ESG investors worry that unchecked climate change is a threat to human existence. The GOP appears to worry that unchecked ESG investors are a threat to Republican existence. Both sides are right.

ESG criteria (for “environmental, social, and governance”) are a set of standards for public companies’ actions that investors use to guide where they put their money. (These criteria could include committing to reduce carbon emissions by a certain percentage by a specific date, allowing employees work-at-home flexibility in light of pandemic safety and child care issues, or requiring that a minimum percentage of the board of directors be female or persons of color.) As more and more investors, large firms, and asset managers have gravitated toward ESG positions in recent years, they have found themselves at odds with a Republican Party that used to count on these institutions as A base of support. Republicans are now striking back, which is why you hear more of them railing against “woke capitalism” and ESG. One group recently formed a new right-wing business lobby, the American Free Enterprise Chamber of Commerce, to compete with the U.S. Chamber of Commerce, a long-standing supporter of mainstream Republican policies that anti-ESG activists now see as corrupted by the left. Another recent anti-ESG initiative has been to push red states to pass legislation to divest state pension fund assets from firms who follow ESG principles. For all the GOP fretting over left-wing “cancel culture,” the party is working very hard to cancel ESG.

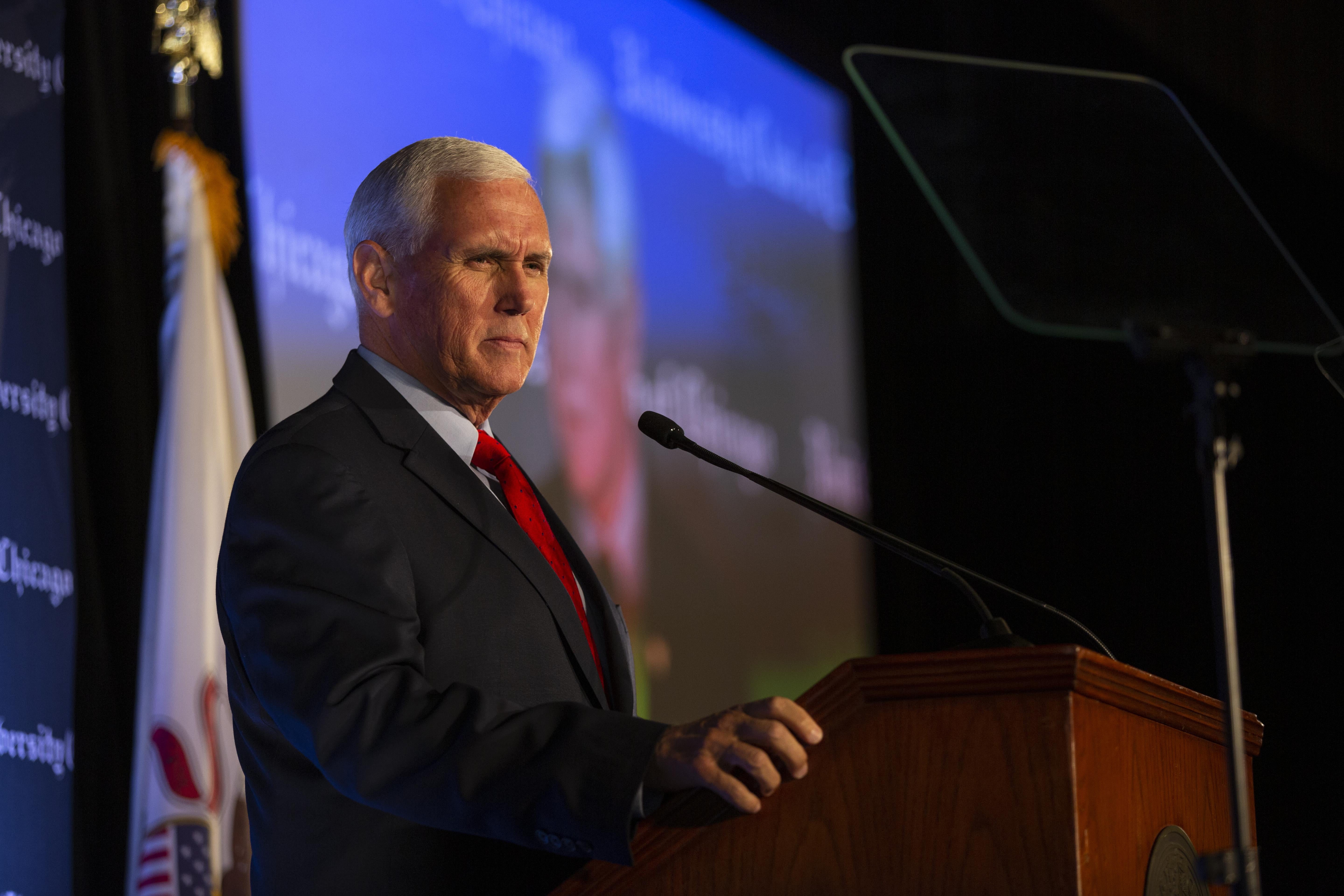

A typical example comes from former Vice President Mike Pence, who wrote a May 26 op-ed in the Wall Street Journal (“Republicans Can Stop ESG Political Bias”) full of right-wing fervor. He called ESG a “pernicious strategy” from the “woke left” including “an unelected cabal of bureaucrats” and “large and powerful Wall Street financiers” who “almost never refuse to do business with China or Russia.” He compared ESG ratings to something from the Chinese Communist Party. He warned that far-left extremists are using ESG to impose a radical agenda and take away our freedoms. In fact, it is Pence who is trying to override the free market, where millions of investors have decided ESG is what they want.

ESG investing has become a global trend. The term was coined in 2005, but the concept of integrating nonfinancial considerations into investment decisions has been around for decades. ESG and its variants are also called socially responsible investing, sustainable investing, and impact investing. Since the 1960s, investors have periodically boycotted companies associated with tobacco, weapons of war, apartheid, and other “sin stock” issues. In recent years, scientific consensus about the threat of climate change has prompted many investors to consider environmental issues. In 2020, interest in ESG further increased as the murder of George Floyd and the pandemic highlighted racial inequality and workplace issues, and more investors decided they had their own levers to pull in order to agitate for a more just society.

ESG has evolved because diverse, broad-based investor groups—including pension funds, endowments, hedge funds, retail investors of all ages (but particularly millennials), investors of color, and women, among many others—have been demanding investments that are both profitable and socially responsible. Studies by Morgan Stanley and Vanguard show that investments based on ESG have either outperformed, or performed as well as, non-ESG investments. What is good for people is generally good for business.

Given the growing wave of influential ESG investors, most public companies and asset managers have incorporated ESG into their operations to meet investor demand. Incorporating ESG means implementing policies and procedures to measure and accurately disclose the firm’s application of ESG principles to its business operations, workforce, and governance. For asset managers, incorporating ESG also means creating financial products that follow ESG principles, such as ESG-based investment funds. That is the free market at work. Customer demand shifts and businesses adjust their operations to meet the new demand. ESG is the product of a free market, not a cabal of pernicious financiers with international sympathies.

Pence’s performative outrage sounds like something from a far-right radio program. In fact, conservative talk-show host Glenn Beck, who has promoted false conspiracy theories involving hedge fund manager George Soros and former President Barack Obama among others, has criticized ESG using similar arguments and language. Beck hosted a radio show on March 18, 2022, titled: “Why are woke CEOs using ESG to DESTROY our free market?” During the show, Beck called ESG “the opposite of the free market. It is 21st century fascism.” In apparent disapproval of U.S. sanctions against Russia, he blamed the sanctions on ESG. Beck said: “We’re not the ones that—that have decided to go to war against Russia. These sanctions, these are not governmental sanctions. This is ESG.”

Much anti-ESG ire has been directed at Larry Fink, the billionaire CEO of BlackRock. In January 2020, in his annual letter to CEOs of public companies, Fink said that BlackRock supports ESG principles and expects public companies to do the same. Since BlackRock is the world’s largest asset manager, the letter gave ESG credibility. Conservatives were apoplectic. Many saw Fink as a traitor to his class. Some accused him of acting like a socialist, a strange charge against someone who built up a business handling $10 trillion in assets. His support for ESG is clever capitalism because it positions BlackRock to attract business from the growing wave of investors who want profits and to feel good about their investments.

Pence dislikes ESG investors because they do not share his views, including his opposition to—if not outright hostility toward—climate change initiatives, LGBTQ rights, corporate board diversity, workers’ rights, gun safety legislation, and women’s reproductive rights. He is entitled to his views. But so are ESG investors, who should be free to invest based on considerations they deem important.

Some criticism of ESG is fair and justified. In May, for example, Standard & Poor’s rebalanced stocks in its sustainability portfolio, dropping Tesla but retaining ExxonMobil. Technical ratings may have triggered the actions, but most felt that the moves lacked common sense and were plain wrong. Tesla CEO Elon Musk wrote on Twitter: “ESG is a scam. It has been weaponized by phony social justice warriors.” His anger was understandable. Others have criticized ESG for encouraging companies to engage in “greenwashing” by making false or exaggerated claims about their ESG practices to attract clients. The SEC recently brought its first enforcement case based on greenwashing and has signaled to the industry that it will look for violations going forward. ESG is still being refined and mistakes can be expected going forward. But good-faith mistakes and honest criticism are different in nature from Republican misrepresentations about ESG as a pernicious effort to take away our freedoms.

The GOP is on a crusade to discredit ESG by blaming it on “woke” extremism. But ESG has more mainstream acceptance than right-wing extremism. Pence, in his Wall Street Journal piece, states that ESG is a threat to American freedom. A more truthful description would be that ESG is a threat to Republican minority control over increasingly unpopular issues. In that sense, Pence’s attack on businesses who adopt ESG principles is akin to Florida Republicans who penalized Disney for taking a position on “Don’t Say Gay” legislation.

Pence’s proposed solution to his fabricated ESG threat is for the next president to work with Congress to “end the use of ESG principles nationwide.” In other words, he wants the government to step in and cancel ESG because he dislikes what the free market came up with. Republicans traditionally have criticized Democrats for imposing government regulations that interfere with free market decisions. Yet Pence is proposing exactly that.

Hypocrisy notwithstanding, it is unclear how Pence would cancel ESG from a practical standpoint, since it is widely accepted and integrated throughout the capital markets. Would a President Pence force thousands of U.S. public companies and asset managers to terminate their ESG operations and financial products? That action could harm U.S. capital formation by driving investors overseas where ESG thrives. For millions of investors who now consider ESG an important part of their investment decisionmaking process, would Pence cancel access to ESG information and their freedom to decide how to invest their hard-earned money? His vision looks less like freedom in America and more like something from the Chinese Communist Party.