Analyst Viewpoint

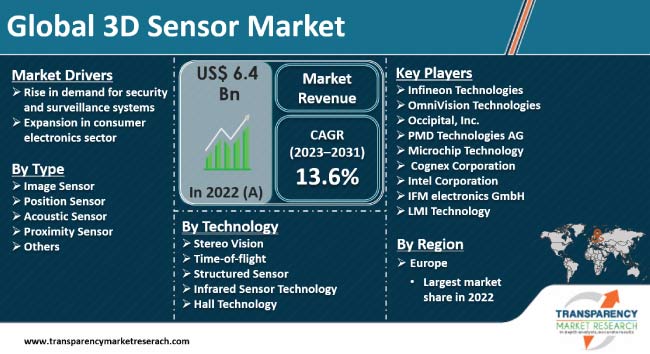

Rise in demand for security and surveillance systems and expansion in consumer electronics sector are fueling the 3D sensor market size. Image processing sensors are gaining traction in security cameras due to surge in the need for security and protection around commercial and residential premises.

Integration of 3D sensors in smartphones and tablets is likely to offer lucrative opportunities to vendors in the global 3D sensor industry. According to the latest 3D sensor market trends, key players are developing next-generation 3D sensing hardware. They are partnering with other players to accelerate the development and commercialization of 3D imaging and sensing hardware. Lack of product differentiation and heavy maintenance costs are expected to hinder the global market growth during the forecast period.

3D sensors are devices that can produce 3D maps of a user’s environment or surroundings in response to the external environment. Image processing sensors, time-of-flight sensors, structured light systems, ultrasound, and stereo vision are some of the elements that are included in 3D sensors. These sensors play an important role in improving performance and bringing output with the help of image and gesture analysis.

3D sensors can detect the shape, scale, and distance of an object within the field of vision. These sensors use various techniques to distinguish objects in space. They are employed in 3D printing, object recognition, facial recognition, and gesture-based control. 3D sensor technology for gesture recognition has gained popularity in various applications, including gaming, smart homes, virtual reality, and human-computer interaction. Additionally, 3D sensors with depth sensing capabilities play a crucial role in robotics for solving assembly problems, preventing collisions, and teleconferencing in virtual reality.

Offices, schools, and houses are focusing on surveillance and security. They are investing in security cameras with 3D sensors. These cameras are known for their position tracking, depth sensing, and gesture recognition capabilities. 3D sensor cameras also offer real-time sensing and scanning for improved surveillance and security. Major companies in the aerospace & defense sector rely on 3D sensing capabilities to enhance security. Thus, surge in adoption of 3D sensing technologies is driving the 3D sensor market revenue.

LiDAR drones have become an integral part of several industries such as aerospace & defense, industrial, and retail (e-commerce). LiDAR or laser detection and ranging (LADAR) systems are used to operate drones. Such types of drones are employed to collect data to make detailed 3D models for a variety of applications and industries. Various 3D sensor companies are offering AI-enabled products, thereby fueling the 3D sensor market progress. Leica Geosystems provides BLK247 intelligent 3D surveillance system with AI-enabled sensors. This 3D sensor includes LiDAR, a video camera, and thermal imaging technology for state-of-the-art security and surveillance.

Consumer electronics, such as smartphones, tablets, PCs, TVs, washing machines, fridges, and music players, have become integral parts of routine lives. These devices are becoming smarter with the ongoing technological advancements and integration of Internet of Things (IoT) and AI.

Consumer electronics with features, such as facial recognition for unlocking devices, augmented reality, and improved camera functionalities, are gaining traction. Major electronic manufacturers, including Huawei, Samsung, Oppo, LG, and Apple, have pioneered the integration of 3D ToF sensors into their smartphones. Huawei P30 Pro, Samsung Galaxy S10 5G, Oppo RX17 Pro, Honor View 20, LG G8 ThinQ, and iPhone 2020 models come with integrated 3D ToF sensors. Hence, surge in adoption of 3D sensors in electronic devices is driving the 3D sensor market development.

According to the latest 3D sensor market analysis, Europe held the largest share in 2022. Rise in investment in the R&D of next-generation image-sensing technologies is fueling the market dynamics of the region. Additionally, government funding and initiatives to develop novel imaging sensor technologies are also propelling the market share in Europe. Horizon Europe is one of the largest research innovation funding initiatives in the European Union, with a budget of €95.5 Bn for 2021-2027. This finances several scientific and technological projects, including 3D imagining and sensing technology.

Increase in demand for high-resolution cameras containing 3D sensors in various end-user industries, such as automotive, consumer electronics, and security, is augmenting the market trajectory in Europe. Moreover, surge in production of smartphones and tablets with upgraded camera quality functions and improved quality of images and integration of multiple camera features in a single device with the latest features, such as low-light photography and optical zoom, is also boosting the 3D sensor market landscape in the region.

Major companies in the 3D sensor sector are collaborating with other companies to expand the usage of 3D imaging and sensing technologies. They are investing in the development and commercialization of 3D imaging and sensing hardware to expand their product portfolio.

Infineon Technologies, OmniVision Technologies, Occipital, Inc., PMD Technologies AG, Microchip Technology, Cognex Corporation, Intel Corporation, IFM Electronic GmbH, and LMI Technology are some of key 3D sensor manufacturers.

Each of these companies has been profiled in the 3D sensor market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 6.4 Bn |

| Market Forecast (Value) in 2031 | US$ 20.1 Bn |

| Growth Rate (CAGR) | 13.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 6.4 Bn in 2022

It is anticipated to advance at a CAGR of 13.6% from 2023 to 2031

Rise in demand for security and surveillance systems and expansion in consumer electronics sector

Europe was the leading region in 2022

Infineon Technologies, OmniVision Technologies, Occipital, Inc., PMD Technologies AG, Microchip Technology, Cognex Corporation, Intel Corporation, IFM Electronic GmbH, and LMI Technology

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global 3D Sensor Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global 3D Sensor Market Analysis, by Type

5.1. 3D Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

5.1.1. Image Sensor

5.1.2. Position Sensor

5.1.3. Acoustic Sensor

5.1.4. Proximity Sensor

5.1.5. Others

5.2. Market Attractiveness Analysis, by Type

6. Global 3D Sensor Market Analysis, by Technology

6.1. 3D Sensor Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

6.1.1. Stereo Vision

6.1.2. Time-of-flight

6.1.3. Structured Sensor

6.1.4. Infrared Sensor Technology

6.1.5. Hall Technology

6.2. Market Attractiveness Analysis, by Technology

7. Global 3D Sensor Market Analysis, by End-use

7.1. 3D Sensor Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

7.1.1. Consumer Electronics

7.1.2. Healthcare

7.1.3. Aerospace & Defense

7.1.4. Automotive

7.1.5. Industrial Robotics

7.1.6. Security & Surveillance

7.1.7. Media & Entertainment

7.1.8. Others

7.2. Market Attractiveness Analysis, by End-use

8. Global 3D Sensor Market Analysis and Forecast, by Region

8.1. 3D Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America 3D Sensor Market Analysis and Forecast

9.1. Market Snapshot

9.2. 3D Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

9.2.1. Image Sensor

9.2.2. Position Sensor

9.2.3. Acoustic Sensor

9.2.4. Proximity Sensor

9.2.5. Others

9.3. 3D Sensor Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

9.3.1. Stereo Vision

9.3.2. Time-of-flight

9.3.3. Structured Sensor

9.3.4. Infrared Sensor Technology

9.3.5. Hall Technology

9.4. 3D Sensor Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

9.4.1. Consumer Electronics

9.4.2. Healthcare

9.4.3. Aerospace & Defense

9.4.4. Automotive

9.4.5. Industrial Robotics

9.4.6. Security & Surveillance

9.4.7. Media & Entertainment

9.4.8. Others

9.5. 3D Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country, 2017–2031

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Type

9.6.2. By Technology

9.6.3. By End-use

9.6.4. By Country/Sub-region

10. Europe 3D Sensor Market Analysis and Forecast

10.1. Market Snapshot

10.2. 3D Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

10.2.1. Image Sensor

10.2.2. Position Sensor

10.2.3. Acoustic Sensor

10.2.4. Proximity Sensor

10.2.5. Others

10.3. 3D Sensor Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

10.3.1. Stereo Vision

10.3.2. Time-of-flight

10.3.3. Structured Sensor

10.3.4. Infrared Sensor Technology

10.3.5. Hall Technology

10.4. 3D Sensor Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

10.4.1. Consumer Electronics

10.4.2. Healthcare

10.4.3. Aerospace & Defense

10.4.4. Automotive

10.4.5. Industrial Robotics

10.4.6. Security & Surveillance

10.4.7. Media & Entertainment

10.4.8. Others

10.5. 3D Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.5.1. U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Technology

10.6.3. By End-use

10.6.4. By Country/Sub-region

11. Asia Pacific 3D Sensor Market Analysis and Forecast

11.1. Market Snapshot

11.2. 3D Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

11.2.1. Image Sensor

11.2.2. Position Sensor

11.2.3. Acoustic Sensor

11.2.4. Proximity Sensor

11.2.5. Others

11.3. 3D Sensor Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

11.3.1. Stereo Vision

11.3.2. Time-of-flight

11.3.3. Structured Sensor

11.3.4. Infrared Sensor Technology

11.3.5. Hall Technology

11.4. 3D Sensor Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

11.4.1. Consumer Electronics

11.4.2. Healthcare

11.4.3. Aerospace & Defense

11.4.4. Automotive

11.4.5. Industrial Robotics

11.4.6. Security & Surveillance

11.4.7. Media & Entertainment

11.4.8. Others

11.5. 3D Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Technology

11.6.3. By End-use

11.6.4. By Country/Sub-region

12. Middle East & Africa 3D Sensor Market Analysis and Forecast

12.1. Market Snapshot

12.2. 3D Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

12.2.1. Image Sensor

12.2.2. Position Sensor

12.2.3. Acoustic Sensor

12.2.4. Proximity Sensor

12.2.5. Others

12.3. 3D Sensor Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

12.3.1. Stereo Vision

12.3.2. Time-of-flight

12.3.3. Structured Sensor

12.3.4. Infrared Sensor Technology

12.3.5. Hall Technology

12.4. 3D Sensor Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

12.4.1. Consumer Electronics

12.4.2. Healthcare

12.4.3. Aerospace & Defense

12.4.4. Automotive

12.4.5. Industrial Robotics

12.4.6. Security & Surveillance

12.4.7. Media & Entertainment

12.4.8. Others

12.5. 3D Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Technology

12.6.3. By End-use

12.6.4. By Country/Sub-region

13. South America 3D Sensor Market Analysis and Forecast

13.1. Market Snapshot

13.2. 3D Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

13.2.1. Image Sensor

13.2.2. Position Sensor

13.2.3. Acoustic Sensor

13.2.4. Proximity Sensor

13.2.5. Others

13.3. 3D Sensor Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

13.4. Stereo Vision

13.5. Time-of-flight

13.6. Structured Sensor

13.7. Infrared Sensor Technology

13.8. Hall Technology

13.9. 3D Sensor Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

13.9.1. Consumer Electronics

13.9.2. Healthcare

13.9.3. Aerospace & Defense

13.9.4. Automotive

13.9.5. Industrial Robotics

13.9.6. Security & Surveillance

13.9.7. Media & Entertainment

13.9.8. Others

13.10. 3D Sensor Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.10.1. Brazil

13.10.2. Rest of South America

13.11. Market Attractiveness Analysis

13.11.1. By Type

13.11.2. By Technology

13.11.3. By End-use

13.11.4. By Country/Sub-region

14. Competition Assessment

14.1. Global 3D Sensor Market Competition Matrix - a Dashboard View

14.1.1. Global 3D Sensor Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Infineon Technologies

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. OmniVision Technologies

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Occipital, Inc.

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. PMD Technologies AG

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Microchip Technology

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Cognex Corporation

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Intel Corporation

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. IFM electronics GmbH

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. LMI Technology

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global 3D Sensor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 2: Global 3D Sensor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 3: Global 3D Sensor Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 4: Global 3D Sensor Market Value (US$ Mn) & Forecast, by End-use, 2017‒2031

Table 5: Global 3D Sensor Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 6: Global 3D Sensor Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 7: North America 3D Sensor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 8: North America 3D Sensor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 9: North America 3D Sensor Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 10: North America 3D Sensor Market Value (US$ Mn) & Forecast, by End-use, 2017‒2031

Table 11: North America 3D Sensor Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 12: North America 3D Sensor Market Volume (Million Units) & Forecast, by Country, 2017‒2031

Table 13: Europe 3D Sensor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 14: Europe 3D Sensor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 15: Europe 3D Sensor Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 16: Europe 3D Sensor Market Value (US$ Mn) & Forecast, by End-use, 2017‒2031

Table 17: Europe 3D Sensor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 18: Europe 3D Sensor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 19: Asia Pacific 3D Sensor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 20: Asia Pacific 3D Sensor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 21: Asia Pacific 3D Sensor Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 22: Asia Pacific 3D Sensor Market Value (US$ Mn) & Forecast, by End-use, 2017‒2031

Table 23: Asia Pacific 3D Sensor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 24: Asia Pacific 3D Sensor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 25: Middle East & Africa 3D Sensor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 26: Middle East & Africa 3D Sensor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 27: Middle East & Africa 3D Sensor Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 28: Middle East & Africa 3D Sensor Market Value (US$ Mn) & Forecast, by End-use, 2017‒2031

Table 29: Middle East & Africa 3D Sensor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 30: Middle East & Africa 3D Sensor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 31: South America 3D Sensor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 32: South America 3D Sensor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 33: South America 3D Sensor Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 34: South America 3D Sensor Market Value (US$ Mn) & Forecast, by End-use, 2017‒2031

Table 35: South America 3D Sensor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 36: South America 3D Sensor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global 3D Sensor Market

Figure 02: Porter Five Forces Analysis – Global 3D Sensor Market

Figure 03: Technology Road Map - Global 3D Sensor Market

Figure 04: Global 3D Sensor Market, Value (US$ Mn), 2017-2031

Figure 05: Global 3D Sensor Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 06: Global 3D Sensor Market Projections, by Type, Value (US$ Mn), 2017‒2031

Figure 07: Global 3D Sensor Market, Incremental Opportunity, by Type, 2023‒2031

Figure 08: Global 3D Sensor Market Share Analysis, by Type, 2022 and 2031

Figure 09: Global 3D Sensor Market Projections, by Technology, Value (US$ Mn), 2017‒2031

Figure 10: Global 3D Sensor Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 11: Global 3D Sensor Market Share Analysis, by Technology, 2022 and 2031

Figure 12: Global 3D Sensor Market Projections, by End-use, Value (US$ Mn), 2017‒2031

Figure 13: Global 3D Sensor Market, Incremental Opportunity, by End-use, 2023‒2031

Figure 14: Global 3D Sensor Market Share Analysis, by End-use, 2022 and 2031

Figure 15: Global 3D Sensor Market Projections, by Region, Value (US$ Mn), 2017‒2031

Figure 16: Global 3D Sensor Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global 3D Sensor Market Share Analysis, by Region, 2022 and 2031

Figure 18: North America 3D Sensor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 19: North America 3D Sensor Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 20: North America 3D Sensor Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 21: North America 3D Sensor Market, Incremental Opportunity, by Type, 2023‒2031

Figure 22: North America 3D Sensor Market Share Analysis, by Type, 2022 and 2031

Figure 23: North America 3D Sensor Market Projections, by Technology (US$ Mn), 2017‒2031

Figure 24: North America 3D Sensor Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 25: North America 3D Sensor Market Share Analysis, by Technology, 2022 and 2031

Figure 26: North America 3D Sensor Market Projections, by End-use, Value (US$ Mn), 2017‒2031

Figure 27: North America 3D Sensor Market, Incremental Opportunity, by End-use, 2023‒2031

Figure 28: North America 3D Sensor Market Share Analysis, by End-use, 2022 and 2031

Figure 29: North America 3D Sensor Market Projections, by Country, Value (US$ Mn), 2017‒2031

Figure 30: North America 3D Sensor Market, Incremental Opportunity, by Country, 2023‒2031

Figure 31: North America 3D Sensor Market Share Analysis, by Country, 2022 and 2031

Figure 32: Europe 3D Sensor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 33: Europe 3D Sensor Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 34: Europe 3D Sensor Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 35: Europe 3D Sensor Market, Incremental Opportunity, by Type, 2023‒2031

Figure 36: Europe 3D Sensor Market Share Analysis, by Type, 2022 and 2031

Figure 37: Europe 3D Sensor Market Projections, by Technology, Value (US$ Mn), 2017‒2031

Figure 38: Europe 3D Sensor Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 39: Europe 3D Sensor Market Share Analysis, by Technology, 2022 and 2031

Figure 40: Europe 3D Sensor Market Projections, by End-use, Value (US$ Mn), 2017‒2031

Figure 41: Europe 3D Sensor Market, Incremental Opportunity, by End-use, 2023‒2031

Figure 42: Europe 3D Sensor Market Share Analysis, by End-use, 2022 and 2031

Figure 43: Europe 3D Sensor Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 44: Europe 3D Sensor Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 45: Europe 3D Sensor Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 46: Asia Pacific 3D Sensor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 47: Asia Pacific 3D Sensor Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 48: Asia Pacific 3D Sensor Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 49: Asia Pacific 3D Sensor Market, Incremental Opportunity, by Type, 2023‒2031

Figure 50: Asia Pacific 3D Sensor Market Share Analysis, by Type, 2022 and 2031

Figure 51: Asia Pacific 3D Sensor Market Projections, by Technology, Value (US$ Mn), 2017‒2031

Figure 52: Asia Pacific 3D Sensor Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 53: Asia Pacific 3D Sensor Market Share Analysis, by Technology, 2022 and 2031

Figure 54: Asia Pacific 3D Sensor Market Projections, by End-use, Value (US$ Mn), 2017‒2031

Figure 55: Asia Pacific 3D Sensor Market, Incremental Opportunity, by End-use, 2023‒2031

Figure 56: Asia Pacific 3D Sensor Market Share Analysis, by End-use, 2022 and 2031

Figure 57: Asia Pacific 3D Sensor Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 58: Asia Pacific 3D Sensor Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 59: Asia Pacific 3D Sensor Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 60: Middle East & Africa 3D Sensor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 61: Middle East & Africa 3D Sensor Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 62: Middle East & Africa 3D Sensor Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 63: Middle East & Africa 3D Sensor Market, Incremental Opportunity, by Type, 2023‒2031

Figure 64: Middle East & Africa 3D Sensor Market Share Analysis, by Type, 2022 and 2031

Figure 65: Middle East & Africa 3D Sensor Market Projections, by Technology, Value (US$ Mn), 2017‒2031

Figure 66: Middle East & Africa 3D Sensor Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 67: Middle East & Africa 3D Sensor Market Share Analysis, by Technology, 2022 and 2031

Figure 68: Middle East & Africa 3D Sensor Market Projections, by End-use, Value (US$ Mn), 2017‒2031

Figure 69: Middle East & Africa 3D Sensor Market, Incremental Opportunity, by End-use, 2023‒2031

Figure 70: Middle East & Africa 3D Sensor Market Share Analysis, by End-use, 2022 and 2031

Figure 71: Middle East & Africa 3D Sensor Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 72: Middle East & Africa 3D Sensor Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 73: Middle East & Africa 3D Sensor Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 74: South America 3D Sensor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 75: South America 3D Sensor Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 76: South America 3D Sensor Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 77: South America 3D Sensor Market, Incremental Opportunity, by Type, 2023‒2031

Figure 78: South America 3D Sensor Market Share Analysis, by Type, 2022 and 2031

Figure 79: South America 3D Sensor Market Projections, by Technology, Value (US$ Mn), 2017‒2031

Figure 80: South America 3D Sensor Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 81: South America 3D Sensor Market Share Analysis, by Technology, 2022 and 2031

Figure 82: South America 3D Sensor Market Projections, by End-use, Value (US$ Mn), 2017‒2031

Figure 83: South America 3D Sensor Market, Incremental Opportunity, by End-use, 2023‒2031

Figure 84: South America 3D Sensor Market Share Analysis, by End-use, 2022 and 2031

Figure 85: South America 3D Sensor Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 86: South America 3D Sensor Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 87: South America 3D Sensor Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 88: Global 3D Sensor Market Competition

Figure 89: Global 3D Sensor Market Company Share Analysis