TDG GOLD DEFINES DRILL TARGETS WITHIN POTENTIAL NORTHERN EXTENSION AT METS

White Rock, British Columbia, January 08, 2024. TDG Gold Corp. (TSXV: TDG) (the “Company” or “TDG”) is pleased to provide a targeting update from ongoing analysis and interpretation of geophysical data from TDG’s 100% owned Mets mining lease located in the Toodoggone District of north-central B.C.

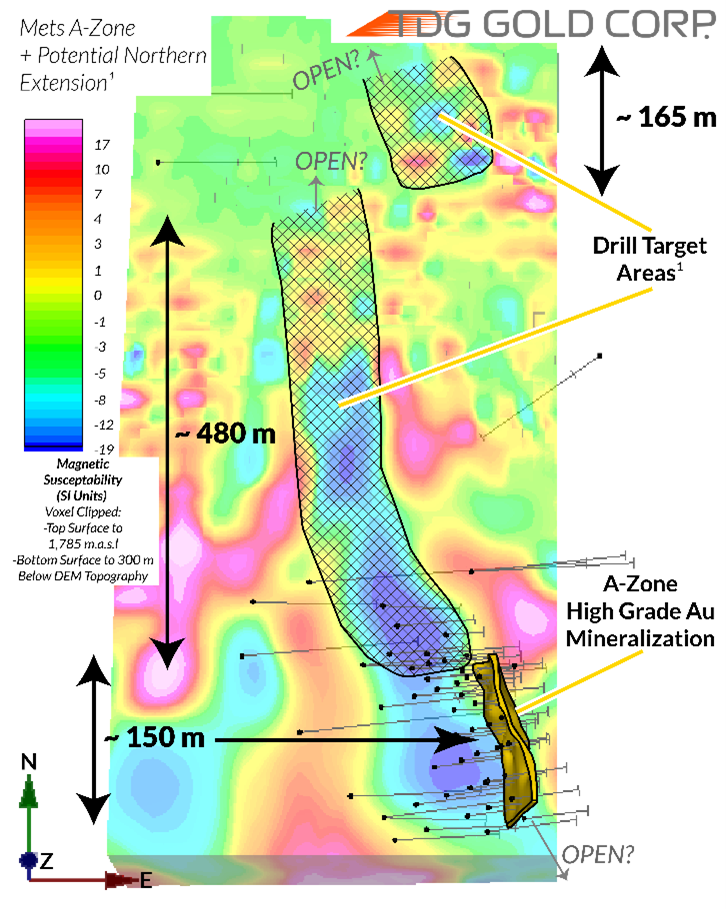

Within this news release are the first 3-dimensional (“3D”) geophysical renderings of the high-grade Mets A-Zone1 and its potential northern extension1 covering a total of ~800 metres (“m”) of the ~3,850 m of anomalous trend1 identified on Mets (news release Nov 14, 2023). Definition of additional drill targets1 for the remaining anomalous geophysical, geochemical, and structural features at Mets is ongoing.

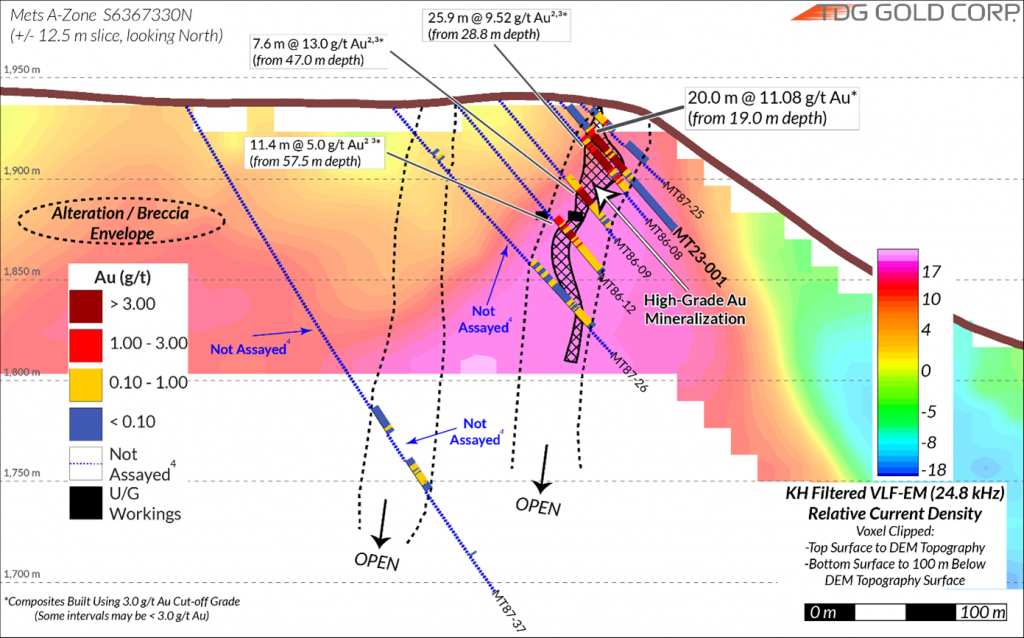

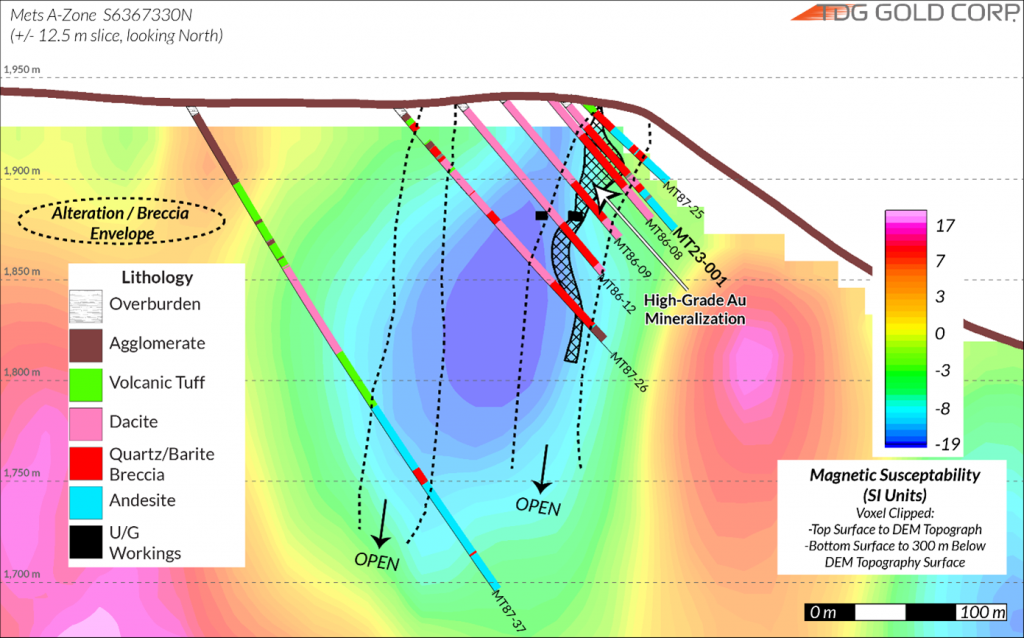

The historical high-grade, near surface gold (“Au”) within the A-Zone at Mets was confirmed by TDG’s diamond drilling in 2023including 20 m of 11.1 grams per tonne (“g/t”) Au from 19 m depth, and 8.3 m of 16.4 g/t Au from 51 m depth (news releases Sep 07, 2023 and Dec 04, 2023). The high-grade mineralization appears to be coincident with a parallel west dipping conductive feature and magnetic susceptibility low with a ~16-degree plunge to the north. The A-Zone1 and these geophysical features are interpreted to extend for ~800 m and remains open to the north (Figure 1).

Figure 1. 3D View of Mets A-Zone & Potential Northern Extension1 displaying ground magnetics (left) and VLF-EM (right).

Fletcher Morgan, TDG’s CEO, commented: “Exploration for high-grade gold mineralization at Mets is a high priority for TDG. The geophysical anomalies associated with the high-grade gold in the A-Zone1 and its potential northern extension1 continue for at least 800 m with a gentle plunge and remains open at depth. Our 2023 high-resolution ground magnetics and VLF-EM program evaluated only a shallow vertical extent. With this additional data, we believe that we can explain why the historical drillholes either hit or missed and, most importantly, we have generated additional drill targets based on our interpretations. We’re applying a similar approach to the potential southern extension1 of the A-Zone1 and the two new parallel anomalous trends1 that have never been drill tested. We look forward to publishing more targets in the coming weeks.”

METS A-ZONE1

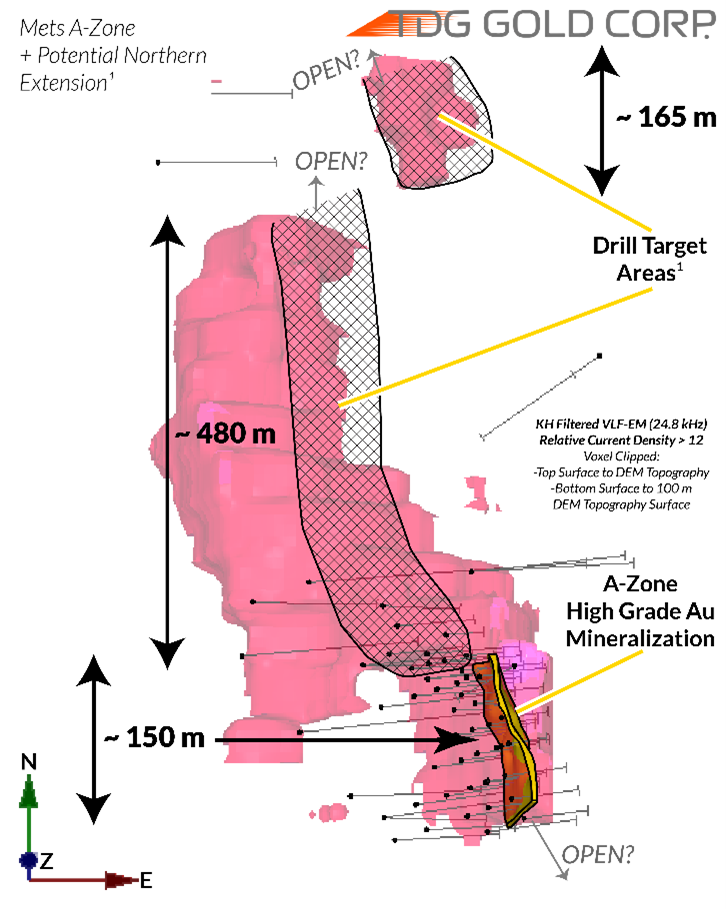

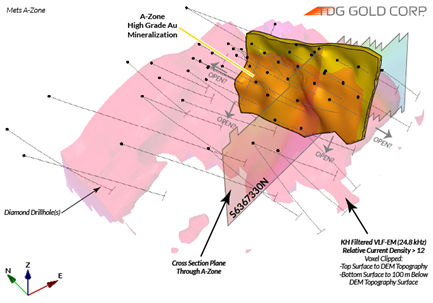

The well-understood portion of the Mets A-Zone high-grade Au mineralization is hosted in hydrothermal quartz-barite breccia(s) at/or adjacent to a structurally disrupted lithological contact between the dacite (hanging wall) and andesite (footwall). It can be conceptualized in 3D as a ‘sheet’ of high-grade Au mineralization sub-parallel to the lithological contact which remains open in both directions and at depth (Figure 2). The sheet of mineralization appears to be steeply west dipping, near surface and has a gentle plunge (~16°) to the north.

The high-grade mineralized sheet coincides with two geophysical features. Firstly, using a Very Low Frequency Electromagnetic (“VLF-EM”) survey, the response is defined by a relative charge density of ~>12 using the Karous-Hjelt (“KH”) filtered 24.8 kHz frequency (Figure 3) and is described as a north-trending, plunging anomaly. Secondly, using ground magnetics survey data with the response calibrated by drillhole data, the high-grade sheet coincides with a magnetic susceptibility low, which may represent the destruction of mafic minerals during the course of alteration and mineralization (Figure 4).

Through historical recompilation and modern geophysics, a second alteration/breccia envelope was rediscovered west of the main A-Zone trend (Figures 3 and 4). This zone1 is only partially evaluated by historical drilling, remains open at depth, and shares the same geophysical signatures as the main A-Zone trend. An evaluation of the continuity of this second breccia/alteration zone is ongoing and may represent further dimensionality in endeavors expanding the potential size of the A-Zone1.

Figure 2. 3D View of Mets A-Zone & KH filtered 24.8 kHz relative charge density ~12.

POTENTIAL NORTHERN EXTENSION1

The modern high-resolution ground-based magnetics and VLF-EM data have provided an updated framework for exploration outside of the A-Zone. The potential northern extension1 appears to have the same characteristic VLF-EM conductive response and is also associated with a continuation of the linear magnetic susceptibility low. Additionally, surficial soil sampling, geological mapping and 3D modeling also support the interpretation of the favourable structural corridor having continuity to the north. (See ‘Target #2’ Figures 1 a & b for ground magnetics/VLF-EM and Figures 2 a & b for historical Au/Ag surficial soil sampling results; news release Nov 14, 2023).

Qualified Person

The technical content of this news release has been reviewed and approved Steven Kramar, MSc., P.Geo., Vice President, Exploration for TDG Gold Corp., a qualified person as defined by National Instrument 43-101.

1Mineral Exploration/Exploration Target Area(s): TDG is a mineral exploration focused company and the Company’s Projects are in the mineral exploration stage only. The degree of risk increases substantially where an issuer’s properties are in the mineral exploration stage as opposed to the development or operational stage. Exploration targets and/or Exploration zones and/or Exploration areas are speculative and there is no certainty that any future work or evaluation will lead to the definition of a mineral resource.

2Historical Data: This news release includes historical information that has been reviewed by TDG’s qualified person (QP). TDG’s review of the historical records and information reasonably substantiate the validity of the information presented in this news release; however, TDG cannot directly verify the accuracy of the historical data, including (but not limited to) the procedures used for sample collection and analysis. Therefore, any conclusions or interpretations borne from use of this data should be considered too speculative to suggest that additional exploration will result in mineral resource delineation. TDG encourages readers to exercise appropriate caution when evaluating these data and/or results.

3Historical Drillcore Sampling & Assay Methodology: Historical drillcore was geologically logged with lithologies identified and notable geological features recorded. Historical drillcore was split in half (and in rare cases sawn in half) along sample intervals (lithology and mineralization dependant) generally less than 3 m. Chemical analysis was performed dominantly for precious metal analysis (Au and Ag), and infrequently for base metals (Pb, Zn, Cu), and rarely for major elements and trace elements. Historically, different commercial laboratories were utilized in addition to an assay lab at Baker Mine Site. These lab facilities may or may not have had accreditation and in all cases accreditation (if applicable) pre-dated current ISO standards. Over that period, a variety of digestion and assay methods were used, including atomic absorption, fire assay atomic absorption, aqua regia atomic absorption and aqua regia ICP with varying detection limits. Reference materials (if any) were inserted at the analytical level and thus were unblind to the facility processing the samples.

4Unassayed Historical Drill Core: Historical drill core intersections, lengths or intervals referenced for re-assay or geological analysis may not be available or suitable for sampling. Historical drill cores were inherited with the project and TDG provides no guarantees or warranties that these drill cores are part of the historical inventory, are available and/or have not degraded to a state that would render them wholly unusable for the purposes of scientific investigation. TDG provides no warranties/guarantees that these historical un-assayed drill cores host precious or base metal mineralization.

About TDG Gold Corp.

TDG is a major mineral tenure holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG’s flagship projects are the former producing, high-grade gold-silver Shasta and Baker mines, which produced intermittently between 1981-2012, and the historical high-grade gold Mets developed prospect, all of which are road accessible, and combined have over 65,000 m of historical drilling. The projects have been advanced through compilation of historical data, new geological mapping, geochemical and geophysical surveys and, at Shasta, 13,250 m of modern HQ drill testing of the known mineralization occurrences and their potential extensions. In May 2023, TDG published an updated Mineral Resource Estimate for Shasta (see TDG news release May 01, 2023) which remains open at depth and along strike. In January 2023, TDG defined a larger exploration target area adjacent to Shasta (Greater Shasta-Newberry; see TDG news release January 25, 2023). In September 2023, TDG published the first modern drill results from the Mets mining lease (see TDG news releases September 07, 2023, September 11, 2023 and November 28, 2023).

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information contact:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release contains forward-looking statements that are based on the Company’s current expectations and estimates. Forward-looking statements are frequently characterized by words such as “appear”,” interpret”, “demonstrate”, “coincident”, “potential”, “confirm”, “suggest”, “evaluate”, “support”, and variations of these words as well as other similar words or statements that certain events or conditions “could”, “may”, “should”, “would” or “will” occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current and planned exploration activities including the potential for the definition of a high-grade gold or other style of mineral deposit of potential economic value within the Mets mining lease; that geophysical survey results and interpretations thereof are defining potentially mineralized corridors; results from future exploration programs including drilling; interpretation and meaning of completed and future geophysical surveys; conclusions of future economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in grades of mineralization and/or future actual recovery rates; accidents, labour disputes and other risks of the mining industry; the availability of sufficient funding on terms acceptable to the company to complete the planned work programs; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated, or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.