. Home Appliances

14.5.4. E-bikes

14.5.5. Electric Vehicle

14.5.6. Energy Storages Systems

14.5.7. Personal Electronics and Appliances

14.5.8. Others

14.6. MEA Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

14.6.1. Automotive and Transportation

14.6.2. Consumer Electronics

14.6.3. IT and Telecommunication

14.6.4. Energy and Utility

14.6.5. Others

14.7. MEA Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

14.7.1. GCC

14.7.2. South Africa

14.7.3. North Africa

14.7.4. Rest of Middle East & Africa

14.8. MEA Battery Monitoring IC Market Attractiveness Analysis

14.8.1. By Battery Type.

14.8.2. By Type

14.8.3. By Number of Cells

14.8.4. By Applications

14.8.5. By End-use Industry

14.8.6. By Country & Sub-region

15. South America Battery Monitoring IC Market Analysis and Forecast

15.1. Market Snapshot

15.2. South America Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Battery Type, 2017‒2031

15.2.1. Lithium-ion-based

15.2.2. Lead-acid-based

15.2.3. Nickel-based

15.2.4. Flow Batteries

15.2.5. Others

15.3. South America Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017‒2031

15.3.1. Battery Protection IC

15.3.2. Cell Balancing IC

15.3.3. Cutoff FETs

15.3.4. Battery Fuel Gauge ICs

15.3.5. Battery Chargers IC

15.3.6. Others

15.4. South America Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by Number of Cells, 2017‒2031

15.4.1. Upto 2

15.4.2. 2- 4

15.4.3. 4 - 10

15.4.4. 10 -16

15.4.5. Above 16

15.5. South America Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by Applications, 2017‒2031

15.5.1. Power Tools

15.5.2. UPS System

15.5.3. Home Appliances

15.5.4. E-bikes

15.5.5. Electric Vehicle

15.5.6. Energy Storages Systems

15.5.7. Personal Electronics and Appliances

15.5.8. Others

15.6. South America Battery Monitoring IC Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

15.6.1. Automotive and Transportation

15.6.2. Consumer Electronics

15.6.3. IT and Telecommunication

15.6.4. Energy and Utility

15.6.5. Others

15.7. South America Battery Monitoring IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

15.7.1. Brazil

15.7.2. Rest of South America

15.8. South America Battery Monitoring IC Market Attractiveness Analysis

15.8.1. By Battery Type.

15.8.2. By Type

15.8.3. By Number of Cells

15.8.4. By Applications

15.8.5. By End-use Industry

15.8.6. By Country & Sub-region

16. Competition Assessment

16.1. Global Battery Monitoring IC Market Competition Matrix - a Dashboard View

16.2. Global Battery Monitoring IC Market Company Share Analysis, by Value (2020)

16.3. Technological Differentiator

17. Company Profiles (Manufacturers/Suppliers)

17.1. Analog Devices, Inc.

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. Diodes Incorporated

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. Infineon Technologies AG

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. Maxim Integrated

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. Microchip Technology Inc.

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. Monolithic Power Systems, Inc.

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. Nisshinbo Micro Devices Inc.

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. NXP Semiconductors.

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. Panasonic

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. Renesas Electronics Corporation.

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. ROHM Co. Ltd

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

17.12. STMicroelectronics

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Key Financials

17.13. Texas Instruments Incorporated.

17.13.1. Overview

17.13.2. Product Portfolio

17.13.3. Sales Footprint

17.13.4. Key Subsidiaries or Distributors

17.13.5. Strategy and Recent Developments

17.13.6. Key Financials

18. Recommendation

18.1. Opportunity Assessment

18.1.1. By Battery Type.

18.1.2. By Type

18.1.3. By Number of Cells

18.1.4. By Applications

18.1.5. By End-use Industry

18.1.6. By Region

List of Tables

Table 1: Global Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Battery Type, 2017‒2031

Table 2: Global Battery Monitoring IC Market Volume (Million Units) & Forecast, by Battery Type, 2017‒2031

Table 3: Global Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 4: Global Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Number of Cells, 2017‒2031

Table 5: Global Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Applications, 2017‒2031

Table 6: Global Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Applications, 2017‒2033

Table 7: Global Battery Monitoring IC Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 8: Global Battery Monitoring IC Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 9: Global Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 10: North America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Battery Type, 2017‒2031

Table 11: North America Battery Monitoring IC Market Volume (Million Units) & Forecast, by Battery Type, 2017‒2031

Table 12: North America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 13: North America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Number of Cells, 2017‒2031

Table 14: North America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Applications, 2017‒2031

Table 15: North America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Applications, 2017‒2033

Table 16: North America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 17: North America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 18: North America Battery Monitoring IC Market Volume (Million Units) & Forecast, by Country, 2017‒2031

Table 19: Europe Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Battery Type, 2017‒2031

Table 20: Europe Battery Monitoring IC Market Volume (Million Units) & Forecast, by Battery Type, 2017‒2031

Table 21: Europe Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 22: Europe Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Number of Cells, 2017‒2031

Table 23: Europe Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Applications, 2017‒2031

Table 24: Europe Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Applications, 2017‒2033

Table 25: Europe Battery Monitoring IC Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 26: Europe Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 27: Europe Battery Monitoring IC Market Volume (Million Units) & Forecast, by Country, 2017‒2031

Table 28: Asia Pacific Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Battery Type, 2017‒2031

Table 29: Asia Pacific Battery Monitoring IC Market Volume (Million Units) & Forecast, by Battery Type, 2017‒2031

Table 30: Asia Pacific Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 31: Asia Pacific Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Number of Cells, 2017‒2031

Table 32: Asia Pacific Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Applications, 2017‒2031

Table 33: Asia Pacific Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Applications, 2017‒2033

Table 34: Asia Pacific Battery Monitoring IC Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 35: Asia Pacific Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 36: Asia Pacific Battery Monitoring IC Market Volume (Million Units) & Forecast, by Country, 2017‒2031

Table 37: Middle East and Africa Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Battery Type, 2017‒2031

Table 38: Middle East and Africa Battery Monitoring IC Market Volume (Million Units) & Forecast, by Battery Type, 2017‒2031

Table 39: Middle East and Africa Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 40: Middle East and Africa Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Number of Cells, 2017‒2031

Table 41: Middle East and Africa Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Applications, 2017‒2031

Table 42: Middle East and Africa Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Applications, 2017‒2033

Table 43: Middle East and Africa Battery Monitoring IC Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 44: Middle East and Africa Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 45: Middle East And Africa Battery Monitoring IC Market Volume (Million Units) & Forecast, by Country, 2017‒2031

Table 46: South America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Battery Type, 2017‒2031

Table 47: South America Battery Monitoring IC Market Volume (Million Units) & Forecast, by Battery Type, 2017‒2031

Table 48: South America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 49: South America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Number of Cells, 2017‒2031

Table 50: South America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Applications, 2017‒2031

Table 51: South America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Applications, 2017‒2033

Table 52: South America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 53: South America Battery Monitoring IC Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 54: South America Battery Monitoring IC Market Volume (Million Units) & Forecast, by Country, 2017‒2031

List of Figures

Figure 01: Global Price Trend Analysis (Million US$) (2021, 2026, 2031)

Figure 02: Global Battery Monitoring IC Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 03: Global Battery Monitoring IC Market Size & Forecast, Value (US$ Mn),Y-O-Y, 2017‒2031

Figure 04: Global Battery Monitoring IC Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 05: Global Battery Monitoring IC Market Size & Forecast, Volume (Million Units),Y-O-Y, 2017‒2031

Figure 06: Global Battery Monitoring IC Market Projections by Battery Type, Value (US$ Mn), 2017‒2031

Figure 07: Global Battery Monitoring IC Market Share Analysis, by Battery Type, 2022 and 2031

Figure 08: Global Battery Monitoring IC Market, Incremental Opportunity, by Battery Type, 2021‒2031

Figure 09: Global Battery Monitoring IC Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 10: Global Battery Monitoring IC Market Share Analysis, by Type, 2022 and 2031

Figure 11: Global Battery Monitoring IC Market, Incremental Opportunity, by Type, 2021‒2031

Figure 12: Global Battery Monitoring IC Market Projections by Number of Cells, Value (US$ Mn), 2017‒2031

Figure 13: Global Battery Monitoring IC Market Share Analysis, by Number of Cells, 2022 and 2031

Figure 14: Global Battery Monitoring IC Market, Incremental Opportunity, by Number of Cells, 2021‒2031

Figure 15: Global Battery Monitoring IC Market Projections by Applications, Value (US$ Mn), 2017‒2031

Figure 16: Global Battery Monitoring IC Market Share Analysis, by Applications, 2022 and 2031

Figure 17: Global Battery Monitoring IC Market, Incremental Opportunity, by Applications, 2021‒2031

Figure 18: Global Battery Monitoring IC Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 19: Global Battery Monitoring IC Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 20: Global Battery Monitoring IC Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 21: Global Battery Monitoring IC Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 22: Global Battery Monitoring IC Market Share Analysis, by Region 2022 and 2031

Figure 23: Global Battery Monitoring IC Market, Incremental Opportunity, by Region, 2021‒2031

Figure 24: North America Price Trend Analysis (Million US$) (2021, 2026, and 2031)

Figure 25: North America Battery Monitoring IC Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 26: North America Battery Monitoring IC Market Size & Forecast, Value (US$ Mn), Y-O-Y, 2017‒2031

Figure 27: North America Battery Monitoring IC Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 28: North America Battery Monitoring IC Market Size & Forecast, Volume (Million Units), Y-O-Y, 2017‒2031

Figure 29: North America Battery Monitoring IC Market Projections by Battery Type, Value (US$ Mn), 2017‒2031

Figure 30: North America Battery Monitoring IC Market Share Analysis, by Battery Type, 2022 and 2031

Figure 31: North America Battery Monitoring IC Market, Incremental Opportunity, by Battery Type, 2021‒2031

Figure 32: North America Battery Monitoring IC Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 33: North America Battery Monitoring IC Market Share Analysis, by Type, 2022 and 2031

Figure 34: North America Battery Monitoring IC Market, Incremental Opportunity, by Type, 2021‒2031

Figure 35: North America Battery Monitoring IC Market Projections by Number of Cells, Value (US$ Mn), 2017‒2031

Figure 36: North America Battery Monitoring IC Market Share Analysis, by Number of Cells, 2022 and 2031

Figure 37: North America Battery Monitoring IC Market, Incremental Opportunity, by Number of Cells, 2021‒2031

Figure 38: North America Battery Monitoring IC Market Projections by Applications, Value (US$ Mn), 2017‒2031

Figure 39: North America Battery Monitoring IC Market Share Analysis, by Applications, 2022 and 2031

Figure 40: North America Battery Monitoring IC Market, Incremental Opportunity, by Applications, 2021‒2031

Figure 41: North America Battery Monitoring IC Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 42: North America Battery Monitoring IC Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 43: North America Battery Monitoring IC Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 44: North America Battery Monitoring IC Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 45: North America Battery Monitoring IC Market Share Analysis, by Region 2022 and 2031

Figure 46: North America Battery Monitoring IC Market, Incremental Opportunity, by Region, 2021‒2031

Figure 47: Europe Battery Monitoring IC Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 48: Europe Battery Monitoring IC Market Size & Forecast, Value (US$ Mn), Y-O-Y, 2017‒2031

Figure 49: Europe Battery Monitoring IC Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 50: Europe Battery Monitoring IC Market Size & Forecast, Volume (Million Units), Y-O-Y, 2017‒2031

Figure 51: Europe Battery Monitoring IC Market Projections by Battery Type, Value (US$ Mn), 2017‒2031

Figure 52: Europe Battery Monitoring IC Market Share Analysis, by Battery Type, 2022 and 2031

Figure 53: Europe Battery Monitoring IC Market, Incremental Opportunity, by Battery Type, 2021‒2031

Figure 54: Europe Battery Monitoring IC Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 55: Europe Battery Monitoring IC Market Share Analysis, by Type, 2022 and 2031

Figure 56: Europe Battery Monitoring IC Market, Incremental Opportunity, by Type, 2021‒2031

Figure 57: Europe Battery Monitoring IC Market Projections by Number of Cells, Value (US$ Mn), 2017‒2031

Figure 58: Europe Battery Monitoring IC Market Share Analysis, by Number of Cells, 2022 and 2031

Figure 59: Europe Battery Monitoring IC Market, Incremental Opportunity, by Number of Cells, 2021‒2031

Figure 60: Europe Battery Monitoring IC Market Projections by Applications, Value (US$ Mn), 2017‒2031

Figure 61: Europe Battery Monitoring IC Market Share Analysis, by Applications, 2022 and 2031

Figure 62: Europe Battery Monitoring IC Market, Incremental Opportunity, by Applications, 2021‒2031

Figure 63: Europe Battery Monitoring IC Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 64: Europe Battery Monitoring IC Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 65: Europe Battery Monitoring IC Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 66: Europe Battery Monitoring IC Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 67: Europe Battery Monitoring IC Market Share Analysis, by Region 2022 and 2031

Figure 68: Europe Battery Monitoring IC Market, Incremental Opportunity, by Region, 2021‒2031

Figure 69: Asia Pacific Battery Monitoring IC Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 70: Asia Pacific Battery Monitoring IC Market Size & Forecast, Value (US$ Mn), Y-O-Y, 2017‒2031

Figure 71: Asia Pacific Battery Monitoring IC Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 72: Asia Pacific Battery Monitoring IC Market Size & Forecast, Volume (Million Units), Y-O-Y, 2017‒2031

Figure 73: Asia Pacific Battery Monitoring IC Market Projections by Battery Type, Value (US$ Mn), 2017‒2031

Figure 74: Asia Pacific Battery Monitoring IC Market Share Analysis, by Battery Type, 2022 and 2031

Figure 75: Asia Pacific Battery Monitoring IC Market, Incremental Opportunity, by Battery Type, 2021‒2031

Figure 76: Asia Pacific Battery Monitoring IC Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 77: Asia Pacific Battery Monitoring IC Market Share Analysis, by Type, 2022 and 2031

Figure 78: Asia Pacific Battery Monitoring IC Market, Incremental Opportunity, by Type, 2021‒2031

Figure 79: Asia Pacific Battery Monitoring IC Market Projections by Number of Cells, Value (US$ Mn), 2017‒2031

Figure 80: Asia Pacific Battery Monitoring IC Market Share Analysis, by Number of Cells, 2022 and 2031

Figure 81: Asia Pacific Battery Monitoring IC Market, Incremental Opportunity, by Number of Cells, 2021‒2031

Figure 82: Asia Pacific Battery Monitoring IC Market Projections by Applications, Value (US$ Mn), 2017‒2031

Figure 83: Asia Pacific Battery Monitoring IC Market Share Analysis, by Applications, 2022 and 2031

Figure 84: Asia Pacific Battery Monitoring IC Market, Incremental Opportunity, by Applications, 2021‒2031

Figure 85: Asia Pacific Battery Monitoring IC Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 86: Asia Pacific Battery Monitoring IC Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 87: Asia Pacific Battery Monitoring IC Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 88: Asia Pacific Battery Monitoring IC Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 89: Asia Pacific Battery Monitoring IC Market Share Analysis, by Region 2022 and 2031

Figure 90: Asia Pacific Battery Monitoring IC Market, Incremental Opportunity, by Region, 2021‒2031

Figure 91: Middle East Battery Monitoring IC Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 92: Middle East Battery Monitoring IC Market Size & Forecast, Value (US$ Mn), Y-O-Y, 2017‒2031

Figure 93: Middle East Battery Monitoring IC Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 94: Middle East Battery Monitoring IC Market Size & Forecast, Volume (Million Units), Y-O-Y, 2017‒2031

Figure 95: Middle East Battery Monitoring IC Market Projections by Battery Type, Value (US$ Mn), 2017‒2031

Figure 96: Middle East Battery Monitoring IC Market Share Analysis, by Battery Type, 2022 and 2031

Figure 97: Middle East Battery Monitoring IC Market, Incremental Opportunity, by Battery Type, 2021‒2031

Figure 98: Middle East Battery Monitoring IC Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 99: Middle East Battery Monitoring IC Market Share Analysis, by Type, 2022 and 2031

Figure 100: Middle East Battery Monitoring IC Market, Incremental Opportunity, by Type, 2021‒2031

Figure 101: Middle East Battery Monitoring IC Market Projections by Number of Cells, Value (US$ Mn), 2017‒2031

Figure 102: Middle East Battery Monitoring IC Market Share Analysis, by Number of Cells, 2022 and 2031

Figure 103: Middle East Battery Monitoring IC Market, Incremental Opportunity, by Number of Cells, 2021‒2031

Figure 104: Middle East Battery Monitoring IC Market Projections by Applications, Value (US$ Mn), 2017‒2031

Figure 105: Middle East Battery Monitoring IC Market Share Analysis, by Applications, 2022 and 2031

Figure 106: Middle East Battery Monitoring IC Market, Incremental Opportunity, by Applications, 2021‒2031

Figure 107: Middle East Battery Monitoring IC Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 108: Middle East Battery Monitoring IC Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 109: Middle East Battery Monitoring IC Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 110: Middle East Battery Monitoring IC Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 111: Middle East Battery Monitoring IC Market Share Analysis, by Region 2022 and 2031

Figure 112: Middle East Battery Monitoring IC Market, Incremental Opportunity, by Region, 2021‒2031

Figure 113: South America Battery Monitoring IC Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 114: South America Battery Monitoring IC Market Size & Forecast, Value (US$ Mn), Y-O-Y, 2017‒2031

Figure 115: South America Battery Monitoring IC Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 116: South America Battery Monitoring IC Market Size & Forecast, Volume (Million Units), Y-O-Y, 2017‒2031

Figure 117: South America Battery Monitoring IC Market Projections by Battery Type, Value (US$ Mn), 2017‒2031

Figure 118: South America Battery Monitoring IC Market Share Analysis, by Battery Type, 2022 and 2031

Figure 119: South America Battery Monitoring IC Market, Incremental Opportunity, by Battery Type, 2021‒2031

Figure 120: South America Battery Monitoring IC Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 121: South America Battery Monitoring IC Market Share Analysis, by Type, 2022 and 2031

Figure 122: South America Battery Monitoring IC Market, Incremental Opportunity, by Type, 2021‒2031

Figure 123: South America Battery Monitoring IC Market Projections by Number of Cells, Value (US$ Mn), 2017‒2031

Figure 124: South America Battery Monitoring IC Market Share Analysis, by Number of Cells, 2022 and 2031

Figure 125: South America Battery Monitoring IC Market, Incremental Opportunity, by Number of Cells, 2021‒2031

Figure 126: South America Battery Monitoring IC Market Projections by Applications, Value (US$ Mn), 2017‒2031

Figure 127: South America Battery Monitoring IC Market Share Analysis, by Applications, 2022 and 2031

Figure 128: South America Battery Monitoring IC Market, Incremental Opportunity, by Applications, 2021‒2031

Figure 129: South America Battery Monitoring IC Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 130: South America Battery Monitoring IC Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 131: South America Battery Monitoring IC Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 132: South America Battery Monitoring IC Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 133: South America Battery Monitoring IC Market Share Analysis, by Region 2022 and 2031

Figure 134: South America Battery Monitoring IC Market, Incremental Opportunity, by Region, 2021‒2031

Figure 135: Company Share Analysis