There’s A New Law in Town: Walsh’s Law

IP Networks, Expanded by The IoT Edge and Massive Growth in Content Will Drive New Peering Models This New Decade

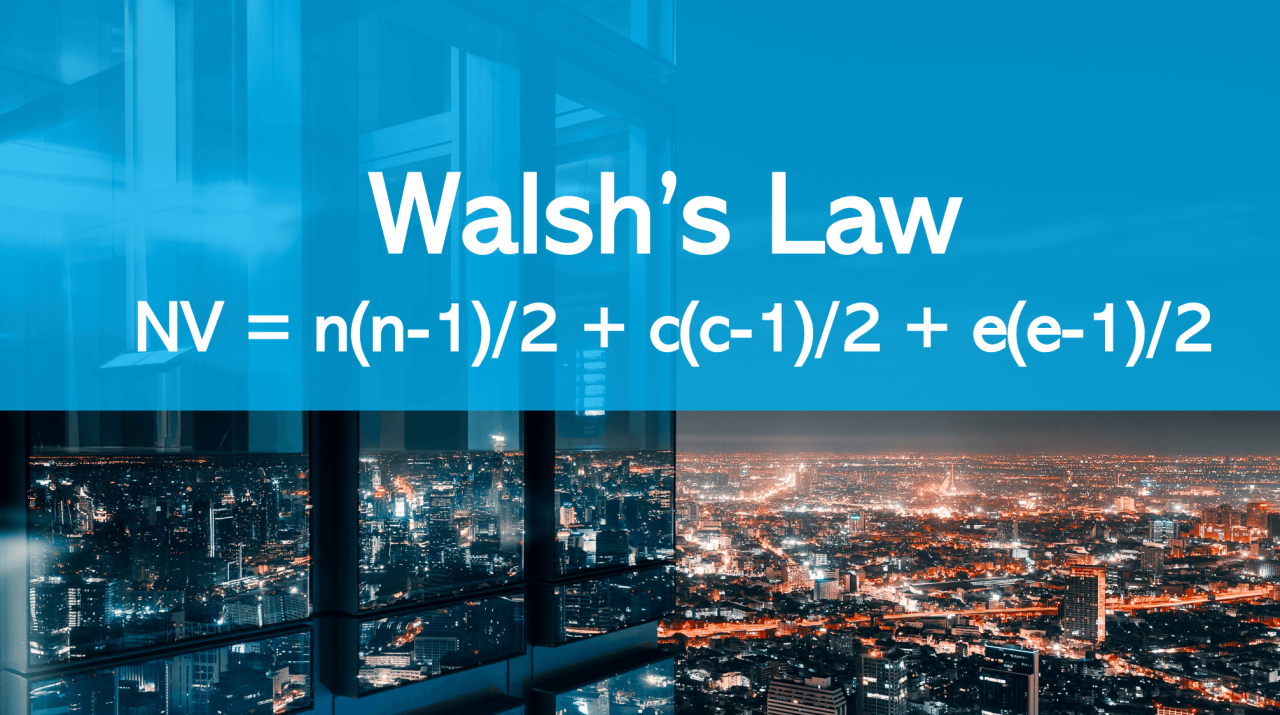

If “N” is users and “C” is content and “E” is IOT endpoints, Walsh’s Law is NV = n(n-1)/2 + c(c-1)/2 + e(e-1)/2.

It is, of course, inspired by Metcalf but extended to a more contextually connected world.

As more people, places, and things are connected, and as more content and data traverse networks constantly and contextually, the value of a network is no longer just the squared value of the number of users, as we believed a few decades ago.

Rather, the new value of the network is created by the number of users, end points, and content connected by the network.

Here the logic behind Walsh’s Law:

It starts off with what Metcalf proved, which is the number of possible cross-connections in a network grows as the square of the number of people in the network increases, and the community value of a network grows as the square of the number of its users increase.

What we now know is the value of a network is also influenced by how much content and the quality of the content is on a network as well as the number of overall endpoints on a network, which goes well beyond users. IoT devices are perfect examples.

Users without content (for example, people using the Public Switched Telephone Network, or the PSTN, to make phone calls) are not nearly as valuable as users with content (for example, Facebook users).

While none of these formulas are perfect as all users are not valued the same, nor is content, Metcalf’s Law was meant to describe the value of networks like the PSTN, not the Internet.

Walsh’s Law looks at the creation of value using networks like this:

NV: Network Value

N: Number users

C: Number of Content Servers

E: Number of machine/IoT endpoints

NV = n(n-1)/2 + c(c-1)/2 + e(e-1)/2

How will this exponentially increased activity supported by the Internet change the nature of IP Peering?

Peering is about moving yourself up the value chain and being rewarded with lower costs and improved performance.

While the Internet is a democratic environment where everyone gets to play, that doesn’t mean everyone, and every packet gets treated the same.

There’s a pyramid from broadband access providers on the bottom, to IP Transit in the middle, to Peerer’s at the top of the Internet food chain.

Content and users are key to continually moving north in this very competitive ecosystem. Your ability to negotiate and your power in the bargain is a function of the quality of the content and users you have directly attached to your network.

Let’s start at the end-state – the Internet in 2030 – and work our way backward from there.

We know how far we’ve come as we race into 2020, but the new technologies and business models – the very core of Internet economics – can only be designed when we can clearly envision what connectivity will mean and what our digital lives will be like ten years from now. The only way value can be created – substantial value – is through envisioning the next decade and “skating towards the puck.”

By 2030, powered up by a mature 5G ecosystem, enterprises and organizations, including government agencies and our largest financial and healthcare institutions, will have completed massive digital transformations.

This is made possible when the Internet can be tamed, with software, to address the challenges of delivering diverse services (people, places, and things, including a pervasive IoT), addressed the need to deliver very specific quality of service at affordable prices.

QoS will be transparent, with platforms that can prove ultra-low latency (sub-millisecond, for example) with more compute happening at the edge of the network, with data being transported to clouds for certain analytics and storage.

Every major city will be a smart city, and even the most rural towns will have access to broadband and the connected services that affordable and easily available broadband will make possible.

Surgeons with highly specialized skills will perform operations on people across oceans, and after surgery, those patients will be monitored remotely, with their vitals automatically and securely tracked, sending alerts based on policy set by the surgeon and the surgeon’s aftercare team.

Retail experiences will be immersive and virtual, and whether your eleven-year-old kid is inside an “experiential arena” (like the new American Dream in the NYC area) or inside your home with an AR/VR headset, he or she will know they can try before they buy, and enjoy an entirely new level of interactive only gaming with their friends, who may be on the other side of the world.

Factories will produce incredibly high-quality automobiles, appliances, furniture and phones, with automation that delivers not only more precision than human workers, but at a dramatically lower cost; in the meantime, “co-botting” will bring together robots and humans, augmenting productivity as human learning advances at least as much as machine learning, and creative breakthroughs become the new “metric” of the modern-day factory worker.

We’ll spend time interacting with our families as our driverless vehicles move us safely from our homes in the suburbs to shining new cities, appreciating more time to be human, more time to experience what is most important in life, rather than giving up hours, days, months and years in nightmarish commutes.

All that and produce too.

Healthier foods will be grown and distributed locally, with farmers able to grow vertically in densely populated areas, and outdoor farmers who can outsmart the weather with incredibly sensitive forecasting and technologies that automatically water crops to the ideal state (while conserving water), warm fields in case of early hard frosts, and harvest and bring to market fresh, organic, delicious fruits and vegetables, legumes, grains, and spices.

Financial markets will flow more fairly, with greater access to capital, and different kinds of currencies, democratizing wealth globally, while also rewarding those who take measured risks and use networks to support the efficient funding and growth of innovators.

Faster, faster, and faster.

Our lifestyles, our business ideas, our governments, and disruption will continue to push new boundaries, beyond 5G into 6G. (Let’s get ready now!)

Data will be the lifeblood for layers of systems, collected and generated by a continually growing number of end-points, and this data, when shared, will create meaningful new integrations enabling system-level operating models leveraging distributed information over a powerful and ultra-secure connectivity fabric. As more and more fiber is lit, as better fiber is installed connecting data centers, edge data centers, multiple locations, and more, what used to feel “digital” will simply feel “natural,” and our Great Expectations will rise above what we could have imagined even today.

By 2030, our Internet will be sliced into millions of private networks, running on a shared physical infrastructure, blending fixed and radio access networks together, delivering real, virtual, augmented, mixed and immersive experiences in a world where holograms will become the norm, and distance will become immaterial.

With all this value to be created, and so much opportunity at stake, how will IP Peering change?

When the Internet was born, there was no precedent for how it would operate. The “OSI” stack stuck with us, and gradually morphed into TCP/IP with the “webification” of everything. We’ve just gone through the “virtualization” of networks and are now onto the “cloudification” of those networks, which is just one way to say that we’ve become increasingly adept at using software to improve how data moves, including our ability to separate data and control planes.

We are in a new world now that just hints at the co-existence of distributed and centralized networking. By 2030, all these worlds will be blurred, and yet there needs to be governing principles that enable us to deliver “super-premium” performance, like that which allows the surgeon to operate successfully and the trader and her trading system to trade efficiently and profitably.

Forcing all Internet traffic to be peered by the incumbents, who connect with each other and exchange traffic, is no longer the only option, even though it will remain relevant for decades to come. We simply need more options, more “routes” so to speak, and it won’t take us ten years to reinvent how we peer IP networks, and with whom.

Google is onto this already, offering Direct Peering, which allows enterprises to establish a direct peering connection between their business network and Google's edge network to exchange high-throughput cloud traffic. This capability is available more than 100 locations in 33 countries.

Their offer is game-changing, but it is nowhere near what you can expect to see when entire industries cooperate to create massive, ultra-low-latency, super-secure Extranets? Why does this make sense? We built the world’s first global financial services Extranet over twenty years ago, and the logic has not changed: the same firms need to connect with each other and the same services (market data, news, exchanges, alternative trading systems, etc.) so why build thousands of railroad tracks when a shared high-speed superhighway can deliver better quality, faster provisioning, and greater security at a fraction of the price?

Why shouldn’t industry groups develop their own peering arrangements, and have a say in the operations and advancement of communications networks which are tuned to their requirements – in fact, tuned to increasingly challenging requirements (for performance, transparency, and agility?)

Those industries who have valuable people, places, and things – digital systems – and a need for global partner ecosystems – not build their own Extranets?

These will become incredibly valuable beyond 2030 when you look at the new world this way:

If “N” is users and “C” is content and “E” is IOT endpoints, Walsh’s Law is NV = (n-1)2 + (c-1)2 + (e-1)2.

Again, the value of a network is no longer just the squared value of the number of users, but end-points and content, especially when those private networks are fully secured.

Co-Founder & CTO at Nectar Services

4yDavid, very thought provoking! A have a question for you if you don’t mind. If I am a user N , and I have 2 laptops + 1 iPad + mobile phone is my contribution to E = 4 in your model or Since I as a user also access content from 5 smart Roku TV’s in my home, countless plane digital media systems, Smart TV’s at other homes I rent / own... how do I account for my E in your model ? Warmest wishes to a fantastic decade Joe

Senior Account Manager and Business Development Manager with experience in Telecommunications at Fortune 500 companies.

4yThere's A New Law a great read ...content matters and peering.The only question I have is how redundancy will be designed. Another day and time...

CEO & Co-Founder at Quickitt LLC

4yHi, David: Very interesting, but doesn't this (like Metcalf's Law) represent the "upper bound" of the value of the Network? As you point out, the quality of the content and something like the "accessibility" of the endpoints I think would determine the actual operational value (as you and Thom Jordan point out). How it is monetized would determine the overall value (see below). I also think that because content relevance will change dynamically and constantly with the needs of the users that the "value (utility?) of the network will change over time. Still, it is nice to know the upper bound if all users, content and endpoints are equal. This approach might have value in some of the video streaming modeling that is going on now. I would think that in order to determine the "monetized value" of a particular media content available for sale, one would need to know the demand preferences of the viewers (the "users") as it relates to the potential video "content", and then the suitability of the content to the population of screen devices ('endpoints"). This could then be expressed as "monetized value" when coupled with more common metrics like "conversion rate" and "average purchase value" of the "user demographics" (assuming some sort of "click throughpurchase", like Thom Jordan implies. This should allow content "brokers" to buy undervalued content "low" from content owners (like old TV rights) and sell it "high" to streaming providers for given user (viewers) and end point (screen) populations. I would think that some sort of "figure of merit" for the content rights would be particularly useful for AVOD (Advertising Video On Demand). For example, an approach tiered by advertising is reportedly being taken by the NBC "Peacock" service.

Very Cool David! Kudo’s!!

React Native Tech Lead

4yWhy would you expect multiple content servers to increase the value of the network? This is a function of the topology and one big server can provide just as much value as 1000 small servers.